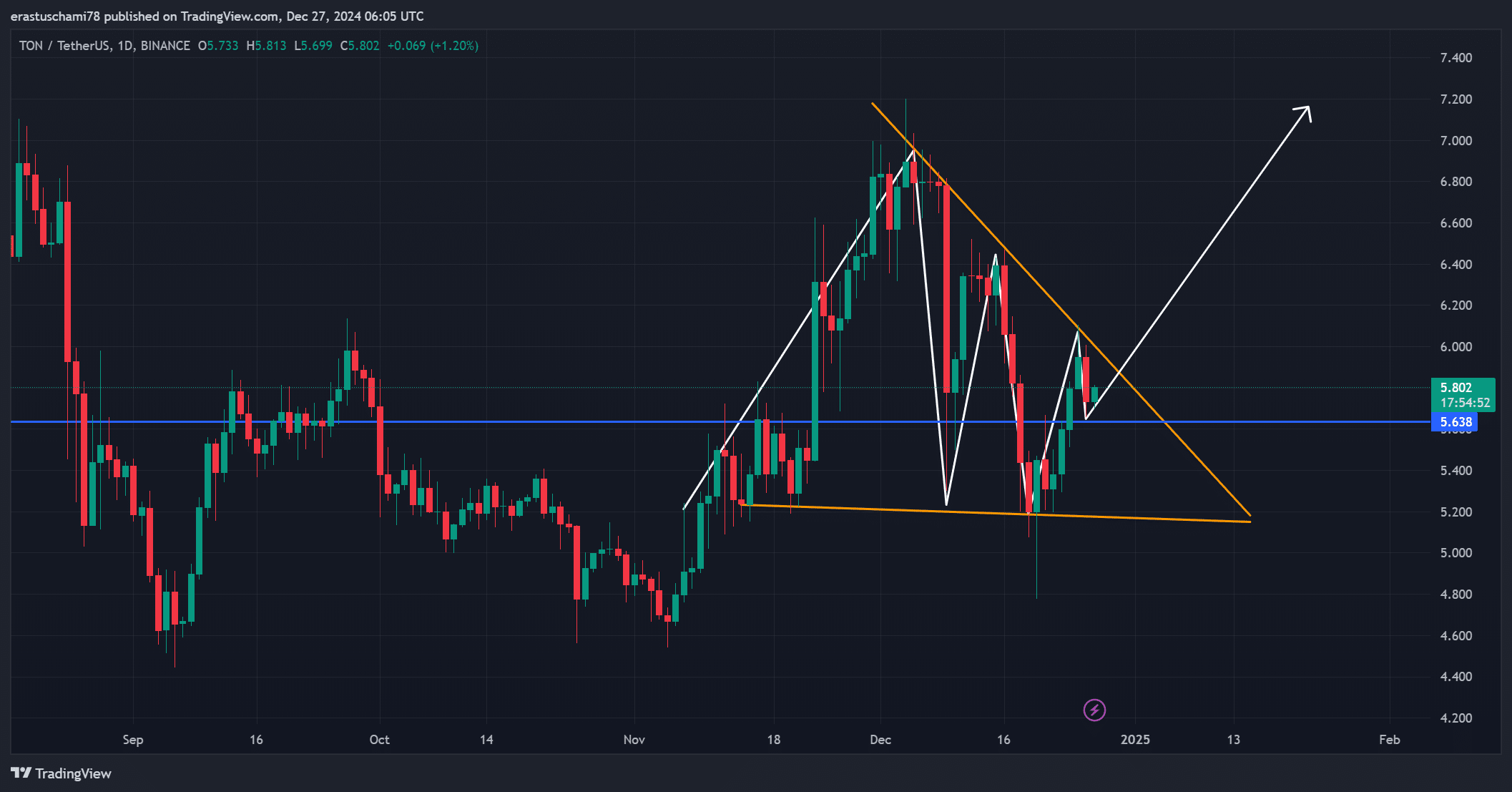

- The bullish pennant pattern signaled a potential breakout, with a target price of $7.2

- On-chain metrics and technical indicators were in line with each other, showing strong momentum and rising adoption

As a seasoned analyst with years of experience in navigating the complex world of cryptocurrencies, I find myself increasingly intrigued by Toncoin‘s [TON] recent price action. The bullish pennant flag pattern and the alignment of on-chain metrics and technical indicators point towards an exciting breakout opportunity, potentially propelling TON to a target price of $7.2.

Recently, there’s been a surge of interest in Toncoin [TON], as it appears to be preparing for a possible breakout from a bullish pennant pattern. Currently, TON is being traded at $5.79, representing a 1.21% decrease over the past day. Notably, despite this dip, TON remains above the crucial $5.6 resistance level.

As a seasoned trader with over two decades of experience, I have seen countless market trends come and go. However, this particular technical setup has piqued my interest like few others. Based on my analysis, if the price successfully breaks out, it could potentially surge towards $7.2. What makes me confident in this prediction is the strong support from on-chain metrics, which aligns with a bullish outlook for TON. I have personally witnessed similar market conditions lead to significant gains, and the momentum behind TON seems to be building steadily, making it an exciting opportunity for investors.

Analyzing TON’s price movement and breakout potential

The behavior of TON suggests a strong possibility of a bullish pennant formation, indicating a period of consolidation followed by an expected increase in price. Previously, $5.6 functioned as a significant barrier, but a recent successful test has made it more likely that this level will be surpassed.

Should Tezos (TON) surpass its current threshold due to strong buying activity, it may head towards the $7.2 price zone, potentially yielding substantial profits. Yet, it’s crucial to keep an eye on trading volume and momentum to verify the breakout. If the surge in buying pressure doesn’t hold up, the trend could potentially reverse.

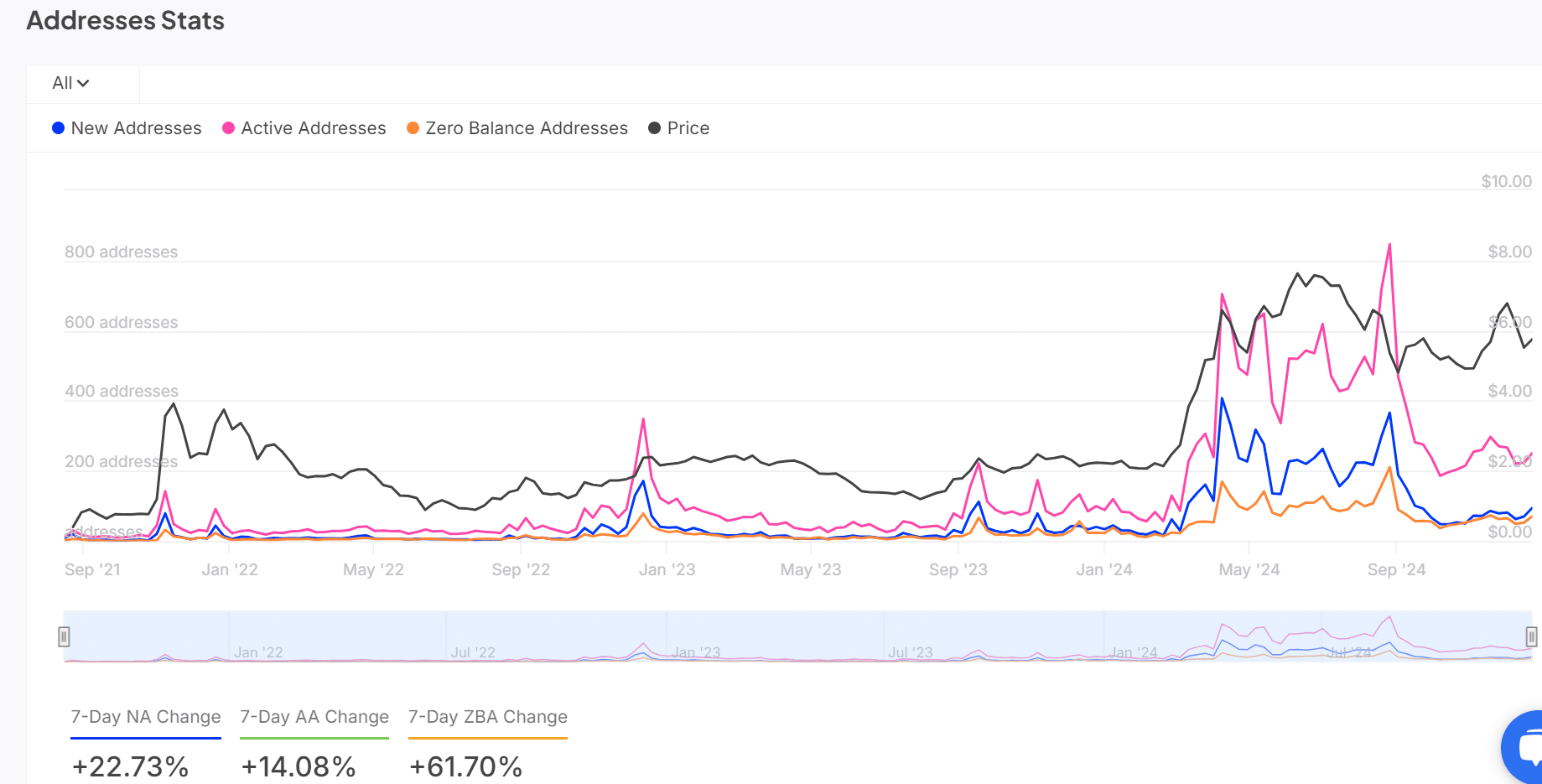

On-chain metrics show growing network activity

Data from the blockchain shows a surge in activity within TON’s network. In just the last seven days, there has been a 22.73% increase in new accounts, climbing from 167 to 205. Additionally, active addresses have grown by 14.08%, escalating from 178 to 203.

Moreover, there was a significant increase of 61.7% in the number of zero-balance addresses, climbing from 330 to 534 – Indicating a surge of new users joining the platform.

It appears that these measurements indicate a speeding-up trend in TON’s adoption. For investors’ trust to remain high and for continued increases in value to occur on the graphs, consistent expansion is crucial.

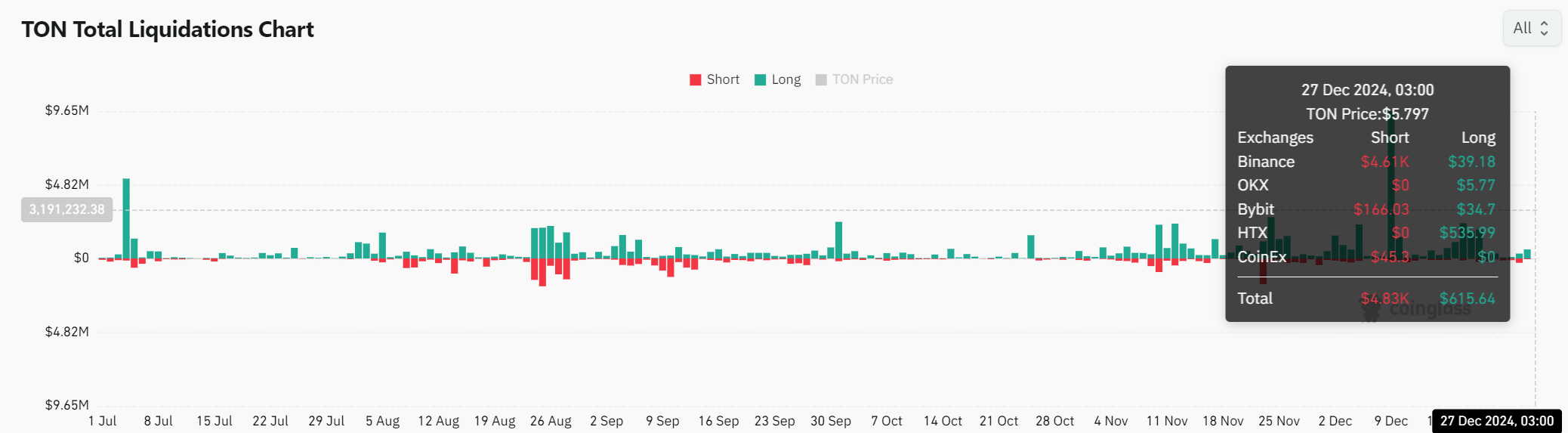

TON’s liquidation data hints at cautious optimism

The pattern of closing down assets suggests a mix of caution and hopefulness among the traders. More shorts were closed at $4,830 compared to only $615.64 in longs being opened, indicating that traders are wary about taking on large, long-term investments.

In simpler terms, if the price rises above $5.6, it might lead to a chain reaction of sellers who have short positions (betting on a drop in price) being forced to sell, which could intensify the price increase. So, traders should keep an eye on these levels as they can signal significant changes in market trends.

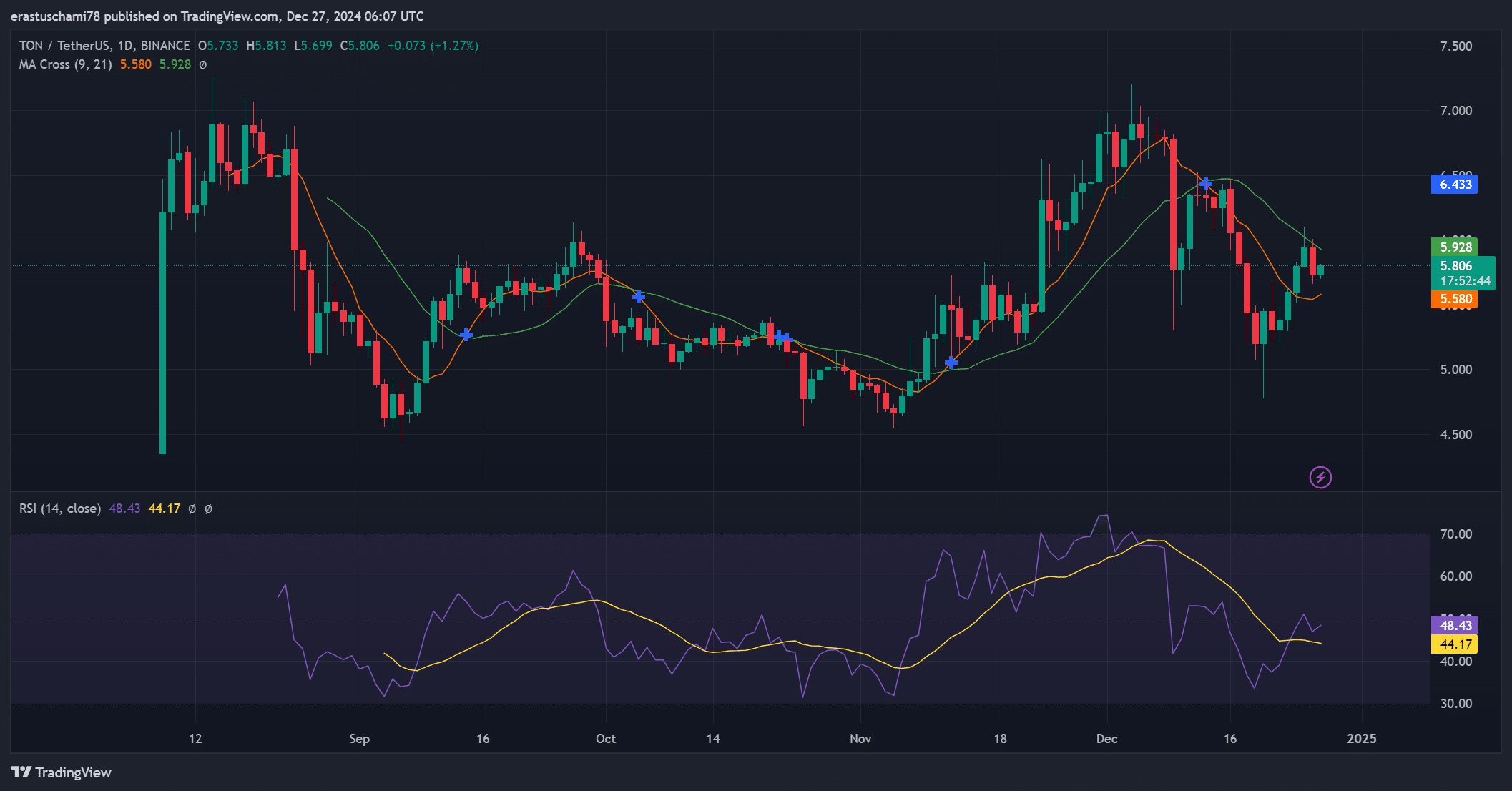

Technical indicators signal bullish momentum

In simpler terms, the technical analysis points towards a positive outlook for TON. The Relative Strength Index (RSI) stood at 48.43, suggesting neutral momentum that could potentially increase. Additionally, the 9-day average price was higher than the 21-day average, which typically signals a positive trend.

With the pennant flag configuration, these signals appeared to suggest a market ready for a surge. Yet, persistent buying power is essential for maintaining this upward thrust.

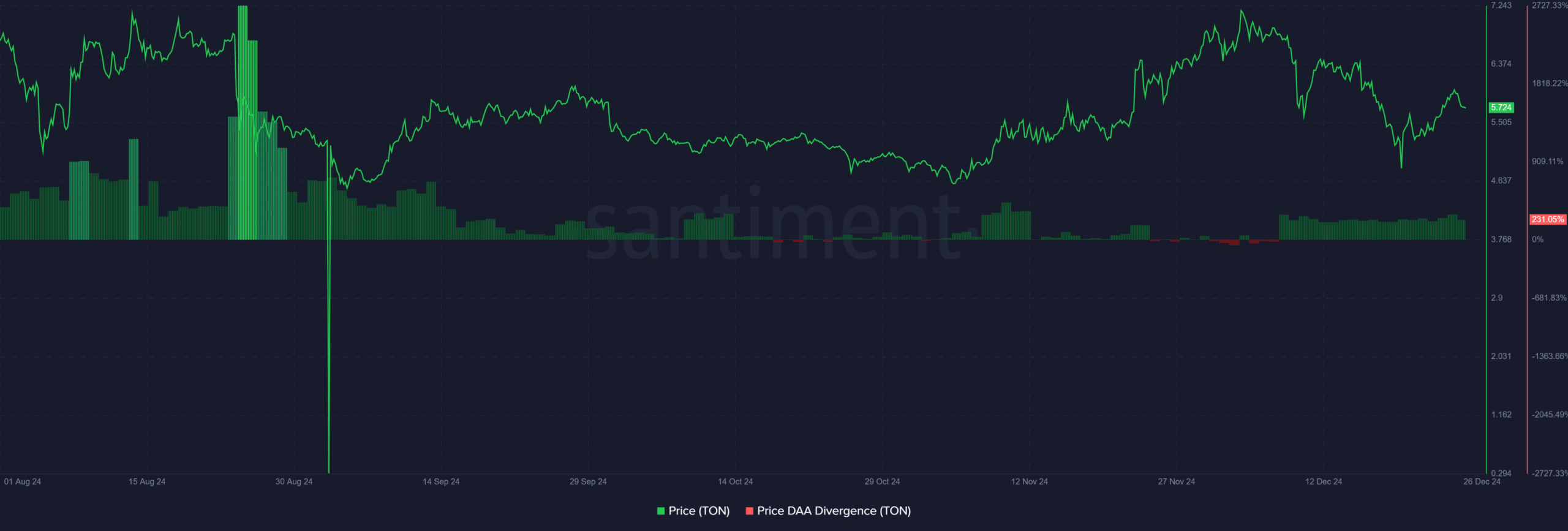

Daily active addresses divergence reflects strength

The price and daily active addresses (DAA) divergence offered some additional optimism. In fact, the DAA at 231% aligned closely with TON’s price action at $5.7.

The increasingly small gap indicates strengthening underlying factors, implying that the strength of TON’s network might be mirroring its price fluctuations.

Read Toncoin’s [TON] Price Prediction 2024–2025

The token TON seems poised for an upsurge, given its robust technical signals and increasing on-chain actions. If it manages to break through the $5.6 mark, we can expect the value to trend towards $7.2, signaling the commencement of a powerful upward momentum.

Simply put, TON’s outlook remains highly promising as it continues to gain momentum.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-12-27 16:08