- A looming US recession and BoJ’s rate hike were responsible for the recent market losses.

- US recession outcome presents a conflicting scenario for crypto markets.

As a seasoned crypto investor with a knack for navigating market volatility and a keen eye for macroeconomic trends, I find myself treading cautiously amidst the recent market turmoil. The looming US recession and BoJ’s rate hike have undeniably played a significant role in the steep market losses we’ve witnessed.

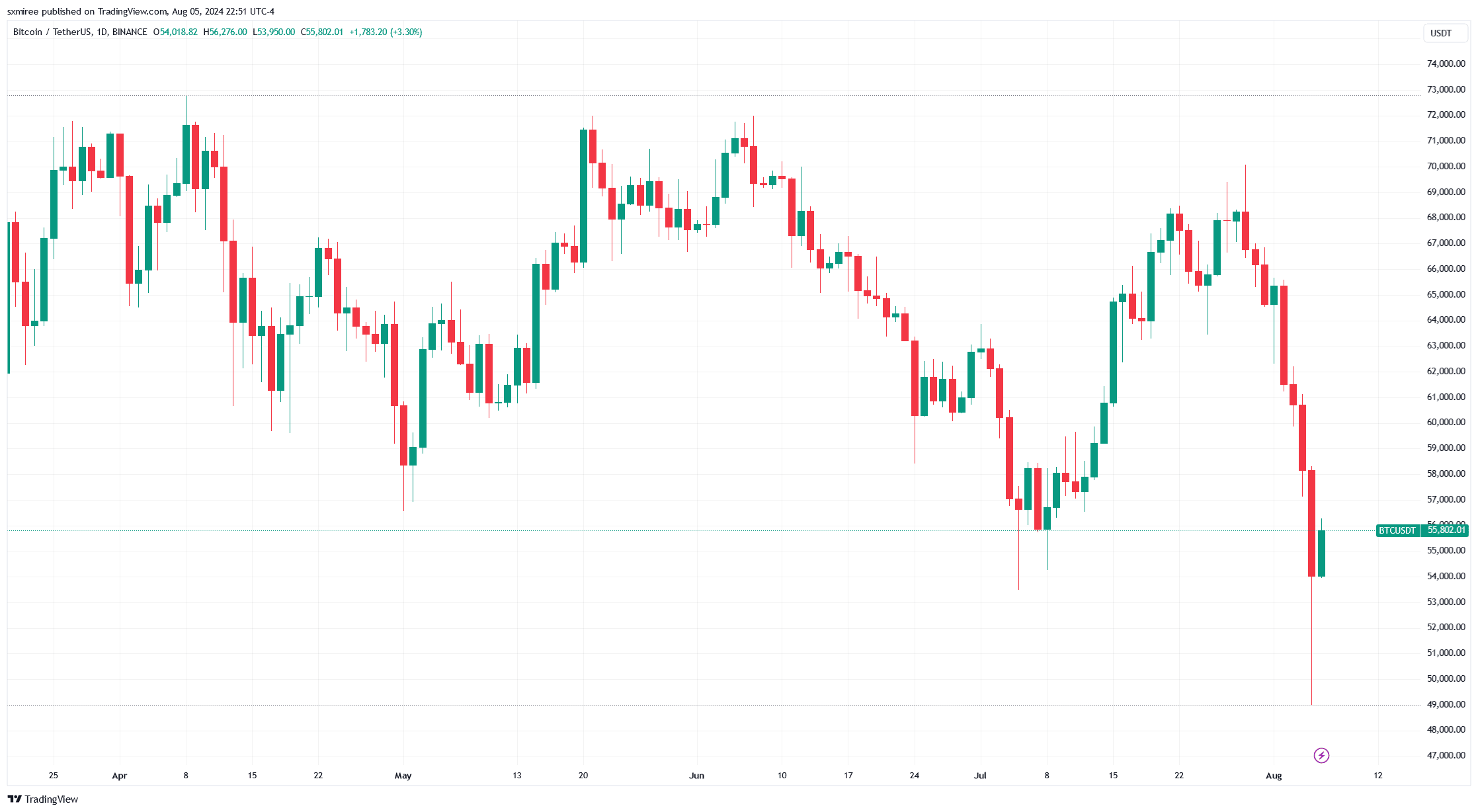

On Friday, the 2nd of August, Bitcoin (BTC) and other altcoins experienced a significant drop in price, with the decline continuing over the weekend. By the end of the weekend, Bitcoin plummeted past the $60,000 mark, and on Monday, 5th August, it plunged below crucial support levels.

On Friday, the worldwide stocks experienced a retreat due to a U.S. jobs report that fell short of expectations, which was published outside of regular trading hours.

In just a few days, there was a significant drop in Bitcoin’s value, which occurred barely a week after it was nearly reaching its peak for the year on July 29th. This incident underscores how broader economic conditions can impact cryptocurrencies.

Impact of a US recession on Bitcoin price

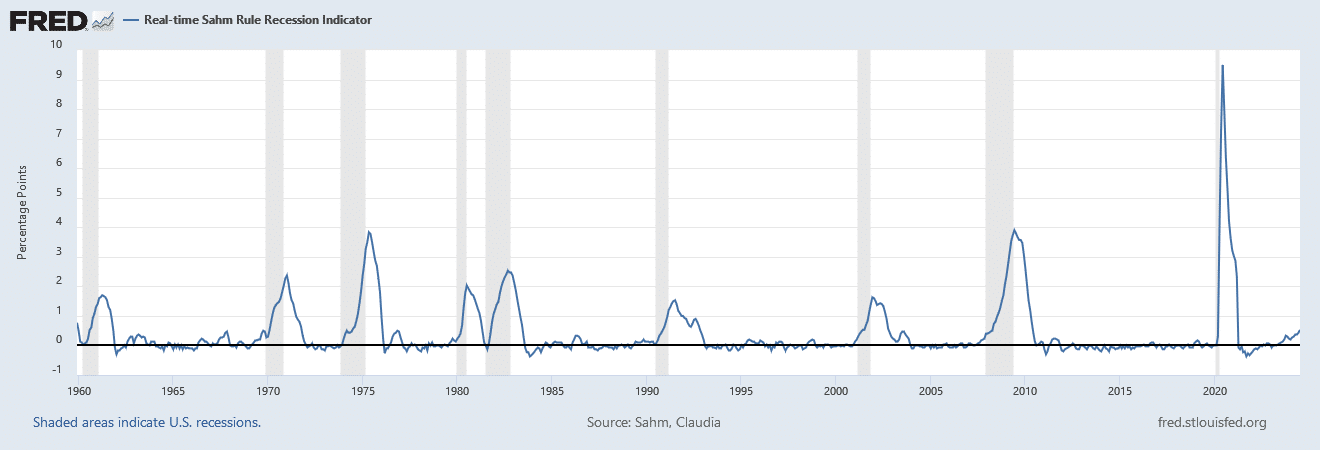

For the last year, there’s been a debate about whether the United States is experiencing an economic downturn, as different perspectives on the country’s financial situation have emerged.

On Friday, disheartening job figures added to the anxiety among U.S. stock market investors and revived worries about a potential economic slowdown.

It’s important to note that the escalating geopolitical disagreements have added a layer of economic instability worldwide. The persistent conflicts in regions like the Middle East and Ukraine have significantly influenced the fragile economic situation that the U.S., being involved in both, currently finds itself in.

Here is how a possible recession would affect Bitcoin price in the current cycle.

Investor sentiment

In times of economic downturn (recession), investors often become more cautious and prefer to minimize risk. As a result, they tend to focus on safer investments with lower volatility, such as bonds or stable stocks, rather than venturing into high-risk assets like cryptocurrencies.

As investors opt for safer conventional assets instead, it’s expected that this decision could increase the stress on Bitcoin’s price, despite Bitcoin’s allure of having a fixed supply.

Certain analysts are expressing the viewpoint that during this economic cycle, Bitcoin might separate itself from stocks as it thrives in a recessionary phase.

In a recession, money supply tends to shrink, leading to stricter circumstances as investors focus more on safeguarding their funds. This situation can cause less investment flowing into cryptocurrencies, which puts pressure on their prices and may cause them to decrease in value.

Financial authorities and governments could choose to strengthen regulations and introduce fresh measures due to economic downturns. Historically, the cryptocurrency market has been influenced by regulatory changes, so any new limitations are expected to increase market volatility.

Instead of leading to tightening, a recession can also spur monetary easing and fiscal stimulus actions such as lower interest rates. There’s growing optimism that the Federal Reserve will now lower its key interest rate by 0.5% instead of the previous forecast of 0.25% in September.

In light of the present market trends, reducing interest rates could increase the money supply, which might be advantageous for Bitcoin as it thrives under favorable macroeconomic conditions that typically lead to a devalued U.S. dollar.

Historical context

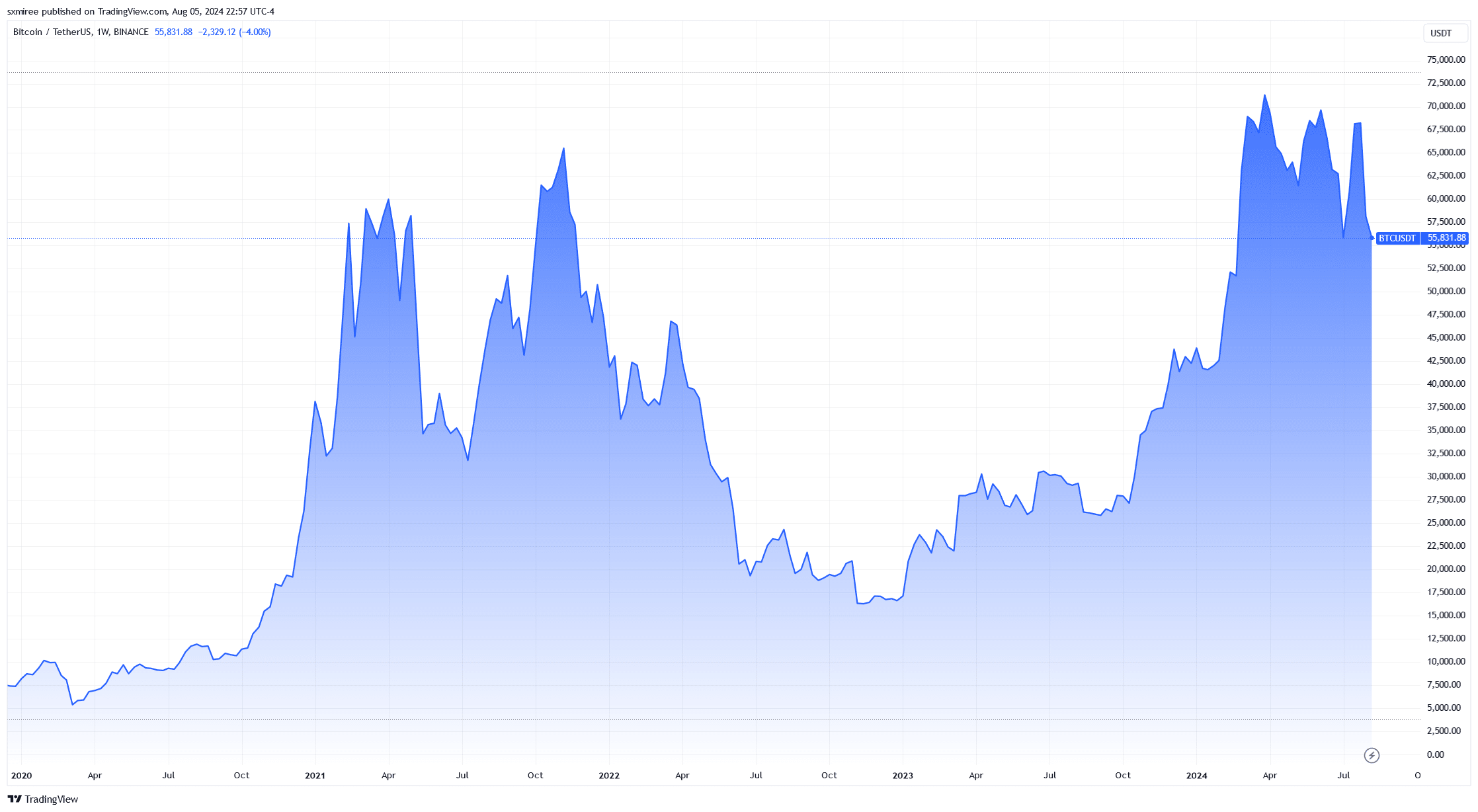

Historical information suggests that Bitcoin’s market behavior has been diverse during times of economic decline, demonstrating its dual nature as both a speculative asset and a form of digital savings or value storage.

In March 2020, when the Federal Reserve lowered interest rates, Bitcoin was trading at around $7,000. However, its value climbed to approximately $60,000 within the next twelve months.

Instead of maintaining interest rates at their highest level in 23 years as the Federal Reserve decided on July 31st, Japan’s central bank adjusted its monetary policy to become more restrictive on August 5th.

The Bank of Japan (BoJ) raised its benchmark interest rate from near-zero to 0.25%.

Trajectory ahead

Despite an initial pessimistic response to concerns about a recession, this shouldn’t be interpreted as a sign of a lasting downward trend. This week’s economic data is relatively scant, focusing attention on the upcoming July Consumer Price Index (CPI) inflation report next week.

As someone who has lived through various financial crises over the past few decades, I can attest to the fact that economic challenges are a constant and unavoidable part of life. The current situation facing the US economy is no exception, and it’s crucial for us all to be vigilant about its potential impact on our lives. While I am hopeful that the country will find a way to navigate these difficulties without slipping into a severe depression, it’s important to remember that history has shown us that such events can happen unexpectedly. As a result, I strongly advise market participants to stay informed and keep a close eye on economic indicators and policy responses in the coming weeks. It’s better to be prepared than caught off guard.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-08-06 11:04