- BNB Chain has seen a decline in network activity lately

BNB’s derivatives market noted a drop in trading activity over the past 24 hours too

The number of transactions on BNB Chain [BNB] reached a 30-day low on April 17, as reported by Artemis. With data from this on-chain provider, we find that there were only around 1.1 million unique addresses engaged in at least one transaction that day. This figure represents a 21% decrease compared to the 1.4 million daily active addresses recorded on March 19 – the highest number in the past month.

The number of active addresses on the BNB Chain has gone down, resulting in fewer daily transactions. As of April 17, there were 3.8 million unique interactions recorded, a 21% decrease from the 5 million transactions that occurred on March 19, according to Artemis’ data.

When the number of users on a blockchain network like BNB Chain decreases, the typical cost for processing transactions, or transaction fees, tends to drop based on observable data.

On April 17th, users on the chain collectively paid $659,000 in transaction fees. This represents a 56% decrease from the YTD peak of $1.6 million in transaction fees, which was reached on March 15th.

As a result, the past few weeks have been marked by a steady drop in network revenue.

According to Artemis’s report, BNB Chain earned a revenue of $57,000 on the 6th of April – which is its lowest figure since February. By the 17th of April, the daily revenue had dropped to $66,000, representing a 22% decline from the start of the month.

A positive trend for BNB on the charts

Currently, BNB is worth around $560 based on the latest news. In line with the minor surge in the cryptocurrency market over the last day, BNB’s value increased by approximately 3%, as indicated by CoinMarketCap.

Read Binance Coin’s [BNB] Price Prediction 2024-25

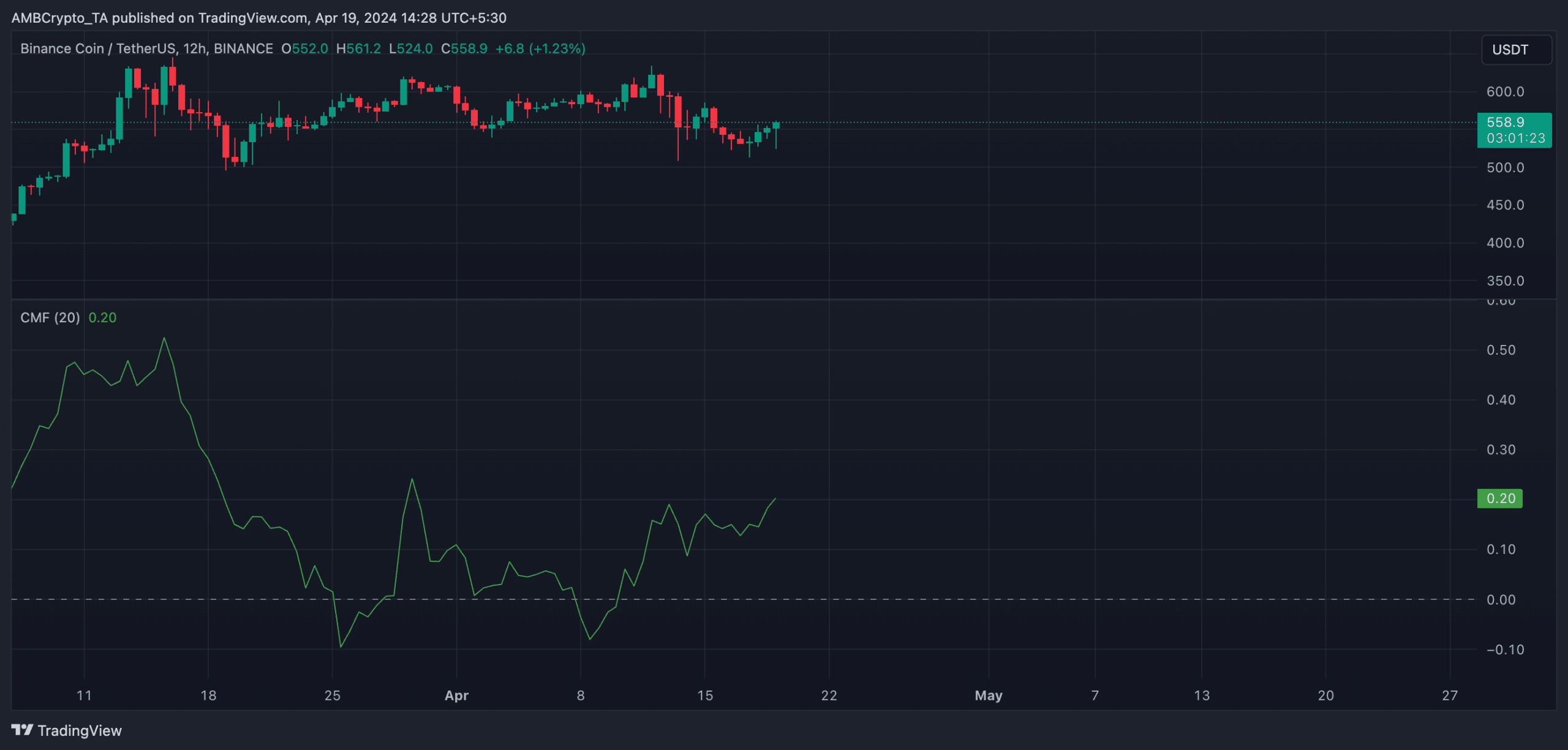

On a 12-hour scale, the price of Binance Coin (BNB) showed a noticeable increase in interest and demand.

An example is the Chaikin Money Flow (CMF) indicator, which calculates the momentum of money flowing in and out of an asset. When this indicator was rising, it indicated a net inflow of funds into the asset, resulting in a positive value.

A positive CMF value indicates robust market conditions, implying that there’s a net flow of funds entering the market to support price increases in the near future.

Despite a strong indication of pessimism towards the coin’s derivatives market based on recent data, it may pose challenges for BNB investors. Specifically, the open interest for this coin has dropped by 7% within the past 24 hours as per Coinglass records. In simpler terms, the current situation might call for caution when dealing with BNB.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Ethereum ETF Day 1 beats ‘20% of BTC’ estimate – What’s next?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

2024-04-19 15:03