-

BTC miners have sent fewer coins to exchanges over the past few weeks

According to a CryptoQuant analyst, they may be waiting for the coin’s price to rally to sell at a profit

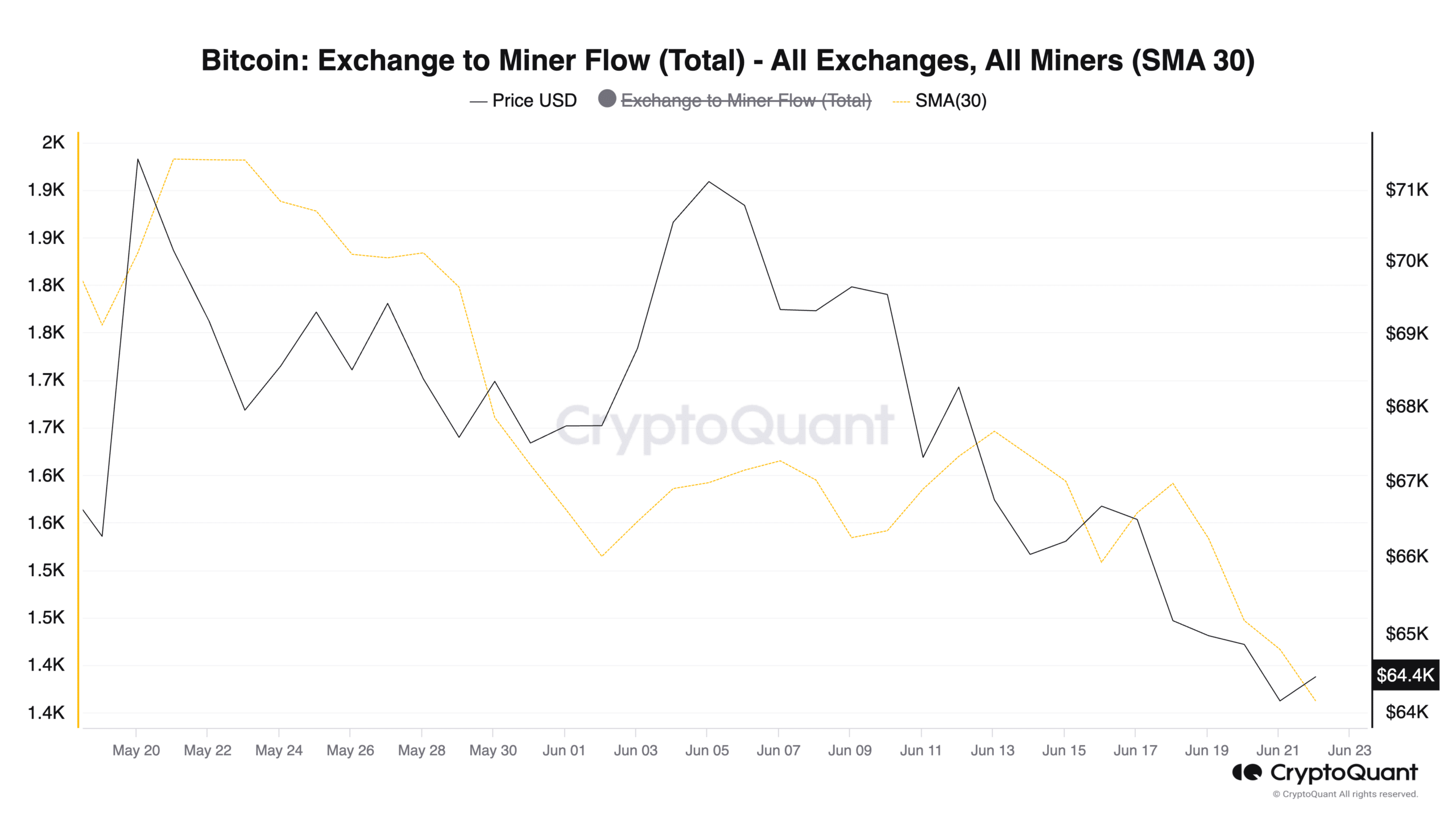

As a researcher with extensive experience in analyzing Bitcoin’s (BTC) market trends, I find it intriguing that BTC miners have been holding back from sending their coins to exchanges over the past few weeks. According to CryptoQuant analyst The Kriptolik, this could indicate that they are waiting for a price rally before selling their coins at a profit. This trend is significant because miner reserves have reached a two-week high, and miners usually sell a portion of their coins to cover operational costs and generate revenue.

The mining sector’s transactions from Bitcoin [BTC] miners to exchanges have decreased noticeably over the past few weeks, contrasting with the increase in coins held by miners in their wallets on the network, as observed by the anonymous cryptocurrency analyst known as The Kriptolik.

Based on the analysis, the level of Bitcoin miner reserves has reached a two-week peak. This refers to the number of coins stored in the wallets linked to miners. The worth of these reserves reflects the coins that miners have not yet sold. At present, their value is approximately $117 billion according to current market prices.

The persistent weak performance of Bitcoin’s price has caused miners to be less active in selling large quantities of their mined coins on cryptocurrency exchanges, according to Kriptolik’s observation.

Even though Bitcoin mineral reserves have hit record highs over the past fortnight, miners have been reluctant to transfer large quantities of BTC to cryptocurrency exchanges for selling. Instead, they are hoarding the digital currency, likely in response to the recent downturn in BTC prices.

Based on data from the previous 30 days, there’s been a 11% decrease in the amount of Bitcoin mined and transferred to exchanges by miners compared to the beginning of June. This indicator monitors the BTC moving from mining wallets to cryptocurrency trading platforms for selling purposes.

The current trend indicates that Bitcoin miners could be holding back on selling their mined coins, potentially anticipating a price increase. Once such an uptick occurs, these miners may choose to transfer their BTC to exchanges for profitable sales.

“This indicates that there could be selling pressure from miners during a future Bitcoin uptrend.”

BTC at risk of further decline

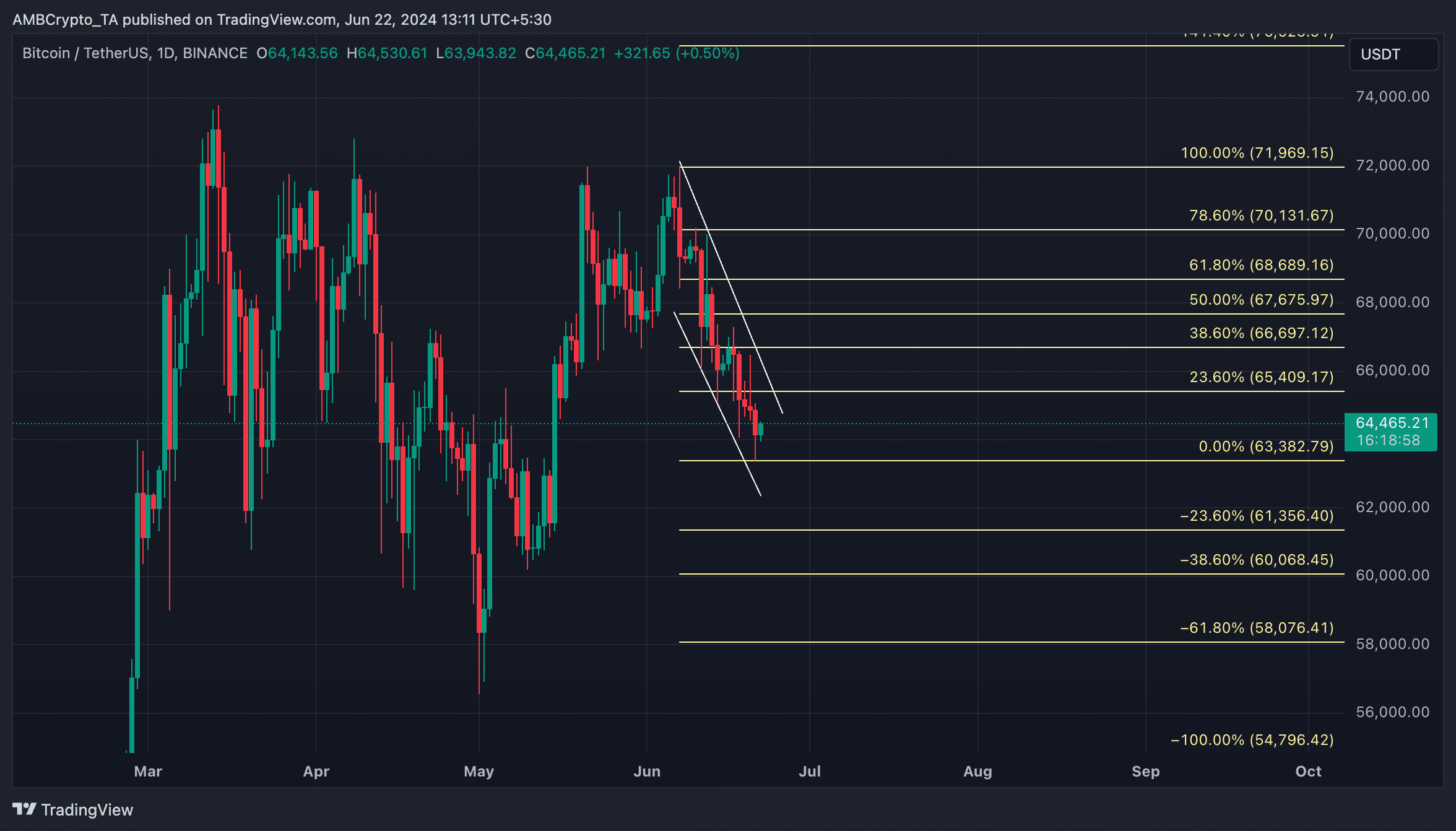

I have analyzed the current market situation and at the moment I observe that Bitcoin is priced at approximately $64,403 based on the latest data available. Since the 7th of June, there has been a downward trend for Bitcoin’s price. On the charts, this trend can be seen as a descending channel, suggesting potential further price declines.

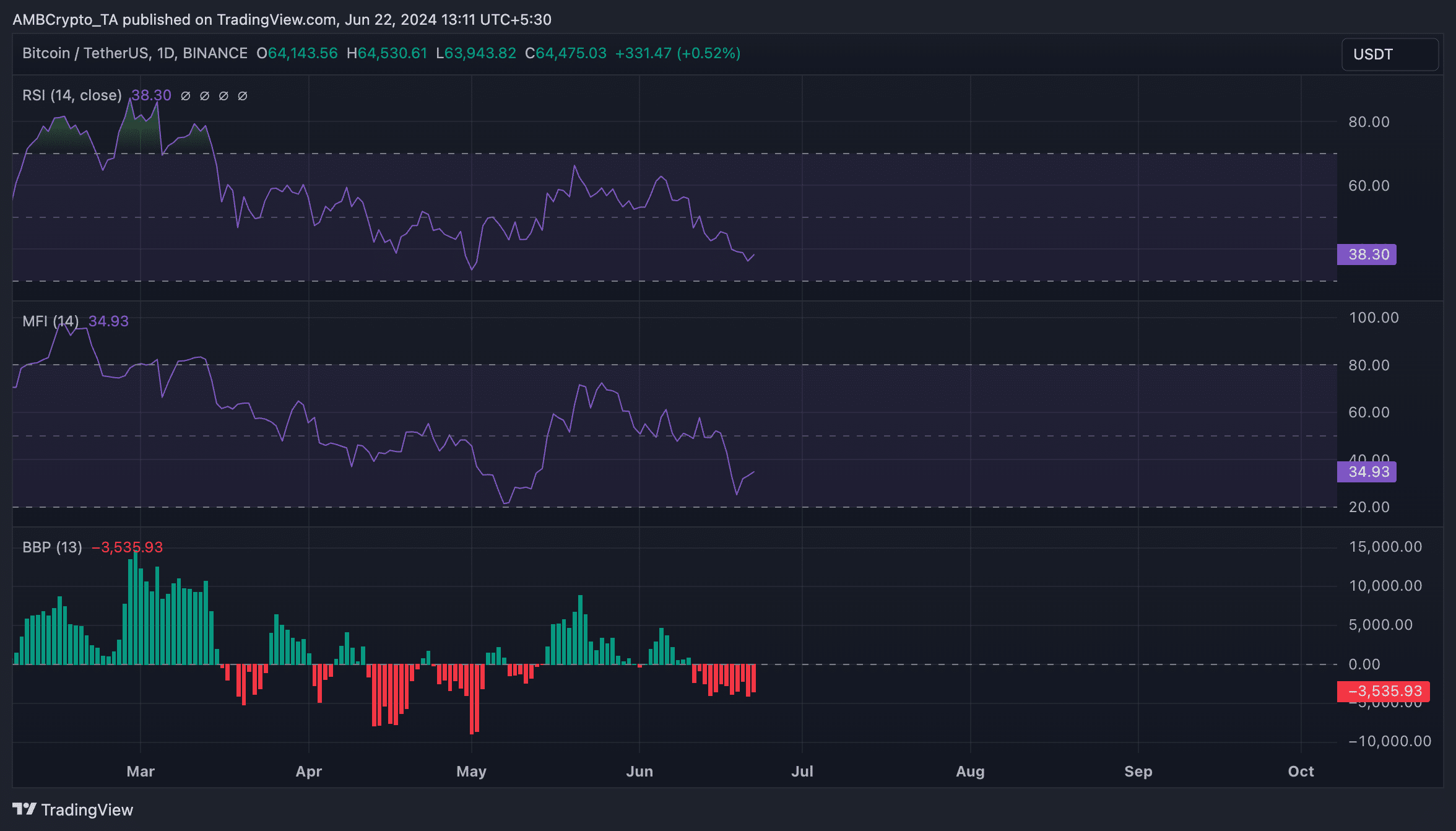

At the time of publication, the crucial momentum markers for BTC were situated below their average levels. The Relative Strength Index (RSI) amounted to 37.81, and the Money Flow Index (MFI) stood at 34.89.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a crypto investor, I have observed that at these current levels, the distribution of Bitcoin (BTC) among market participants has surpassed accumulation. This means more people are selling or giving away their Bitcoins than those who are buying and holding them.

At present, the Elder-Ray Index for Bitcoin, which reflects bearish sentiment towards the leading cryptocurrency, is displaying a negative value. This trend began on June 7th and has persisted since then during the market downturn.

this metric reflects the balance between buying and selling forces in the market. A negative value implies that selling pressure holds more influence.

If the downtrend intensifies on the charts, BTC’s price might plunge to $63,382.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-22 21:11