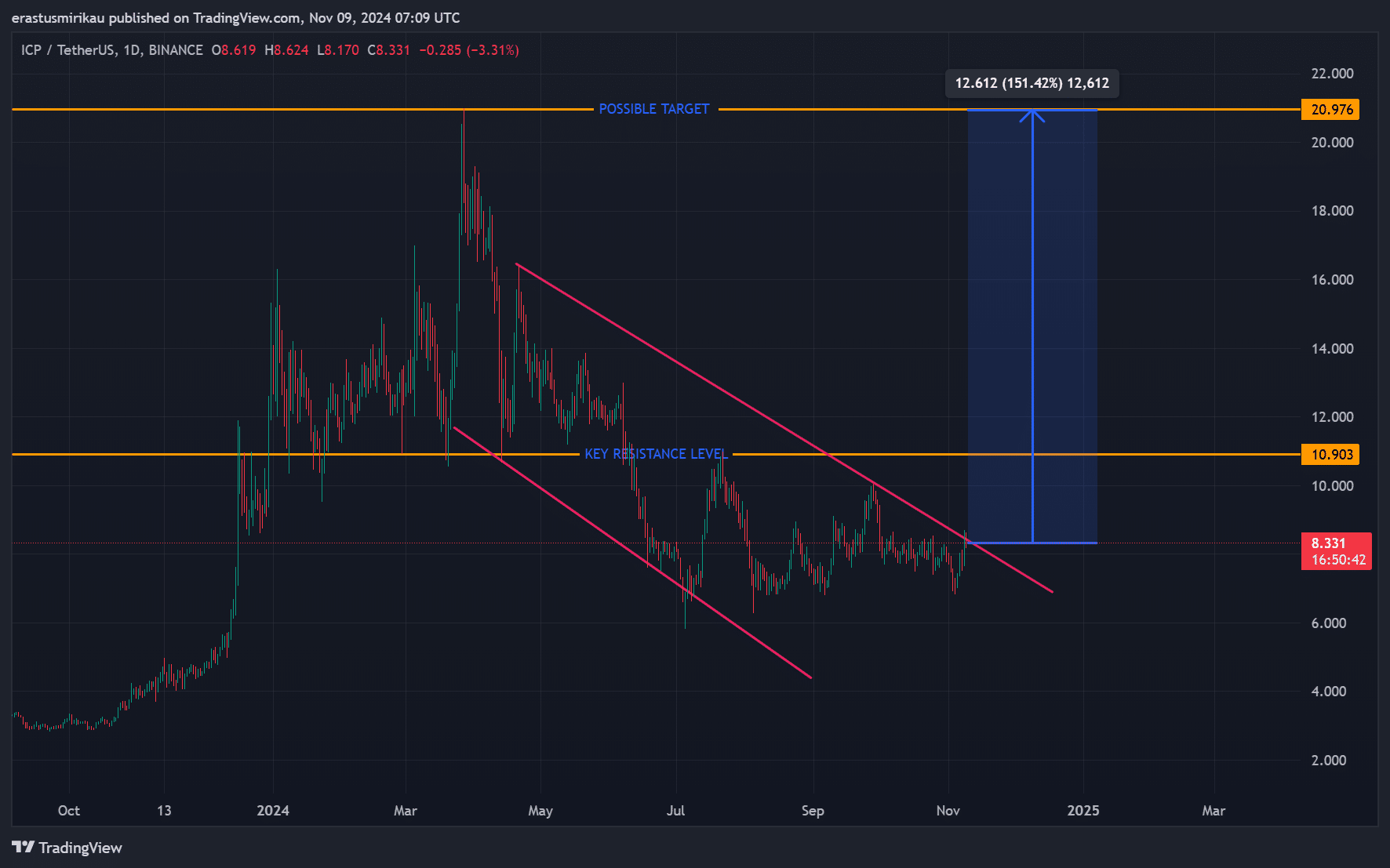

- ICP formed a bullish pennant pattern, with the critical resistance level at $10.90

- Steady social volume and bullish liquidation trends underlined growing interest and positive sentiment in ICP

As a seasoned analyst with years of experience under my belt, I have seen countless cryptocurrencies rise and fall like waves upon the digital sea. However, the current trajectory of Internet Computer Protocol [ICP] has piqued my interest more than ever before.

Following several months of stabilization, Internet Computer Protocol (ICP) might be preparing for a substantial uptrend. At the moment, it’s trading at $8.35 and has increased by 8.29%. The charts suggest that ICP is forming a bullish pennant shape, which is typically associated with a potential for price increase.

Consequently, if ICP manages a successful breakout, it might surge towards the $20 level, creating attractive investment opportunities for those chasing bullish trends. Nonetheless, sustaining this upward trend is a significant concern that needs to be addressed.

Can ICP overcome its key resistance to hit new highs?

Currently, ICP is encountering a crucial barrier near $10.90 – a level it has found difficult to surpass in previous attempts. If it manages to break through this barrier, it might open the way towards the $20 goal. Yet, this barrier serves as a substantial obstacle since a failure to overcome and maintain a position above it could dampen optimism among bulls.

Consequently, if ICP can surmount this hurdle with substantial trading activity, it might spark renewed curiosity – leading to increased demand.

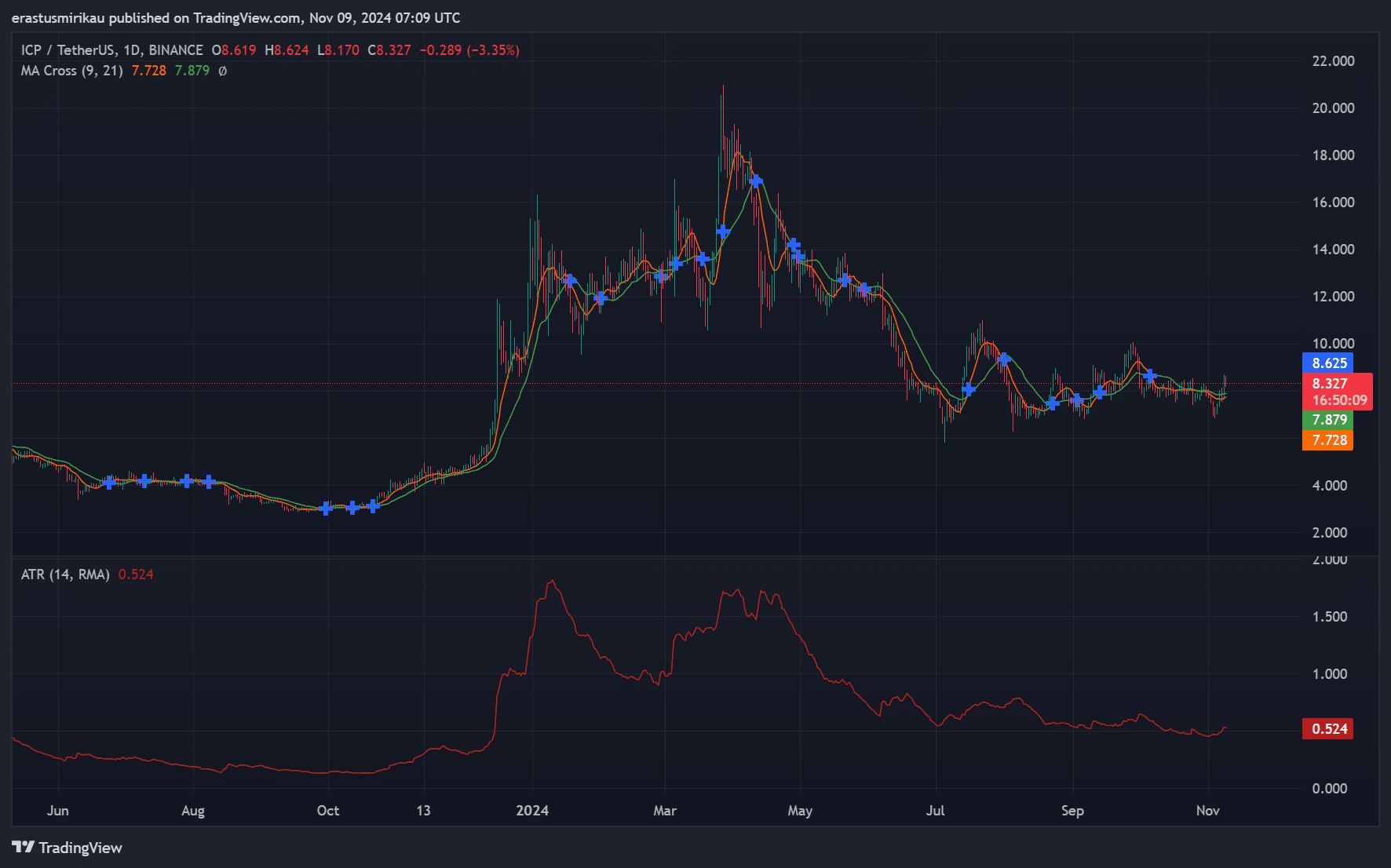

Technical indicators suggest potential for upward movement

Upon analyzing the technical aspects, positive signals emerged on the graphs. For instance, the latest crossover on the daily chart suggested a change in the short-term direction, possibly indicating potential reinforcement within ICP’s current price range. At this moment, the price was transacting above both the 9-day and 21-day moving averages, creating a strong foundation for potential further growth.

Moreover, the Average True Range (ATR) was 0.524, indicating a period of minimal price fluctuations. As a result, this tranquility might pave the way for a significant shift. Notably, low volatility typically precedes substantial market swings, either upward or downward. Thus, these indicators together created an image of underlying robustness.

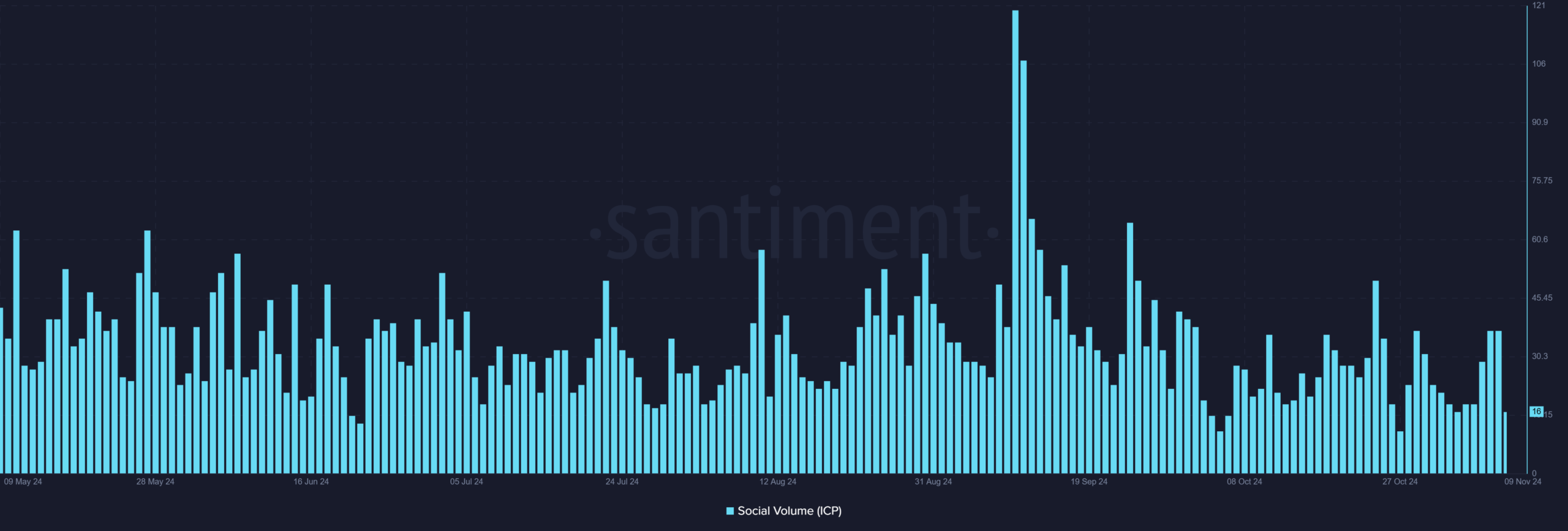

ICP’s social volume sees modest hike

The current social activity level on the ICP platform has reached 16, indicating a level of engagement that’s somewhat less than the record highs seen in August and September, which surpassed the 100 mark.

Despite muted activity at present, the persistent curiosity indicates that ICP continues to be relevant in the crypto sphere. This ongoing interest might foster future growth if a surge happens. Notably, increased talks around the asset tend to attract more attention.

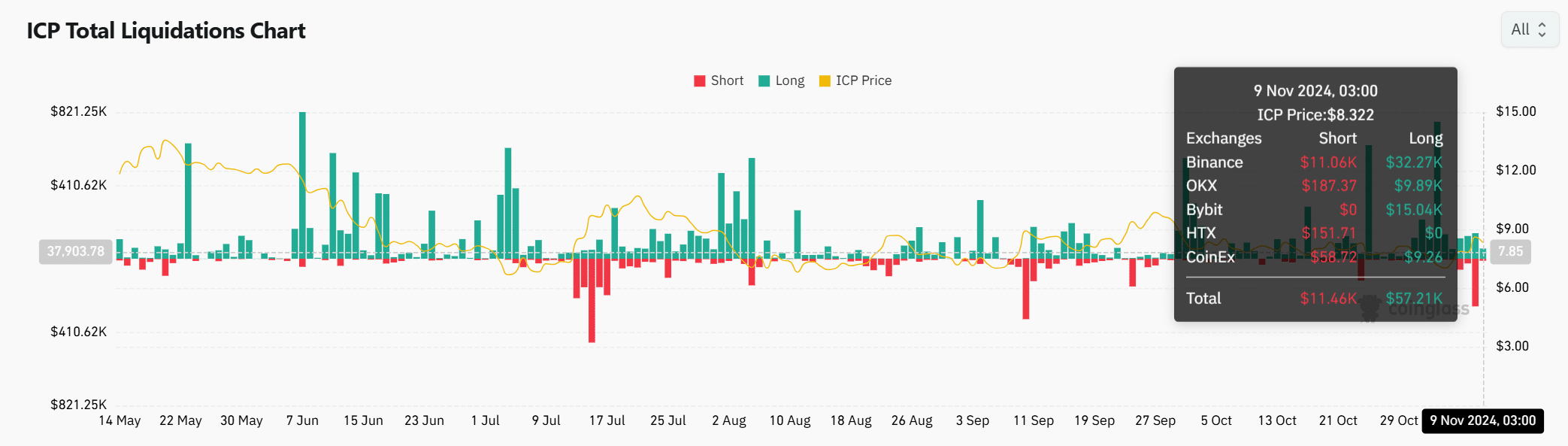

Liquidations reveal investor sentiment

Regarding the closing of positions, ICP has witnessed a significant inflow of capital with long positions totaling approximately $57,210 being closed. In contrast, short liquidations amounted to only about $11,460. This disparity suggests that traders are generally optimistic (bullish) as they’re investing more in long positions compared to short ones.

In other words, sharp drops in price might lead to more sell-offs, increasing market turbulence. Keeping an eye on liquidation patterns will thus be vital because they could suggest whether investor optimism remains strong or if a market adjustment is approaching.

Read Internet Computer’s [ICP] Price Prediction 2024-25

In summary, at the moment of reporting, it seemed that ICP was ready for an upsurge, backed by robust technical signs, consistent social attention, and optimistic market liquidations.

Should the price surmount the $10.90 barrier, an upward trend toward approximately $20 could ensue. It would be prudent for investors to get ready for possible profits, as the token appears to be demonstrating robust indications of transitioning into a bullish market trend in the near future.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-10 03:03