- INJ bulls held $21.65 support as analysts predict a potential 12x move to $380.

- Futures Open Interest trended up, and trading volume jumped 9.54%, signaling strong market confidence.

As a seasoned market analyst with over two decades of experience, I must say that the current state of Injective (INJ) presents an intriguing opportunity. The bullish continuation pattern, as evidenced by the strong rally and successful defense of the $21.65 support level, is certainly appealing to long-term investors. If the trend remains intact, a potential 12x move to $380 could be on the horizon.

At the moment of reporting, Injective was being traded at $27.77, marking a 0.46% decrease within the last 24 hours and a 1.66% downturn over the previous week.

As an analyst, I’m reporting that the 24-hour trading volume for INJ stands at approximately $221.5 million. The current market capitalization is around $2.73 billion, while the circulating supply amounts to roughly 98 million INJ tokens.

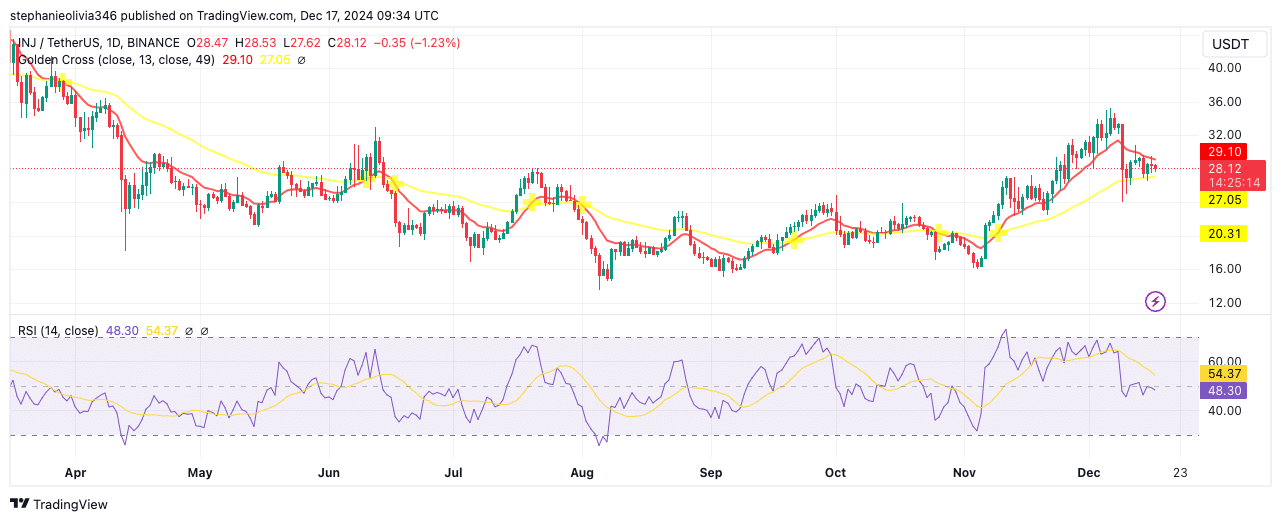

The chart shows INJ breaking out of a prolonged downtrend after forming a rounded bottom pattern. This structure led to a strong rally, with buyers continuing to defend the $21.65 support level.

Maintaining a position above this crucial resistance level is vital for preserving the upward trend and bullish momentum. Experts project a potential logarithmic price increase up to $380, which represents a significant 12-fold growth from the existing prices if the positive trend persists.

Technical indicators suggest mixed momentum

As a research analyst, I’ve been examining the Invesco DB Oil Fund (INJ)’s technical signals, and they seem to be presenting a mixed picture. Recently, a positive development occurred when the 13-day moving average surpassed the 49-day moving average, a phenomenon known as the Golden Cross. This crossing is typically seen as a bullish indicator, suggesting that the short-term trend might be heading upwards.

Currently, the price has fallen beneath the 13-day moving average ($29.06), but it remains higher than the 49-day moving average. If the price can’t maintain this position above the 49-day moving average, the next significant support level is approximately $20.31.

In simple terms, the Relative Strength Index (RSI) was at 47.63, indicating a neutral-to-bearish trend since it’s lower than 50. This below-50 position suggests decreasing buying momentum. Moreover, the downward slant in the RSI indicates waning interest among buyers.

If the price surpasses the $29.06 barrier once more, sellers may lose control and the price could potentially rise towards $32 in the short term, giving buyers back the upper hand.

On-chain data shows a drop in INJ’s activity

According to data from IntoTheBlock, it appears that Injective has seen reduced network activity over the past week. As of December 16th, there were approximately 654 total addresses on the network, with 123 newly created addresses and 422 currently active ones.

New addresses fell by 21.66%, while active addresses dropped 11.34% over the past seven days.

As a researcher observing the data, I noticed a modest increase of 1.87% in zero-balance addresses, indicating that some users might have transferred funds or liquidated their positions. Despite a general decrease in overall user activity, the network’s foundations appear to be sustained by the active participation of existing users.

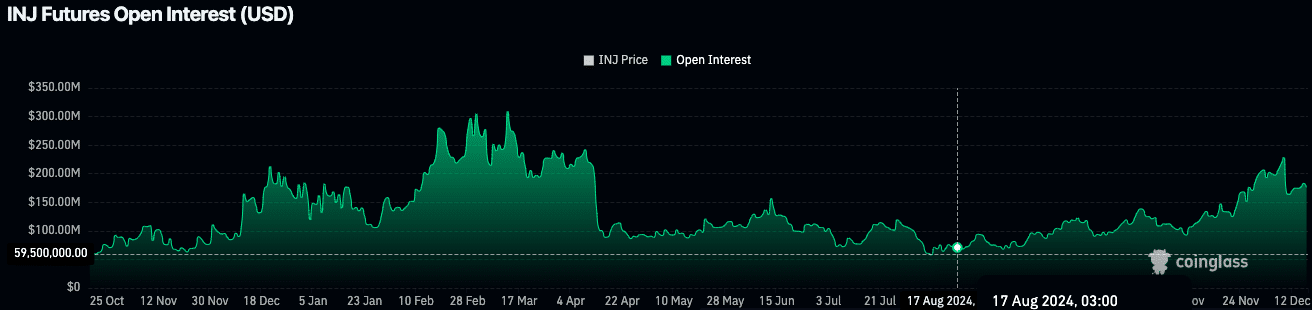

Futures data shows steady market interest

Based on data from Coinglass, the Open Interest for INJ futures currently stands at approximately $174.37 million, representing a slight decrease of 0.80%. This suggests that there might be some profit-realization happening or a decrease in short-term trading activities.

On the other hand, there’s been a noticeable rise in OI activity since October, implying that traders have maintained their involvement consistently.

The trading volume has risen by approximately 9.54%, totaling around $271.95 million, which indicates sustained curiosity and involvement in the futures market.

Increased trading activity, coupled with continuous investor commitment as indicated by consistent open interest, suggests that investors remain confident about INJ.

Read Injective’s [INJ] Price Prediction 2024–2025

Given the ongoing influence of technical patterns and increasing curiosity in futures, as well as high trading activity, INJ’s configuration continues to suggest potential for additional upward momentum.

Read More

2024-12-17 17:44