- Oh, the whimsy! Bitcoin‘s short-term holders, in their infinite wisdom, have begun to sell at a loss, leaving us all to ponder the meaning of life, the universe, and BTC. 🙃

- Lo and behold! The STH SOPR, a metric so mysterious it sounds like a character from a Russian novel, has dipped below zero. Could this be a sign of doom or a golden opportunity? 🎭

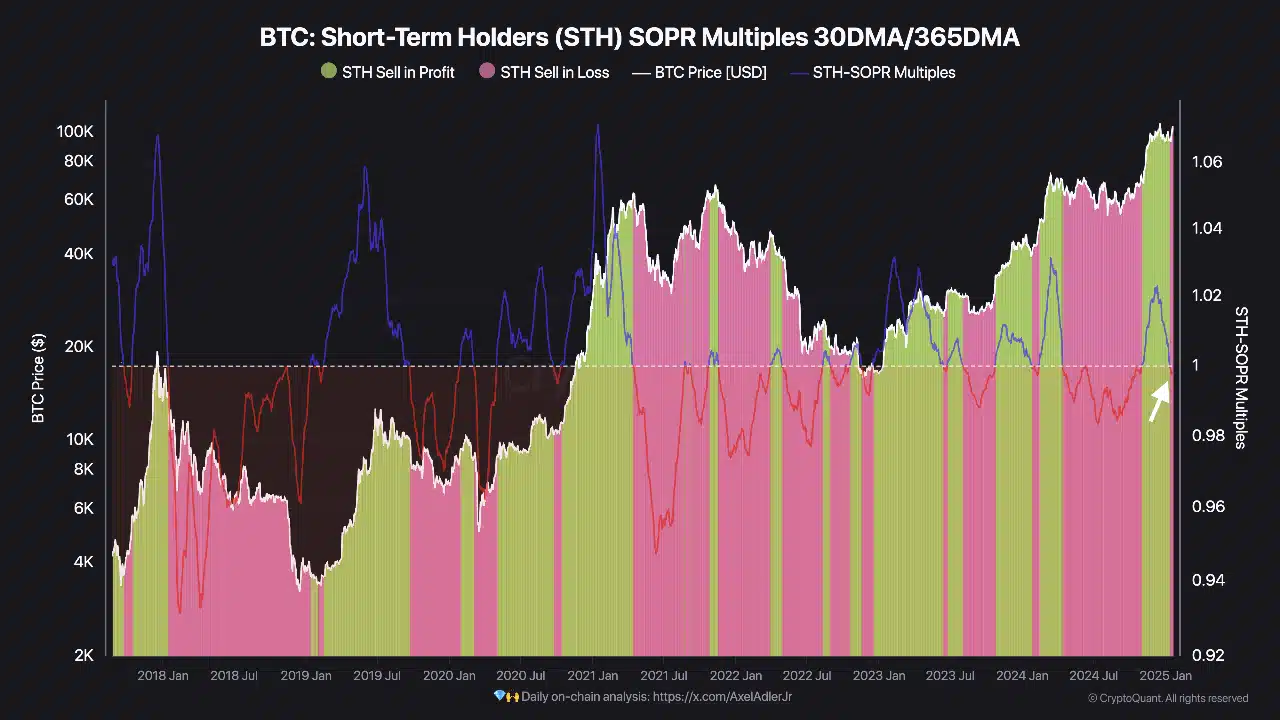

Dear reader, gather ’round for a tale of woe and wonder! Bitcoin’s short-term holders, those fleeting butterflies of the crypto world, have taken a turn for the worse. The Short-Term Holder Spent Output Profit Ratio (STH SOPR), a name so long it deserves its own opera, has turned negative. 🎶

This curious metric, comparing the 30-day STH SOPR to its 365-day average, has taken a dark turn. It’s as if the moon has gone into eclipse, casting shadows upon the land of Bitcoin. 🌑

History whispers in our ears, telling tales of significant market turning points. Are we at the brink of a grand opportunity or facing the abyss of short-term peril? Only time will tell, my friend. ⏳

STH SOPR: The Cryptic Oracle of BTC

Our dear STH SOPR, a measure of whether short-term holders are selling at a profit or a loss, has entered the realm of the negative. It’s like stepping into a parallel universe where up is down and dogs walk humans. 🐕🚶♂️

Historically, these dips have been harbingers of market stress, but they’ve also presented a chance for long-term investors to scoop up Bitcoin at a discount. It’s a game of cat and mouse, with the market playing both roles. 🐱🐭

Behold the chart, a work of art painted by the hands of fate. The recent plunge below 1.0 signals a lack of confidence among our short-term brethren. Will they continue to sell, deepening the market’s correction, or hold tight, creating a potential price floor? 🌊…

The Great Divide: Two Paths Lie Ahead

Two roads diverge in a yellow wood, and sorry we cannot travel both. Short-term holders face a choice: hold fast or capitulate. 🍃…

In the first scenario, our brave STHs stand tall, refusing to sell at a loss. Their realized price becomes a shield, protecting Bitcoin from further falls. It’s a scene straight out of a heroic saga. 🛡️…

Alas, the second path is fraught with peril. Should our STHs succumb to fear and sell, the market may face a storm of epic proportions. It’s the stuff of nightmares, or perhaps, a thrilling adventure for the bold. 🌀…

Through the Looking-Glass: Historical Insights

Peering through the looking-glass, we see times when the STH SOPR dipped into negative territory. Each time, it was followed by either chaos or a phoenix rising from the ashes. 🔥…

Remember March 2020, when the world stood still and Bitcoin’s STH SOPR took a nosedive? Those who dared to buy then were rewarded handsomely as Bitcoin soared to new heights. 🚀…

And what of mid-2018, when Bitcoin retreated from its lofty perch? The STH SOPR painted a picture of despair, yet it marked the beginning of a new chapter for Bitcoin. 📖…

Read Bitcoin’s [BTC] Price Prediction 2025–2026 for more musings on the future. 📈…

For the long-term investor, these negative SOPR phases have often been preludes to great recoveries. Selling pressure fades away, making way for the dawn of a new era. 🌅…

So, dear reader, while the current trend may cast a shadow of doubt, history reminds us that there’s always hope on the horizon. 🌄…

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-22 02:16