-

Injective was gaining momentum following a breakout from a month-long descending channel, with projections pointing to an upward movement towards $29.84.

At press time, market sentiment around INJ was positive, positioning the token favorably.

As a seasoned analyst with over two decades of market experience under my belt, I must say that the current trajectory of Injective [INJ] is nothing short of intriguing. The token has shown remarkable resilience and potential, breaking out from a month-long descending channel and aiming for a peak at $29.84.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent ForecastOver the last seven days, Injective’s price has surged significantly, jumping by 18% following a bounce back from the lower limit of its trading range.

With a notable 3.02% increase in the last 24 hours, the upward trend appears set to continue.

Injective aims for $29 peak

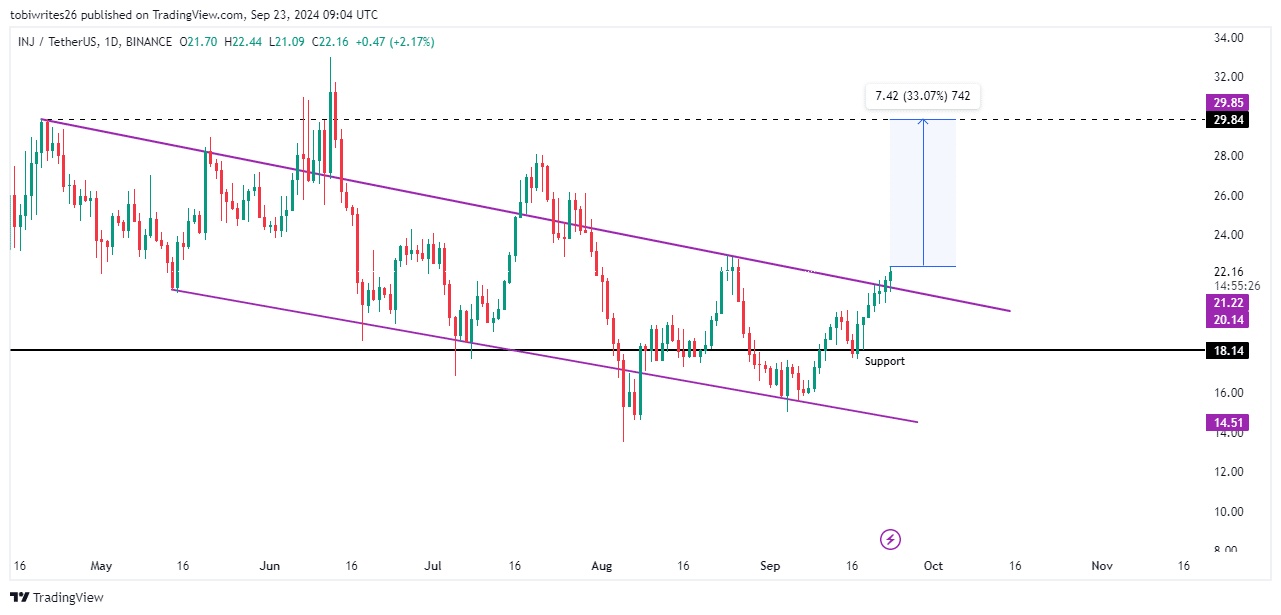

At the moment I’m observing, the INJ has been showing a substantial uptrend after breaking free from a descending channel it started in April. Such a pattern is usually a precursor to a significant upward movement in price.

The action started when INJ rebounded from its support line within the downward trending channel, gaining additional speed as it continued trading near the subsequent support point of 18.14.

Should the existing bullish momentum persist, the INJ could potentially rise from its current value of $22.14 to reach the channel’s maximum point at $29.84. This upward movement represents a possible increase of approximately 33.07%.

If INJ experiences a drop, there’s a possibility that it may return to around $18.14 before possibly continuing its climb again.

Buying interest rises

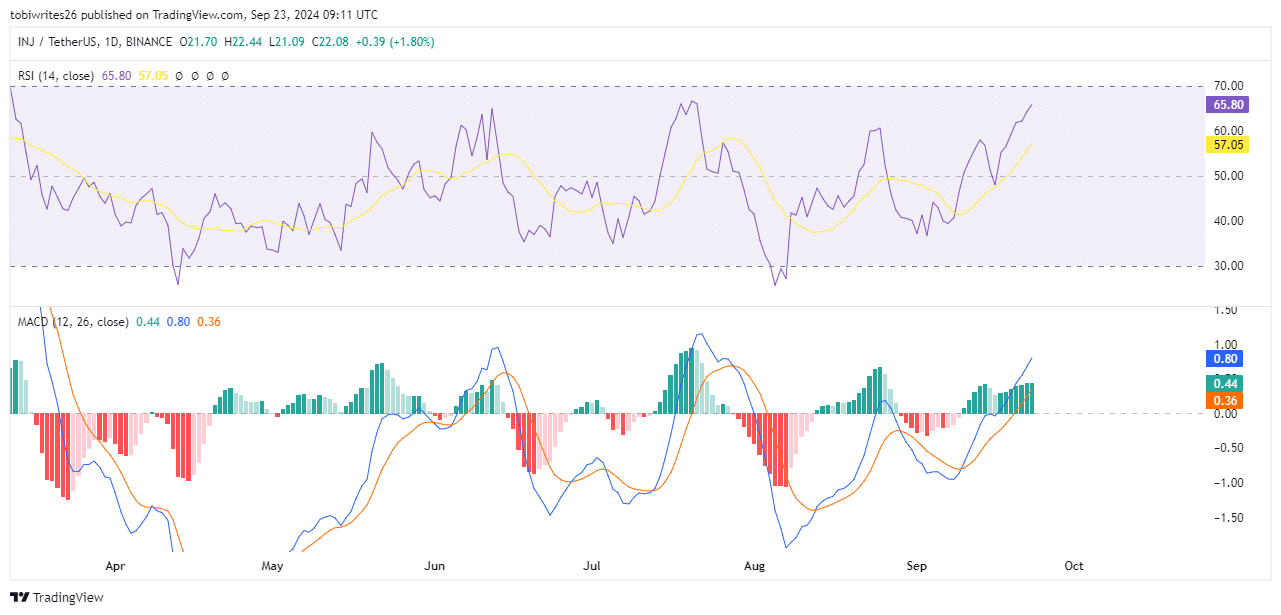

The purchase price for Injective (INJ) has significantly increased, as suggested by both the Relative Strength Indicator (RSI) and the Moving Average Convergence Divergence (MACD) charts, pointing towards an upward or bullish market movement.

The RSI was 65.80, indicating strong trader accumulation, which could further boost INJ’s price from its current level.

The MACD, a key trading indicator, reinforces this outlook by displaying a strong buy signal.

It’s clear that we’re seeing this occurrence because the blue MACD line and the orange signal line have moved into a positive region, and there are more green, upward-trending momentum bars present.

As a researcher examining market trends, I find myself optimistic about INJ‘s future performance in the upcoming trading sessions, based on the consistent patterns observed in these key indicators.

THIS signals a continued bullish trend

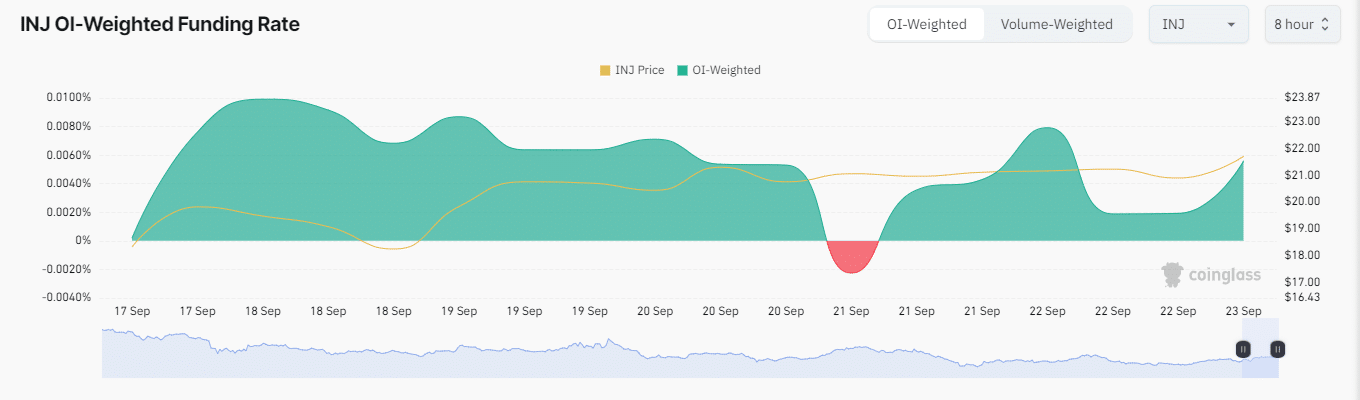

At the moment of reporting, I observed a robust uptrend for Injective, according to Coinglass, as increased capital influx propelled the asset. This upward momentum was underscored by an elevated OI-Weighted Funding Rate, sitting at 0.0056% at press time.

As a researcher, I noticed a surge in market transactions, which seemed to indicate heightened purchasing enthusiasm. Particularly intriguing was this uptick happening during a period of market growth, suggesting a positive trend.

Read Injective’s [INJ] Price Prediction 2024–2025

The OI-Weighted Funding Rate, which adjusts the standard Funding Rate based on the Open Interest of each leverage tier, offers a more precise reflection.

Currently, a favorable rate often suggests robust market confidence, which tends to bolster assumptions that the Inj may hit its predicted target of $29.84.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-24 01:11