- INJ pumped by double-digits following its Upbit listing

- Will the update help INJ to break its downtrend?

As a seasoned researcher with years of experience in the cryptoverse, I have seen my fair share of market pumps and dumps. The recent 16% surge of Injective [INJ] following its Upbit listing is indeed intriguing, reminding me of the famous “cats vs dogs” meme from MEW‘s past.

On October 17th, Injective’s [INJ] price spiked by an impressive 16% following the announcement of its listing on Korea’s largest cryptocurrency exchange, Upbit. This surge took the token from $20 to $23. A significant factor in this growth was a substantial 112% increase in daily trading volume.

Despite a slight decrease as reported at the time of publication, this listing holds significant importance due to the significant effect that being listed on Upbit has on cats within a dog’s market (MEW).

To provide some context, MEW (Meme-ew) debuted in March and became available on various platforms like Bybit and OKX. Yet, it was being traded on Upbit in September that sparked an unprecedented surge for this feline-themed meme token.

The explosive pump happened because the exchange is Korea’s largest crypto trading platform. Hence, the question – Will INJ follow MEW’s steps?

Will the uptrend continue?

It’s yet unclear if INJ’s upward trend will continue following the listing. Interestingly, the price surge post-update seems to be driven more by futures market speculators, as opposed to the traditional spot market.

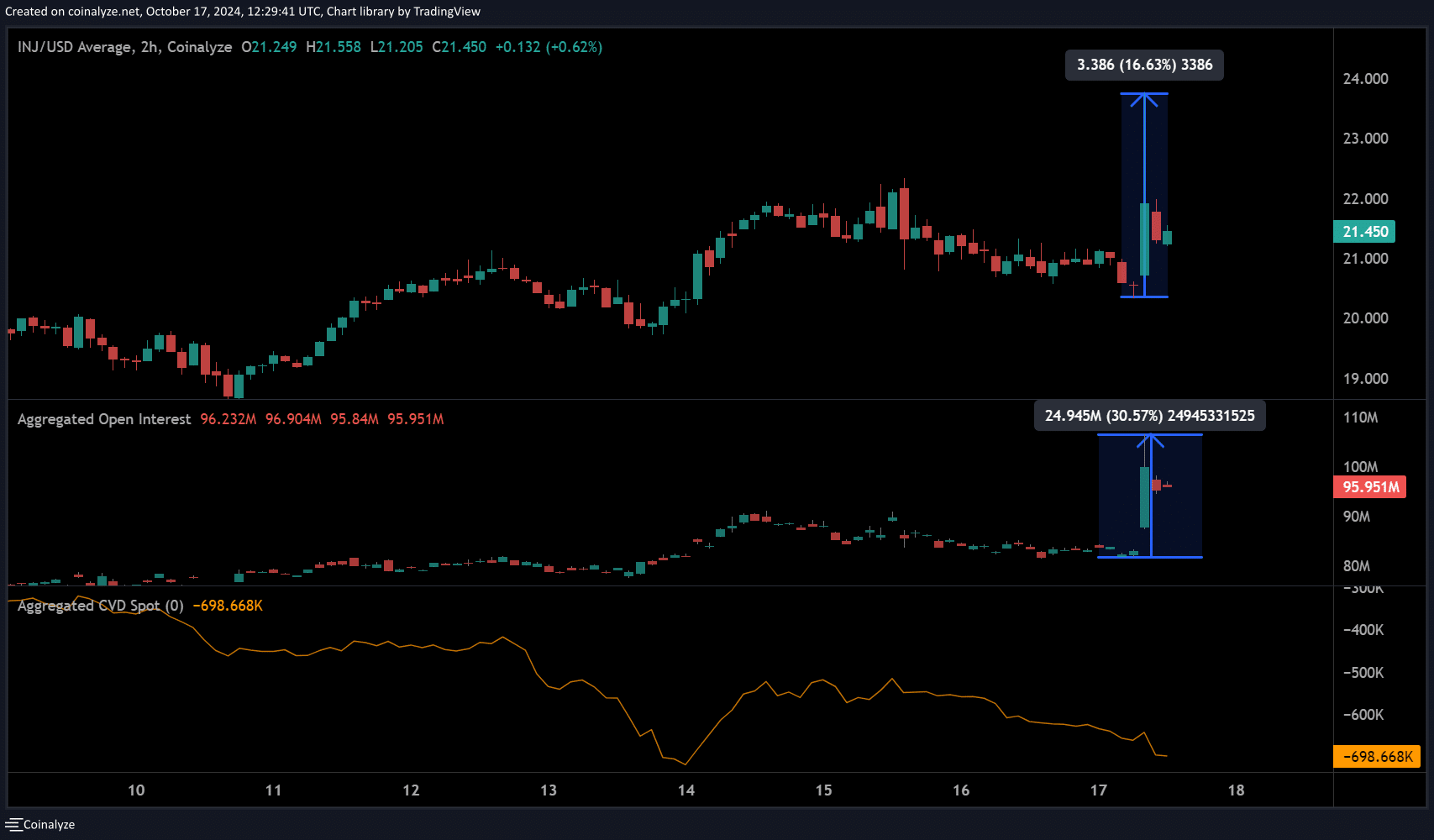

Based on data from Coinalyze, there was an increase of more than 15 million Open Interest for INJ on the Binance exchange during the uptrend.

In other words, it was the leveraged traders who primarily fueled this rapid surge, while interest from spot buyers remained relatively low, as indicated by the minimal difference in cumulative volume delta.

For context, CVD gauges the buying and selling volumes across exchanges, and the decline indicated that selling volume (sellers) was dominant.

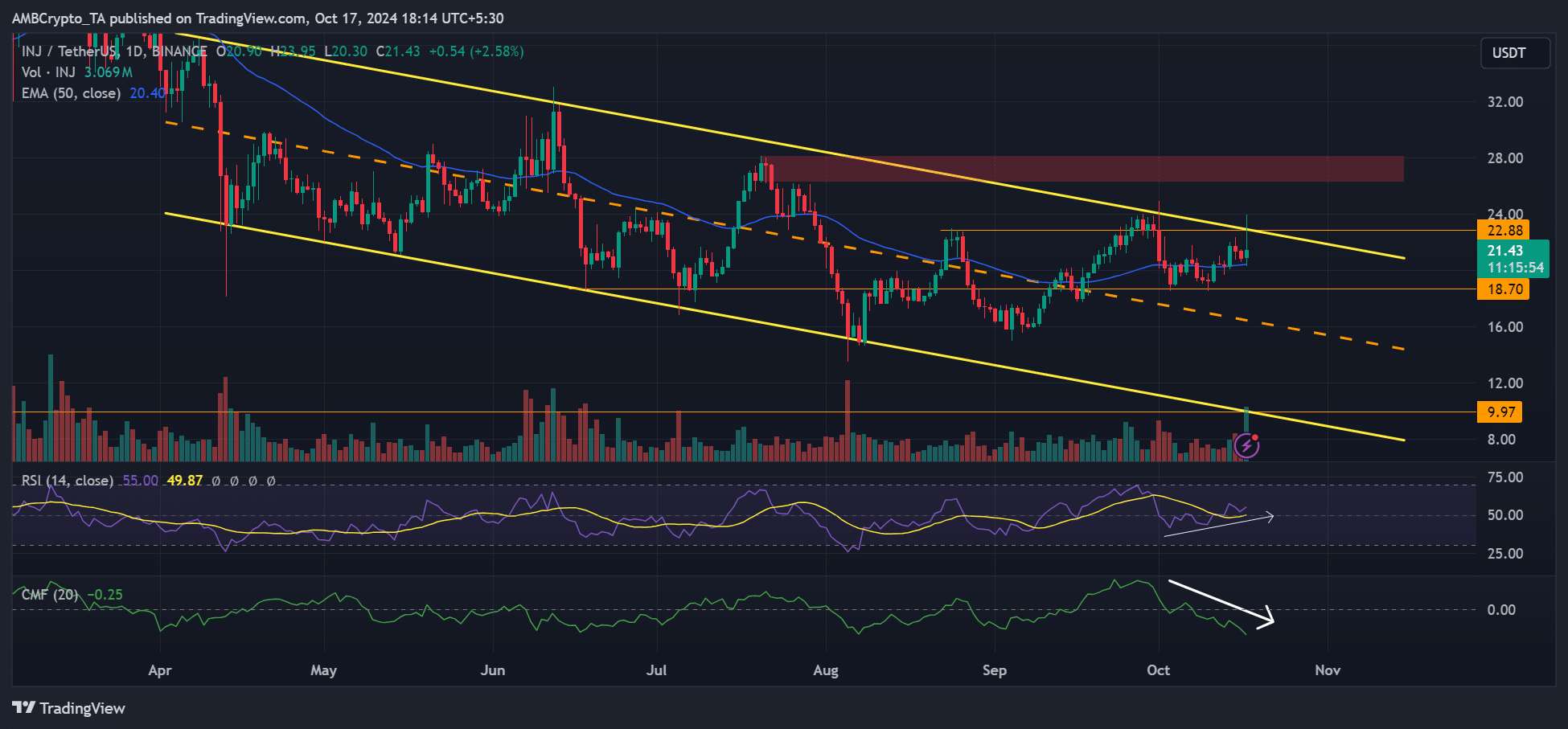

On the larger-scale chart views, the strong upward surge on Thursday served to strengthen INJ’s positive market configuration. Notably, this uptrend is evident as the price has been forming successively higher troughs and peaks since October.

The rally tapped the range-high of the descending channel (yellow). However, the pump didn’t decisively break the downtrend structure.

Even though Investment Joint (INJ) might trigger a surge, it’s been experiencing significant withdrawals in its market since late September. This trend is suggested by the declining Chaikin Money Flow (CMF), which indicates reduced capital inflows. These low inflows may postpone the chances of a breakout occurring.

Yet, when the news was published, INJ found defense at the 50-day Exponential Moving Average (EMA), using it as a base for potential future growth. If this upward trend continues, $24 or $28 may be the next goals, particularly if the bullish momentum maintains its strength over the coming days.

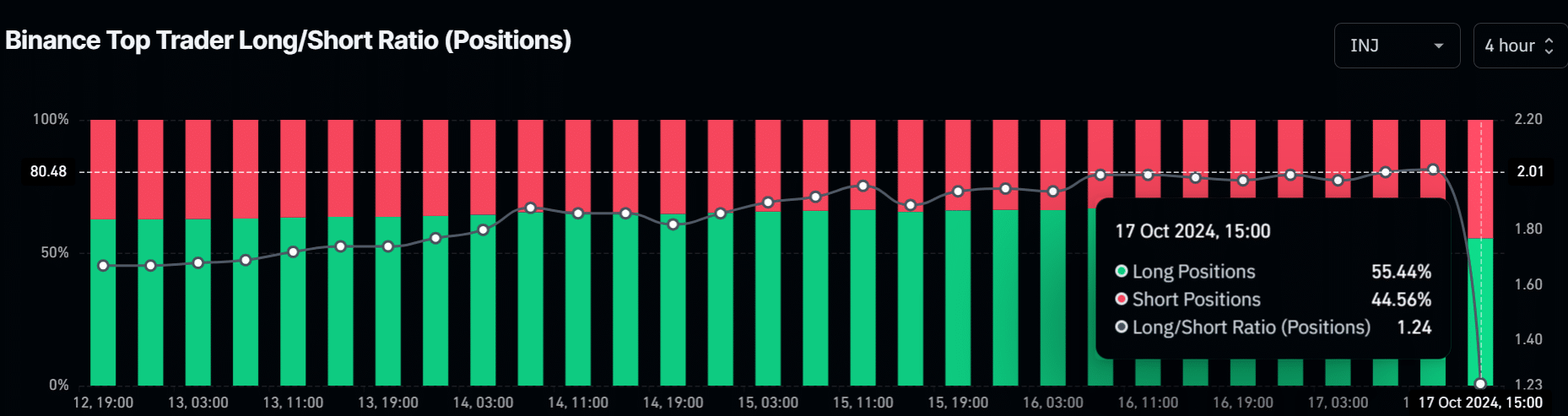

As a crypto investor, I find it noteworthy to mention that a significant portion of the astute investors on Binance were long on the Injective Coin (INJ), with approximately 55% of their positions predicting an increase in its value.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-18 10:15