- INJ’s recent $280K token burn and breakout above $28.44 have intensified bullish momentum, setting sights on $51.90.

- Balanced market sentiment and bullish technical indicators strengthen confidence in a rally continuation.

As a seasoned crypto investor with a knack for spotting promising projects, I find myself increasingly intrigued by Injective [INJ]. The recent token burn and breakout above $28.44 have ignited my bullish sentiments, setting sights on an ambitious target of $51.90.

This week, a burn of over 11,000 Injective [INJ] tokens, worth approximately $280,000, was performed, taking them out of circulation for good. This action intensified the deflationary effect of Injective.

As a crypto investor, I’ve noticed an exciting development with Injective (INJ). The decrease in its supply seems to have sparked optimism among traders, myself included. This is particularly noteworthy given that INJ’s price has just broken free from a long-standing downtrend channel, which could indicate potential growth opportunities.

Currently, market observers are keeping a keen eye to determine if the current momentum will continue, possibly propelling INJ towards higher price levels.

Technical analysis: Breakout, key resistance, and bullish signals

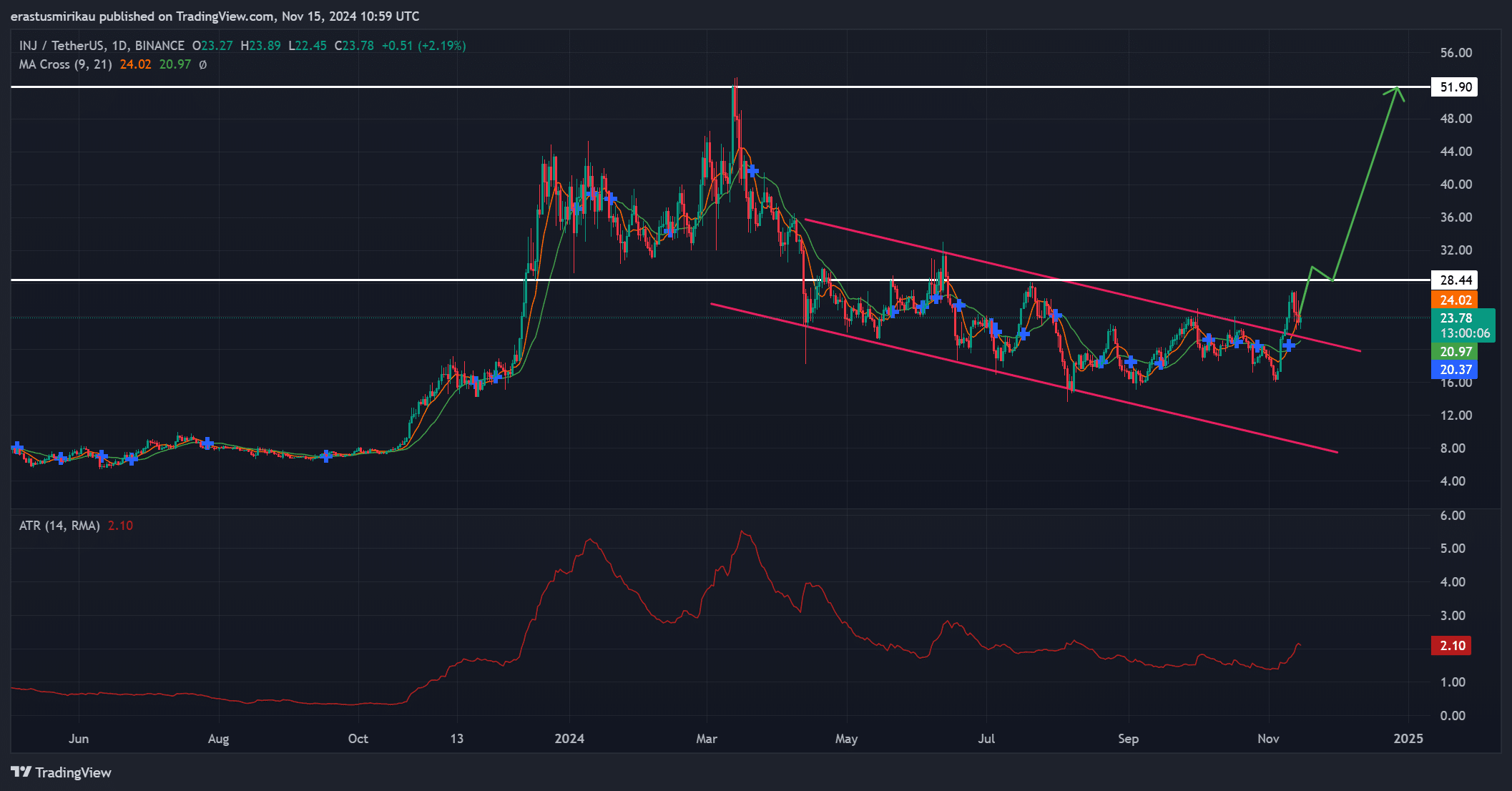

In the past few days, the INJ has surged beyond its downward trendline, a barrier that had been preventing any significant price increase for several months.

This surge suggests a change in investor attitudes, as traders are regaining control over the $28.44 barrier, an essential psychological and technical boundary. Maintaining above this level might catapult INJ towards its next substantial goal of $51.90.

Additionally, technical indicators lend credence to the optimistic outlook. The Average True Range (ATR) indicates an uptick in market volatility, implying elevated investor attention and possible significant price fluctuations.

Moreover, the crossing point of the Moving Average (9-day over 21-day) indicates a positive trend, boosting faith that INJ could see further increases in its value.

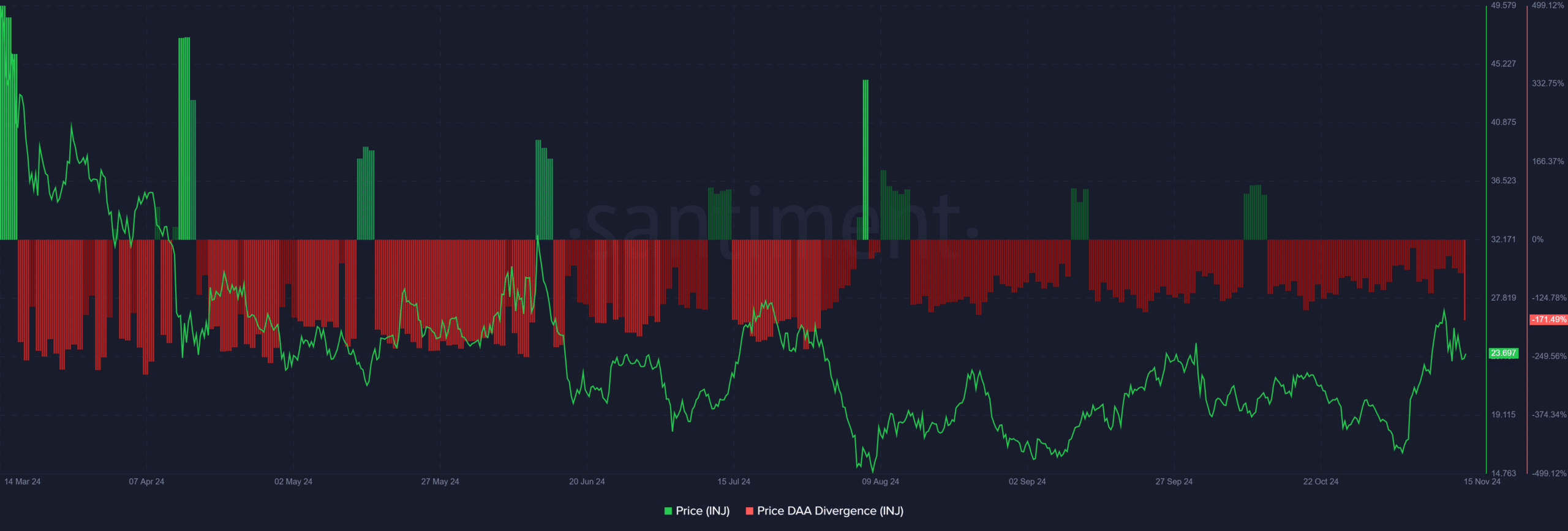

Price DAA divergence hints at caution

Nevertheless, on-chain indicators hint at a slight warning. The discrepancy between the daily active addresses (DAA) and price stands at a significant 171.49%, implying that the network activity lags behind the price fluctuations.

Although this situation might spark worries, the robust structure and persistent token destruction could potentially offset this discrepancy. Consequently, should the buying trend maintain its momentum, this disparity might carry less significance for optimistic investors.

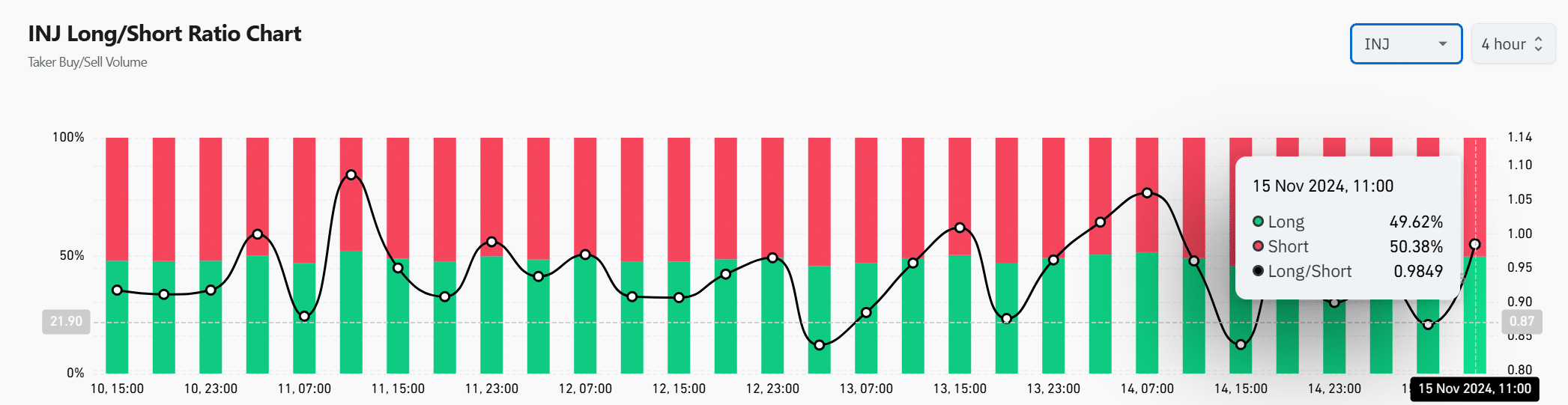

Market sentiment remains balanced but leans bullish

The INJ long/short ratio, with shorts slightly dominating at 50.38% and longs at 49.62%, suggests a guarded optimism among traders. They recognize the recent breakout but remain cautious, preferring to wait for assurance that the $28.44 level will hold firm as a new foundation of support.

If confidence increases, there’s a strong possibility that the outlook could lean more heavily towards the bulls, especially if Injecta Sciences (INJ) maintains its price above $28.44.

Read Injective’s [INJ] Price Prediction 2024–2025

Based on constant token burns, a significant leap above $28.44, and strong technical signals, it seems that INJ is ready for an upward trend.

If the positive trend continues, it’s quite possible that the price could reach around $51.90 within the next few months.

Read More

2024-11-16 05:12