Great job on explaining the basics of reading crypto charts and understanding candlestick patterns! I think it’s important for beginners to understand that while these tools can provide valuable insights, they should not be relied upon solely when making trading decisions. It’s also crucial to keep learning and expanding your knowledge base in order to become a successful trader.

As a crypto investor eager to enhance my trading skills, I’d like to share some insights on reading charts to make informed buy or sell decisions in the digital asset market. Rest assured, there’s no reason to be alarmed. Gaining a solid understanding of how crypto charts function and interpreting the underlying data will only strengthen your investment strategies.

Crypto charts are an essential tool for traders and investors in the crypto space, enabling them to enhance their trading strategies and identify potential price trends. By closely examining these charts, they can gain valuable insights into market sentiment and make informed decisions based on current and future market conditions.

It’s important to improve your technical skills when it comes to analyzing the cryptocurrency market. However, be cautious not to get overly bogged down by the complexities of the terminology and ideas associated with it.

Consider thinking of these tools as an integrated part of yourself, enabling you to effectively evaluate trading opportunities by analyzing crucial data such as trading volumes, chart formations, and technical indicators.

In today’s article, we will explore the essentials of interpreting crypto charts, starting with the fundamentals of chart reading in crypto markets. We will delve into various indicators, technical analysis tools, and concepts to help you understand price movements and trends. Additionally, we will discuss candlestick charts in detail and learn how to recognize potential trend reversals. Lastly, we will touch upon the limitations of crypto charts to provide a well-rounded understanding of this crucial aspect of cryptocurrency trading.

The Basics of Crypto Charts

When engaging in cryptocurrency trading on an exchange, you have the option of checking the price chart for any given trading pair. While the most frequently traded pairs involve cryptocurrencies and the US dollar (USD), there are also crypto-to-crypto pairings available.

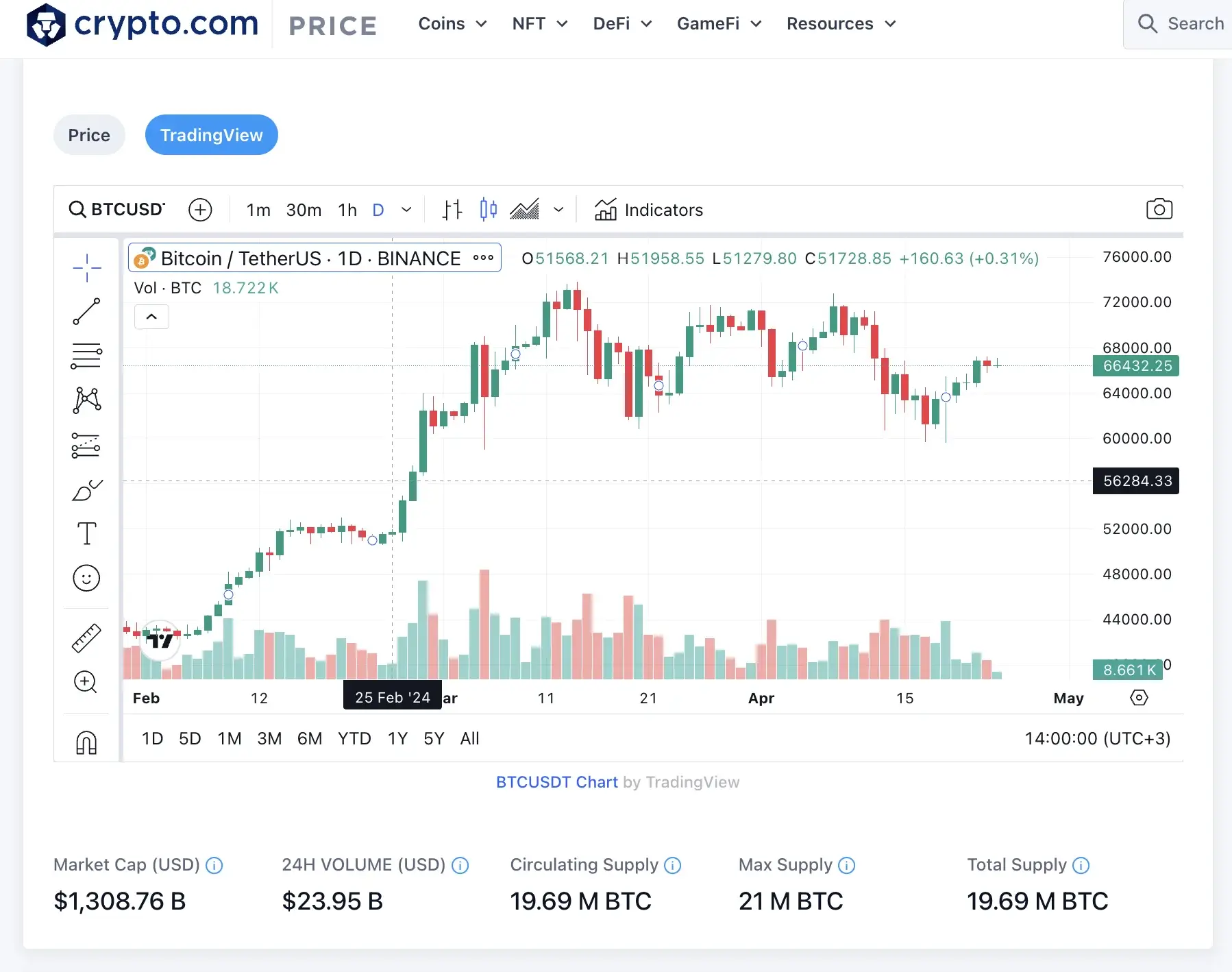

As a crypto market analyst, I would recommend checking out the BTC-USD chart provided by Crypto.com for a clear comparison of Bitcoin‘s price against the US Dollar. By examining this particular chart, we can gain valuable insights into the relationship between these two financial instruments in real-time.

So, let’s break it down further and discover the basics of crypto charts.

1. The Trading Pair

As a researcher examining the realm of digital currencies, I focus on Bitcoin (BTC) as the primary or foundation cryptocurrency, while Tether (USDT) serves as the quote currency in many transactions. USDT is one of the most widely used stablecoins, which are pegged to the value of the US dollar.

On a cryptocurrency exchange, a trading pair plays a crucial role since it enables users to swap one digital currency for another directly, without the need for converting either to traditional fiat money first.

2. The Current Price

As a crypto investor, I prioritize keeping a close eye on the current value of Bitcoin (BTC) in terms of Tether (USDT). This figure is crucial when deciding to buy or sell. Additionally, monitoring Bitcoin’s 24-hour price fluctuations by examining charts can help me adapt to shifting market trends quickly.

3. The Highest and Lowest Prices

By examining the image below, you can use this standard to assess the price fluctuations over the past 24 hours, specifically identifying both the highest and lowest points.

4. 24-hour Volume

As a researcher studying Bitcoin’s trading activity, I can utilize the 24-hour volume data to evaluate the total amount of Bitcoin trades conducted within that timeframe. In this instance, we observe a trading volume exceeding 34 hours, with the figure given in USDT as the quote currency.

Additionally, this data point is significant since it offers insight into the investor’s engagement with the cryptocurrency and the volume of transactions that have occurred within the last day.

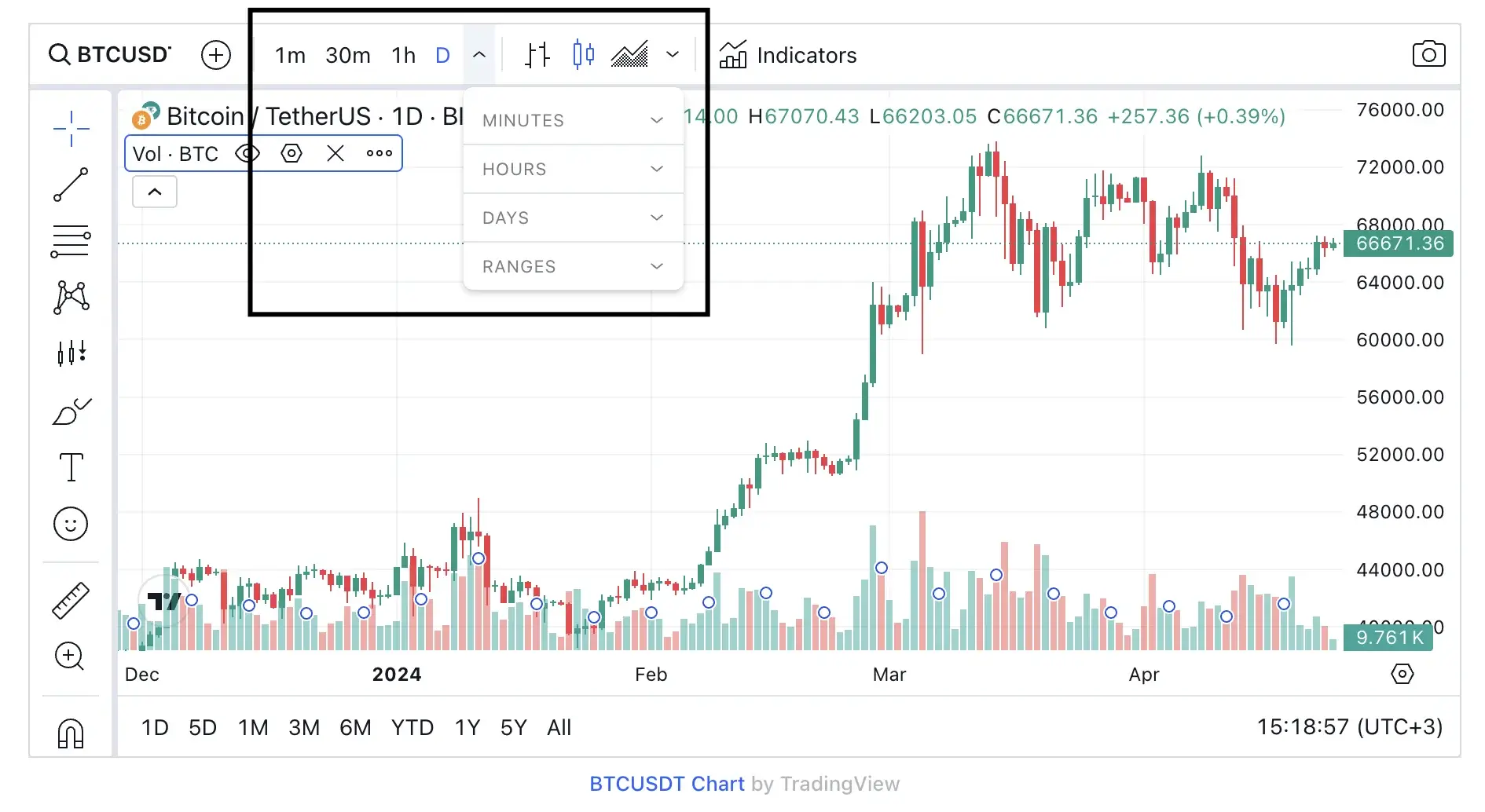

5. Unit of Time

Another option is to specify the time duration for examining the cryptocurrency graphs. Consequently, you have the flexibility to select among intervals such as minutes, hours, days, or customized periods.

6. Price Chart Patterns

As a crypto investor, I find it helpful to consider certain benchmarks when analyzing price trends. By doing so, I can more effectively gauge the ups and downs of a cryptocurrency over specified periods, be it hourly, daily, monthly, or even annually.

7. Trading Volume Chart

Beneath the primary cryptocurrency graph displaying price fluctuations, you’ll find the trading volume chart, which signifies the number of transactions for your specific asset.

In simpler terms, long bars signify greater trading activity, while the colors represent the direction of price changes – green for rising prices and red for falling ones.

From my perspective as an analyst, I understand that this process may not involve the complexity of rocket science, but it does necessitate a significant amount of focus until you fully grasp the concept. However, there are resources available to aid in your understanding, such as instructional videos, note-taking, and practice sessions. These tools can make the learning experience more effective and rewarding.

According to our perspective, studying crypto chart patterns is a valuable approach that can enhance your cryptocurrency trading experience and distinguish you as an experienced trader from a beginner.

What Are the Crypto Charts Indicators to Look Into?

Crypto chart indicators serve multiple purposes, including evaluating trading strategies and deciphering crypto market moods, as well as identifying market tendencies. Regrettably, most of these technical indicators for crypto charts exhibit a lagging behavior, thereby undermining their effectiveness when timely information is crucial.

A frequent error among novice crypto market entrusiasts is overusing multiple technical indicators at once, which can quickly become unwieldy and leave them feeling swamped. Instead, it’s recommended to focus on a select few indicators that provide a clearer and more comprehensive understanding of the market trends.

As a researcher, I find it crucial to utilize various technical indicators to enhance my analysis of financial markets. Some of the most indispensable tools I employ are:

As a researcher studying cryptocurrencies, I can confirm that all chart indicators in crypto are based on price actions and trading volumes. Consequently, it’s essential to use them alongside the price data for accurate analysis. In simpler terms, technical indicators serve as an extra layer on price charts to help identify trends, momentum, and potential support or resistance levels.

Types of Crypto Charts Indicators

As a seasoned crypto investor, I understand the importance of using technical indicators to make informed decisions in the market. While there are numerous options available, I’d like to focus on some of the most widely used and effective ones.

1. Moving Averages (MA)

As a crypto investor, I find the Moving Average indicator to be a valuable tool in my analysis arsenal. Instead of focusing solely on the day-to-day price fluctuations, this indicator helps me understand trends by calculating the average price over a particular time frame. In essence, it smoothes out the price data and provides clearer insights into market direction. The Moving Average comes in two forms: simple and exponential, each with its unique advantages depending on the investor’s needs.

Simple Moving Average (SMA): Calculate the average price over a specific time equally;

Exponential Moving Average (EMA): This type is more responsive to market movements and conditions that apply weighting factors, which decrease exponentially.

When to Use Moving Averages?

Recognizing the general tendencies involves interpreting a rising price as an uptrend, while a falling price indicates a downtrend.

As a market analyst, I would recommend examining Moving Average Crossovers as a method to uncover potential buy or sell opportunities. Specifically, look for instances where the short-term moving average surpasses the long-term moving average (indicating a possible buy signal), or conversely, when the short-term moving average falls below the long-term moving average (potentially signaling a sell opportunity).

One possible paraphrase for “For looking at support and resistance levels, moving averages can serve as the agile guiding lines for price fluctuations, acting as pivots.” or “When examining support and resistance levels, moving averages function as the flexible pathways that price action bounces off.”

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a powerful technical tool that assesses the speed and magnitude of price changes in the crypto market. Ranging from 0 to 100, it offers insight into the current market conditions and allows you to identify when cryptos have been overbought or oversold.

As a crypto investor, I would interpret the reading of a value above 70 as a sign that the crypto market is overbought. This implies that there might be an impending correction, meaning prices could potentially drop to restore balance. Conversely, when the value falls below 30, it indicates that the crypto market is oversold. In this case, the market may experience a rebound as buyers enter to capitalize on undervalued assets.

3. Moving Average Convergence Divergence (MACD)

In the image, the Moving Average Convergence Divergence (MACD) interacts with the trend-following momentum indicator: One line in this pairing signifies the MACD line, while the other is referred to as the signal line.

The MACD line represents the difference between two exponentially weighted moving averages, while its signal line is the average of these difference values. A key concept to grasp is the crossover point of these lines, as it indicates the shift in momentum for buying or selling.

4. Fibonacci Retracement

Using the principles of Fibonacci sequences, this tool employs dashed lines to identify possible levels of support and resistance. Fibonacci ratios are derived from mathematical progressions in which every number represents the sum of the two preceding ones.

5. Bollinger Bands

Bollinger Bands represent a moving average with two sets of lines, each located a standard deviation above and below it. These lines illustrate stock price volatility. When prices stay within these bands, the market is considered range-bound. On the other hand, when prices breakout from the bands, it may signal a trend reversal or an increase in momentum.

As a crypto investor, I’d be happy to clarify some aspects of Bollinger Bands for you. The middle line represents the simple moving average, often referred to as the baseline or centerline. On the other hand, the upper band functions as the resistance level, where prices may encounter selling pressure or potentially reverse course.

As a researcher, I’d like to add that the lower band represents the minimum threshold in our analysis. At this stage, prices exhibit a high probability of rebounding or experiencing renewed purchasing activity.

Bollinger Bands serve as valuable tools for investors by pinpointing potential support and resistance levels in the market. These bands expand and contract depending on market data and volatility, making it easier to detect price breakouts.

Crypto chart technical indicators can significantly facilitate an investor’s crypto trading experience by providing valuable insights. However, selecting the right indicator depends on your specific goals and level of expertise. For those seeking guidance, we suggest exploring detailed crypto guides that explain how to interpret crypto charts effectively and implement advanced crypto trading techniques.

Understanding Technical Analysis

As a researcher in the field of cryptocurrencies, I would describe technical analysis as a powerful tool or method used to predict potential price trends for a specific cryptocurrency pair. By closely examining historical chart data, we identify patterns such as trendlines, consolidation, and breakouts, providing insights into possible future price movements based on past trading activity.

But what is the link between technical analysis and crypto charts?

To conduct a thorough technical analysis, it’s essential to examine cryptocurrency trading charts since their interdependence is crucial. Analyzing past price fluctuations in the crypto market allows for the prediction of future price trends by considering prevailing market trends and investor sentiments.

Additionally, technical analysis techniques are applicable to various financial markets such as stocks, indices, commodities, and cryptocurrencies.

A Brief Technical Analysis Incursion & The Dow Theory

Charles Dow, the pioneering figure behind the Wall Street Journal and Dow Jones & Company, introduced the concept of technical analysis. As the founder and editor of the Wall Street Journal and a co-founder of Dow Jones & Company, he was also responsible for creating the first stock index, the Dow Jones Transportation Index (DJT).

Why is it essential to know the man behind technical analysis?

As a seasoned market analyst, I’ve come to appreciate the enduring relevance of the Dow Theory. Originating from extensive research spanning many decades, this time-honored approach has shaped our current understanding of stock market trends and patterns.

Let’s discover more about the Dow Theory and see which principle it operates on.

1. The Price of the Assets Incorporates All Information

In simpler terms, the market price of an asset reflects all known information about its earning capacity.

2. The Primary Market Trends

In simple terms, bull and bear markets represent the primary trends in financial markets, with bull markets being periods of continuous price rise and bear markets being periods of consistent price decline. Secondary trends include corrections during bull markets, where prices temporarily fall before continuing to rise, and rallies during bear markets, where prices experience brief gains before resuming their downward trend.

3. The Primary Trends Phases

growth, public investment, and peak; while bear markets undergo distribution, public involvement, and panic phases.

4. Market Indices Must Corelate Between Them

In simpler terms, the indices of different markets should align with each other’s trends. They cannot display contradictory movements – one showing an uptrend while the other indicates a downturn. Instead, they should move in the same direction for consistency.

5. The Market Trend and the Trading Volume Ratio

In a bull market, you’d expect to see an uptick in trading activity. Conversely, during a bear market, trading volumes usually decrease. A significant drop in trading volume during a bull market might signal an emerging bearish trend, potentially leading to a shift towards a bear market sentiment.

6. Persisting Trends Until A Turnaround

It is said that crypto market trends will continue until a disruption occurs.

Candlestick Charts Basics

As a crypto investor, I find it incredibly helpful to analyze the candlestick charts of various digital assets. These charts serve as visual depictions of the trading activity for each specific crypto, providing me with valuable insights. They reveal essential details such as the asset’s opening and closing prices and the changes in price throughout different time frames – both short-term and long-term. By closely examining these charts, I can make informed decisions regarding buying or selling opportunities based on the trends and patterns they display.

As a crypto investor, I examine each candlestick chart using a visually engaging graph to understand the price data. The vertical axis on my chart signifies the price levels, while the horizontal axis displays the time frames.

As a researcher studying the cryptocurrency market for potential day trading opportunities, I find it essential to closely examine the price candles’ structures. Each candle’s top and bottom represents the opening and closing prices within a specific time frame. These levels are crucial indicators of bullish or bearish trends. For instance, if the opening price is lower than the closing price but the upper part of the candle’s body (known as the ‘wick’) is relatively short, it could signify a potential bull flag, indicating an uptrend may be forming. Conversely, if the opening price is higher than the closing price with a long wick, it might indicate a bearish flag, suggesting a downtrend could be on the horizon.

By examining automated cryptocurrency trading systems, it becomes clear that they efficiently process vast quantities of trading information and create live candlestick charts. As a result, crypto traders can effectively identify trends and make well-informed decisions based on the presented data.

An alternative perspective to consider is the hue of the candlesticks, as they signify the opening and closing prices with the former being indicated by the candlestick’s base and the latter by its peak. When there’s a price rise, the candle assumes a green color, which is also referred to as a bullish candle, with the bottom marking the opening price and the top indicating the closing price.

If a candle is red in color, it signifies a decline in price during the specified period. This type of candle is referred to as a “bearish candle,” where the opening price represents the top of the body and the closing price marks the bottom.

As a crypto investor, I’d like to explain that we next focus on the candle wick or tails, located above and below each candlestick’s body. These thin lines represent the highest and lowest price points within the specified time frame for the particular cryptocurrency being charted.

As a seasoned crypto investor, I’ve come to appreciate the value of analyzing candlestick charts to discern trends, patterns, and market sentiment. These visual representations of price action are essential tools for making informed investment decisions. Let me walk you through some popular candlestick patterns:

3 of the Most Common Candlestick Patterns

1. Doji Candle Pattern

When the open and closing prices of a cryptocurrency are nearly identical, resulting in a candlestick without a distinct body, we encounter the doji pattern. This figure indicates market uncertainty and may signal an impending trend reversal.

2. The Hammer

The hammer shape is evident in this candlestick pattern. Its name is descriptive, as it boasts a compact upper body and an elongated lower shadow. Following a decline, the hammer indicates a possible bullish turnaround.

3. The Shooting Star Pattern

As a crypto investor, I’ve noticed that the “shooting star” candlestick pattern resembles the hammer in reverse. This means it has a long wick at the top and a small body near the bottom. Typically, when I see this pattern emerge during an uptrend, it may signal an impending bearish reversal.

As these are just some examples, there could also be the Abandoned Baby Top/Bottom, the Three Black Crows, and many more.

Finding Crypto Charts Patterns

After making significant progress, you are now able to recognize, dissect, and decipher the constituents of a crypto chart. These charts, including candlestick varieties, convey the narrative of a cryptocurrency’s price action. This skill is indispensable as your trading strategy hinges upon it, providing insight into the market’s trends for a specific asset.

Additionally, with the abundance of various charts, pricing levels, and candlestick formations, it’s evident that no single pattern fits all. Therefore, consider focusing on essential trading principles and how they impact your approach to trading.

The Support and Resistance Levels

In simple terms, support levels denote prices where a cryptocurrency tends to bounce back during a downtrend due to buying interest. These levels provide a foundation, or “support,” preventing further decline in price.

As an analyst, I would describe resistance levels as the price thresholds where a cryptocurrency encounters significant selling pressure and finds it difficult to break through, acting like a barrier or ceiling.

Traders interpret the significance of support and resistance levels by drawing trendlines through an asset’s price data. The direction of the trendline, whether ascending or descending, can indicate increased buying pressure (support) or selling pressure (resistance).

One way to explain how to determine support and resistance levels using moving averages could be:

Crypto Charts Drawbacks

Traders frequently hold the conviction that cryptocurrency charts can accurately forecast future price trends. However, it’s essential to recognize that these charts only represent potential outcomes since the nature of crypto markets is complex and unpredictable.

As a crypto investor, I’ve learned that focusing too much on charts and candlesticks isn’t the only path to success in trading. In fact, spending too much time on these visuals can lead to confusion and even conflicting signals. Instead, it’s important to maintain a balanced perspective and consider other factors such as market trends, news events, and fundamental analysis.

As a cryptocurrency analyst, I would advise you to familiarize yourself with the intricacies of crypto charts and candlestick patterns. These tools can provide valuable insights into market trends and price movements. However, it’s essential to understand that they only represent historical data and should not be taken as definitive predictions for future price actions. Instead, use them as guides to inform your investment decisions while keeping in mind their purposes, values, and limitations.

FAQ

How to Read Crypto Charts?

As a researcher delving into the intricacies of cryptocurrency markets, I’ve come to realize that support and resistance levels hold significant importance when interpreting charts. Support levels signify price points where assets don’t typically decline below, acting as a floor for potential buying activity. Conversely, resistance levels denote price thresholds where assets are not expected to advance significantly within a specific timeframe, serving as a ceiling for selling pressure.

How to Read Crypto Charts for Day Trading?

Day traders have various technical analysis methods at their disposal, including chart patterns, trading alerts, and indicators, to help them make knowledgeable decisions. Nevertheless, relying solely on these tools isn’t the key to success. Mastering risk management techniques, such as implementing stop-loss orders, is crucial for an effective day trading strategy.

How to Read Crypto Candlestick Charts?

To put it simply, candlestick charts represent the highs and lows, as well as the opening and closing prices, of an asset during a particular time frame. The vertical lines extending above and below the rectangular bodies signify the highest and lowest prices, respectively. Lastly, green candles denote price increases, while red ones indicate price decreases.

Conclusion

Having mastered the art of interpreting cryptocurrency charts, I’ve become proficient in deciphering price trends, identifying key technical indicators, and recognizing various candlestick patterns. I’ve also delved deeper into the realm of technical analysis to gain a more comprehensive understanding of market behavior.

As a savvy crypto investor, I understand the importance of utilizing charts in my investment strategy. However, it’s essential not to rely solely on them. Instead, combine your chart analysis with effective risk management techniques and a touch of intuition to successfully navigate the thrilling and volatile world of cryptocurrencies.

Certainly! “Have you honed your new abilities? Brave the crypto market with assurance, and never cease in your quest for knowledge and discovery.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-13 12:47