- IDEX crypto exploded ahead of mainnet launch for perpetual DEX.

- Will the mainnet update be a ‘sell-the-news’ event?

As a seasoned analyst with a knack for deciphering market trends and a flair for finding hidden gems, I find myself intrigued by the meteoric rise of IDEX crypto ahead of its mainnet launch. The anticipation is palpable, and the market’s response has been nothing short of exhilarating.

Enthusiasts are optimistic about the IDEX cryptocurrency, which serves as the native token for Idex, a versatile decentralized exchange operating across multiple blockchains, in anticipation of its main network deployment.

Over the last seven trading sessions, the value of that token jumped by approximately 25%, defying the general downward trend observed within the broader market.

Since May, Idex has been functioning in a testing environment, facilitating trades for prominent digital currencies such as Bitcoin [BTC], Ethereum [ETH], and Solana [SOL].

On August 29th, its main network is scheduled to launch, introducing additional assets and functionalities. The sudden increase in market capitalization, from $31 million to a high of $48 million, indicates that traders were already positioning themselves ahead of the announcement.

Following the mainnet launch, it could potentially serve as a catalyst for selling. Now that a new chapter is beginning for IDEX, what are the crucial points to keep an eye on?

IDEX crypto price levels to watch

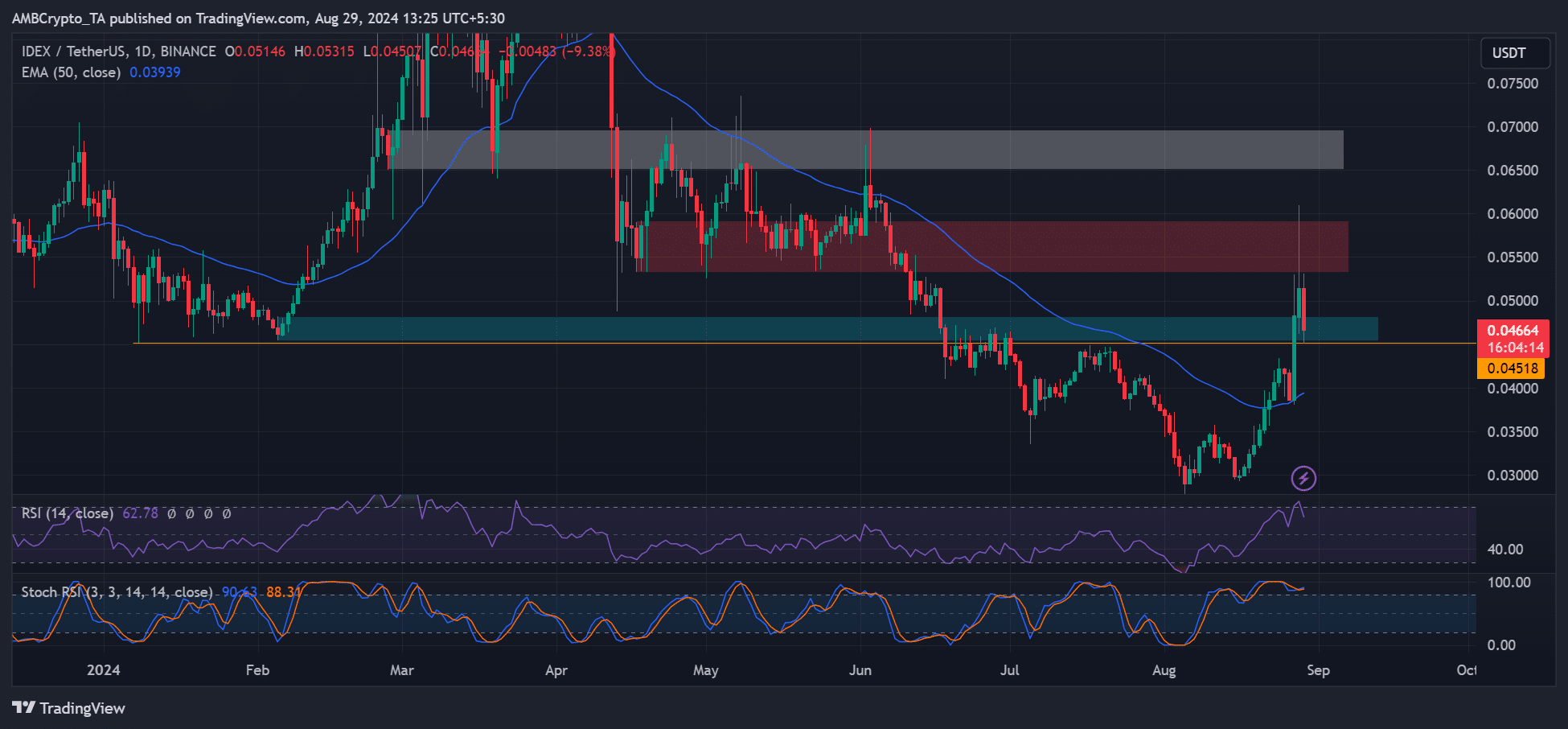

Starting from August 27th, an intense surge in price charts can be observed, which originated at the 50-day Exponential Moving Average (50-day EMA). Following this event, IDEX successfully surpassed its initial support for early 2024, which was around $0.045, as indicated by the cyan mark.

Currently, as I’m typing this, the upward trend encountered resistance at the supply zone and an earlier Q2 support level around $0.055 – $0.060, which is highlighted in red on the chart.

The cool-off was back at the previous support at $0.045, which could offer market re-entry for late bulls if it was defended.

As a crypto investor, I had my sights set on some optimistic price points for IDEX. The first bullish target was situated at around $0.055 to $0.060, which I considered an immediate area of potential resistance. If the market pushed through this level, my next target lay above $0.065, a zone I had marked in white on my charts.

The bullish readings on RSI (Relative Strength Index) and Stochastic RSI supported the bullish outlook.

However, the indicators also flashed overbought conditions. A caution for bulls. A drop below $0.045 would invalidate the bullish thesis. In such case, the dynamic support of 50-EMA would be a key level to watch out for.

IDEX speculators bullish, but…

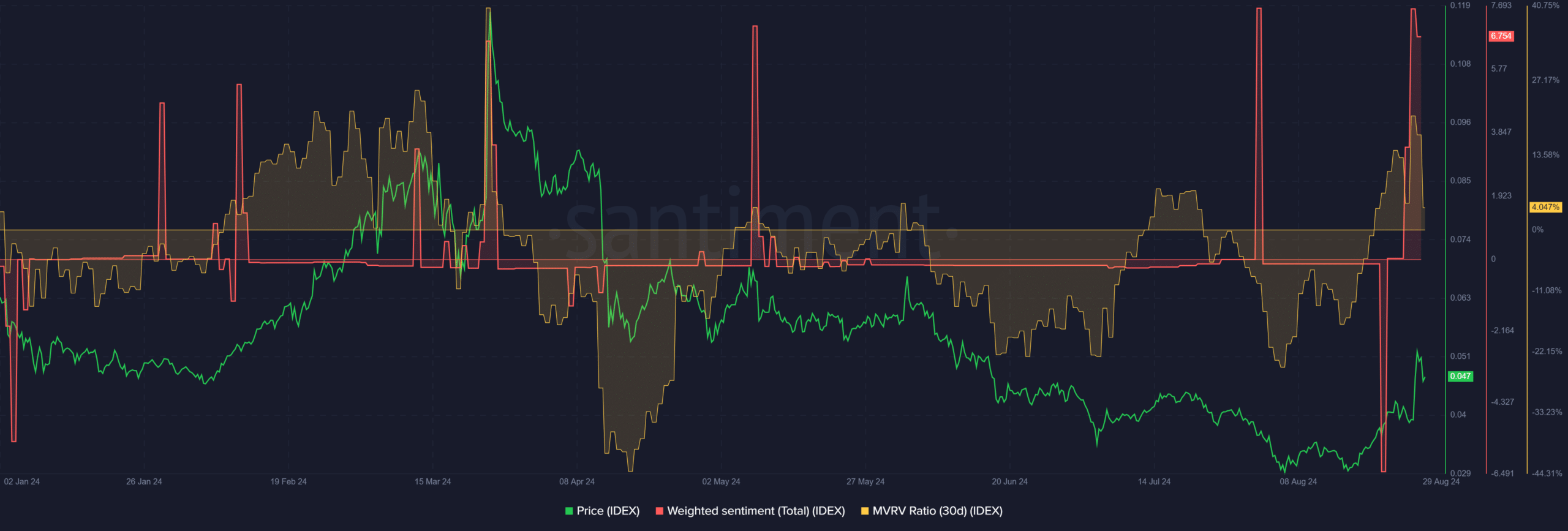

Based on Santiment’s analysis, there was a significant increase in optimistic sentiment among investors regarding IDEX, as shown by the substantial rise in Weighted Optimism.

On the other hand, those holding assets for a shorter period might find themselves in a profitable position, potentially enticed to cash out due to the favorable 30-day MVRV (Market Value to Realized Value) indicator.

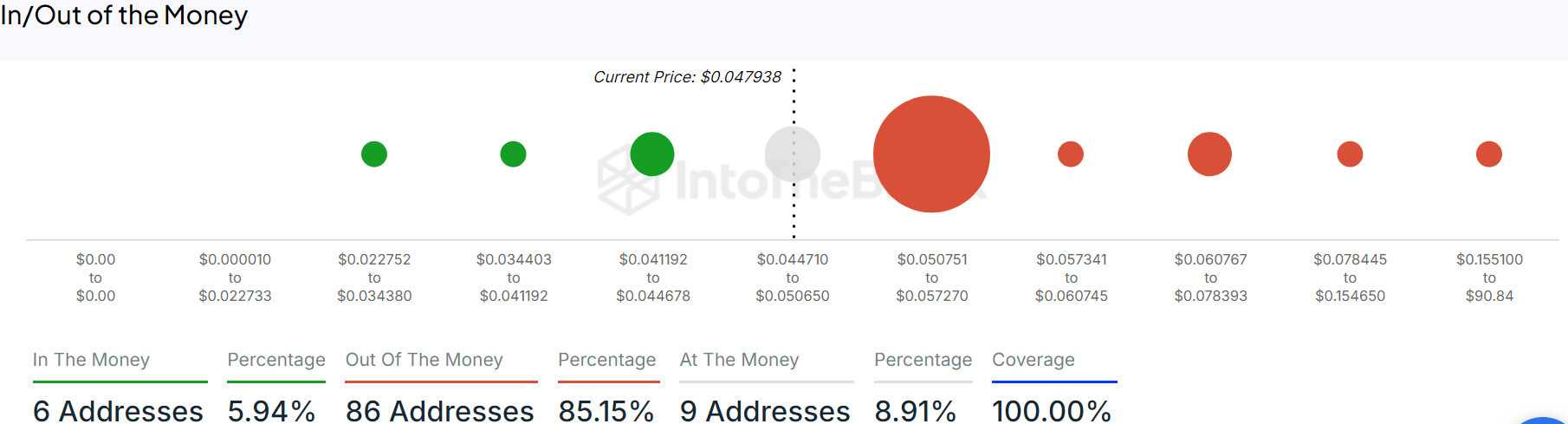

In the meantime, a significant level of resistance for the price was found at $0.57, which represented an area where many IDEX tokens had been previously purchased according to IntoTheBlock data. Also, it appeared that most users holding IDEX tokens were experiencing losses at this price point.

So, more sell pressure could be experienced at the level.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-30 05:11