- Hyperliquid witnessed a record USDC outflow.

- The outflow coincides with reports of possible attacks from DPRK hackers.

As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed countless market fluctuations and security breaches. The recent events surrounding Hyperliquid[HYPE] have piqued my interest, not because of its record-breaking outflow of USDC on December 23rd, but due to the potential security threats that seem to coincide with it.

Recently, Hyperliquid[HYPE] has found itself back in the news, but this time not in a way that its token owners might appreciate. Some alarm bells have been ringing due to possible security breaches on the network, which seems to coincide with a significant withdrawal of USDC on the 23rd of December.

Although these occurrences might seem unrelated at first glance, they’ve ignited quite a buzz in the cryptocurrency circles.

Is Hyperliquid under attack?

As reported by security researcher Taylor Montana, there have been transactions deemed suspicious, which appear to be connected to wallets tied to North Korea, identified within the Hyperliquid network.

Montana proposed that these transactions might be trial runs, possibly paving the way for a larger-scale assault. Upon examination, it was found that these wallets suffered a loss of approximately $701,000 due to their Ethereum futures contracts.

Although this setback appears small relative to previous accomplishments by the team, the potential for a security breach has sparked worries. Montana from MetaMask pointed out potential weaknesses in the validator infrastructure of Hyperliquid.

She noted that the network operates with only four validators running identical code, making it more susceptible to coordinated attacks.

A USDC outflow coincidence?

On December 23rd, not only were there security issues at hand, but also a significant drain of USDC funds occurred with Hyperliquid as well.

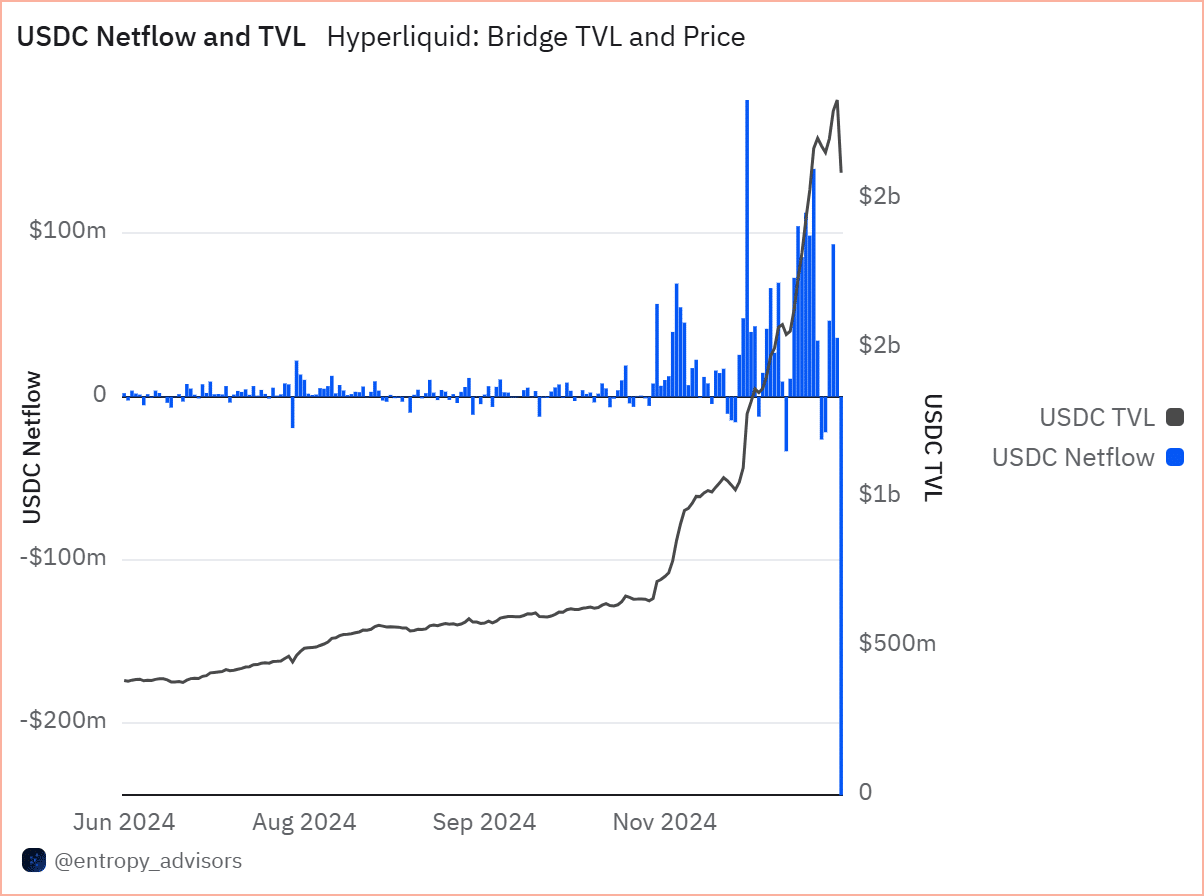

During the most recent trading day, Dune Analytics data showed a massive withdrawal of approximately $249 million, setting a new record for the largest single outflow ever seen on the network.

Although the outflow itself doesn’t automatically raise suspicions, the timing has sparked questions regarding its possible link to the suspected hacking activities.

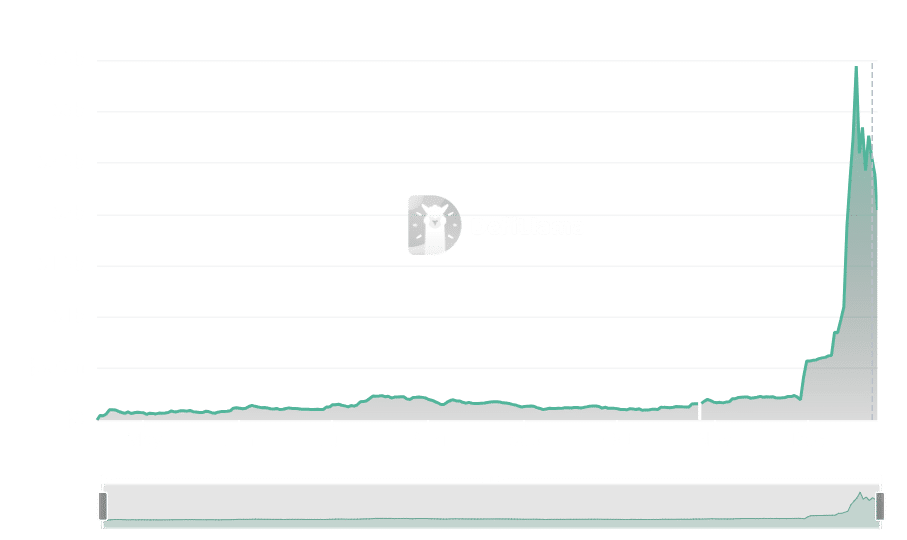

Despite an outflow, Hyperliquid’s combined value locked up (TVL) continues to be significant, surpassing the $2 billion mark as reported by DeFiLlama.

On the other hand, this figure shows a substantial decrease compared to its $3 billion TVL on December 17, primarily due to the fall in HYPE’s worth.

HYPE’s price action and the team’s response

As I pen this down, I find that Hyperliquid’s native token, HYPE, is currently trading around $29.80. This represents a significant recovery of more than 4.5% after it dipped to $25 earlier. However, on the 22nd of December, we witnessed a sharp decline in the value of HYPE, with over 11% plummeting from its value. This steep drop undeniably played a role in reducing TVL (Total Value Locked).

Partially due to rumors of an impending attack, there was a noticeable dip, yet more recently it appears to be leveling off and showing signs of recovery.

Based on the reports, the Hyperliquid team has denied any attack allegations, explaining that they haven’t found any weaknesses or loopholes in their system.

The team did not specifically call out any individual, but their remarks hinted at a concern that the researcher’s methodology might have been unprofessional, potentially leading to inflated or questionable results.

– Realistic or not, here’s HYPE market cap in BTC’s terms

Although Hyperliquid claims no current security weaknesses, a mix of safety apprehensions and substantial USDC withdrawals has kept the community uneasy.

As HYPE demonstrates tenacity, we’re eager to observe how they tackle these issues and restore confidence within their network.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-25 07:04