- USDT and USDC grew almost $3 billion amidst crypto market’s downturn

- Tether’s USDT recorded $1.5 billion deposits while Circle’s USDC noted figures of $820 million

As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself intrigued by this latest development. Despite the broader market’s downturn, stablecoins like USDT and USDC have shown remarkable resilience, even growth. This is akin to watching a phoenix rise from the ashes – or in our case, a bear market.

Regardless of strong showings earlier, the broader crypto market took a hit on Monday. This week’s opening was marked by all digital currencies dropping in value due to a global stock market downturn. Yet, unlike other cryptocurrencies, stablecoins bucked the trend and managed to maintain their value throughout the week.

In fact, the stablecoin sector grew in market cap and supply, led by USDT and USDC.

USDT & USDC’s $3B supply in a week

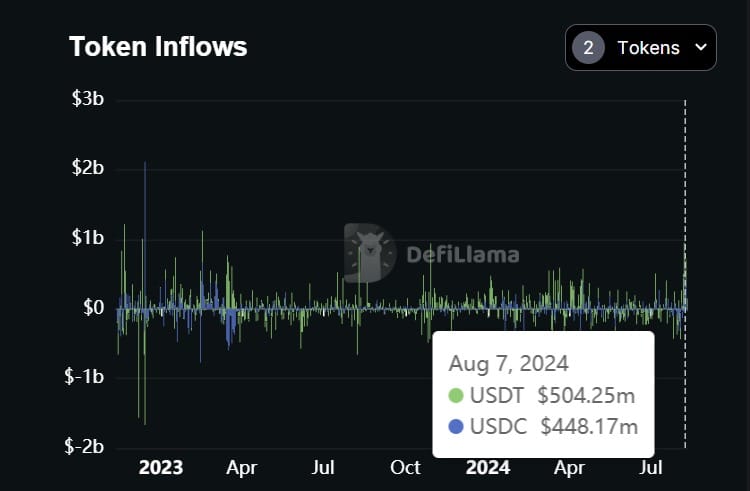

Over the last seven days, I’ve observed a staggering increase in the availability of Tether’s USDT and Circle’s USDC, reaching an astounding $3 billion. Given the prolonged downward trend in the cryptocurrency markets, this surge in supply suggests a heightened demand to capitalize on market dips. Consequently, many investors, including myself, have been drawn towards purchasing during these declines as crypto prices drop.

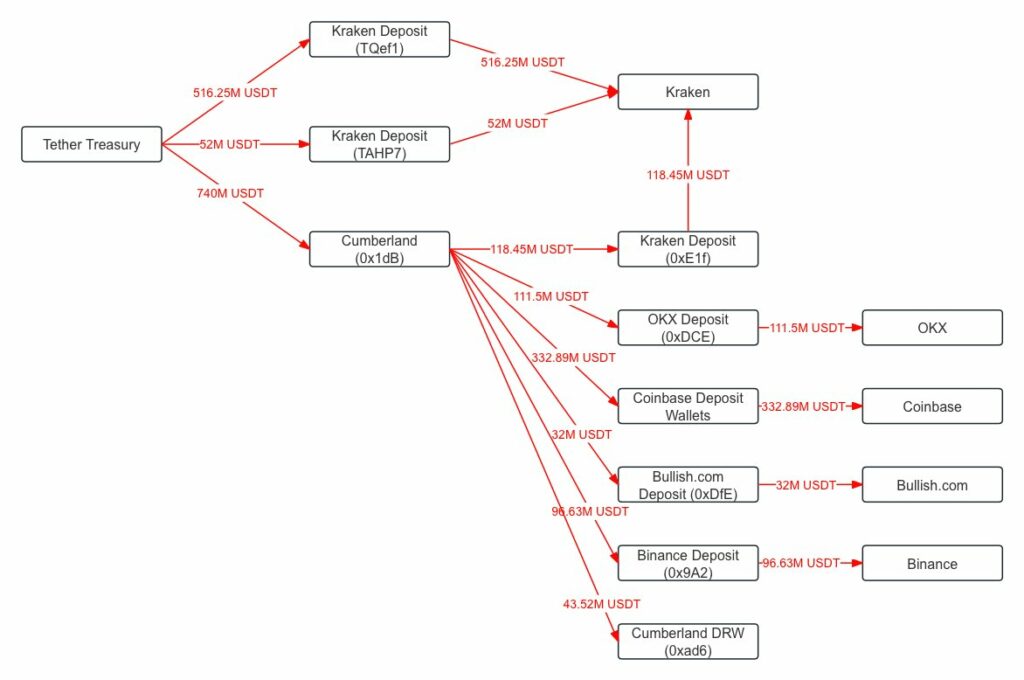

As per data from Lookonchain, it’s been reported that approximately $1.3 billion of Tether has been moved to exchanges and market makers since the recent market crash on Monday, according to Lookonchain’s observations.

“Since the market crash on August 5, 1.3b units of USDT have moved from Tether’s reserve to various cryptocurrency exchanges.”

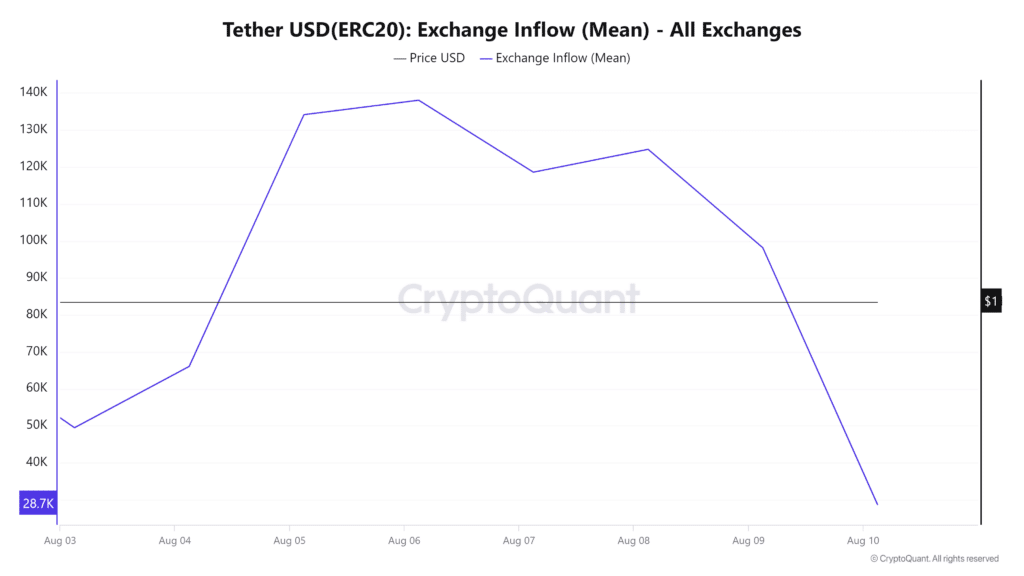

Over the past few days, there’s been a significant increase in the use of stablecoins like USDT, following the downturn in the cryptocurrency market. This rise can be attributed to traders moving their assets into exchanges during this period. Interestingly, Cryptoquant’s data shows that the inflow of USDT into these exchanges increased by a staggering 181% from 3rd August to 6th August, as the market experienced a crash.

As a crypto investor, I’ve noticed an impressive surge in USDT deposits on Binance, with data from defiLlama indicating exponential growth. This growth has culminated in a whopping $1.5 billion deposit.

Additionally, USDC deposits into Binance hit a record of $820 million within just 3 days.

Essentially, the data indicates that the latest market drop offered a purchasing chance since all parties involved became overall net purchasers.

After a period of 48 hours, it became apparent that the markets had begun to rebound strongly as a result of the increased demand for purchases. Gains were substantial and widespread across all sectors.

Market Cap growth to record high

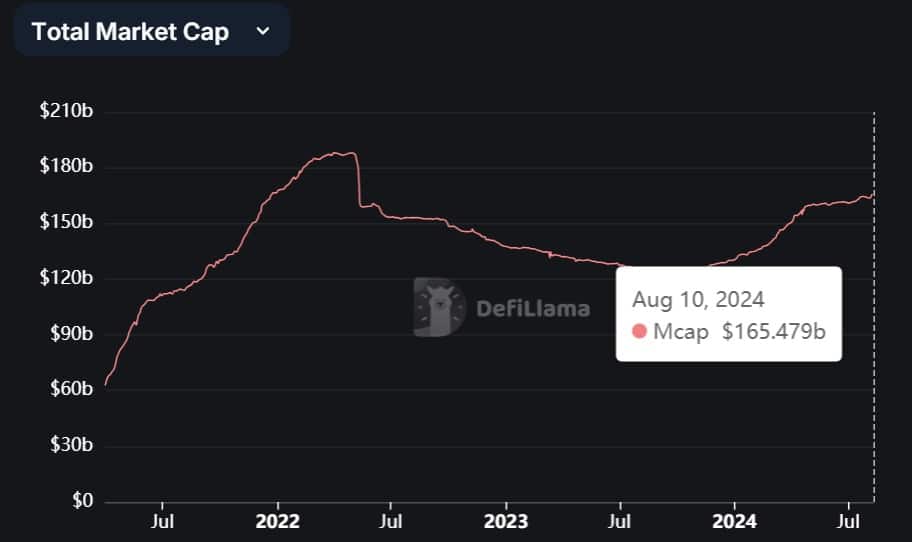

During a market slump, Tether’s market cap soared due to an increase in supply. In fact, it reached an all-time high of $115.4 billion over the last three months. Similarly, USDC has persistently grown since Circle adhered to MICA regulations. Over the past week alone, USDC saw a growth of $1.6 billion, bringing its market cap to $34.48 billion.

Now, USDC is at its yearly high since the collapse of SVB in 2023.

Additionally, this surge was also observed and acknowledged by various cryptocurrency analysts. Specifically, David Alexander provided his insights on the subject, X, through a shared analysis.

“Significant changes in the circulation of USDC this week: the total supply has risen by approximately 1.56 billion dollars (an increase of 4.8%), following a significant drop due to market-wide turbulence ahead. Most of these new funds have been directed towards Ethereum (around 1.34 billion dollars) and Solana (nearly 356 million dollars).”

Over the past year, stablecoins have seen consistent growth from $124.6 billion on 10 August 2023 to $165.4 billion, at press time. This can also be seen as a sign of greater adoption, interest, and usage, translating into USDT’s and USDC’s growth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-08-11 05:12