-

Bitcoin is diverging from its previously observed correlation with the stock market

Could the decoupling be a good thing for BTC going forward?

As a seasoned crypto investor with a decade-long journey in this dynamic market under my belt, I find the decoupling of Bitcoin from its previously observed correlation with the stock market to be a promising development. While it might seem counterintuitive at first glance, this decoupling could potentially signal Bitcoin’s growing maturity as an independent asset class and bolster its safe haven status.

For a while now, Bitcoin’s movements have shown a strong connection with the stock market. However, should this correlation weaken or disappear entirely, how might this affect Bitcoin’s price fluctuations remains an intriguing question.

The surge of institutional investment in Bitcoin and cryptocurrencies overall has been a significant factor driving their similarity with the stock market trends. Consequently, these digital assets have reaped the rewards of increased liquidity as a result of institutional investors looking to expand their investment portfolios.

For a while, it seemed like this pattern held true, but more recent data suggests that it could be breaking apart instead.

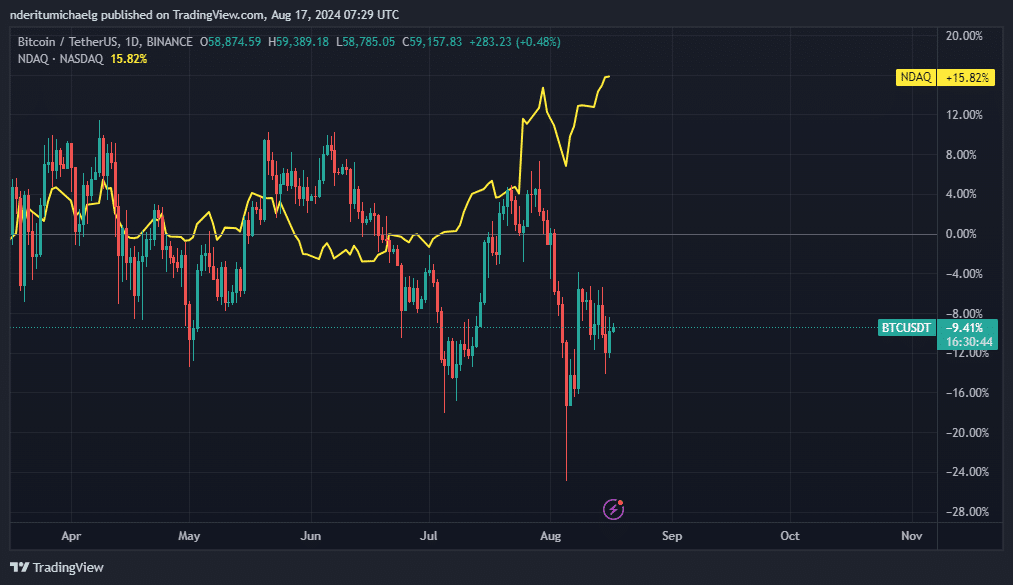

Until now, Bitcoin’s price movements were closely mirroring those of the NASDAQ. Yet, Bitcoin’s downward trend this month suggests a growing disparity, with the NASDAQ still climbing steadily on its charts.

A sign of the times?

Although some might view Bitcoin’s detachment from its NASDAQ correlation as undesirable, it could actually be advantageous. With apprehensions about recession hitting record highs, there’s an increased chance of a significant stock market collapse. Yet, questions linger regarding whether this situation would echo for Bitcoin and the broader cryptocurrency market.

The separation suggests optimism that Bitcoin could potentially fare well during a recession, compared to the stock market. As Bitcoin’s movement is no longer aligned with the NASDAQ, this development lends credence to the idea that Bitcoin might be perceived as a secure investment option if a recession occurs.

The end of the correlation may also promote the idea that Bitcoin is maturing as a distinct asset. This may further support the flight to safety narrative – An outcome that would align with the shifting dynamics observed recently in the market.

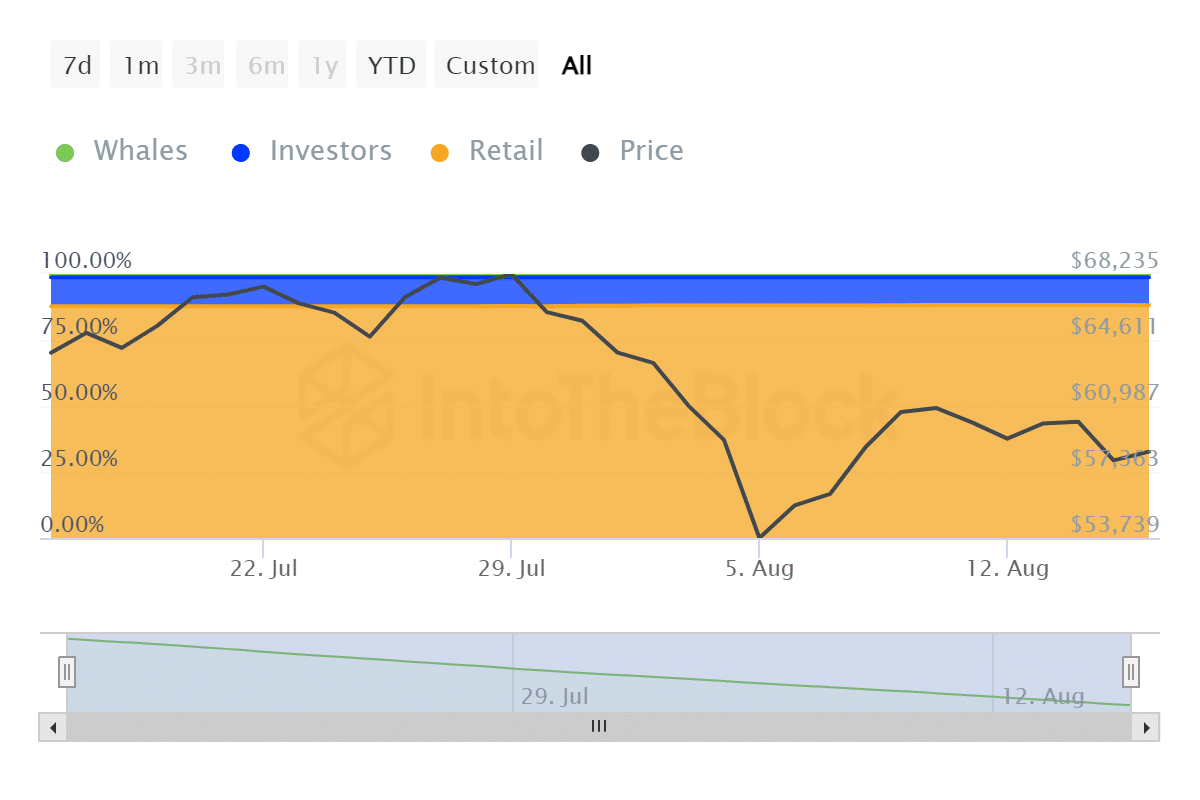

Over the past four weeks, a lower cost for Bitcoin has drawn in more people holding onto it (HODLers). Interestingly, about 80% of Bitcoin owners are currently making a profit, even with the recent drop – A sign of robust demand at lower price points.

In the past four weeks, owners of cryptocurrency within the retail category, on average, increased their holdings by approximately 2.91 million Bitcoins. Institutional sellers contributed to a total of around 80,000 BTC being offloaded. However, the amount held by whales remained stable during this period.

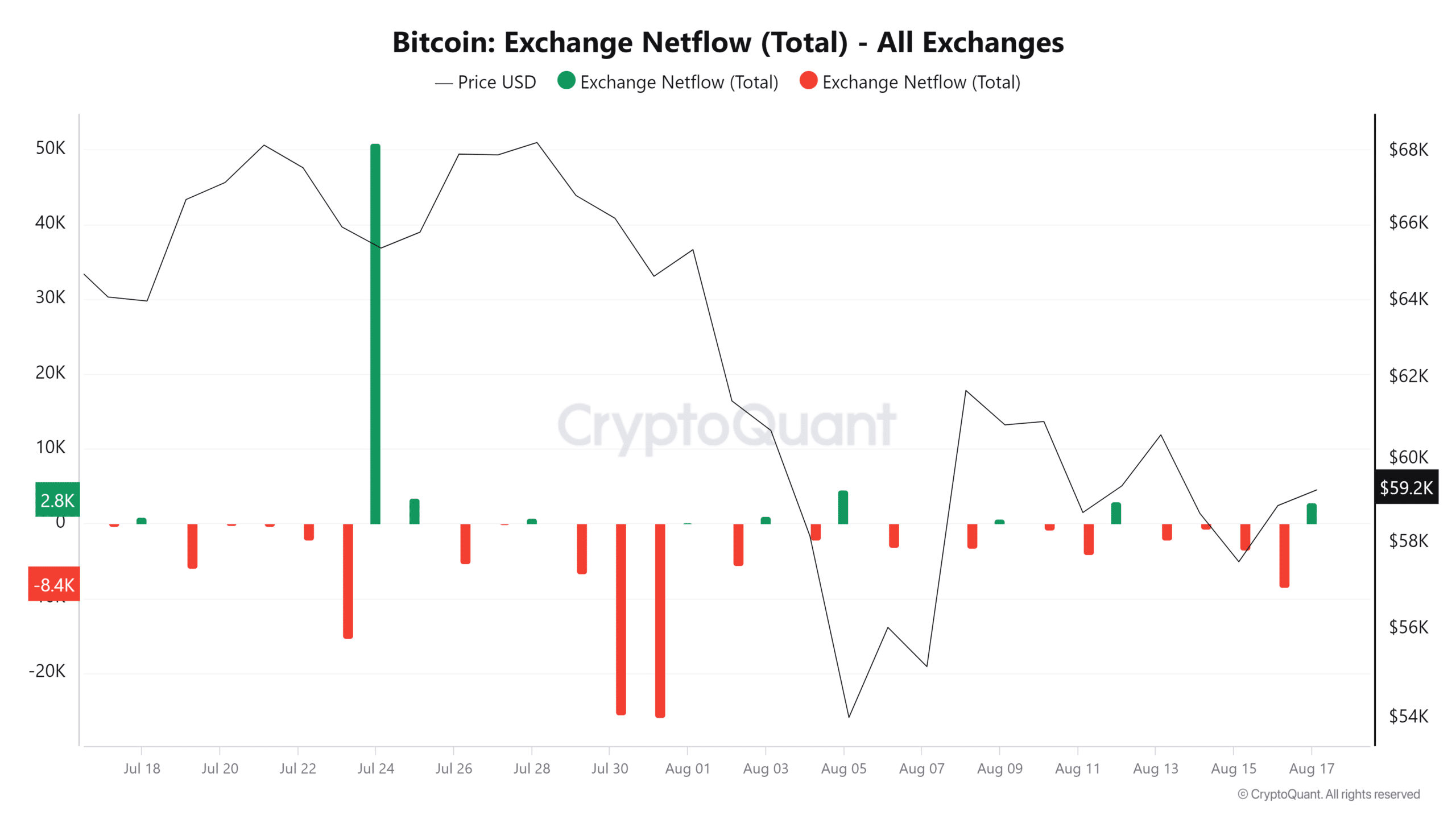

Ultimately, the fluctuations in Bitcoin’s exchange rates provide insight into why its current price is within the specified range.

Over the past few days, there have been more withdrawals (netflows) than deposits. But in the last 24 hours, this trend has reversed, showing increased deposits (positive netflows), suggesting that money is flowing out in a way that favors an upward trend.

Bitcoin’s recent price fluctuations show a short-term ambiguity regarding its direction. Currently, it’s being sustained without a significant enough trigger to cause a substantial increase or decrease in value.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-17 19:03