-

INJ has surged by 3.86% in the last 24 hours.

Despite the price rise, the market lacks strong bullish momentum implying a consolidation.

As an experienced analyst, I have closely monitored the crypto market’s fluctuations, including Injective [INJ]’s recent surge despite a declining altcoin market cap. Based on the available data and trends, it appears that INJ is currently in a consolidation phase rather than experiencing a clear upward or downward trend.

As an analyst, I’ve observed a decrease of approximately $20 billion in the altcoin market cap over the past week, bringing it down from $1.18 trillion to $1.16 trillion. Simultaneously, the global cryptocurrency market cap has experienced a slight dip of 0.23%, amounting to a decrease of around $47 billion, resulting in a current market cap of approximately $2.38 trillion.

Amidst the volatility in the cryptocurrency market, Injective’s price has shown robustness, with INJ currently priced at $23.54 – representing a 3.86% increase within the past 24 hours.

The present market scenario can be attributed to a combination of several elements. Initially, there was a significant surge in demand which led to a shortage of INJ tokens due to numerous burn events. The Injective team announced on their platform X about a recent and upcoming burn, explaining that.

As an analyst, I’ve observed a consistent uptick in weekly protocol revenue for injective dApps over the past three months, resulting in an average increase of 9.64% each week. This translates to approximately a 124% surge in INJ tokens being burned during this period. The upcoming INJ burn event is anticipated to be one of the largest on record.

The Injective team further shared that,

“I’m observing that Injective has hit a new all-time high in staked INJ, amounting to 727 million total transactions. Furthermore, the platform’s volume has surpassed $34 billion across its decentralized exchanges.”

As a researcher studying the cryptocurrency market, I can confidently say that the recent developments, transactions, and burn rates of INJ are significant indicators of the factors shaping its current market conditions. While many altcoins are experiencing dips, INJ’s trends offer valuable insights into what’s driving its performance.

Is INJ moving upward or is it in consolidation?

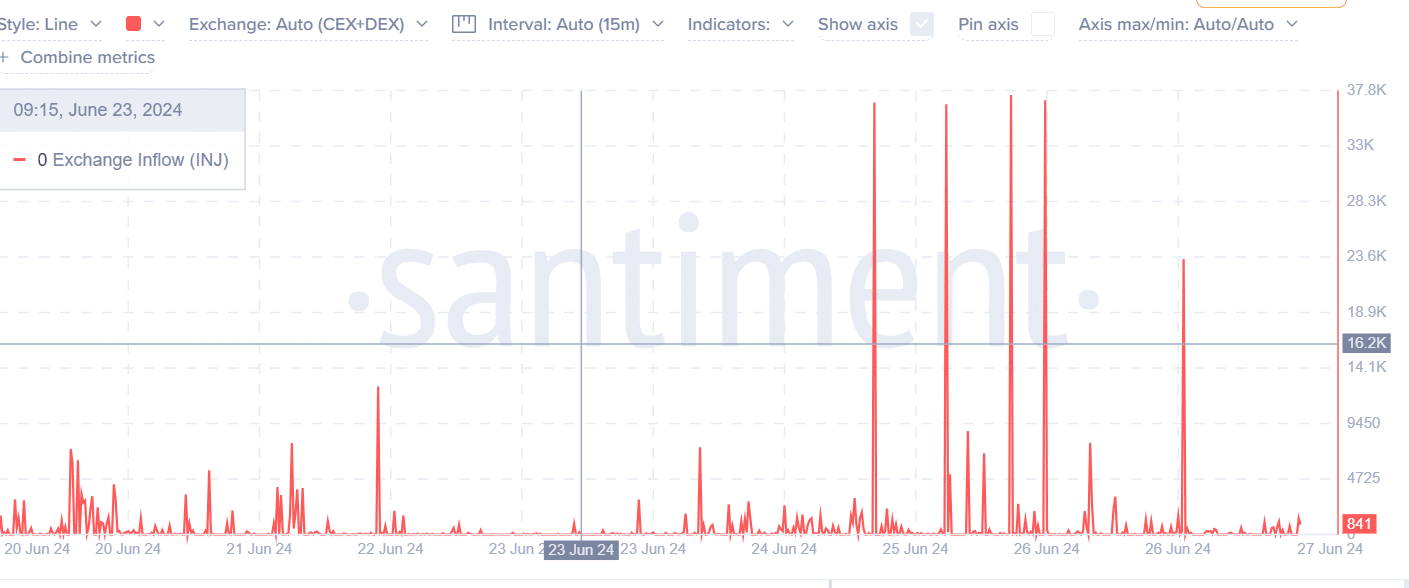

AMBCrypto’s analysis of Santment data shows that the market is currently in a consolidation phase.

Based on Santiment’s analysis, the number of INJ tokens entering exchanges decreased significantly over the past week. After reaching a peak of 38,000 tokens, the exchange inflow dropped to just 841 tokens at the current moment.

In simpler terms, when there is a small amount of new assets entering a market, it often indicates market stability. Consequently, investors are optimistic about earning profits in the near future.

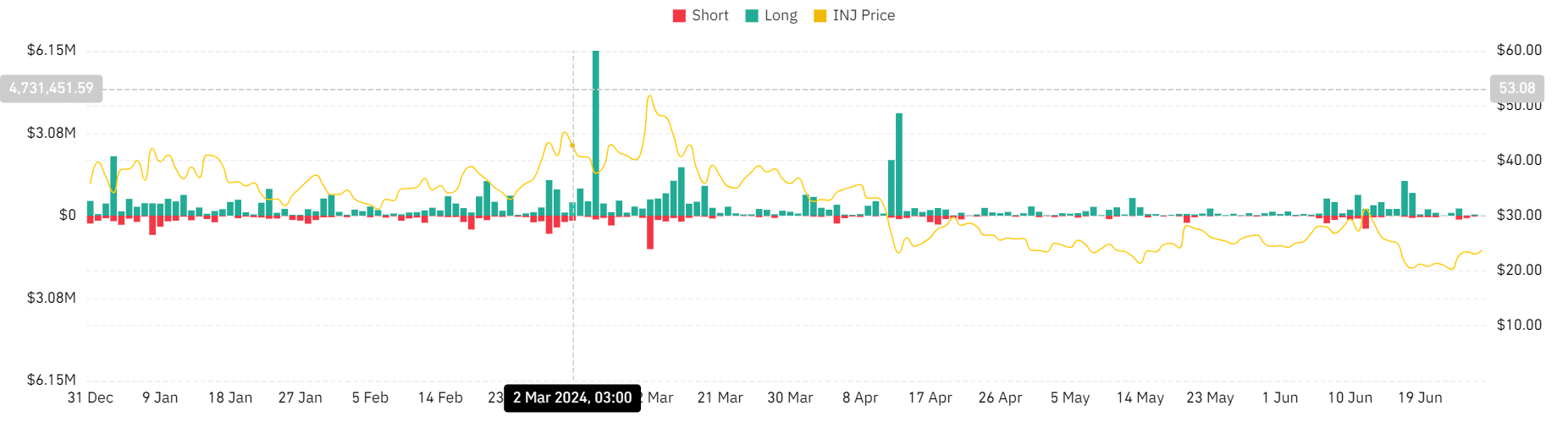

As an analyst, I have examined the data from Coinglass, and my findings indicate a favorable market attitude. This is evidenced by a decrease in liquidations for both long and short positions.

Over the past week, the value of long positions being liquidated dropped dramatically from a peak of $235,000 to a current level of $9,000. Similarly, short positions went from a high of $57,000 to a low of $3,000. This significant decrease in both types of positions indicates market equilibrium and suggests a lack of compelled sales.

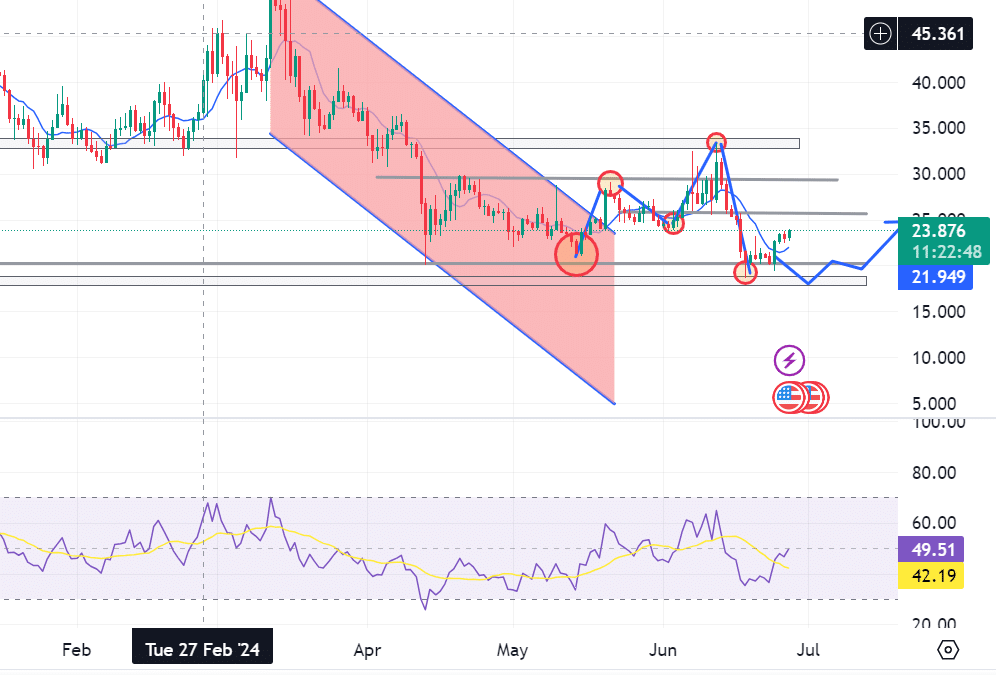

As a researcher analyzing market trends, I’ve observed that the Relative Strength Index (RSI) reported by INJ currently stands at 49. Being in the vicinity of the neutral zone indicates an equal balance between buying and selling pressure. This suggests that the market is experiencing indecision and lacks a clear direction for either significant upward or downward trends.

What next: Bulls or Bears?

As a researcher studying the INJ market, I would describe the price surge as follows: The current upward trend in INJ prices is primarily driven by strong buying demand and expectations of future profits from selling. This speculative buying behavior can lead to rapid price increases, but it’s essential to note that such trends often follow a pattern of peaking and subsequently declining.

Realistic or not, here’s INJ’s market cap in BTC terms

The market mood is presently divided between pessimistic bears and optimistic bulls, resulting in a period of price stabilization.

In a bullish market condition, if the bulls come out on top in the ongoing price battle, the INJ stock prices are expected to climb up to approximately $25.605 or even $29.360 as the next resistance levels. Conversely, in a bearish scenario, if the bears triumph, the INJ stock will likely give up its recent gains and retreat towards the support level of around $20.217.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-06-28 12:39