-

INJ broke out of a descending channel, surpassing $20, and may rally towards new all-time highs.

Despite bearish signals, INJ’s recent price action hinted at a potential surprise rally.

As a seasoned crypto investor with a knack for spotting market trends and a portfolio that has weathered multiple bull and bear cycles, I must admit that Injective [INJ] has caught my attention lately. The recent breakout from its descending channel and the subsequent rally towards $44 was indeed surprising, but not entirely unexpected given the strong support it found at the $12-$14 range earlier this year.

The innovative INJ has garnered interest due to its dynamic performance in the market, noticeably after breaking free from a lengthy downward trend.

Since the beginning of 2024, the value of INJ has generally stayed within a downward-sloping trendline, repeatedly facing resistance whenever it approaches the top edge.

In August, the price of INJ surged beyond its previous trading channel, crossing over the $20 threshold following robust support at around $12 to $14.

As an analyst, I observed a significant surge following this breakout, propelling the price approximately towards $44. This upward movement could suggest a possible bullish reversal, indicating a shift from the earlier bearish trend.

Market observers have been keeping a close eye on INJ‘s progress, especially following its recent burst through barriers. As reported in a piece by World of Charts on platform X (previously known as Twitter),…

In simpler terms, “The overall trend of the descending channel, which has been consolidating recently, has just broken a significant resistance level. This suggests that the price might move towards the trendline. If INJ successfully breaks the trendline of the channel in the coming days, we could potentially witness new record highs within the next few weeks.”

It’s implied that the recent surge might continue, potentially pushing Injection (INJ) to unprecedented peak levels in the coming days.

Current market performance

presently, the value of INJ is being exchanged at $18.23, with a trading volume over the last 24 hours amounting to $123,273,162. According to Coingecko, this price drop reflects a decrease of 1.31% in the previous 24-hour period.

Regardless of the temporary obstacle, the overall outlook for INJ in the market stayed optimistic, with a strong expectation for growth, particularly following its rebound from an important support point at $14.24.

On this particular level, there’s been significant indication of buyers stepping in, potentially paving the way for an advance towards higher resistance areas.

Keep an eye on potential resistance levels around $32.50 to $35.00 in the near future. Should INJ continue its upward trend and surpass these resistance points, it may pave the way for additional growth opportunities.

Keep an eye on the support level at around $17.67, slightly lower than the current price, to determine if the current uptrend will continue or if there could be more price drops ahead.

Bearish signals dominate, but…

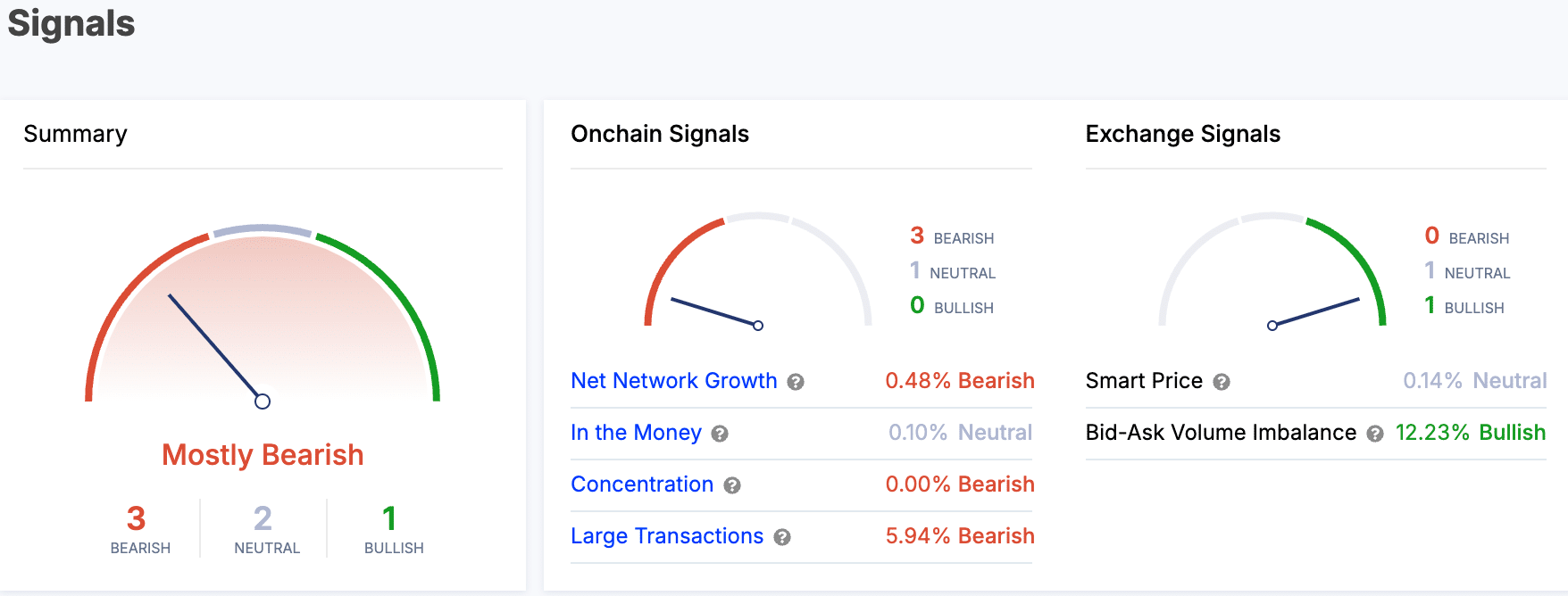

Regarding INJ, the general outlook based on on-chain and trading platform indicators has been predominantly negative, suggesting a continued downtrend rather than an imminent increase.

Based on recent data from IntoTheBlock, four out of the six indicators showed a negative trend, while the remaining two maintained a neutral stance.

The Net Network Growth was slightly bearish at 0.48%, and Large Transactions were showing a strong bearish signal at 5.94%.

In simple terms, the “In the Money” level held steady at 0.10%, suggesting that neither buyers nor sellers had a significant advantage in terms of profitability from their trades.

On the trading platform, there was a noticeable difference between the amount of sellers (22.01% more) and buyers (-22.01% less), suggesting a strong trend towards selling rather than buying.

Realistic or not, here’s INJ’s market cap in BTC’s terms

Furthermore, the Smart Price signal wasn’t leaning strongly in any particular direction, indicating a lack of decisive trend at the moment.

To put it simply, the latest trends in INJ‘s pricing seem to indicate a strong possibility of a significant rise if this current trend persists.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-14 08:08