- Injective’s volume spike mirrored the surge in the protocol’s elevated social activity

- INJ pulled back at key resistance following a surge in spot outflows

As a seasoned researcher with a knack for deciphering market trends and a soft spot for cryptocurrencies, I find myself intrigued by Injective’s recent performance. The surge in INJ’s volume to its highest figure in eight months is certainly eye-catching, especially when paired with the protocol’s elevated social activity.

Could it be that Injective’s native token INJ is preparing for a significant price surge based on recent insights from on-chain analysis? The data suggests potential signs of an imminent substantial shift in its value.

The focus on injective might be increasing due to the surging liquidity in the crypto market, as the rotation of liquidity within cryptocurrencies persists and Bitcoin‘s dominance decreases. In essence, investors are actively seeking out cryptocurrencies and tokens that show promising growth prospects, particularly those that have recently underperformed.

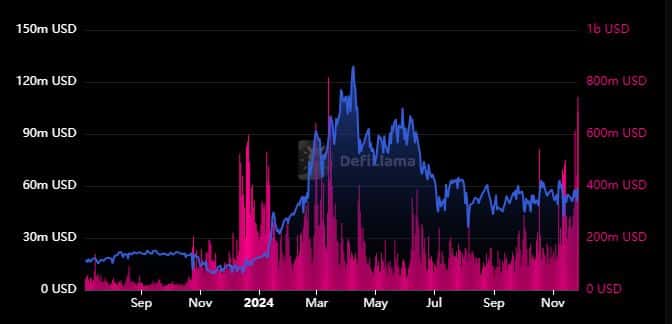

On Injective protocol, it’s been observed that the native token INJ experienced a significant increase in trading volume. The volume peaked at an impressive $741.29 million within the past 24 hours. This was the highest surge for INJ in the last 8 months and the second-highest spike this year.

As a researcher, I find it noteworthy to mention that my observations show that Injective’s Total Value Locked (TVL) has been experiencing a slow growth trend over the past few months, with minimal substantial increases.

It seems like a significant increase in transactions related to the INJ token has occurred this week, which is not unexpected given that the Injective network has been one of the most active cryptocurrency projects on social media platforms.

An increase in interactivity on the Injective network indicates growing interest and recognition of it this week. But, does this automatically mean a surge in positive price movement (bullish momentum)?

INJ retests noteworthy resistance level

The aforementioned volume surge might have been related to its recent bullish momentum.

Indeed, on Tuesday, the INJ experienced a significant increase of 14.35%. This upward movement propelled it towards its earlier price boundary around the $31 region, where both support and resistance were previously established.

Is it possible that the price of INJ could break through a resistance level, given its recent 6.07% pullback to its current value of $28.89?

It appears that the pessimistic results align with the decrease in INJ spot flows seen recently, suggesting that investors are cashing out their gains.

As an analyst, I’ve observed a significant increase in spot outflows, indicating a short-term profit-taking spree that has tempered expectations for a substantial breakthrough. However, despite recent highs, Injective remains potentially undervalued. It’s noteworthy that its Open Interest in the derivatives segment is still relatively low, which might be the reason behind its ongoing struggle to surpass the recent resistance levels.

The highest Open Interest for Injective reached $176.32 million over the past 24 hours, which is significantly less compared to its record high of $308.25 million on March 13th.

A weak return for Total Value Locked (TVL) could indicate that investors remain somewhat cautious, even with the increase in trading volumes.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-28 12:08