- Hyperliquid, when stacked against its rivals, it stands out as the future of crypto fee generation.

- With its unique integration of spot & derivatives exchanges, Hyperliquid is truly setting itself apart from its competitors.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of crypto projects that promised the moon but failed to deliver. However, Hyperliquid [HYPE] has caught my attention and piqued my interest like few others.

With its impressive performance in December, HYPE has proven itself to be a formidable contender in the crypto space. Its 290% surge over the past month and reaching an all-time high of $35 is nothing short of remarkable. But what truly sets it apart is its strategic focus on the core of the crypto ecosystem – exchanges.

The integration of spot & derivatives exchanges, combined with HyperEVM blockspace, gives HYPE a unique edge over its competitors. This tech stack provides users with a seamless experience across both spot and derivatives exchanges, offering a level of convenience that is hard to find elsewhere.

However, the recent decline in DEX volume on the platform has raised some concerns about its long-term viability. But as someone who has seen many projects weather storms and come out stronger on the other side, I believe Hyperliquid’s resilience will carry it through this turbulence.

So, while some may see HYPE’s declining DEX volume as a sign of trouble, I see it as an opportunity for growth. As the market recovers and traders return to the platform, we could see even higher fees being generated – a clear indicator of growing adoption.

In conclusion, while it’s impossible to predict with certainty whether Hyperliquid will become the dominant force in crypto fee generation by 2025, I am bullish on its prospects. With its unique business model and the declining DEX volume of its competitors, I believe HYPE is well-positioned to take advantage of the growing demand for efficient and user-friendly exchanges.

Finally, let me leave you with a little joke to lighten the mood: Why did the Hyperliquid exchange cross the road? To get to the other side of success!

If there’s one coin that turned December into its breakout month, it’s Hyperliquid [HYPE].

Over the last month, HYPE experienced a remarkable jump of 290%, breaking through significant barriers to reach a fresh peak at $35, a record high.

This surge in HYPE is primarily due to a combination of influences. On one hand, the broader market’s shift away from Bitcoin [BTC] and leading altcoins has driven investors towards HYPE as a promising mid-tier option to keep an eye on.

However, what makes HYPE unique is its steadily expanding lead over rival companies, demonstrating benefits in multiple areas.

Hyperliquid, the dominant face in crypto fee generation?

For a novice in the world of layer-1 blockchains, Hyperliquid has swiftly left an indelible impression. The rapid growth it’s experiencing can be clearly seen on the day-to-day graph.

As a seasoned investor with over two decades of experience under my belt, I have witnessed the rise and fall of numerous cryptocurrencies and blockchain projects. However, there is one new player in the crypto fee generation sector that has caught my attention – Hyperliquid. Given my extensive background in this field, I can confidently say that Hyperliquid could soon become a dominant force in the industry by 2025, as some industry heavyweights are already predicting.

This is not just idle speculation; it’s based on Hyperliquid’s innovative technology and the potential it holds for revolutionizing the way transactions are processed on the blockchain. I have seen many promising projects come and go, but Hyperliquid has a unique value proposition that sets it apart from the competition.

In my opinion, the key to Hyperliquid’s success lies in its ability to provide faster transaction speeds and lower fees compared to other cryptocurrencies. This is crucial for attracting mass adoption, as users are increasingly demanding quicker and more cost-effective transactions. Furthermore, the team behind Hyperliquid boasts impressive credentials, with co-founder Ryan Watkins being a respected figure in the industry.

In conclusion, while it’s always important to approach any investment with caution, I believe that Hyperliquid has the potential to become a dominant force in the crypto fee generation sector by 2025. Its innovative technology, fast transaction speeds, and lower fees make it an attractive option for both investors and users alike. Keep an eye on this project, as it could be one of the most exciting developments in the crypto space in the coming years.

Despite lacking comprehensive data support at present, this daring forecast has sparked intrigue among numerous individuals. To delve into the prospective power underlying this concept, AMBCrypto decided to explore in depth the storyline related to HYPE and its possible future.

On Hyperliquid’s innovative system, a significant feature is its Decentralized Cryptocurrency Exchange (DEx). Essentially, when users conduct trades involving different currencies within this platform, transaction fees associated with cryptocurrencies are incurred.

As someone who has witnessed the rise and fall of several cryptocurrency platforms, I can confidently say that when you notice higher fees on Hyperliquid, it’s a clear sign that more traders are flocking to this platform, indicating growing adoption. However, my experience tells me that with every new and exciting venture in the crypto world, there always seems to be a twist in the tale. Despite all the initial hype surrounding Hyperliquid, I believe it’s crucial for users to remain cautious and keep a close eye on its development to avoid potential pitfalls.

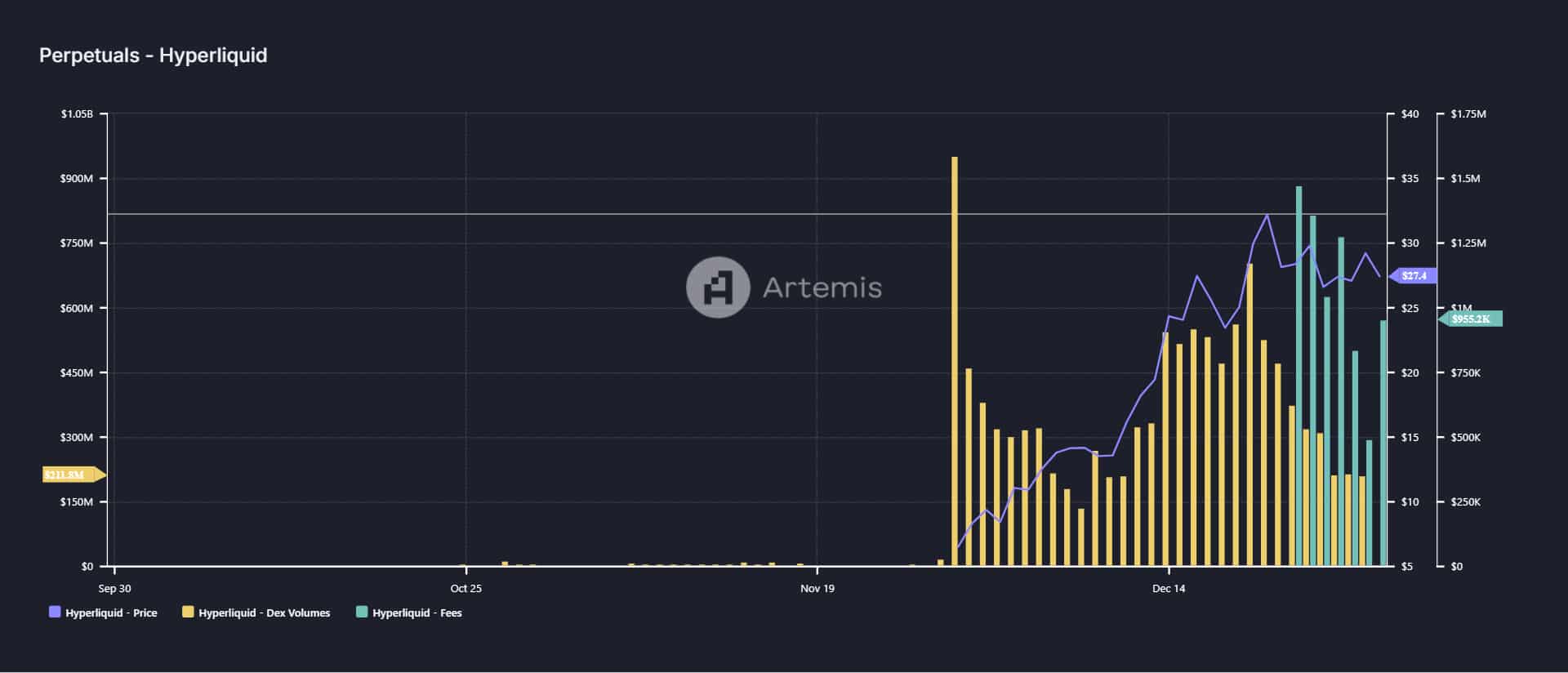

Source : Artemis Terminal

On Hyperliquid’s DEX, the trading volume has experienced a significant decrease. A peak of $952 million in cryptocurrency transactions was reached, but currently, it stands at only $211.8 million – a massive decline from its previous level.

Consequently, the platform’s earnings decreased significantly, dropping from $1.5 million to $955K. This reduction in income now poses a significant threat to its ongoing operational costs.

Despite the chaos, Hyperliquid’s strength shines brightly. Even in a market marked by instability, it’s holding up admirably compared to many other companies – truly a beacon of hope amidst the storm.

What to expect next?

Without a doubt, HYPE is heading into 2025 with an extremely optimistic momentum. Boasting a staggering year-to-date increase of 780%, it has undeniably secured a place among the leading 20 digital currencies.

As we near the end of the year, I’ve noticed a significant surge in excitement around HYPE in the crypto derivatives market. In fact, it’s managed to amass an impressive half a billion dollars in open interest (OI) within only a month of its debut.

It’s particularly thrilling that HYPE leverages Hyperliquid’s cutting-edge tech, potentially making it a leading force in crypto fee generation by 2025.

By merging crucial aspects of cryptocurrency, such as spot and futures trading platforms and the blockchain space known as HyperEVM, Hyperliquid is laying a solid foundation for its future prosperity.

Utilizing our technology mix, we ensure a smooth interaction on all HYPE platforms, encompassing both immediate trading (spot) and future contracts (derivatives).

To put it simply, by merging the best aspects of each, it provides an exceptional advantage for its users – a crucial aspect that sets it apart from others in the market.

Realistic or not, here’s HYPE market cap in BTC’s terms

Based on its strategic concentration on the fundamental heart of the cryptocurrency system – digital exchanges – Hyperliquid has established a lucrative enterprise. This is why industry specialists foresee it outperforming competitors in terms of fee generation by the year 2025.

As its distinctive business strategy sets it apart and the daily decrease in DEX trading volumes among its rivals becomes increasingly evident, the likelihood of this scenario unfolding is growing stronger each day.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-31 00:08