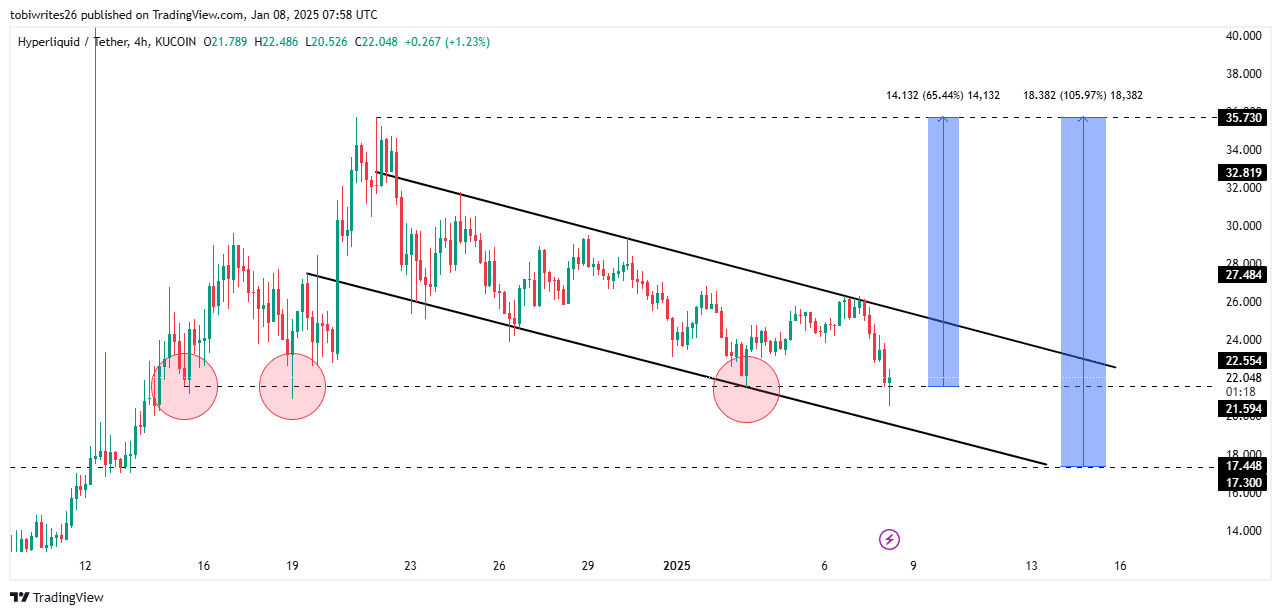

- HYPE is currently trading within a descending channel, with the potential to fall further depending on how it reacts at its current level.

- Key indicators and Total Value Locked (TVL) remain bearish. However, the RSI is gradually hinting that sell pressure may be easing.

Over the last 24 hours, Hyperliquid (HYPE) is one of the biggest market losers, experiencing a drop of approximately 16.57%. As a result, its monthly profits have been trimmed down to around 64.93%.

At its present cost, the token’s direction may decide if it experiences a substantial surge or suffers additional declines as the market mood becomes less optimistic.

Will HYPE yield positively from this pattern?

Analyzing HYPE’s 4-hour price pattern suggests it is confined within a downward sloping channel, marked by progressively lower peak prices and trough prices. The trend indicates that investors are optimistic about a potential price increase as they are gradually buying the asset.

A bullish breakthrough happens when the price surpasses the upper boundary of the channel, which could lead it to reach a high of $35.7.

Currently, when this text is being penned, HYPE is found within a supportive region at $21.59. This area has shown strength in the past by driving bullish movements on three separate instances. If it maintains its supportive role, HYPE might bounce back and potentially rise by 65.44%, reaching its peak as mentioned.

If the price falls below the $21.59 support, there’s a possibility that HYPE could decline to its next potential support at $17.30. This level might trigger a strong surge upwards, leading to a potential increase of around 105.97%.

Mixed market signals

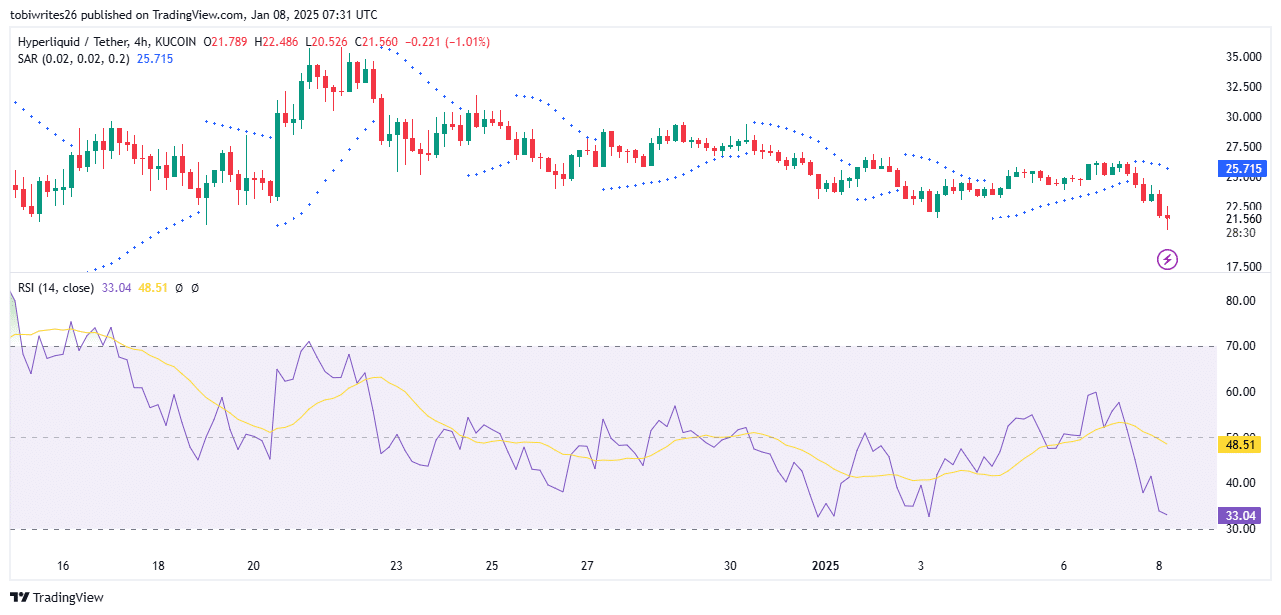

At present, a review of technical indicators shows a split opinion among traders, with their actions hinting at a potential resistance or support level nearby.

Currently, the Parabolic SAR (Stop and Reverse) indicator, which helps determine trend directions and potential reversals by placing dots above or below price fluctuations, is displaying dots positioned above HYPE, suggesting an upward trend or continued increase in this context.

Markings with dots above the price for HYPE imply a pessimistic outlook, suggesting potential drops beyond its present range, signifying a bearish market trend.

Simultaneously, the Relative Strength Index (RSI) – a technical tool – gauges the pace and size of price movements to help determine if the market is overbought or oversold.

Currently, when this message was composed, the Relative Strength Index (RSI) stood at 33.04. This suggests a growing trend of sellers in the market, as it’s moving towards the oversold zone (below 30). As the RSI gets closer to this area, it hints that the selling pressure might lessen around that level.

If HYPE’s value dips under 30, it might rebound and initiate a comeback. Yet, HYPE could potentially change direction even from its present position without touching the 30 mark.

Liquidity outflow hits HYPE

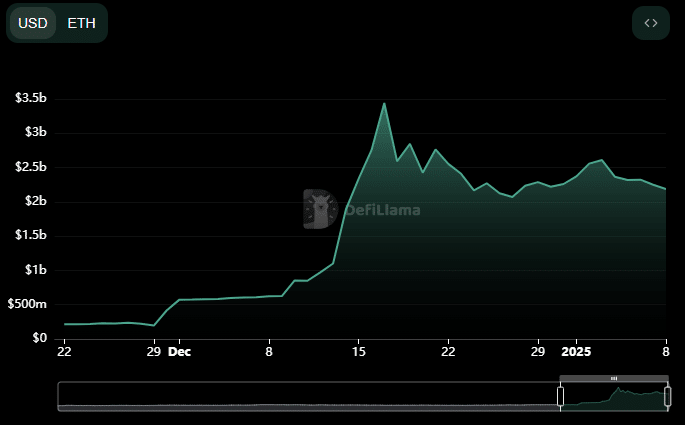

Over the past period, HYPE has witnessed substantial withdrawals of liquidity, causing its Total Value Locked (TVL) to decrease to approximately $1.553 billion. This current figure resembles that observed back on December 14. After reaching a high of $2.244 billion on January 2nd, it has since dropped.

Read Hyperliquid’s [HYPE] Price Prediction 2025–2026

Decreased withdrawals from Total Value Locked (TVL) suggest waning investor interest, a trend that typically has a negative effect on HYPE’s price, potentially leading to additional drops.

As an analyst, I’m observing a consistent outflow of liquidity for HYPE. This trend might lead to further decline in the stock’s value from its current position, with the possibility of it dropping even lower if no reversal is seen.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-08 17:11