As someone who has been closely following and participating in the crypto space for years, I can confidently say that launching an ICO is a thrilling yet challenging journey. Having witnessed both successful and less-than-successful launches, I’ve learned valuable lessons that could help those embarking on this path.

🚀 Trump Effect: EUR/USD Primed for Wild Swing?

Expert predictions show massive EUR/USD reaction to Trump's latest tariff agenda!

View Urgent ForecastFundraising for any startup or business idea is the most important and quite difficult stage in any activity. One of the most popular fundraising methods in the blockchain and cryptocurrency industry is an Initial Coin Offering (ICO), allowing startups and entrepreneurs to raise capital by issuing their own ICO tokens.

By leveraging the fast-paced expansion of Decentralized Finance (DeFi) and blockchain technology, there’s an exceptional opportunity to launch groundbreaking Initial Coin Offering (ICO) projects, connecting with a diverse, worldwide pool of investors.

As an analyst, I can’t help but emphasize that orchestrating a successful Initial Coin Offering (ICO) demands meticulous preparation, adherence to legal guidelines, and a deep grasp of both the technical and business intricacies involved. If you’re pondering over how to initiate an ICO, this extensive guide will serve as your roadmap, detailing the crucial stages, mandatory prerequisites, and vital factors to ensure a prosperous ICO launch.

Key Takeaways:

- Establishing a successful ICO requires careful planning, legal compliance, and a solid own ICO project with real-world utility.

- A well-orchestrated marketing strategy that engages the crypto community through social media, forums, and listing websites is essential to drive demand for your token.

- The cost of launching an ICO varies greatly depending on the own ICO platform, marketing, and legal fees. However, the investment is worth it if done right.

What is an ICO Campaign?

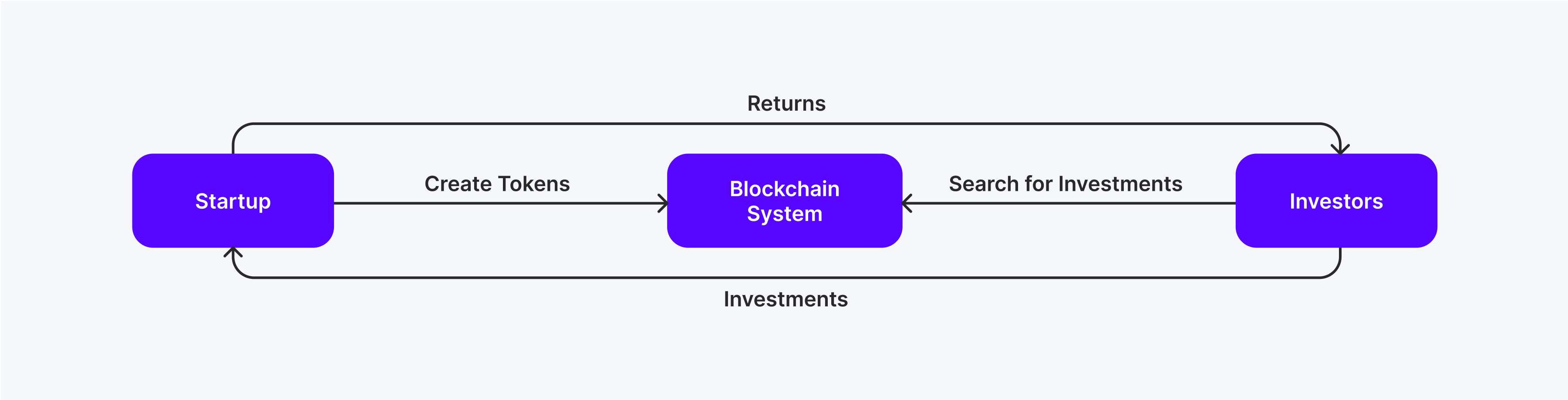

A Initial Coin Offering (ICO) is a method used by companies within the blockchain sector to raise funds by issuing digital tokens to investors, who can pay using other cryptocurrencies or traditional currency (fiat money). These tokens frequently symbolize ownership shares in the company or entitle holders to utilize its products and services.

During an Initial Coin Offering (ICO), a company shares its aspirations and explains how the collected funds will be utilized, usually in a detailed ICO whitepaper. Interested investors purchase these tokens early on, anticipating that their value might increase as the project progresses, attracts more attention, and becomes successful.

Initial Coin Offerings (ICOs) are frequently likened to Initial Public Offerings (IPOs) in traditional finance, with the key distinction being that instead of purchasing shares in a company, investors acquire tokens.

The flexibility and ease of access have made ICOs a popular fundraising tool. Still, they come with risks, such as regulatory challenges and potential fraud, making careful planning and legal compliance critical to success.

Fast Fact:

Among all time’s most significant Initial Coin Offerings (ICOs), it was Ethereum in 2014 that stands out. The sale of their Ether tokens accumulated a substantial amount, roughly $18 million, as they showcased the novel and groundbreaking concept behind smart contracts.

Why Launch an ICO Campaign?

Initiating Initial Coin Offerings presents numerous benefits, particularly for fledgling businesses and blockchain initiatives seeking financial support. Let me outline some compelling motives behind organizing an ICO:

Access to Global Funding

As a researcher, I find that Initial Coin Offerings (ICOs) serve as a revolutionary means for companies to reach out to a global network of potential investors. Unlike traditional fundraising methods, which are often limited by geographical boundaries or exclusive accreditation requirements, ICOs extend an open invitation to anyone with internet connectivity and cryptocurrency holdings. This expansion significantly enlarges the pool of prospective investors, making it possible for a broader range of individuals to take part in the financial growth and innovation of these companies.

Lower Barriers to Entry

Compared to traditional funding methods such as venture capital or Initial Public Offerings (IPOs), Initial Coin Offerings (ICOs) typically come with less regulatory oversight and financial prerequisites. This flexibility allows smaller startups and projects to secure funding more effortlessly, without the necessity of substantial resources or complex legal structures.

Community Building and Early Support

A Initial Coin Offering (ICO) enables you to establish a supportive community for your project at an initial stage. By attracting investors, they not only offer financial resources but also become advocates, actively promoting your project. This can lead to increased usage and enhanced visibility for the project.

Decentralization and Innovation

Initiating an Initial Coin Offering (ICO) mirrors the philosophy of decentralization that underpins blockchain technology. This approach grants projects greater autonomy in managing their operations and administration, reducing dependence on traditional centralized financial bodies.

Token Utility

Initial Coin Offerings (ICOs) frequently develop tokens that possess unique functions within their respective project’s environment, including access to services, voting privileges, or bonuses. This encourages a self-supporting economy revolving around the project, motivating token owners to engage and contribute to its lasting development.

However, ICOs are not without their challenges. Regulatory landscapes constantly evolve, and competition for investor funds can be fierce. It’s essential to ensure your project offers a compelling solution with a strong value proposition to succeed in the ICO market.

How to Create an ICO Project

Approaching an Initial Coin Offering (ICO) thoughtfully is essential. Every stage demands meticulous preparation, starting with ideating your project and ending with the actual token sale execution.

Step 1: Develop a Strong Project Idea

Your ICO’s success depends heavily on the value your project provides. Whether it’s decentralized finance, NFTs, or any other blockchain solution, ensure your project has clear, measurable goals.

- Define your mission.

- Research market demand.

- Identify your unique value proposition.

Step 2: Choose the Blockchain Platform

Many people prefer the Ethereum blockchain because of its versatile smart contract capabilities. If you’re interested in creating an Initial Coin Offering (ICO) on Ethereum, it’s essential to grasp Ethereum’s ERC-20 token standard. This standard simplifies the process of developing and distributing tokens.

Other blockchain platforms you might consider:

Every Initial Coin Offering (ICO) platform offers advantages and disadvantages with regards to scalability, transaction speed, and costs. Nevertheless, Ethereum stands out as the most reliable option because of its vast developer base and strong emphasis on security.

Step 3: Create Your Cryptocurrency Token

Creating your token is at the heart of the ICO process. ICOs generally issue two types of tokens: utility tokens and security tokens.

- Utility Tokens offer access to your project’s products or services.

- Security Tokens represent investment contracts and are subject to financial regulations.

An Initial Coin Offering (ICO) launch platform simplifies the process of generating tokens, offering pre-built solutions for your convenience. With tools such as TokenMint or OpenZeppelin Contracts Wizard at hand, even those with limited programming skills can effortlessly create and deploy their own token.

Step 4: Write a Compelling Whitepaper

Your whitepaper is the blueprint of your project. It outlines your business model, the problem you aim to solve, and how your token fits into the solution. A whitepaper should include:

- Technical details of your project

- Token distribution strategy

- Project roadmap

- Legal considerations

Crafting a thoroughly well-designed whitepaper effectively establishes trust and credibility with prospective investors, so be sure to invest sufficient effort in its creation.

Step 5: Develop a Legal Framework

Navigating the legal environment is essential to dodge regulatory obstacles, especially for Initial Coin Offerings (ICOs). If you’re dealing with security tokens, you’ll encounter close examination from financial authorities. To make sure your ICO adheres to regulations, it’s important to collaborate with lawyers who are experts in cryptocurrency legislation.

- AML laws

- SEC regulations (for the U.S.)

- KYC requirements

Step 6: Set Up a Marketing Campaign

A key factor in ensuring the success of an Initial Coin Offering (ICO) is effective marketing. This involves generating excitement for your project by participating in pre-sale activities, organizing airdrops, and leveraging social media platforms. It’s crucial to emphasize the distinctiveness of your project to potential investors to capture their interest.

- Utilize social platforms like Reddit, Discord, Twitter, and Telegram.

- Submit your ICO to popular listing sites like CoinMarketCap and ICOBench.

- Engage influencers in the crypto space.

Marketing involves more than simply creating hype; it’s equally important to establish a supportive community for your initiative. An actively engaged community can serve as the foundation for a thriving Initial Coin Offering (ICO) cryptocurrency launch.

Step 7: Choose the Best Crypto ICO Launchpad

Choosing the right launch platform is crucial for a successful Initial Coin Offering (ICO). Notable cryptocurrency launch platforms include:

- Binance Launchpad: One of the largest and most reputable platforms.

- CoinList: Focuses on compliance and a broad user base.

- Polkastarter: Popular for cross-chain decentralized projects.

To ensure success, select a launchpad that matches your objectives, providing ample support and visibility for your project.

Step 8: Launch the ICO and Manage the Token Sale

As a crypto investor, I’ve made all necessary arrangements and now, with anticipation, I’m gearing up for the official Initial Coin Offering (ICO) launch. During this exciting phase, prospective investors will purchase my tokens using well-established cryptocurrencies. Overseeing the ICO requires:

- Offering multiple payment options like Bitcoin and Ethereum.

- Monitoring the smart contract to ensure security and transparency.

- Communicating with your community regularly to keep them updated.

Additionally, it’s essential to plan ahead for the post-launch stage, involving listing your token on various trading platforms and keeping an open line of communication with your investors.

How Much Does it Cost to Launch an ICO?

The cost to launch an ICO can vary widely depending on the project’s complexity, marketing level, legal compliance, and technical requirements. A significant portion of your budget will go into:

- Smart contract development

- Token Development

- Own ICO Website Development

- Legal compliance

- Marketing and promotions

- Token listing on exchanges

- Security and Audit

For various factors such as scale, intricacy, and ambition, the overall expenditure to initiate an Initial Coin Offering (ICO) can fall between $50,000 and $300,000, potentially rising for extensive projects. However, the exact cost will be determined by factors like the size, complexity, and breadth of the ICO, as well as the marketing and legal endeavors required.

Conclusion

Initiating an Initial Coin Offering (ICO) offers a distinctive chance for pioneering initiatives to secure funds and establish a robust user base. By diligently following the instructions provided in this manual and sticking to industry best practices, you can enhance your odds of launching a successful new ICO. Keep in mind that careful preparation, open disclosure, and dedication to providing value are vital for sustained success.

FAQs:

Who can launch ICO?

A company specializing in blockchain technology, intending to create a novel application or service involving cryptocurrencies, can organize an Initial Coin Offering (ICO) as a means to acquire necessary funds.

How to build an ICO team?

As a dedicated researcher, I delve deep into my professional connections, seeking out individuals who embody intelligence, innovation, diligence, and trustworthiness. The intricate world of Initial Coin Offerings (ICOs) demands such qualities, as the journey is not an easy one.

How to launch ICO on Ethereum?

Select a Development Platform, Establish a Token Contract, Codify Initial Coin Offering (ICO) Functionality, Determine Pricing and Settings, Ensure Safe Management of Funds.

What was the first ICO?

The initial Cryptocurrency Offering (ICO) was known as Mastercoin. This event occurred within the Bitcoin network in 2013. The developers behind Mastercoin’s ICO were working to construct a Layer-2 protocol on Bitcoin, which would facilitate the creation of new cryptocurrencies.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-02 14:51