bitcoin-usd/”>BITCOIN‘S WILD RIDE: Whales Bet Big, Institutions Keep Buying 🚀

- Hyperliquid whales who control significant funds in the market have opened more short positions

- Institutional investors, on the other hand, have continued to buy Bitcoin

Bitcoin [BTC], after gaining by 1.59% last week, took a different route over the last 24 hours. In fact, the aforementioned period saw the crypto lose almost 3% of its value. One would think that the whales would be swimming in the right direction, but nope! 🐳

This is worth looking at, especially since AMBCrypto’s analysis revealed that this decline could extend itself as Hyperliquid whales took control of the derivatives market with a negative net BTC position. This raises an important question though – Can institutional investors regain ground and reverse the downturn? After all, it’s not like the whales are trying to make a splash… 😒

Hyperliquid whales bet on a major drop

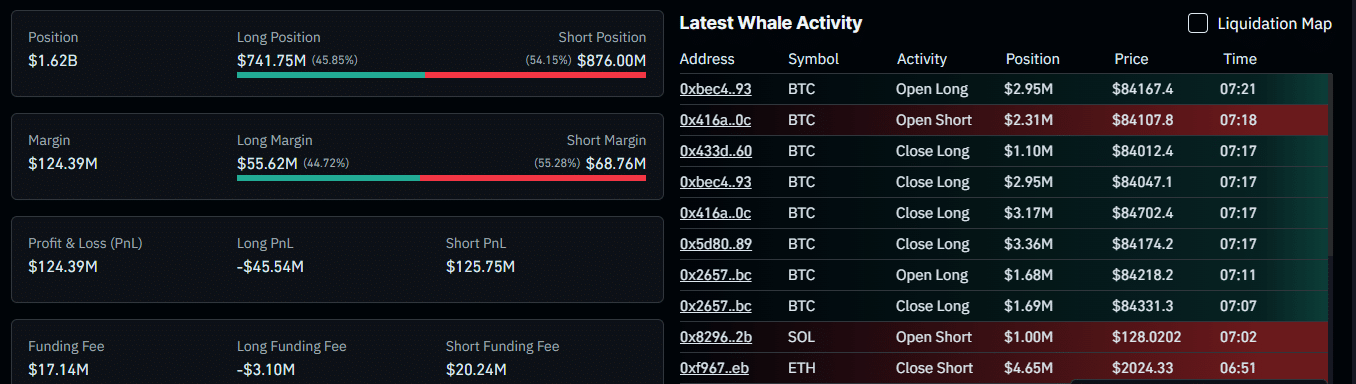

According to Coinglass, there has been a surge in derivative positions on Hyperliquid – A platform that monitors large traders’ positions – with figures for the same climbing to $1.62 billion. It’s like they’re trying to short-sell the whole ocean! 🌊

Interestingly, short positions seemed to account for 54.15% of these open positions, worth $876 million. Typically, when market data reveals activity skewed in favor of the bears, it might hint at a lack of interest from top market participants. This could potentially lead to a major market decline on the charts. Or, you know, the whales might just be trying to make a quick buck… 🤑

Further data revealed that traders who placed opposing bets—long trades—are at a loss now. At the time of writing, long profit and loss (PnL) was down by $45.5 million, while short traders gained $125.75 million within this period. It’s like the whales are swimming against the tide… 🌊

To put it simply, this suggested that selling has been more profitable – Something that may have influenced Bitcoin’s decline in the last 24 hours. AMBCrypto also found that institutional players are actively buying, likely for the long term. Because, you know, whales can’t be right all the time… 🙄

Institutional investors keep accumulating

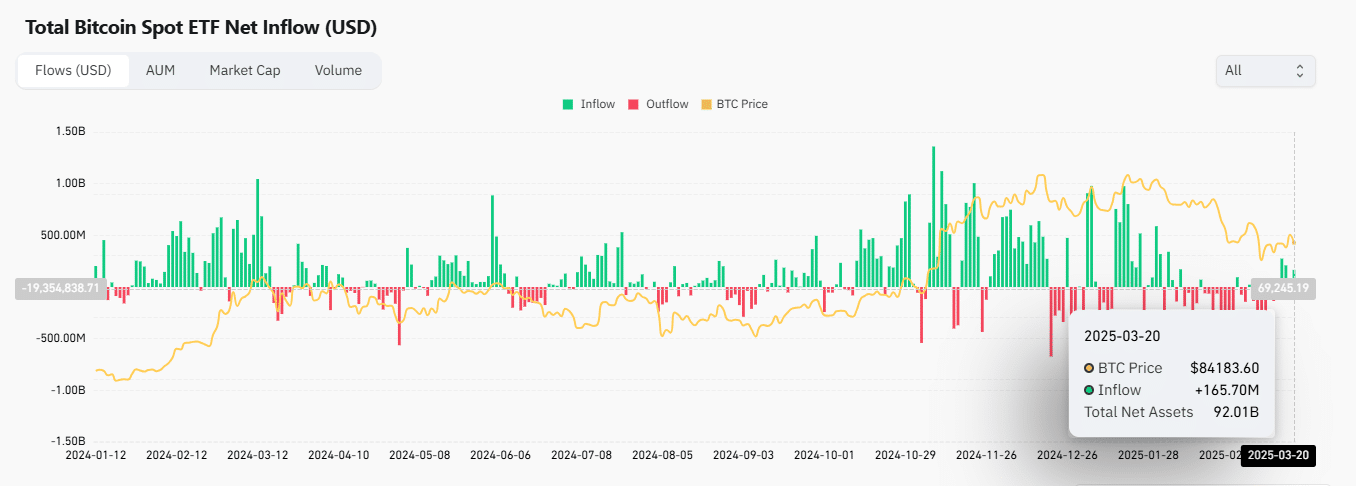

While whales on Hyperliquid are predominantly selling, institutional investors have been actively purchasing Bitcoin. This can be evidenced by the netflows tracking inflows and outflows. It’s like they’re trying to fill the ocean with more Bitcoins! 🌊

According to the same, investors purchased a total of $165.7 million worth of BTC over the last 24 hours. Such a significant amount is a sign of high level of interest in Bitcoin. Maybe the whales should take a hint… 🐳

The Fund Market Premium, another key metric comparing Bitcoin prices on institutional investment platforms to the broader spot market, showed buying activity from these platforms. At the time of writing, the metric sat above the neutral level of 0. It’s like the whales are trying to make a splash, but the institutions are just calmly buying more… 😐

AMBCrypto also found that this institutional buying sentiment seemed to be in line with long-term holders’ decisions to accumulate. The movement of their assets in the past seven days has notably declined, with a Binary CDD (Coin Days Destroyed) reading of 0.285. It’s like they’re trying to hold onto their Bitcoins for dear life! 🙅♂️

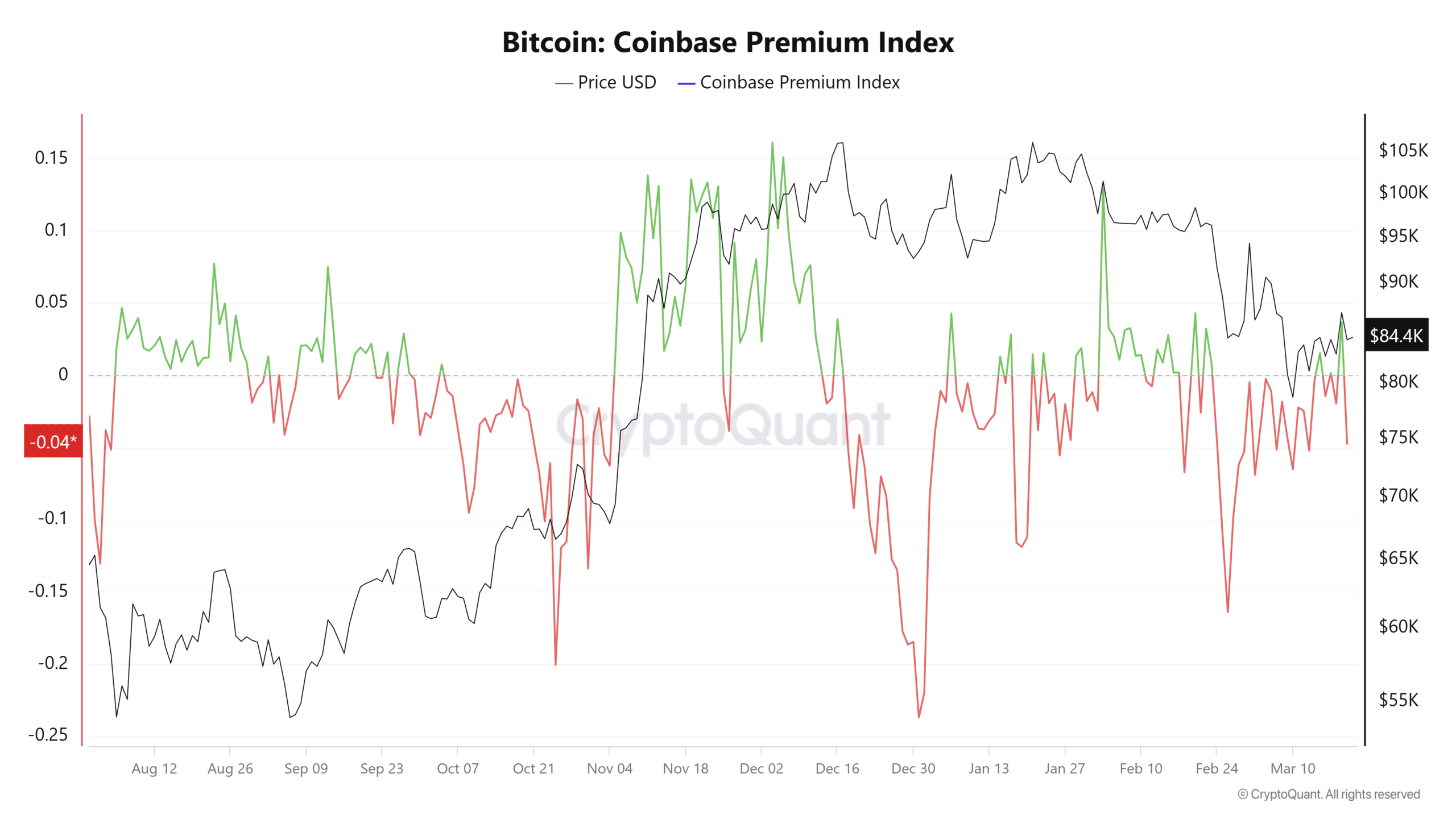

U.S investors are selling

Finally, American investors are following the same path as Hyperliquid whales, currently selling, as reflected by the Coinbase premium dropping to -0.04. When this premium enters negative territory, it alludes to significant selling pressure. It’s like the whales are trying to sell the whole ocean to the Americans! 🌊

Typically, U.S investors influence Bitcoin’s long-term movement, meaning that if their selling pressure continues to climb, Bitcoin could fall further. However, if selling eases, Bitcoin could rebound in line with the institutional investors’ bullish wave. It’s like the whales are trying to make a splash, but the institutions are just calmly buying more… 😐

Overall, a key shift in either direction—bullish or bearish—will lend us more clarity on Bitcoin’s next few weeks and months. Until then, it’s just a wild ride… 🎠

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-22 09:18