As a seasoned crypto enthusiast with years of experience navigating the digital asset landscape, I find Uniswap to be an indispensable tool in my decentralized finance journey. Its user-friendly interface and robust features have made it a go-to platform for trading various ERC-20 tokens without intermediaries.

To reap the advantages of decentralized trading platforms, you’ll likely find yourself utilizing Uniswap, given its widespread popularity among DEX users today. Nevertheless, for beginners, navigating through Uniswap may initially appear complex.

In this write-up, I’d like to share my insights on Uniswap – a popular platform in the crypto world. Here, I’ll guide you through its essential features and offer tips on maximizing your experience with it.

What is Uniswap?

Back in November 2018, Uniswap was among the earliest applications in the field of Decentralized Finance (DeFi) to garner significant interest on the Ethereum network. Now, it stands as the biggest Decentralized Exchange (DEX) operating on the Ethereum blockchain.

Unlike conventional platforms such as Binance or Coinbase, Uniswap operates independently without central control by a specific corporation or institution.

This platform employs a distinctive trading strategy known as the Automated Market Maker (AMM). Here, users deposit their tokens into liquidity pools which then determine prices dynamically according to market conditions like supply and demand.

As a crypto investor, I appreciate this setup that allows me to engage in peer-to-peer transactions, such as buying, swapping, and sending cryptocurrencies, all without the need for intermediaries like conventional exchanges.

As a proud crypto investor, I’m part of the Uniswap community, where we all hold the UNI token. This governance token empowers us to have our say in significant modifications and decisions concerning the platform, such as determining token distribution strategies or adjusting fees – truly putting the power in the hands of the people!

In September 2020, the UNI tokens were launched as a means to discourage users from migrating to an alternative platform, SushiSwap, which is derived from Uniswap.

How Does Uniswap Work?

Uniswap functions distinctly compared to conventional centralized trading platforms. It eliminates the requirement for an order book, which isn’t suitable for decentralized exchanges (DEX) due to factors like liquidity problems. Instead, it employs a system known as the Constant Product Market Maker, a form of Automated Market Maker (AMM).

Automated Market Makers (AMMs) function as smart contracts that manage liquidity pools, which facilitators trades. These pools are capitalized by liquidity contributors—anyone who can deposit an equivalent value of two tokens into the pool. In exchange for offering liquidity, these contributors receive a fee from traders, and this fee is distributed among the contributors according to their proportion in the pool.

In Uniswap, it’s possible to contribute two identical value tokens (like Ethereum [ETH] and another ERC-20 token, or two distinct ERC-20 tokens) into a common pool, thereby establishing a trading market for those specific assets.

Many pools use stablecoins like DAI, but it’s not a requirement. In exchange for liquidity, these providers earn “liquidity tokens,” representing their share of the pool.

Let’s consider an ETH/DAI liquidity pool as a practical example. In this scenario, “x” stands for the amount of ETH in the pool and “y” denotes the DAI. The platform Uniswap uses these two quantities to determine the total liquidity, denoted by “k.” Essentially, the total liquidity “k” stays consistent regardless of the trades taking place within the pool.

So, the formula looks like this: x * y = k.

If an individual, similar to Patrick, decides to engage in trading by exchanging 1 ETH for 2300 DAI, they would increase the DAI amount within the pool while decreasing the Ethereum (ETH) quantity. Since there is now a smaller supply of ETH in the pool, its value increases due to the demand-supply equilibrium. This constant dance between supply and demand, where the total value represented by “k” remains unchanged, is what ultimately sets the token prices within Uniswap’s pools.

How to Use Uniswap Protocol – Everything You Must Know

With a foundational grasp of Uniswap and its operations under your belt, let’s delve into the essentials for beginners to get started with various tasks on this platform.

Initially, let’s guide you on a crucial process: linking your wallet with the Uniswap application. This step is vital as it enables you to perform various activities such as exchanging tokens or trading NFTs, all of which require a connected wallet.

As a researcher delving into the world of decentralized finance, let me walk you through the process of swapping, sending, purchasing tokens, and trading Non-Fungible Tokens (NFTs) on Uniswap. This step-by-step guide aims to make it effortless for you to explore and utilize all the features that Uniswap has at your disposal.

How to Connect Your Crypto Wallet to Uniswap: Step-by-Step Guide

Currently, there are several methods to link your cryptocurrency wallet with the Uniswap Protocol. These include:

For your convenience, we’ll guide you through the steps using MetaMask, though the overall process is similar across most other wallets. In essence, we’re aiming to keep things straightforward no matter which wallet you choose.

Step 1. Access the Uniswap Official Website to Launch the App and Press the “Connect” Button

First, navigate to the main Uniswap site. Upon arrival, find the “Launch Application” button located on the upper right side of the page. Go ahead and click it to begin your journey.

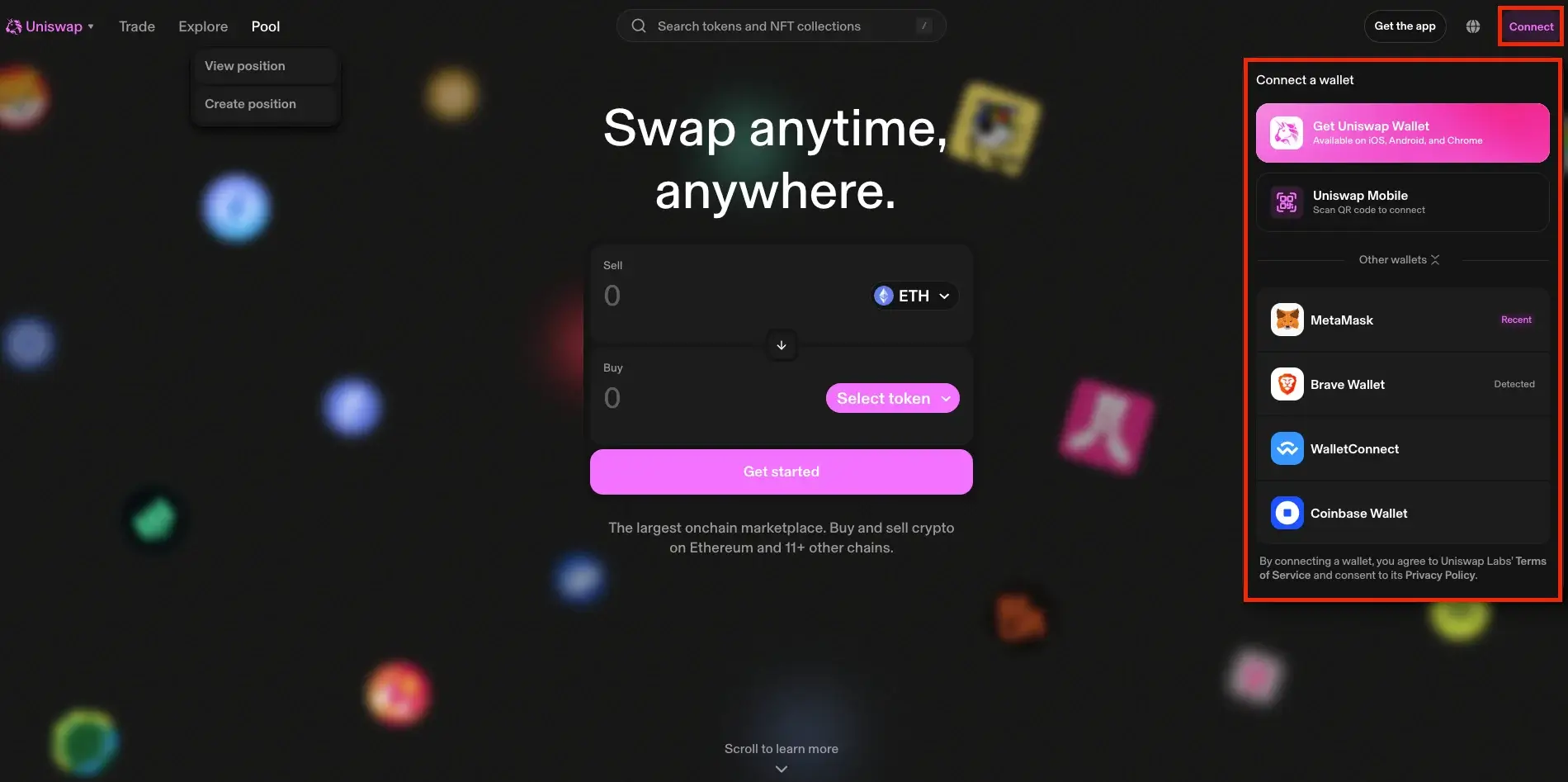

Once you’ve launched the application, search for the “Connect” button located at the upper right corner. Press it, then select the digital wallet you prefer (for instance, MetaMask) to proceed with.

Step 2. Link Your MetaMask Wallet

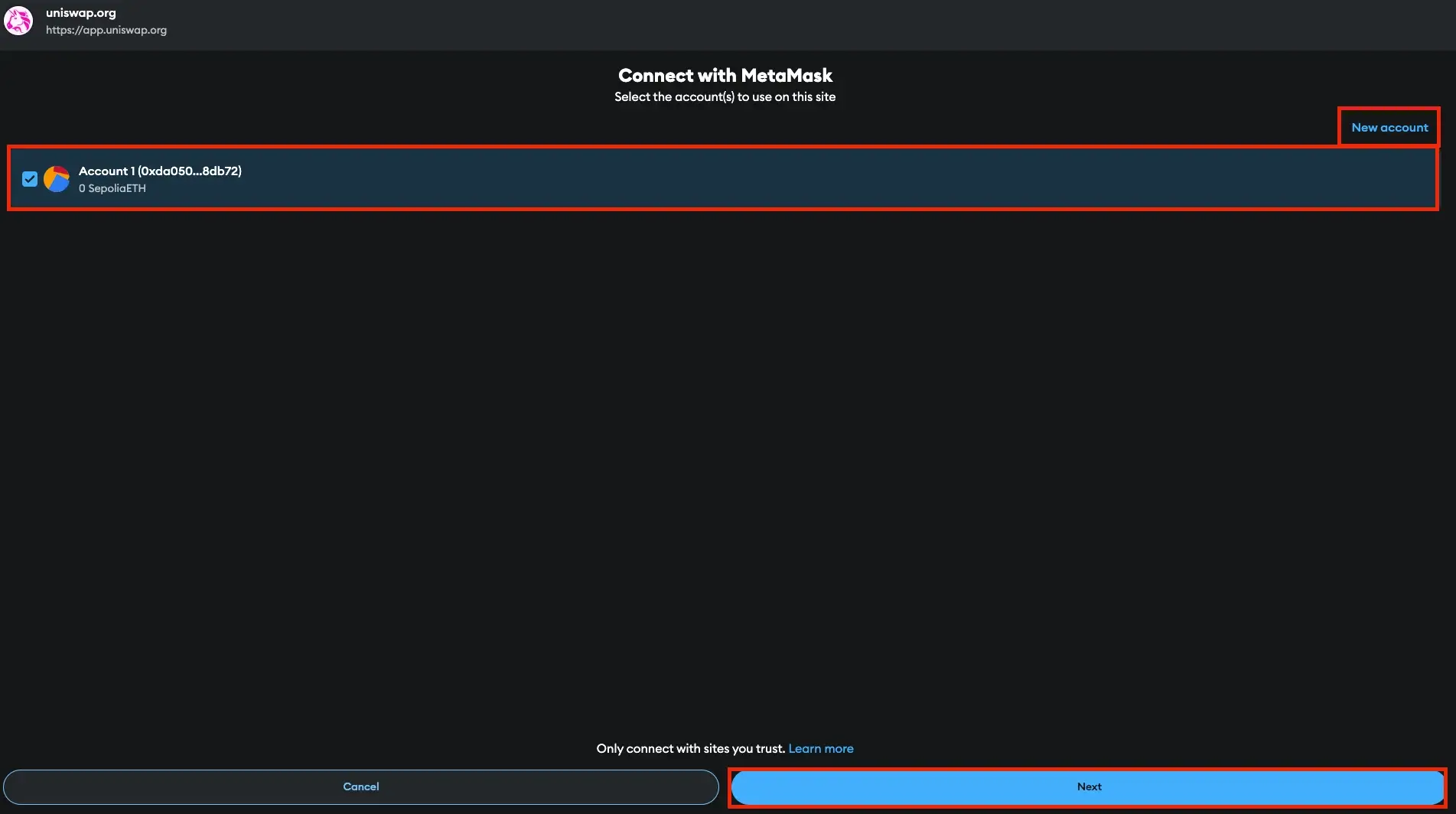

After you hit “Connect,” a fresh window will appear. In this window, you’ll be able to choose the MetaMask account you wish to connect with Uniswap. If you don’t currently have an account or would like a new one, just click on “New Account” to set it up.

Once you’ve chosen your account, go ahead and press “Next”. Then, to allow Uniswap the required permissions, click on “Confirm”.

And just like that, your MetaMask wallet is connected to Uniswap!

How to Use Uniswap to Swap Tokens: Step-by-Step Guide

Exchanging one cryptocurrency for another on Uniswap is straightforward since you can do it directly through the platform, bypassing the need for middlemen. This process, being decentralized, ensures easy and safe trading of various tokens.

Below, we’ll walk you through the steps to successfully swap tokens on Uniswap.

Step 1. Go to the “Swap” Section and Enter Your Transaction Details

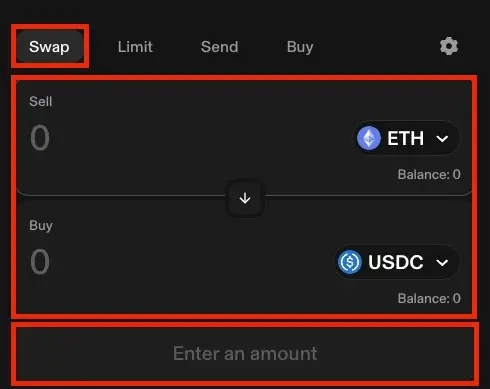

Once you link your wallet with Uniswap, proceed to the homepage and hit the “Swap” tab to initiate the process of exchanging your cryptocurrencies.

Pick the cryptocurrency you wish to sell from your portfolio using the given menu, input the desired quantity, and finally decide on the cryptocurrency you prefer to get in return.

After entering all the details, click “Swap.”

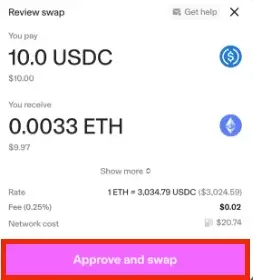

Step 2. Review and Confirm the Swap

Please take a quick look at all the transaction information. If it appears correct to you, go ahead and click the “Confirm and Exchange” button.

To complete the swap of your token within your digital wallet, you’ll be asked for approval, which incurs a network charge. If this is your initial time exchanging this specific token on Uniswap, you will also need to grant permission for that token to be traded.

After completing that step, add your signature to the message within your wallet (no network fees are necessary for this action). Lastly, verify the exchange within your wallet, which will necessitate a network charge once more.

After confirmation, your exchange will be processed on the blockchain, and you’ll receive a “Swap Completed” message with a green checkmark once the transaction has been successfully executed.

How to Use Uniswap to Send Crypto Assets: Step-by-Step Guide

Transferring cryptocurrency assets using Uniswap is a simple method for moving tokens from one digital wallet to another, be it for payment purposes or shifting funds between your own wallets. Uniswap streamlines this process, making it effortless.

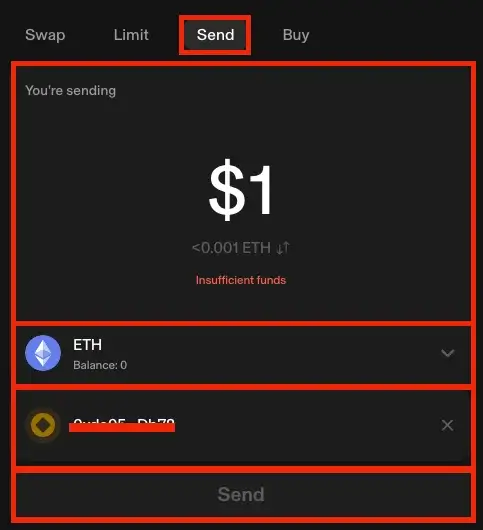

Step 1. Go to the “Send” Section and Enter Your Transaction Details

After linking your wallet to Uniswap, navigate to the homepage and tap on the “Transfer” area to send your cryptocurrency.

To initiate a transaction, please input the desired amount, select the preferred cryptocurrency using the drop-down list, and enter either the recipient’s wallet address or their ENS name in the “Recipient” field.

Once all the details are filled in, click the “Send” button.

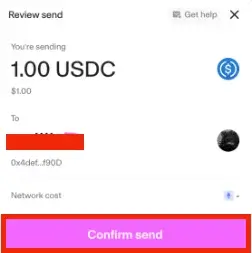

Step 2. Review and Confirm the Transaction

Should your wallet be transferring tokens to the provided address for the first time, a message might appear. Make sure to thoroughly examine it before proceeding with “Continue.” Following this step, you’ll need to verify the transaction by choosing “Confirm send.

After you send the transaction, you’ll notice a “pending” symbol appearing at the upper right corner. You’ll receive a message when the transaction is finished. Simply click on the message to explore the transaction details in the blockchain browser.

How to Use Uniswap to Buy Crypto: Step-by-Step Guide

On Uniswap, users have the freedom to acquire various ERC-20 tokens directly through the Uniswap interface. Here’s a simple guide on how to go about it:

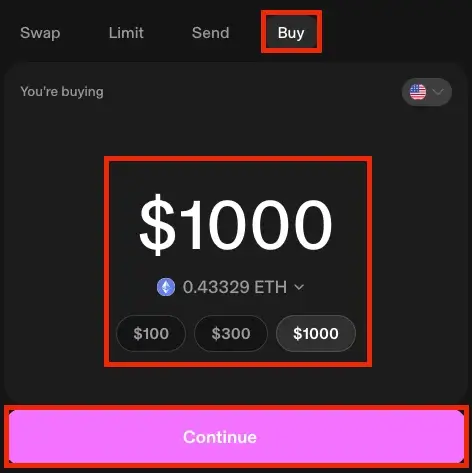

Step 1. Go to the “Buy” Section and Enter the Details About the Transaction

Once you’ve linked your digital wallet with Uniswap, navigate to its primary screen and tap on the “Buy” area to initiate the process of acquiring cryptocurrency.

In this interface, you’ll be asked to choose your location, input the desired purchase amount, and select a preferred cryptocurrency. After filling in these details, simply press “Continue.

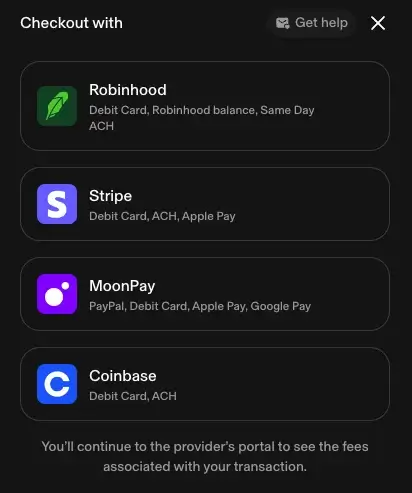

Step 2. Choose a Provider and Complete the Transaction

Now, you’ll see a list of providers you can use to buy crypto. The options will depend on your region and could include providers like Robinhood, Coinbase, MoonPay, or Stripe.

Select your preferred provider, and you’ll be redirected to their site to complete the purchase.

For new users, it’s possible that you’ll be asked to confirm your email address, phone number, or personal identity, based on where you’re located during the initial sign-up process.

Once you’ve completed these steps, your crypto will be deposited directly into your wallet.

How to Use Uniswap for NFT Trading: Step-by-Step Guide

On Uniswap, it’s straightforward to acquire Non-Fungible Tokens (NFTs) without leaving the platform. Here’s a simple guide to help you navigate:

Furthermore, you have the option to purchase NFTs from well-known marketplaces such as OpenSea, but through Uniswap, following a comparable procedure.

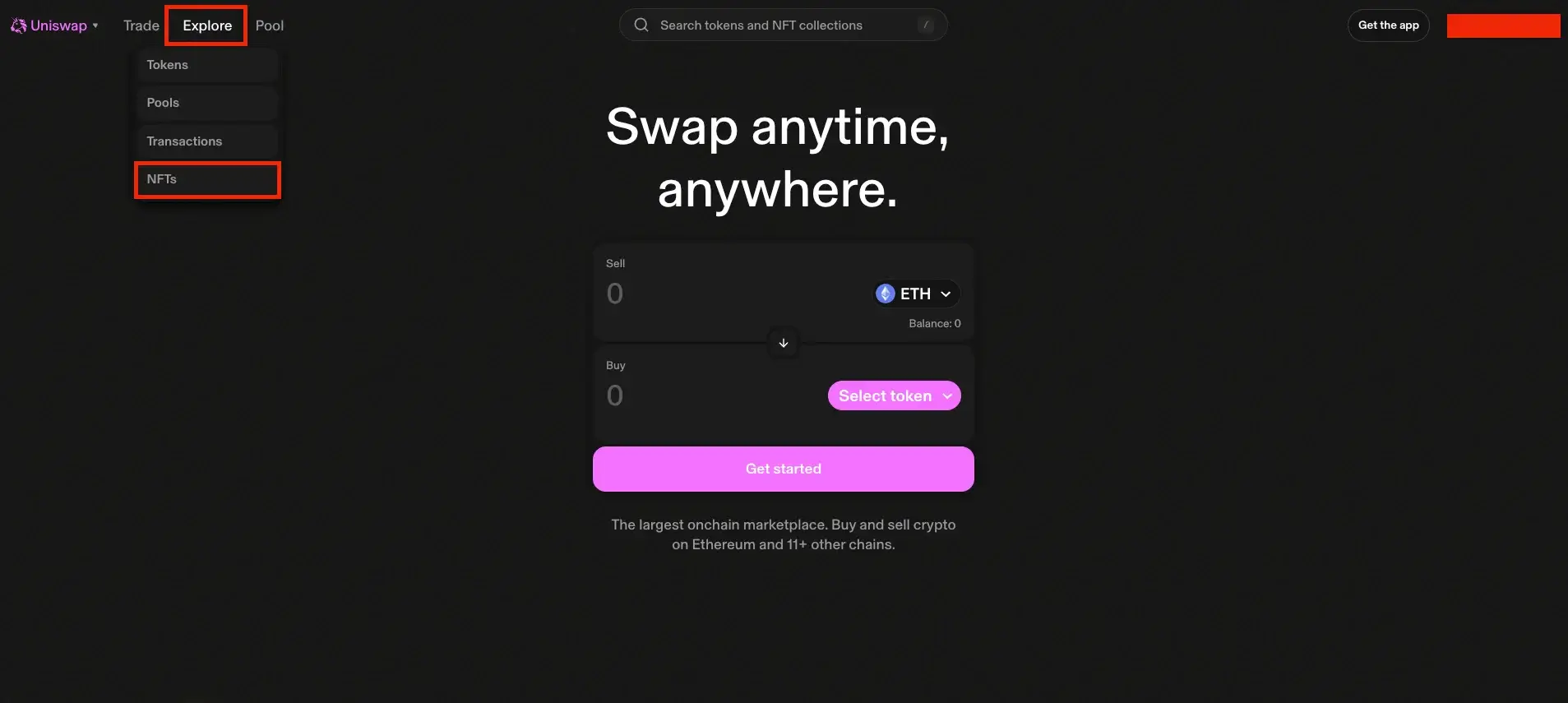

Step 1. Go to the NFT Trading Page on Uniswap

To trade Non-Fungible Tokens (NFTs) on the Uniswap platform, navigate to the dedicated section. You can reach this by clicking on “Explore” from the header menu and then choosing “NFTs”. This action will lead you directly to Uniswap’s page for NFT trading.

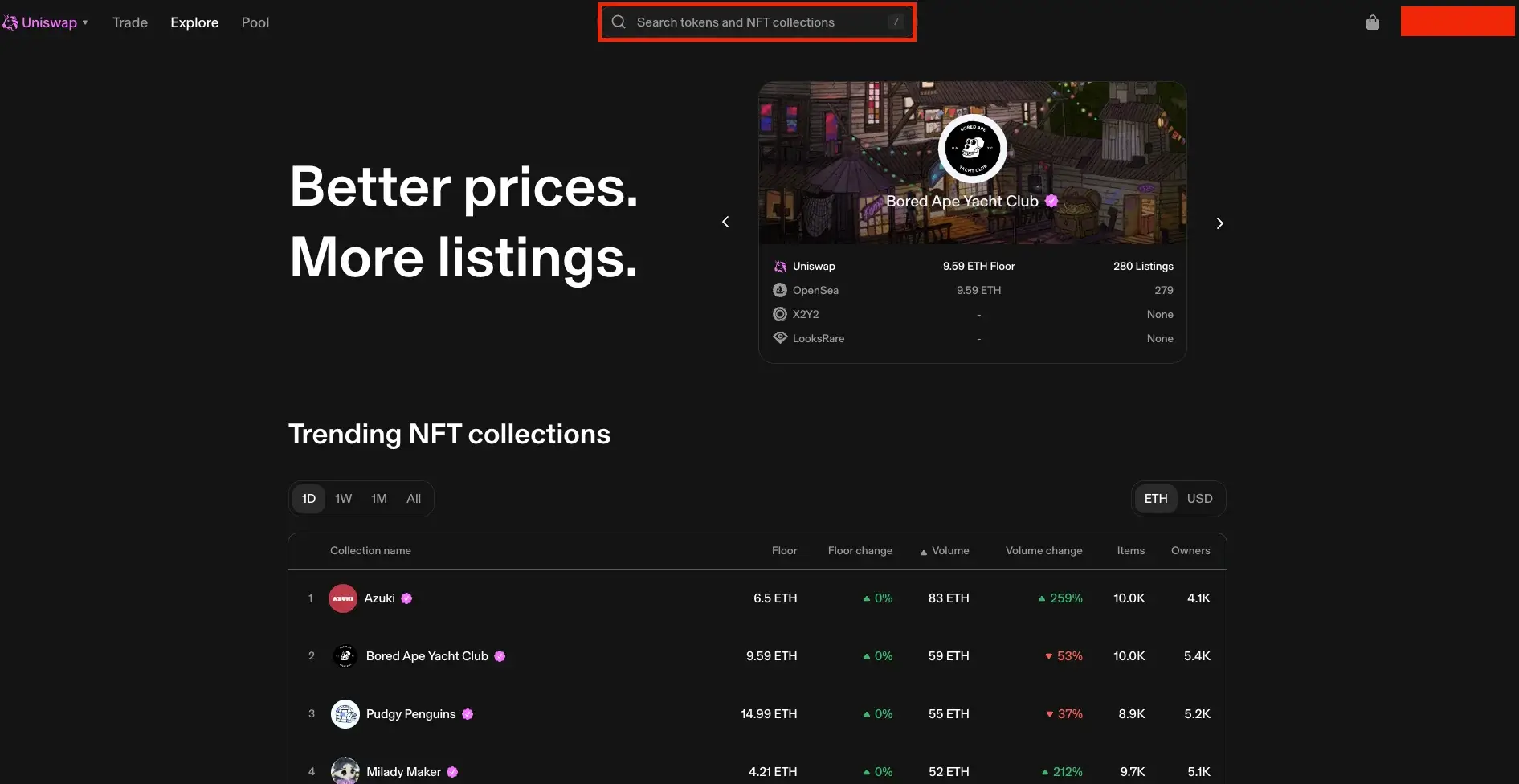

Step 2. Search for Your Desired NFT

At the head of the NFT marketplace, you’ll notice a search box. Use this tool to locate and purchase your desired NFT directly.

You can also explore popular NFT collections displayed just below the search bar.

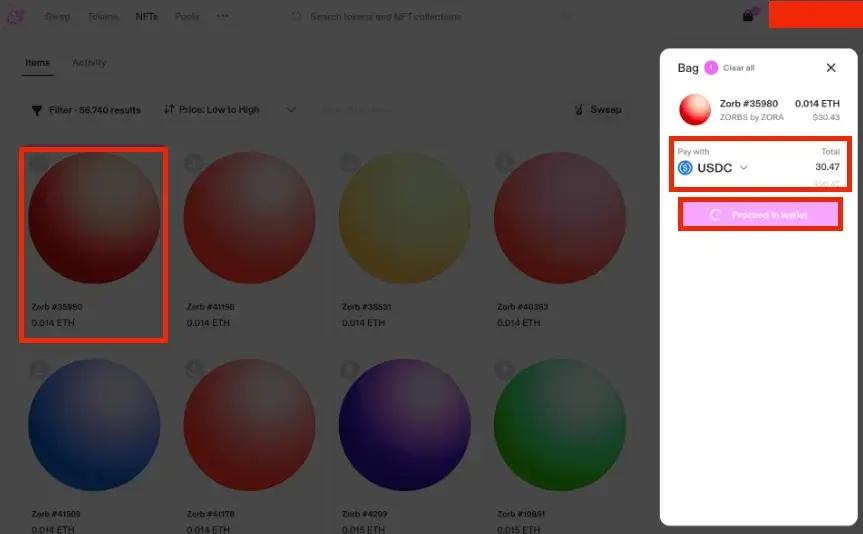

Step 3. Add the NFT to Your Bag and Complete the Purchase

Once you find the NFT you want, hover over it and click the “Add to bag” button.

Once you’ve placed the item in your cart, select the cryptocurrency you prefer for payment, then hit “Pay.” Ensure that the number of coins in your wallet is sufficient to cover the entire cost of the NFT, and you’re good to go!

How to Use Uniswap Protocol as a Liquidity Provider: Step-by-Step Guide

“I can leverage Uniswap, an automated liquidity platform, by contributing my cryptocurrencies to the pool and earn fees in return.

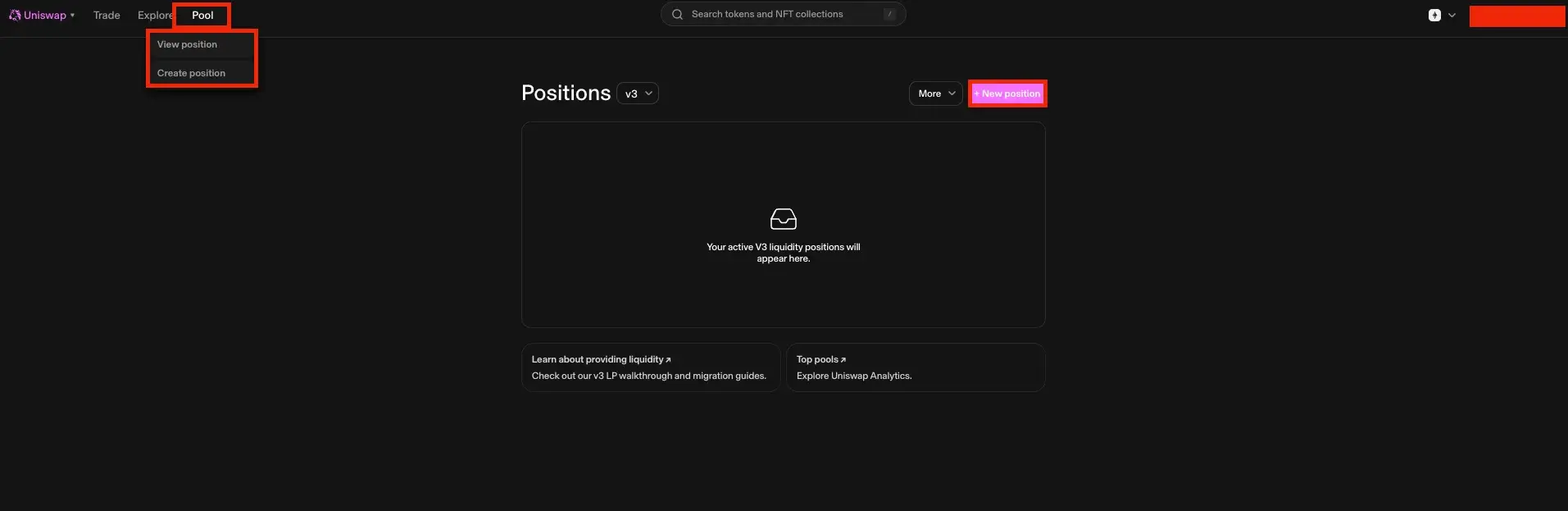

Step 1. Access the Uniswap App and Select “New Position”

To get started with providing liquidity on Uniswap V3, launch the Uniswap web application and head over to the “Pools” area. In this section, you can either establish new liquidity pools or take care of existing ones.

From here, click on the “New Position” option to start. You’ll need to select the tokens for which you want to add liquidity by choosing them from the drop-down menus.

Uniswap allows any pair of ERC-20 tokens, so you have plenty of options.

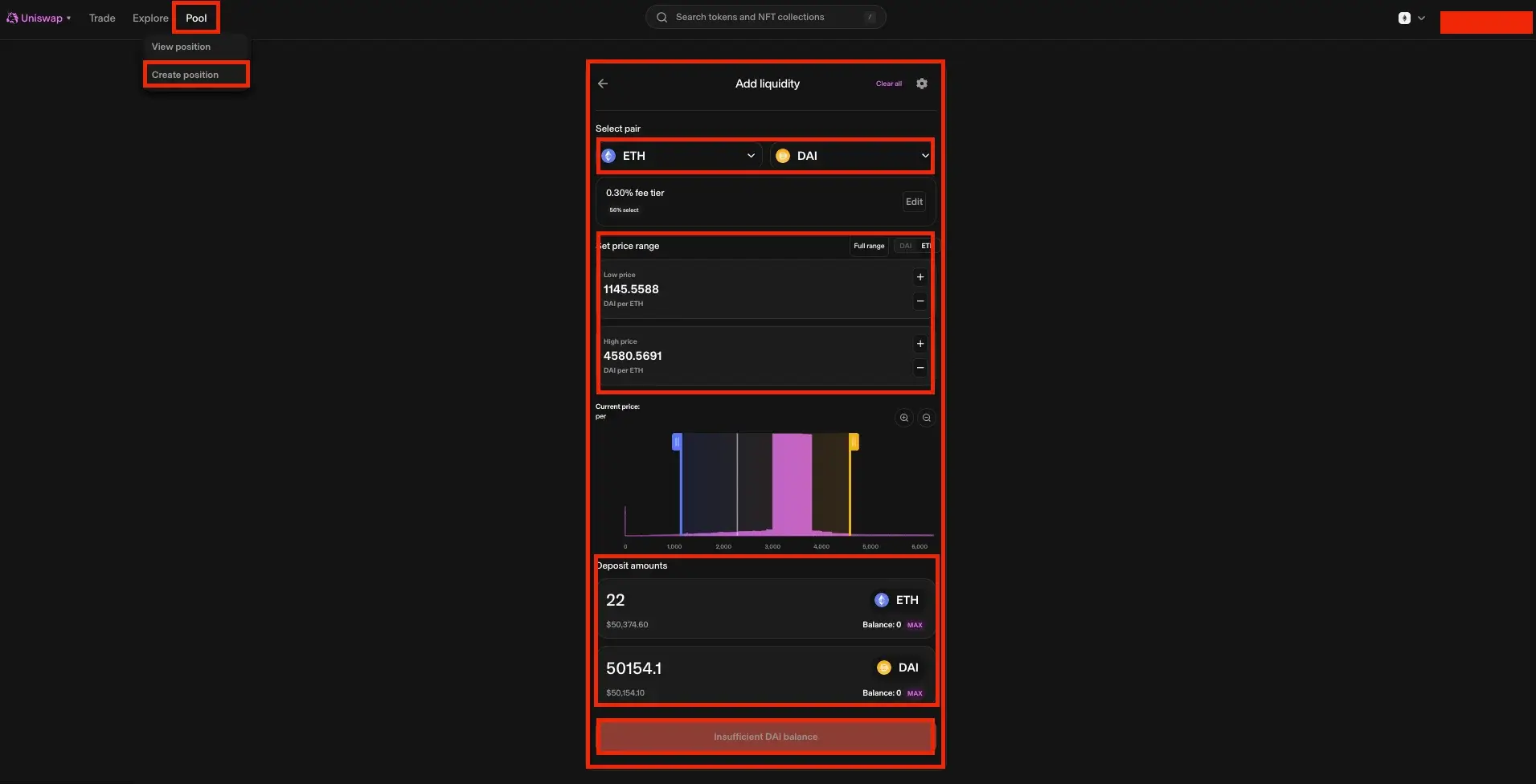

Step 2. Select Fee Tier and Price Range

Once you decide on your token pair, pick the fee rate you prefer. Uniswap provides four rates: 0.01%, 0.05%, 0.3%, and 1%. The fee rate impacts the trading fees you’ll receive. If there’s already a pool for your chosen fee rate, your liquidity contribution will merge with it; otherwise, you’ll initiate a new pool.

After that, determine the price band in which your liquidity will operate. If the price deviates beyond this predefined range, your liquidity will be consolidated into either asset, ceasing to generate fees. You have the option to set a particular price range or distribute your liquidity across the entire price spectrum.

Step 3. Add Tokens and Confirm Transaction

Please input the number of tokens you’d like to contribute to the pool, or choose “Max” to deposit the highest possible amount.

After completing the process, click “Authorize” to allow Uniswap access to these tokens from your wallet, noting that this action may involve network fees. Upon approval, you can preview the details by clicking “Review”. To finalize the transaction, select “Confirm”. Please note that a final confirmation in your wallet is required, which will also incur another network charge.

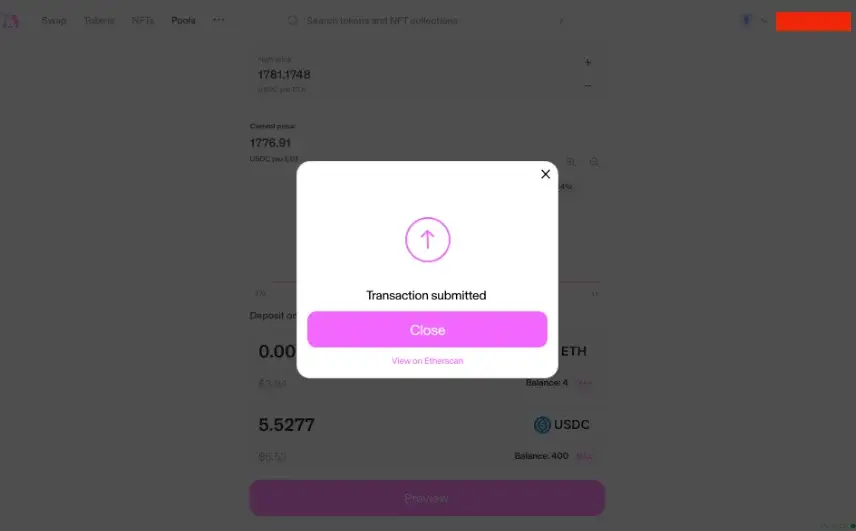

Upon finishing the process, I’ll be notified with a confirmation and can monitor its status on Etherscan. My liquidity position in the V3 Pool will then become active and accessible for management directly from the V3 Pool page.

FAQs

How is Uniswap Used?

Typically, Uniswap serves as a tool for users to supply liquidity, exchange, transfer, and acquire ERC-20 tokens in a decentralized fashion. Moreover, users can trade Non-Fungible Tokens (NFTs) and engage in governance via the platform’s UNI token. It is well recognized as an ideal choice for trading cryptocurrencies without intermediaries, making it a popular destination for activities within the realm of decentralized finance.

How Do You Use Uniswap Swap?

Exchanging tokens through Uniswap is a straightforward process. Begin by linking your digital wallet, navigate to the “Swap” area. Then, pick the token you’re selling, input the quantity, and opt for the token you prefer as payment. Next, press “Swap” and verify the details. Give approval for the transaction in your wallet, confirm the swap, and pay any required network charges. Upon completion, your exchange will be processed on the blockchain.

Do I Need ETH to Use Uniswap?

On the Ethereum blockchain, ETH serves as the native cryptocurrency, but having ETH isn’t always a requirement to use Uniswap. In fact, Uniswap accommodates various ERC-20 tokens, allowing you to exchange other tokens for ETH or even swap them directly for other ERC-20 tokens right away.

To engage with the Ethereum blockchain, including platforms like Uniswap, you’ll have to pay gas fees in Ether (ETH). These fees are charged to cover the computational resources the network uses for each transaction. The amount of ETH needed for these fees can fluctuate based on network traffic and the intricacy of the transaction at hand.

What are Some Popular Decentralized Exchanges Besides Uniswap?

Beyond Uniswap, there are numerous other well-liked Decentralized Exchanges (DEXs) that each offer unique characteristics and advantages. For instance, PancakeSwap, SushiSwap, 1inch Network, Curve Finance, and Kyber Network are some of the more recognized alternatives in this space.

Conclusion

Uniswap provides an efficient and straightforward platform for exchanging various cryptocurrencies using its decentralized system. Whether you’re looking to swap tokens, transfer crypto assets, or delve into the world of Non-Fungible Tokens (NFTs), mastering how to use Uniswap will significantly improve your trading journey.

With the basics covered, you’re now ready to dive into decentralized finance confidently.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Elevation – PRIME VIDEO

2024-09-30 11:02