-

BTC saw a massive sell-off amid Israel-Iran tensions.

BTC showed strong sensitivity to U.S. equities, making it susceptible to geopolitical tensions.

As a crypto investor with years of experience under my belt, I must admit that the recent sell-off in Bitcoin and the broader crypto market has been a rollercoaster ride. I’ve seen market fluctuations before, but the sensitivity of BTC to U.S. equities and geopolitical tensions like the current Israel-Iran standoff is something new and challenging.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastAs an analyst, I found that Bitcoin [BTC] and the broader crypto market defied pessimistic seasonal predictions by posting positive returns in September. However, it seems that we’ve started October on a challenging note, which I refer to as ‘Uptober,’ as the market is currently experiencing turbulence.

On the first of October, Bitcoin, the leading cryptocurrency globally, dropped by almost 4%, translating to a roughly 10% decrease in its value over the past week.

It dropped from the peak of $65K to a low of $60.1K amid Israel-Iran escalations.

Over the past two days, the significant drop in Bitcoin (BTC) caused a chaotic selling frenzy across the cryptocurrency market, resulting in all sectors showing losses.

Israel-Iran tensions

For a long time now, there’s been ongoing hostility between Israel and Iran, often played out indirectly by groups such as Hezbollah in Lebanon and the Houthis based in Yemen.

Instead, However, instead of taking indirect action, their opponents chose a head-on confrontation, reaching its climax on October 1st when Iran allegedly fired multiple missiles at Israel. This move was reportedly in response to Israel’s ground attack in Lebanon.

Investors swiftly shifted toward a cautious stance, possibly due to concern that the developments might evolve into a disastrous local conflict.

Tech-led U.S. stocks, particularly those in the technology sector, caused a significant market drop. Specifically, the Nasdaq Composite, known for its tech focus, decreased by 1.5%, and the broader S&P 500 Index experienced a dip of 0.93%.

BTC followed suit with a nearly 4% plunge, dragging it to range-low levels near $60K.

At the moment of reporting, Ethereum (ETH) experienced the largest sell-off among significant cryptocurrencies, with a decrease of 6% in its daily chart. Solana’s [SOL] value also dropped by approximately 5.8%.

On October 1st, United States Bitcoin Spot ETFs experienced their largest daily outflow since early September, totaling approximately $242.5 million.

This further underscored crypto investors’ risk-off approach as most switched to gold.

Given Bitcoin’s high-risk nature and its recent strong link with U.S. stock markets, it was not unexpected that there would be a drop in its value.

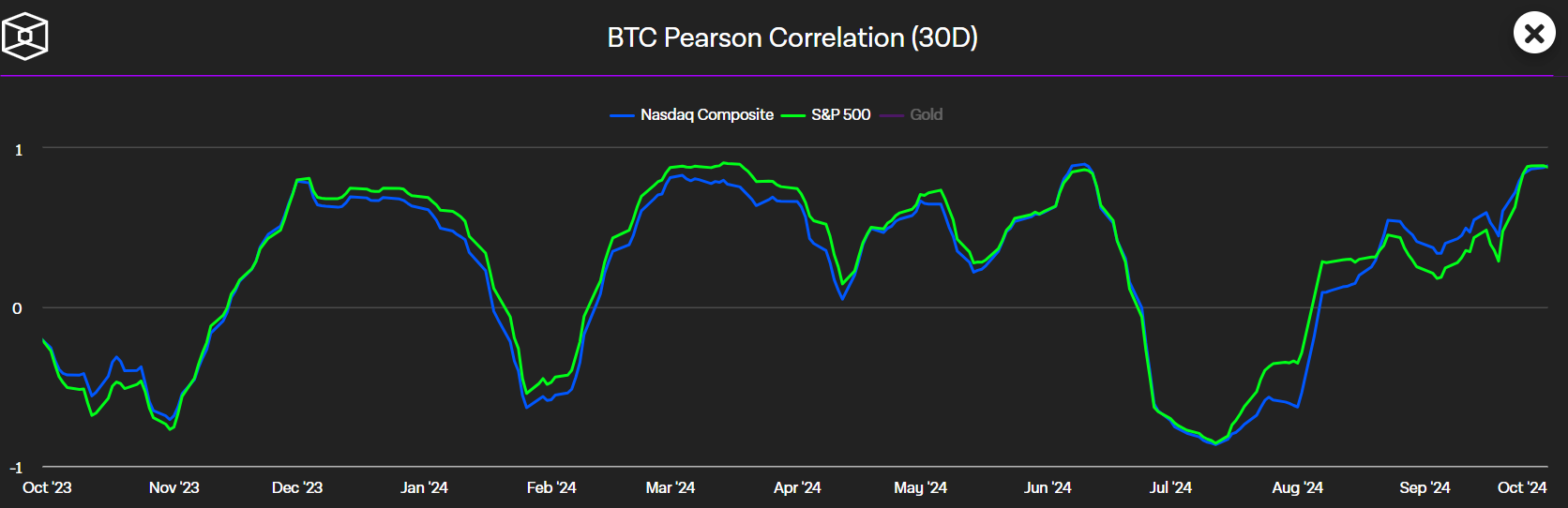

Per BTC Pearson Correlation, BTC has shown increasing sensitivity to US stocks since July.

To put it another way, Quinn Thompson, who is the founder of the cryptocurrency hedge fund Lekker Capital with a macro focus, stated that the recent escalation was a multifaceted move that could potentially impact the upcoming US elections. However, he felt optimistic that the tension would decrease in the near future.

If I were to make a prediction, I’d say that the current predicament might calm down soon, although there could be plenty of showy displays and loud noises like we’ve seen in recent times.

QCP Capital echoed a similar short-term potential impact of the tensions. It said,

For the moment, the political landscape of the Middle East is expected to dominate headlines. However, the relatively minor downturn in the market indicates that there’s still strong demand for investments considered risky.

If Thompson’s projection plays out, BTC and the overall market could rebound soon.

During this period, it was important to observe if the price decline continued and Bitcoin fell below $58,000 as a significant marker.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- ANKR PREDICTION. ANKR cryptocurrency

- Badminton’s Huang Yaqiong Wins Olympic Gold Moments Before Engagement

- NBA 2K25 Guide – How to Reach 99 Overall Quickly

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Taylor Swift and Travis Kelce: A Love Story Unfolds at Chiefs’ AFC Celebration!

2024-10-02 21:12