- BNB’s breakout above $650 signaled bullish momentum with targets at $750 and $800

- Derivatives data revealed growing trader interest, with Options volume up by 47%

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself intrigued by Binance Coin’s [BNB] recent breakout above $650. Having witnessed numerous market cycles and trends, I must admit that BNB’s price action is reminiscent of a mighty phoenix rising from its ashes.

In a significant development, Binance Coin [BNB] surged past a persistent trend line, indicating growing optimism as it gathers momentum within the market. Currently priced at $718.35, BNB experienced a 0.40% increase over the previous 24 hours, and is now only 9.44% shy of its record high of $793.35.

Therefore, the question remains – Can BNB maintain its upward trajectory and surpass its peak?

Parallel channel breakout and price trajectory

The leap of BNB beyond its parallel channel signifies the conclusion of a prolonged period where its price movement was confined. This breakout above the $650 resistance level suggests an opportunity for possible future expansion.

Furthermore, at the current moment, the price movement suggests robust backing from buyers. The key resistances to keep an eye on are $750 and then $800, which serves as a psychological barrier. If Binance Coin (BNB) maintains this momentum, it might pave the path towards a new record high, with $850 serving as the next significant milestone.

BNB technical indicators show growing momentum

A technical analysis flashed mixed, but promising signals. The weekly RSI stood at 64.82, signaling increasing buying pressure while staying below the overbought threshold of 70.

Additionally, the Bollinger Bands showed increased price fluctuations since the value was frequently approaching the upper limit. Yet, approaching this limit usually results in temporary price decreases.

In other words, traders need to stay alert for potential corrections, and they should keep an eye out for periods where the price stabilizes above $700. Such consolidation suggests a more robust resumption of the bullish trend.

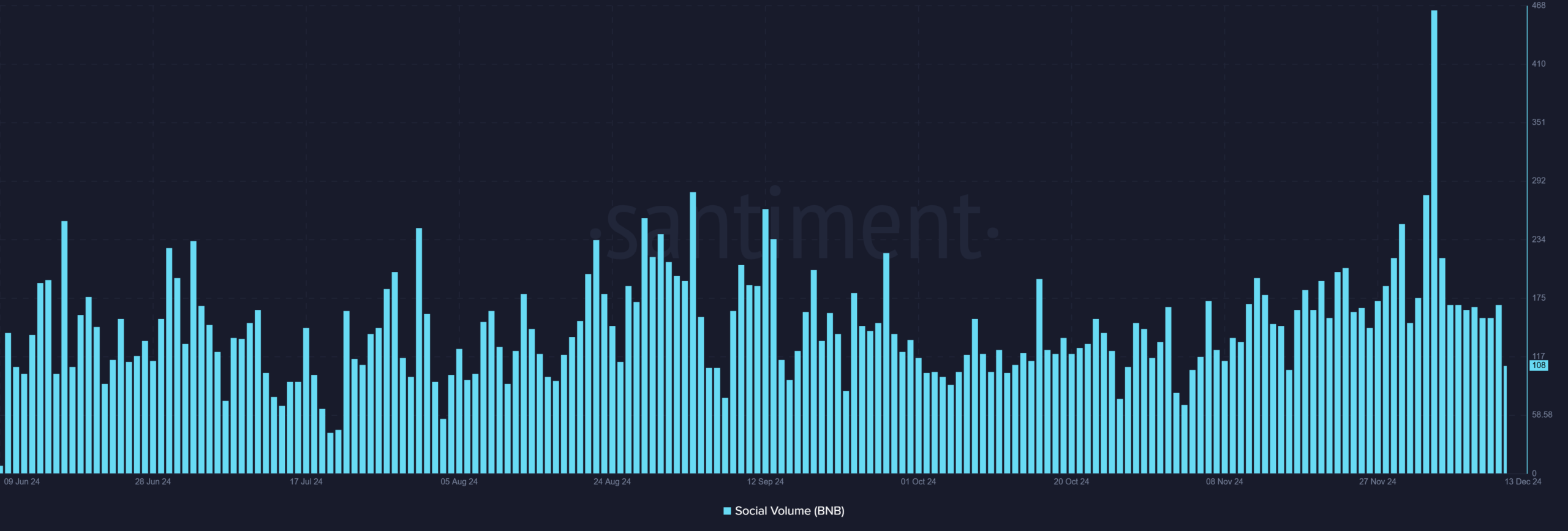

Social volume and market sentiment

Although the social volume dropped from a previous peak of 169 to its current level of 108 at the present moment, this decrease might suggest a transition from speculative retail trading to more consistent institutional engagement.

Less talk in social circles usually coincides with price consistency, offering a stronger basis for future profits. However, investors must stay vigilant for any renewed surge in conversations, as heightened social activity frequently signals upcoming significant price changes.

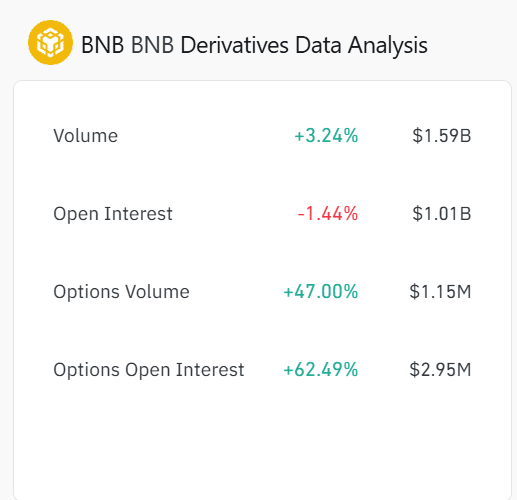

Derivatives market signals growing interest

The derivatives market showed a growing curiosity among traders regarding BNB, as evidenced by a 3.24% surge in trading volume to reach $1.59 billion and a significant 62.49% rise in Options Open Interest, suggesting optimistic attitudes.

Moreover, an increase of 47% in Options trading suggested that traders were ready to wager on potential price increases for BNB. Meanwhile, Futures Open Interest saw a minor decrease by 1.44%, but the overall derivatives data pointed towards a favorable forecast for BNB’s price.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB poised for a breakout above $793?

Currently, at the present moment, Binance Coin (BNB) seems poised to regain its record high of $793.35, thanks to its technical breakthrough, increasing interest in derivatives, and a stable, optimistic outlook. If this positive trend continues with robust buyer backing, BNB could potentially exceed its peak and spearhead the market towards its upcoming bullish cycle.

Read More

2024-12-14 12:07