-

Bitcoin whales offloaded 30,000 BTC worth $1.83 billion

Despite a 23% dip in large transactions, 80% of holders were still in profit at press time

As a seasoned crypto investor who has weathered numerous market cycles, I find myself intrigued by this recent turn of events in the Bitcoin market. The whale activity we’re witnessing is reminiscent of a game of chess, where each move could potentially shift the course of the game.

In recent times, the value of Bitcoin has shown significant fluctuations. Consequently, this instability led to intriguing reactions from numerous investors.

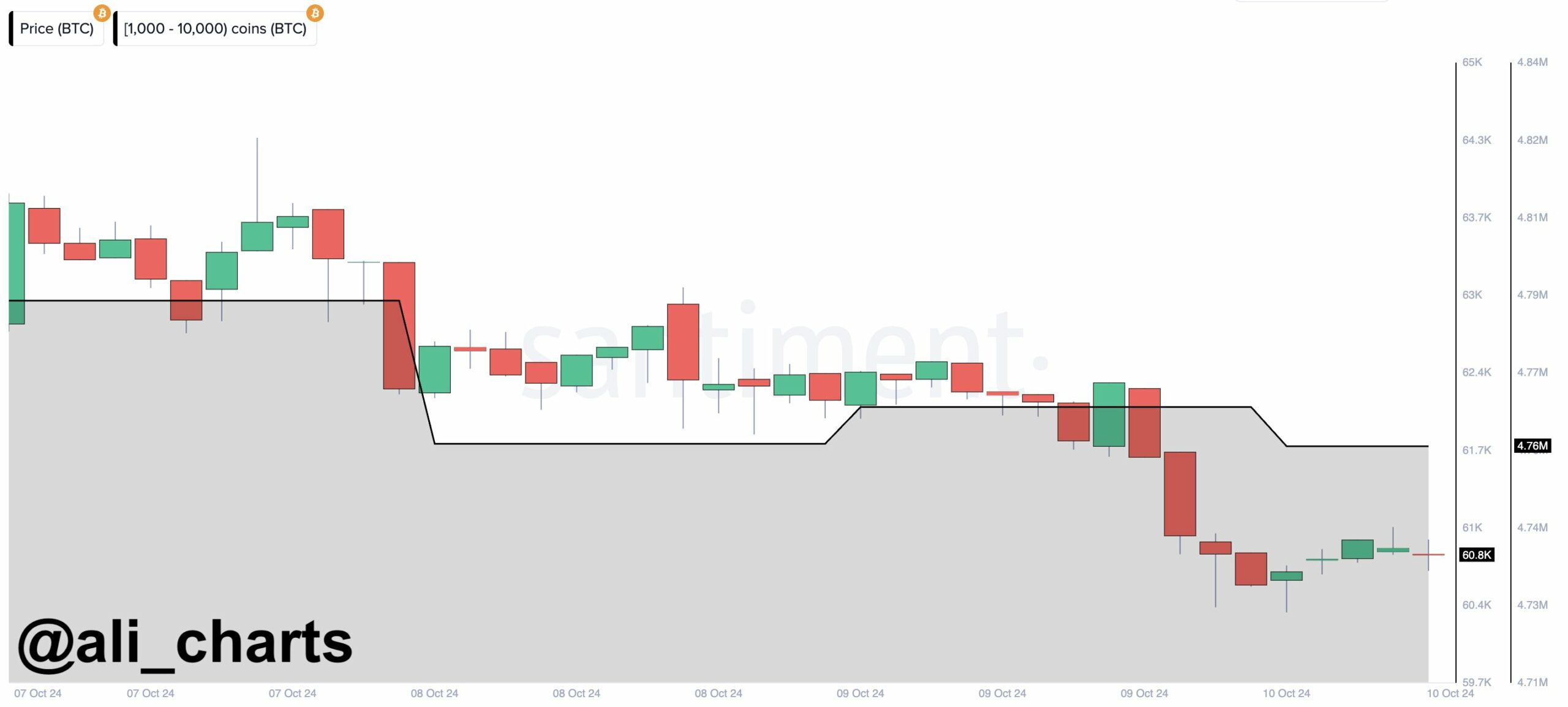

Within the past three days, it has been disclosed that a substantial number of whales (large-scale Bitcoin holders) allegedly offloaded or transferred approximately 30,000 BTC, which equates to an astonishing $1.83 billion.

Given its sizeable shift, it’s inevitable that people will ponder over Bitcoin’s future direction. So, the query arises – Will Bitcoin further decrease or is this merely a deception preceding a genuine crypto surge?

Whales make waves, but profit saves

In terms of market focus, whales’ activities are usually the main event, and this week is no different from that pattern.

Over a brief span of 72 hours, approximately 30,000 Bitcoin units were either sold or re-distributed, causing a series of impacts across the cryptocurrency market. Unsurprisingly, such an event has sparked much discussion about possible additional negative price influences.

Approximately $1.83 billion in Bitcoins were traded recently, leaving market players pondering whether this could be an indication of a broader tactic at play.

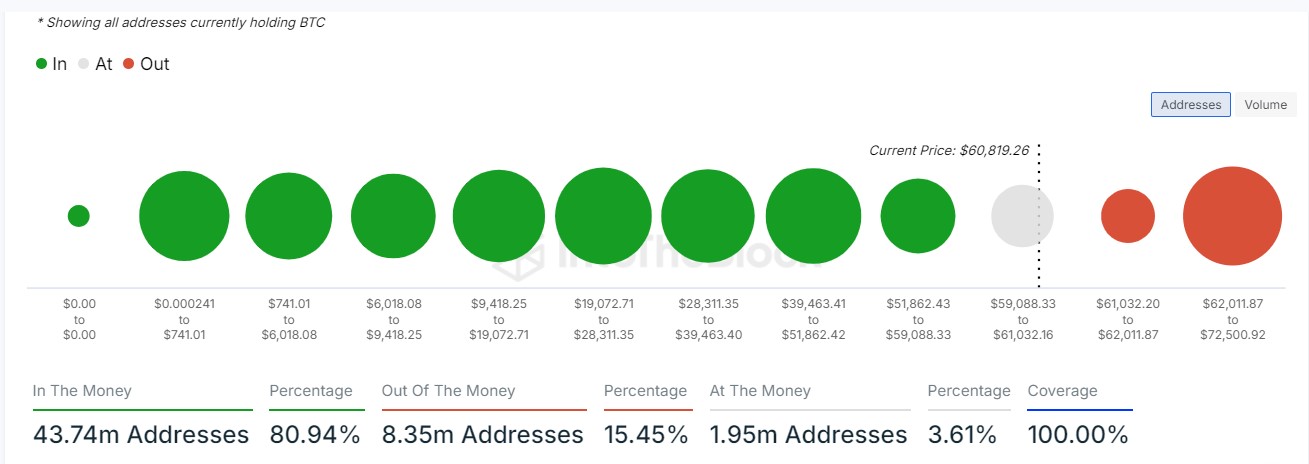

It’s worth mentioning that this significant shift occurred when around 80% of Bitcoin owners were still experiencing profits.

In simpler terms, even though some people sold Bitcoin, others were able to buy it at a lower cost. As a result, they have fewer reasons to panic-sell because they’ve already secured their investment at a reduced price.

Large transactions decline, while Bitcoin holders stay strong

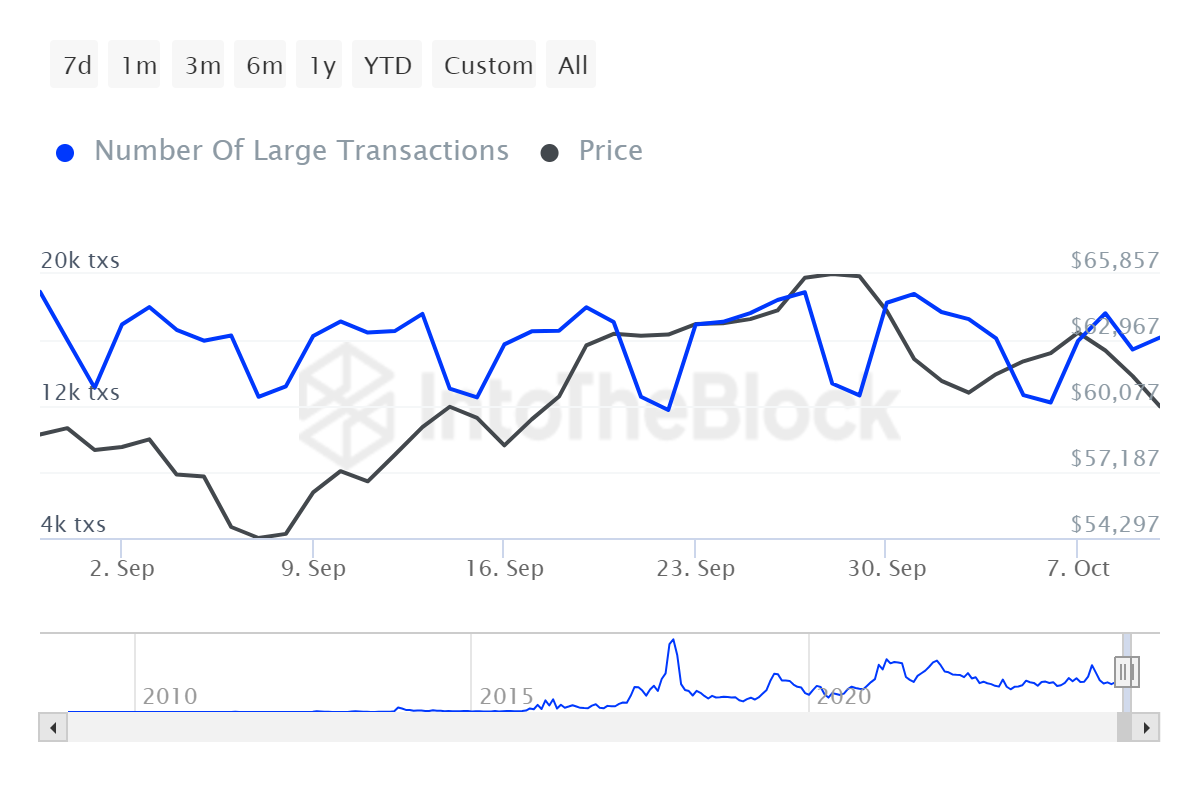

AMBCrypto delved deeper into the extensive transactional data provided by IntoTheBlock to monitor the behavior of significant Bitcoin investors during this critical market period. The findings suggested a 23% decrease in large Bitcoin transactions, often signaling diminished activity among institutional investors and wealthy individuals.

Even so, the vast majority of Bitcoin owners continue to make a profit on their investment. This could indicate that these owners are hesitant to sell in the current market conditions, suggesting a strong desire to hold onto their assets.

Currently, although larger transactions seem to be decreasing, there’s no indication that the wider investor group is experiencing significant worry or alarm.

Inflation adds fuel to speculation

In an unexpected turn of events, the U.S. inflation rate surged to 2.4%, adding complexity to the economic landscape. Typically, when inflation becomes more robust, investors tend to gravitate towards secure investments such as Bitcoin.

As an analyst, I believe my actions could alleviate the immediate selling pressure instigated by the whales, potentially stirring anticipation that this current downturn might be a transient aberration preceding another broader market surge.

Will Bitcoin dip further?

The intersection of increased whale activity and unexpectedly high U.S. inflation creates a sense of unpredictability within the Bitcoin market.

As a researcher delving into this subject, I find myself caught between two schools of thought. Some experts posit that whale activities might be manipulating prices, creating a false downturn with the intent to initiate a substantial upsurge soon. On the flip side, others suggest that the pressure from sellers could escalate, potentially leading to more short-term price drops.

Read More

2024-10-11 19:04