-

BlackRock’s IBIT experienced a remarkable half-a-billion inflow, and record demand has caused IBIT stock to soar 20% in two weeks.

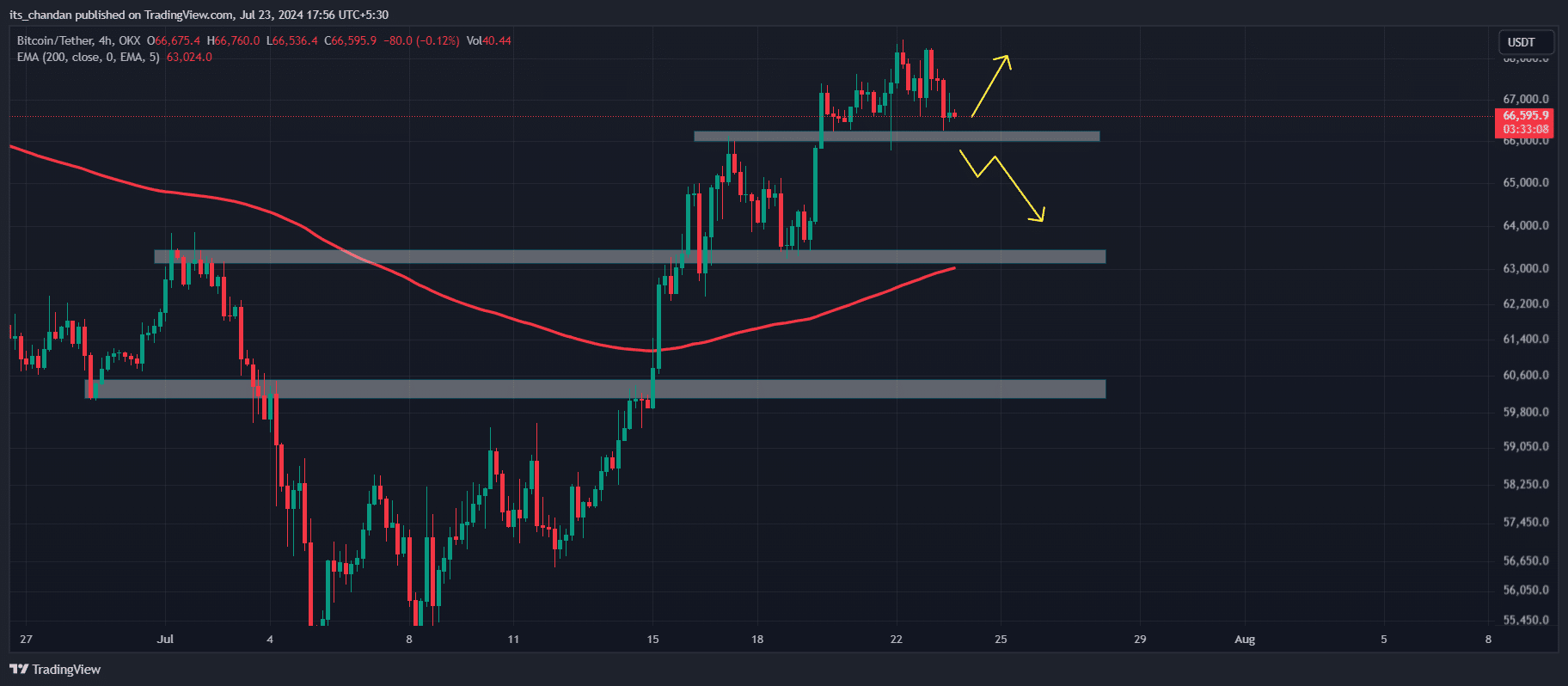

If BTC fails to sustain the $66,200 crucial demand zone, we may see a price drop to the $64,000 level.

As a seasoned financial analyst with extensive experience in cryptocurrency markets, I have witnessed firsthand the volatility and unpredictability of Bitcoin and other digital assets. The recent approval of the spot Ethereum ETF in the US has caused ripples throughout the market, leading to selling pressure that brought down the overall crypto market.

As a crypto investor, I’ve noticed that after the green light for the spot Ethereum [ETH] ETF was given in the US markets, my portfolio took a turn for the worse. The cryptocurrency market as a whole began to bleed out with intense selling pressure.

In spite of persistent attempts to sell Bitcoin [BTC] ETF shares, there has been a substantial influx of approximately $534 million into it, as indicated by data from the analytics firm SpotaChain.

BlackRock’s IBIT total inflows near $20 billion

With this, Bitcoin ETF inflow has remained positive for the last 12 consecutive trading days.

In recent times, the BlackRock iShares Bitcoin Trust (IBIT) has attracted substantial interest, with an impressive half-billion dollar influx.

This is the first time since the 13th of March that IBIT has experienced such a notable inflow.

The record-breaking inflow has brought the grand total for IBIT since its inception to over $19.5 billion. Furthermore, the value of IBIT holdings now stands at approximately 325,000 BTC, equating to a staggering $22.5 billion. As a result, the stock price experienced a notable increase of around 2.56%.

Over the past two weeks, IBIT’s price has experienced a significant increase of more than 20%. In the preceding 30-day period, there was heightened investor and trader attention leading to a notable price rise of over 15% for IBIT.

Besides seeing over $38.4 million withdrawn in a single day, VanEck (HODL), as a notable asset manager apart from BlackRock’s IBIT, experienced its largest outflow since the ETF was established.

Meanwhile, Grayscale’s GBTC experienced a $0 inflow.

Bitcoin technical analysis and upcoming levels

Based on the technical assessment of experts, Bitcoin maintained its bullish trend and was situated at a pivotal support level of $66,200 as of the present moment. In the past four hours, Bitcoin had revisited this support area several times since the 19th of July.

Repeatedly hitting the $66,200 mark without holding may undermine its significance as a support level for Bitcoin (BTC). Should BTC lose its footing and fall below this threshold, it’s possible that the price could slide down to $64,000 in the near future.

The daily and 4-hour charts showed that Bitcoin’s price was continuing to hover above the 200 Exponential Moving Average (EMA). Assets trading above the 200 EMA are typically seen as bullish signs in technical analysis.

At present, Bitcoin was approaching the $66,700 mark for its trade value, and there had been a decline of more than 1.5% in its price within the past 24 hours.

In contrast to the decrease in price, there has been a significant surge of approximately 45% in investor and trader activity, indicating their heightened engagement with Bitcoin (BTC). Over the past month, BTC itself has experienced a growth of around 4.7%.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-24 03:03