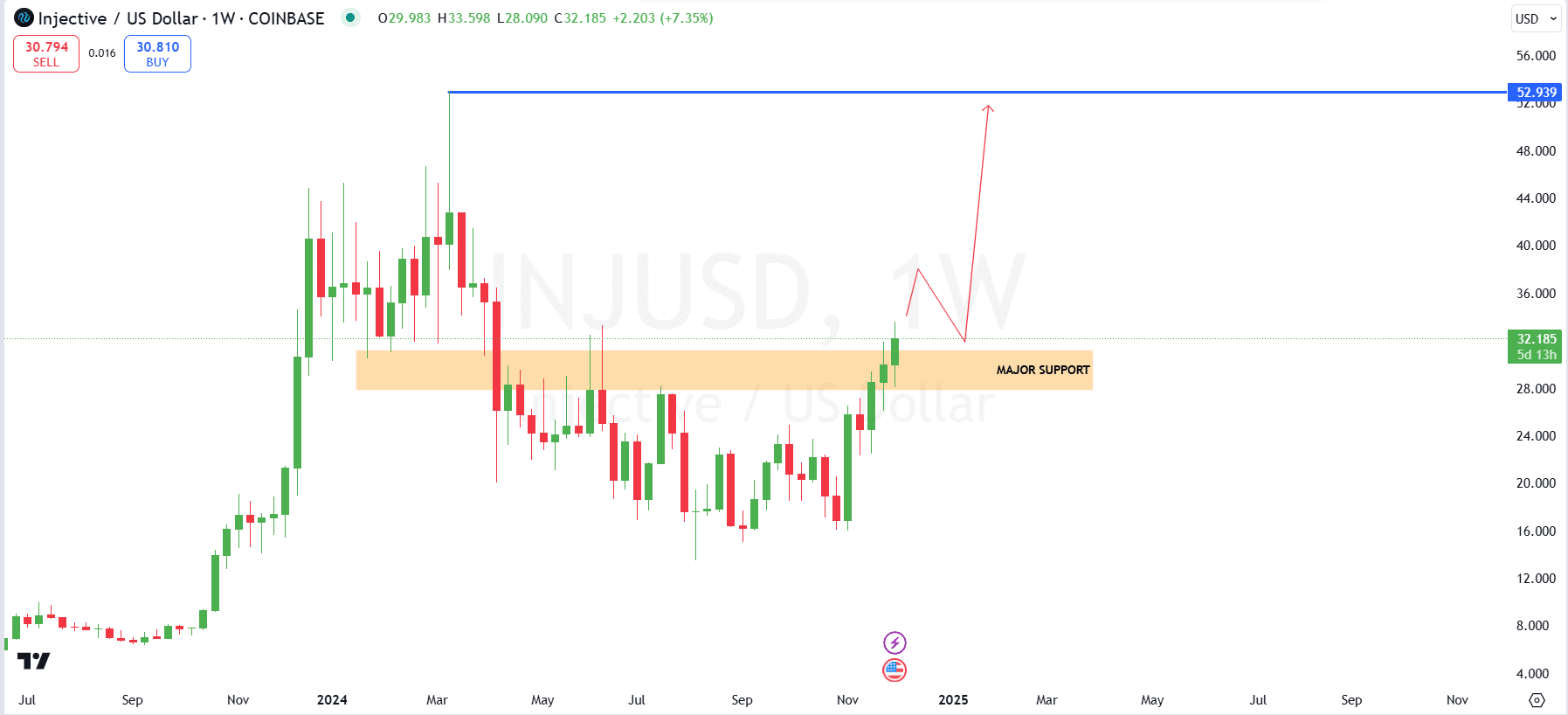

- INJ has surpassed the $30 resistance mark, and a weekly close above a certain level will confirm a bullish outlook.

- Injective is just 36% away from its all-time high.

As a seasoned crypto investor with a knack for spotting hidden gems in the DeFi space, I can confidently say that Injective [INJ] is one of the most promising projects I’ve come across in recent years. The recent breakout above $30 and the strong upward momentum on the weekly chart have me bullish about its potential to reach new all-time highs.

Starting from December 2024, Injective (INJ) has soared by more than 82%, reaching an unprecedented peak of $52.72. This latest breakout beyond the $30 mark hints at a possible additional increase of approximately 36%.

Standing out uniquely within the Decentralized Finance (DeFi) sector, Injective offers zero-fee, decentralized derivative trading and cross-chain compatibility. Unlike rivals like DYDX, Injective distinguishes itself through its emphasis on operational efficiency and deflationary token economics.

Is ATH next after the $30 breach?

As an analyst, I find myself observing a robust uptrend in the weekly chart of Injective (INJ). Currently, INJ is transacting at approximately $32.33, signifying a noteworthy 7.86% surge over the past week.

In the range of around $28.00 – $30.00, this region has demonstrated significant importance as a strong support level. After a period of consolidation back in 2024, it managed to regain its position successfully.

In simple terms, the intense interest in this area has been driving the current surge, suggesting that we’re in an optimistic period where prices have consistently hit new highs after highs, and have not dipped significantly below previous lows since mid-2024.

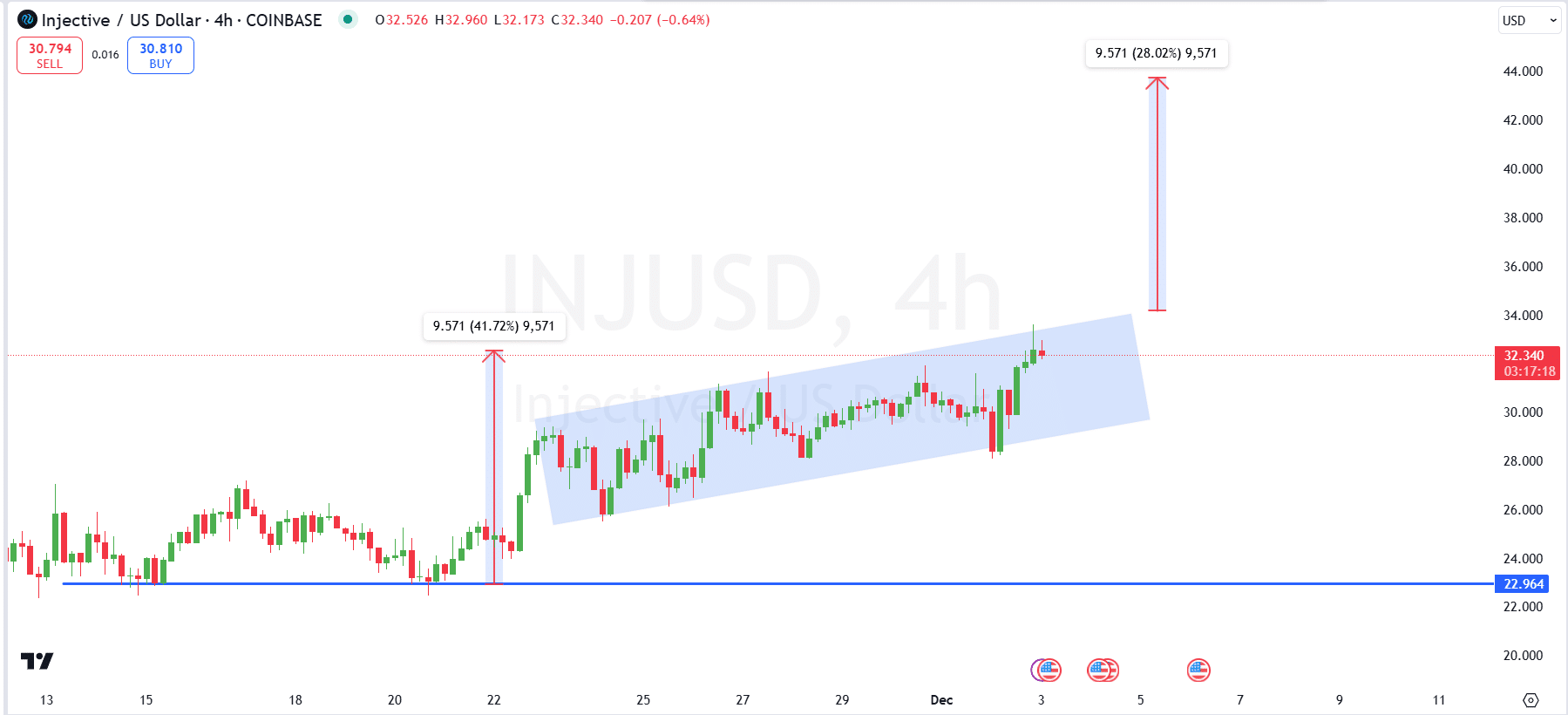

If the current price level continues to stay above its current support, investors anticipate that the highest point for potential growth could reach the previous record high of $52.77. As demonstrated on the 4-hour chart, Injective has been consistently moving upwards within an uptrend channel.

After breaking above the $22.96 support level, INJ has surged by 41.72% in recent sessions.

The surge indicates there might be more room for growth, as it encounters resistance around $42.00, representing a possible increase of 28.02%.

So, as the floor price of the channel holds firm, it’s reasonable to anticipate that the upward trend will continue.

Does INJ need more user activity for a boost?

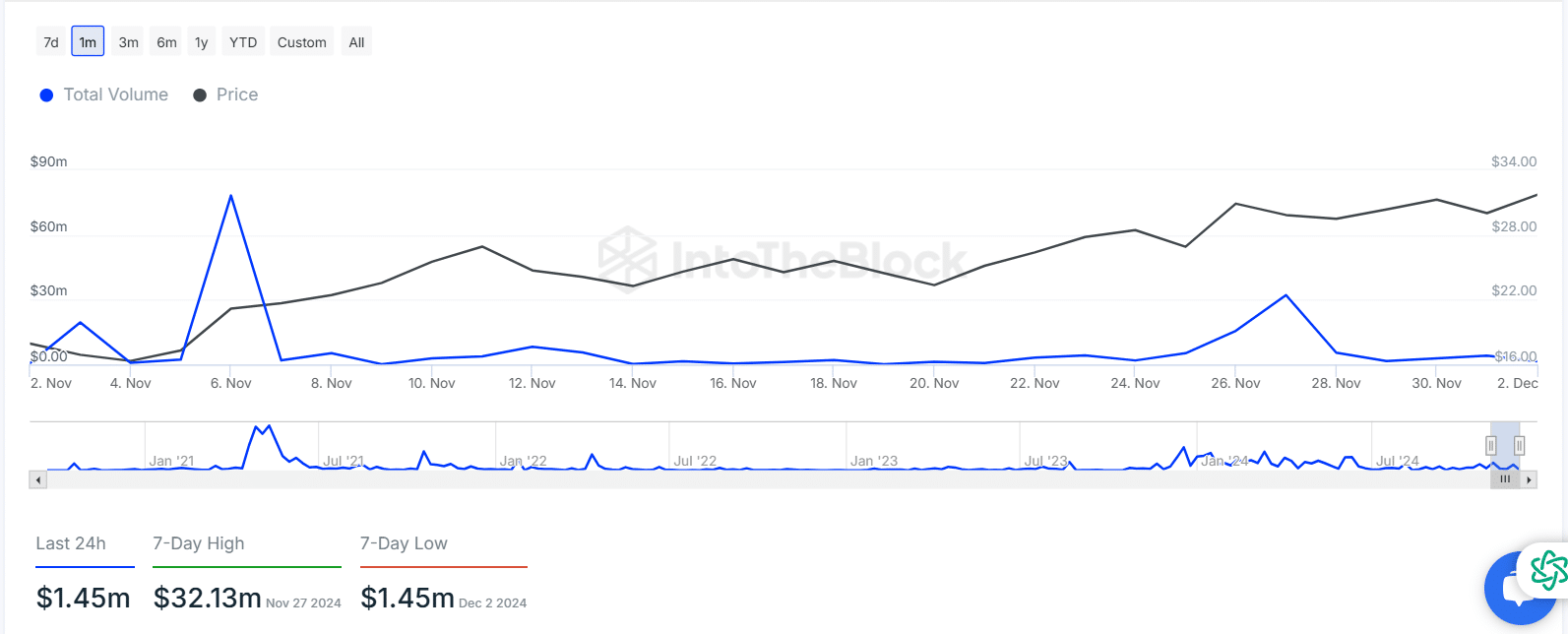

Initially, about ten significant transactions were processed daily starting from early September. However, on September 21st, these big transactions spiked up to around sixty per day, which was concurrent with a rise in INJ’s value from $22.96 to $32.00.

The significant increase in the number of transactions suggests a surge of investor interest in the market, with bigger players starting to invest more.

After reaching this high point, there was a significant drop in major transactions, typically ranging from 5 to 10 daily in October. This corresponded with a period of stabilization in pricing, where it remained between $28.00 and $32.00.

On the other hand, starting from November, there was a resurgence in large transactions, reaching a high of fourteen transactions on November 26th, coinciding with the price surpassing $30.00.

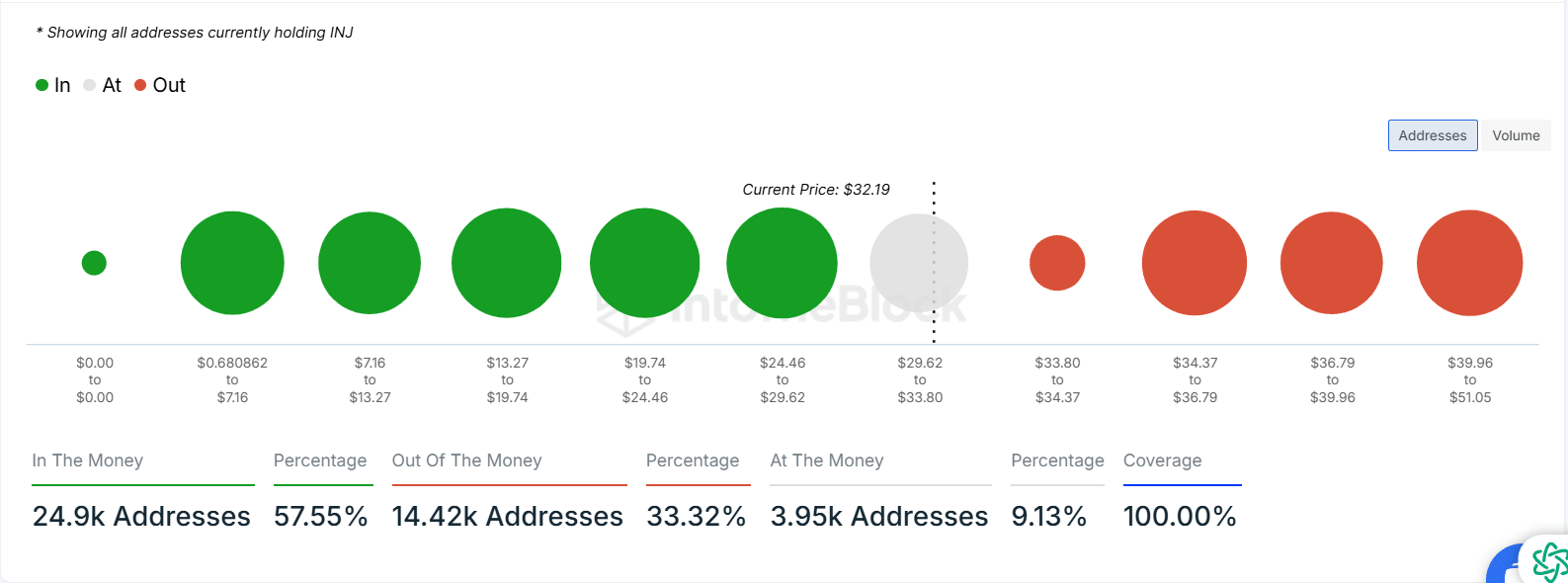

Profitability peaks below $29.62, losses begin above $33.80

Approximately 57.55% (or around 24,900 wallets) of Injective Coin (INJ) holders are currently in a profitable position, as they acquired INJ at a price lower than its current value of $32.19.

Approximately one third (33.32%) or about 14,420 addresses have purchased INJ at prices higher than the current market value. This means they are currently experiencing unrealized losses on their investments.

Furthermore, about 9.13% or approximately 3,950 addresses have their Investment Coin (INJ) balances equal to the current market value, meaning they neither made a profit nor incurred a loss since they bought INJ around its current price.

As an analyst, I find that the profitable price range for this asset stretches up to approximately $29.62, beyond which losses begin at $33.80, demonstrating a comprehensive distribution of holder profitability levels.

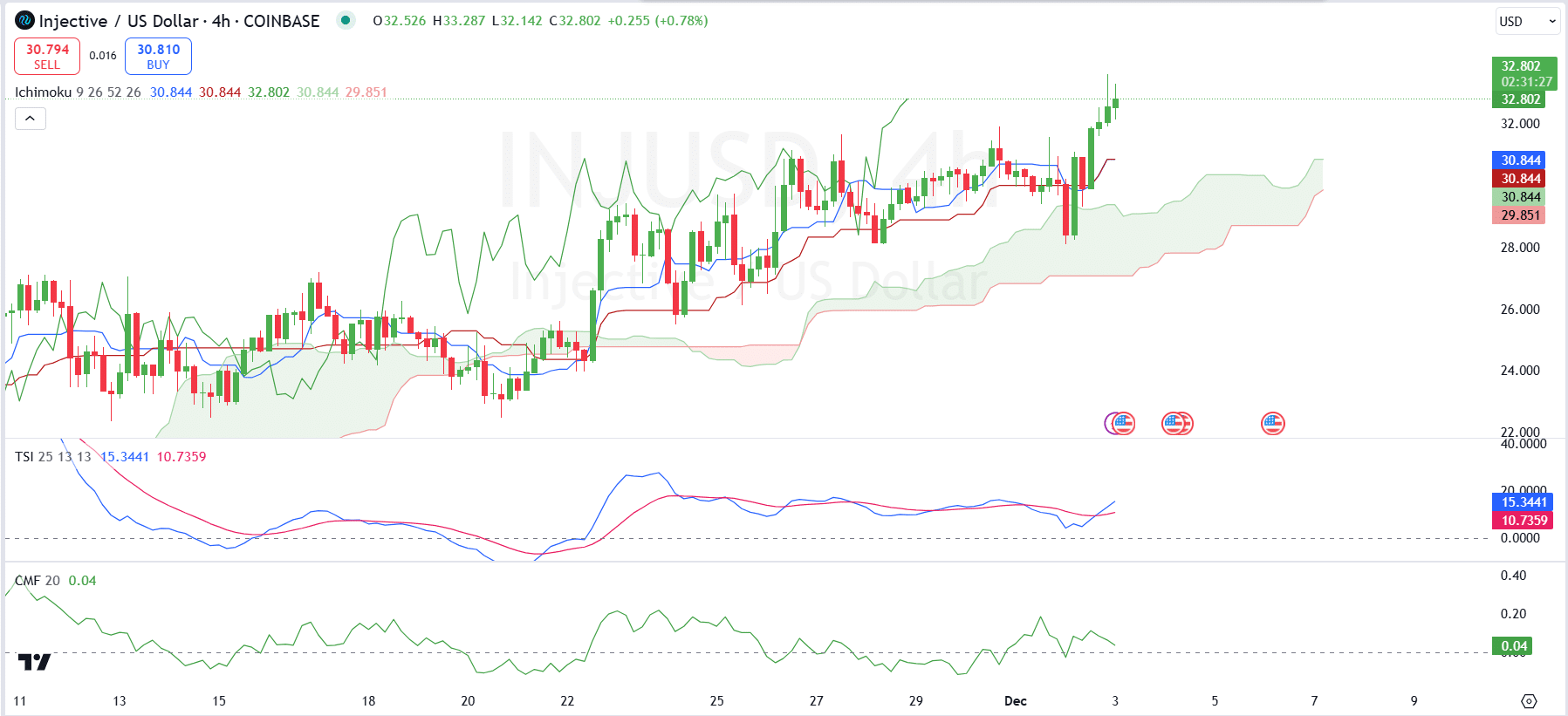

The uptrend on LTF confirmed

In simpler terms, the Ichimoku Cloud chart showed a positive trend, where the price was higher than the ‘cloud’ and a broadening green zone suggested robust upwards movement, implying strong buying pressure.

Read Injective’s [INJ] Price Prediction 2024–2025

Moreover, the TSI (Trade Strategy Indicator) displayed a positive crossover, indicating rising buying force since the short-term trend line moved above the long-term trend line, signifying an upward shift in market sentiment.

Moreover, a CMF value of 0.04 indicates a moderately strong increase in buying activity within the market, suggesting a positive trend in money circulation.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-12-03 21:44