- SEC approved the 19b-4 listing for Ethereum ETFs, but S-1 approval is awaited

- Bitcoin ETFs have been seeing massive inflows, with Ethereum expected to attract millions too

As a researcher with experience in the crypto market, I find the recent developments regarding Ethereum [ETH] ETFs intriguing. The SEC’s approval of 19b-4 listing requests is a significant step forward, but the absence of S-1 registration statements leaves many questions unanswered.

Following intense debate about the SEC’s decision on ETH-backed ETFs, they recently announced approval for their launch.

Instead of “However, what’s significant here is that they’ve only approved the 19b-4 listing requests for ETH ETFs, not the critical S-1 registration statements,” you could say:

What’s behind the split?

The divided opinion on this issue gives rise to concerns, as some people believe it may be influenced by politics rather than a thorough examination of the ETF proposals. In line with this perspective, Matt Hougan, Bitwise’s CIO, expressed his view during a recent ‘Bankless’ podcast episode.

As a seasoned crypto investor, I’ve come across various market scenarios, but none quite like this one. I’ve rarely witnessed such a drastic shift in investor sentiment from complete despair to unexpected approval in just a short time span. It’s as if we went from certain rejection to sudden acceptance overnight. This unprecedented occurrence left me utterly astonished.

Reiterating the same, James Seyffart, Research Analyst at Bloomberg Intelligence, added,

When asked about the next steps in terms of an ETF, Hougan noted,

“The journey from our current situation to these ETFs being listed involves a back-and-forth dialogue between issuers and the Investment Management Division over the specific contents of the prospectus.”

In this context, he stressed that the SEC’s endorsement of 19b-4s represents progress, but the complete rollout of ETH ETFs hinges on the S-1 document being accepted. The process for gaining approval may span anywhere from several weeks to several months.

Impact on ETH’s price

These advancements have undeniably resulted in considerable shifts in Ethereum’s market value. At first, these changes caused a drop in its price chart. Nevertheless, at the moment of writing, ETH was recovering to $3,752, marking a 1.65% increase over the previous day. The overall investor mood, fueled by Bitcoin surpassing $69,000, has also turned optimistic.

Bitwise CIO lent some insights to this matter too by stating,

As an analyst, I would interpret it this way: With no fresh Ethereum entering the market and existing supply remaining steady, this unexpected surge in demand implies that new buyers must acquire Ethereum from those who aren’t compelled to sell. This situation sets the stage for a highly bullish price trend.

BTC inflows vs. ETH inflows

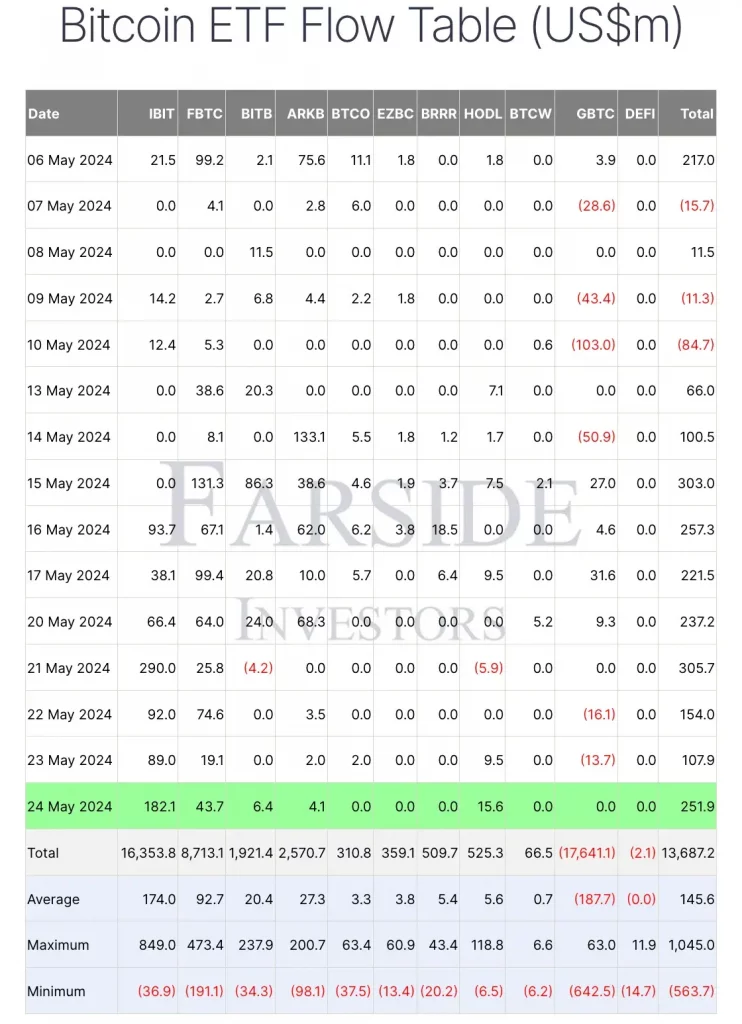

Since their introduction on January 11th, Bitcoin ETFs have experienced extraordinary inflows. In particular, Farside Investors’ most recent figures indicate that a significant sum of $251.9 million flowed into these ETFs on May 24th.

Will Ethereum see similar numbers though? According to Hougan, no. He went on to say,

As a crypto investor, I acknowledge that Ethereum ETFs might not reach the same heights as Bitcoin ETFs in terms of market capitalization. However, I strongly believe that the value of Ethereum ETFs will still be measured in the trillions of dollars.

As a crypto investor, I’ve come to appreciate the distinction between Bitcoin and Ethereum based on their respective roles in the digital currency space. For me, Bitcoin serves as a simpler, more straightforward version of digital gold. Its value proposition lies in its scarcity and decentralization, making it an attractive store of value for many.

For institutional investors, it would be wise to consider expanding their investment portfolios by including both Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-26 04:07