-

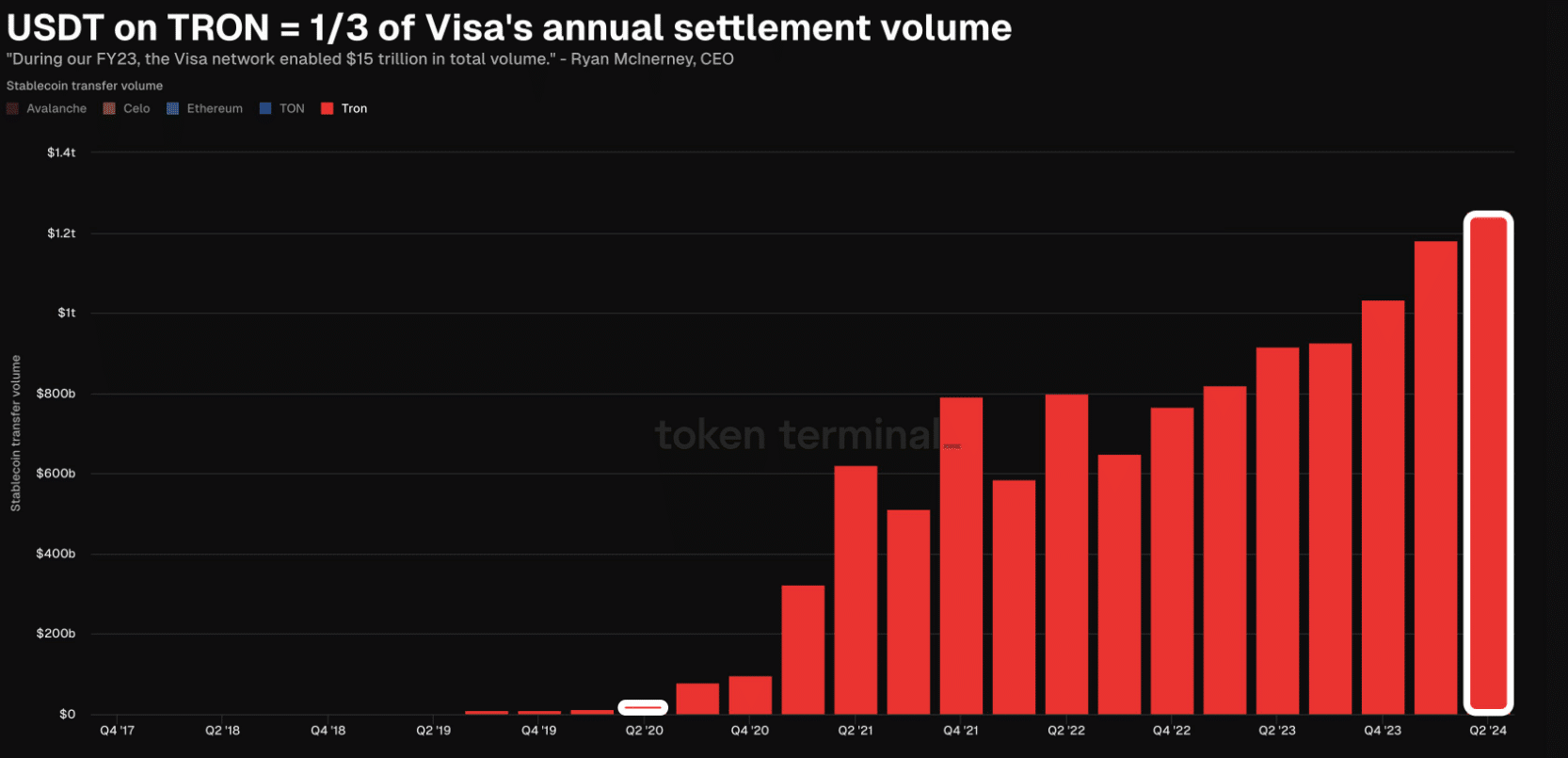

The Tron network is dominating USDT payments, with Q2 settlement volumes hitting $1.25 trillion.

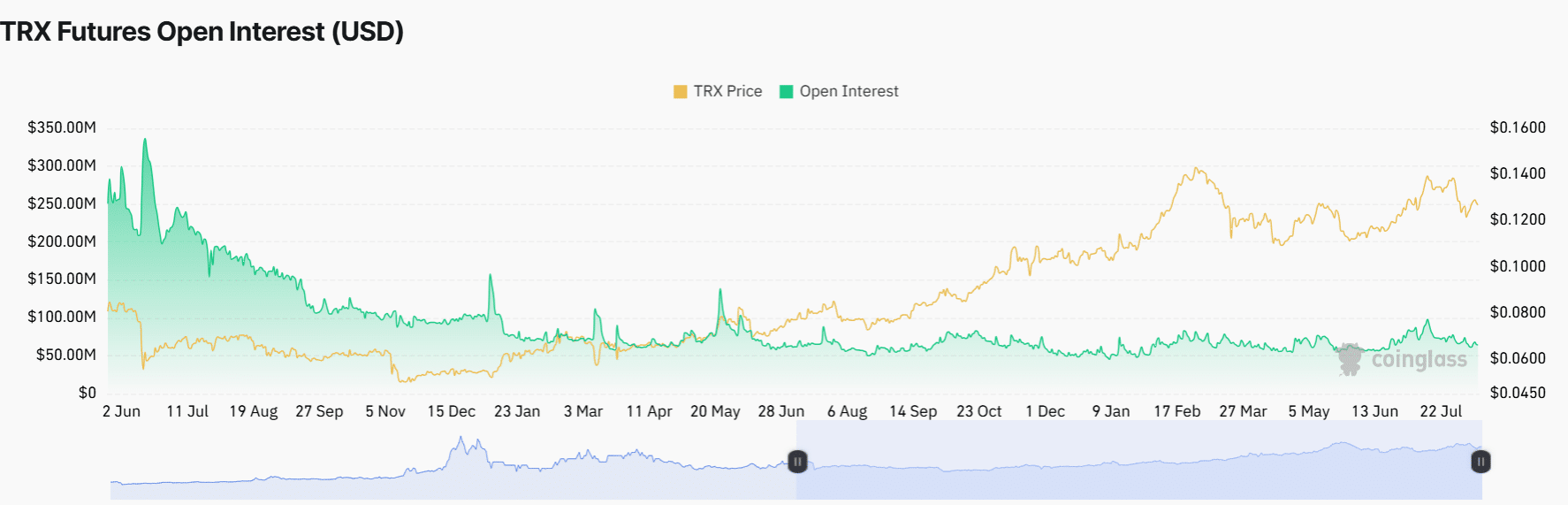

TRX has seen relatively stable volatility this year amid declining Open Interest.

As a seasoned crypto investor with a knack for spotting potential, I find the Tron network’s dominance in USDT payments and its growing influence over the digital payments industry quite intriguing. The $1.25 trillion settlement volumes in Q2 2024 are a testament to this blockchain’s prowess, surpassing a third of Visa’s annual settlement volumes. This is not just a significant milestone for Tron but also a clear indication that the traditional financial landscape might be shifting towards decentralized solutions.

In the second quarter of 2024, Tron (TRX) is showing strong competition against the dominant player in digital payments, Visa, as the volume of transactions settled using USDT reached an impressive $1.25 trillion on its network.

Based on Token Terminal’s data, USDT transaction volumes on the Tron blockchain reached nearly one-third of Visa’s yearly payment settlement amounts. Transactions involving USDT on this network saw a significant increase, roughly five times more than about $25 billion in 2020.

Tron’s rising network activity

2023 saw a significant increase in the trading volume of USDT on Tron, with the figure rising from approximately $4.2 billion to an impressive $16 billion, as reported by AMBCrypto when examining data from Dune Analytics.

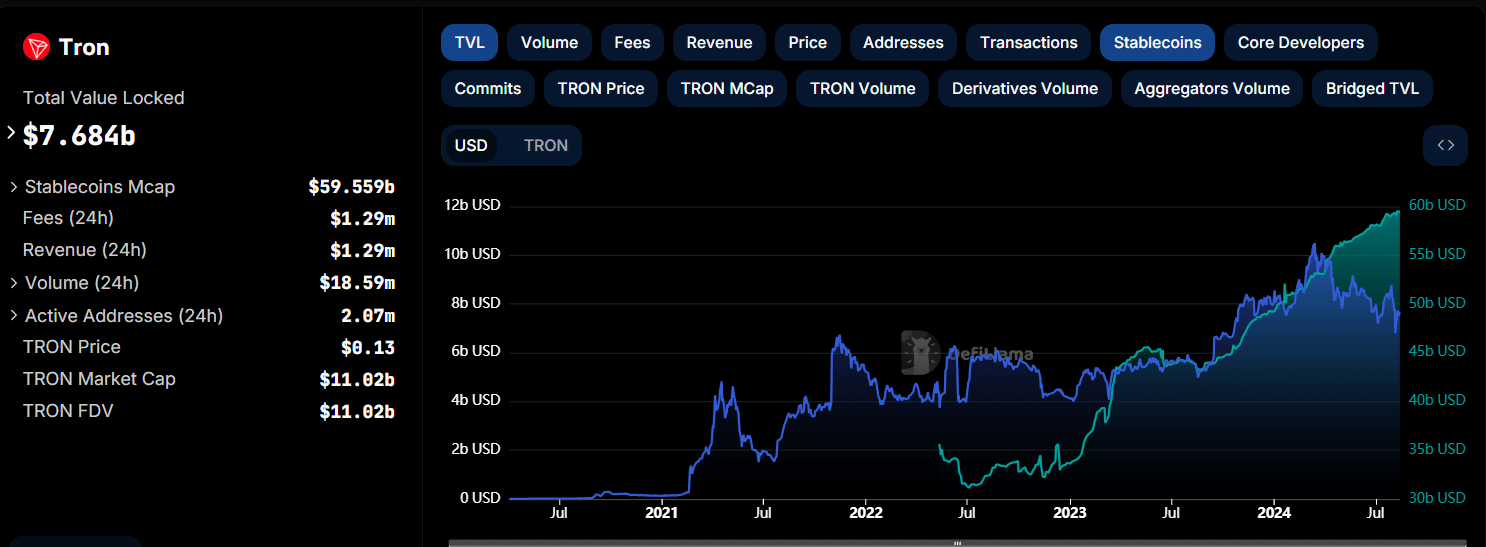

On the network, the combined market value of stablecoins was approximately $60 billion, as reported by DeFiLlama. This implies that the blockchain has emerged as the primary settlement system for Tether (USDT), serving as its default platform.

Apart from leading in transactional networks, Tron is also making significant strides, becoming a strong competitor in the Decentralized Finance (DeFi) sector.

In simple terms, Tron ranks second among all blockchains following Ethereum in terms of Total Value Locked (TVL). As of the current news update, this TVL amounts to approximately $7.68 billion, a significant increase from around $5 billion in August 2023, as reported by DeFiLlama.

Yet, while Tron’s network expansion is relatively modest, Solana’s [SOL] Total Value Locked (TVL) has significantly increased. As of the current report, it stands at approximately $4.76 billion, marking a tenfold jump from around $300 million just a year ago.

Is TRX reflecting Tron’s growth?

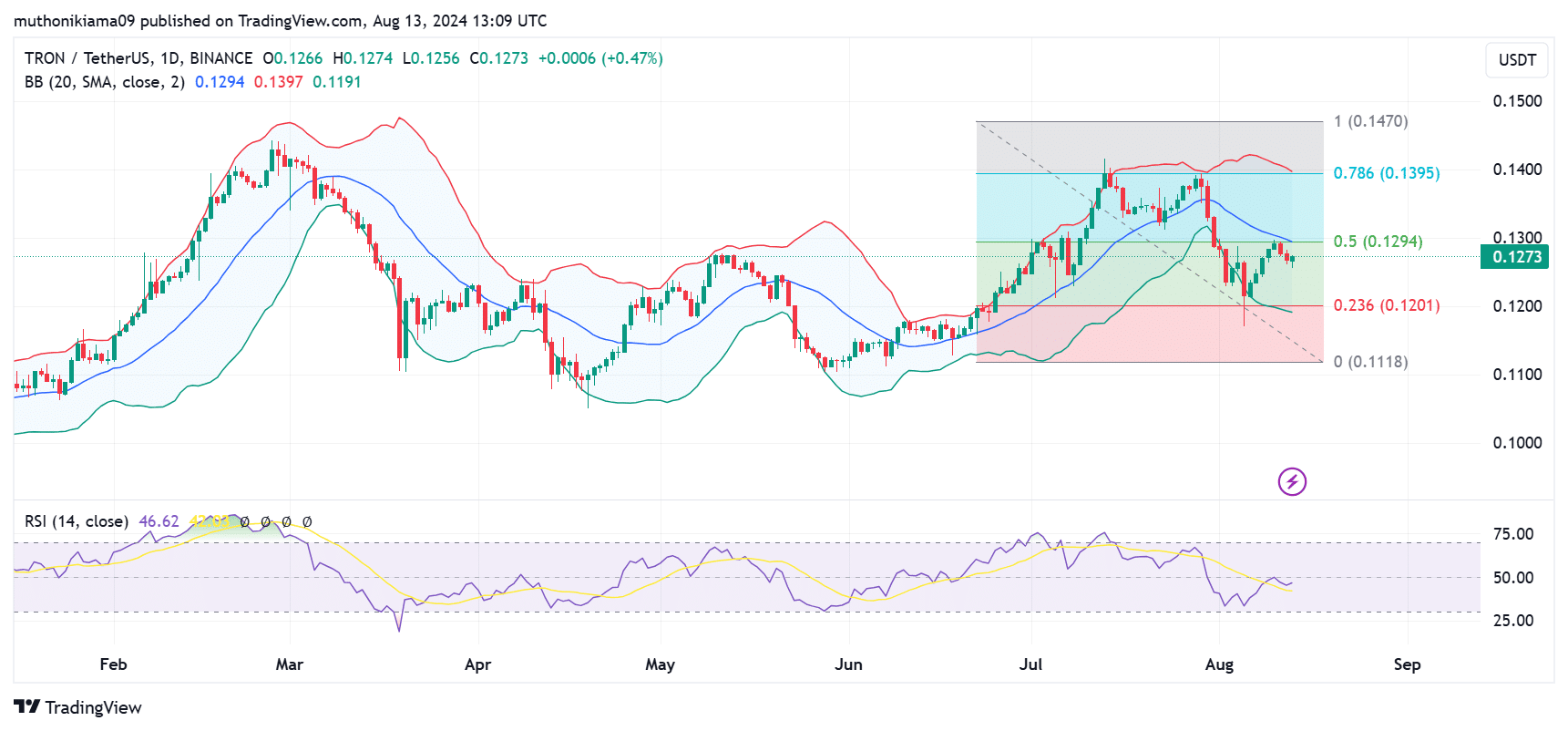

Currently, as I’m typing this, Tron (TRX) has seen a roughly 20% increase since the start of the year. For the majority of 2021, it has fluctuated between approximately $0.14 and $0.10. Additionally, its price movements have fallen within the Bollinger bands, suggesting moderate volatility stability.

The pattern of purchasing indicated a modest level of engagement, as TRX was seldom excessively bought or sold beyond its market value.

As a researcher, I’ve observed that the Relative Strength Index (RSI) has reached a new high, followed by a rebound. This pattern indicates potential for further price increases in the short term.

A key resistance level lies at $0.139, also the 0.786 Fib level. Hitting this target will pave the way for a rally to record highs.

Realistic or not, here’s TRX market cap in BTC’s terms

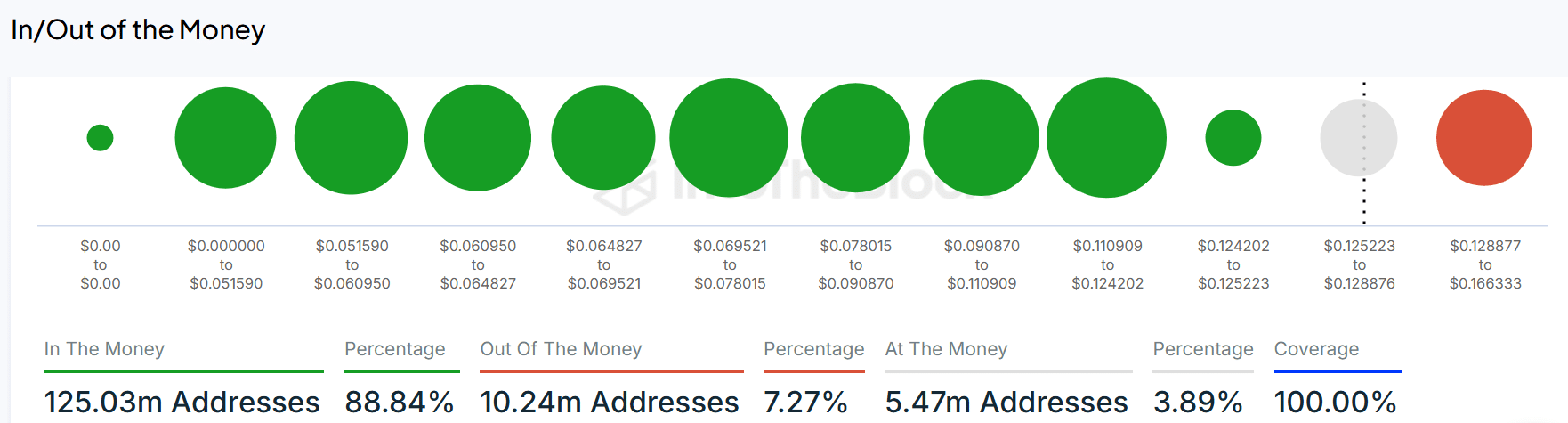

According to data from IntoTheBlock, approximately 88% of Tron (TRX) owners, or around 125 million accounts, were in a profitable position at the current moment, indicating a generally optimistic outlook for the cryptocurrency.

Although the TRX Futures market displayed a biased opinion, the drop in Open Interest suggested that the price fluctuations were modest and there was less engagement in the market overall.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- The Battle Royale That Started It All Has Never Been More Profitable

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

2024-08-14 11:03