- TON maintained its dominance in the market, leaving SOL in the dark

While other metrics surged, development slowed down on the blockchain

Once again, Toncoin (TON) has shown why it’s worth keeping an eye on during this market cycle. Previously, we at AMBCrypto have elaborated on how TON has been outperforming many other projects.

Over the past day, TON‘s cryptocurrency price rose by an impressive 18.15%, remaining the strongest performer among the top cryptocurrencies despite similar price increases in others.

A “TON” of supremacy

A market analysis revealed that among all the contenders, Solana (SOL) came the closest to matching TON‘s growth, recording a rise of 10.38%. Notably, TON’s price surge wasn’t an isolated event on the graphs.

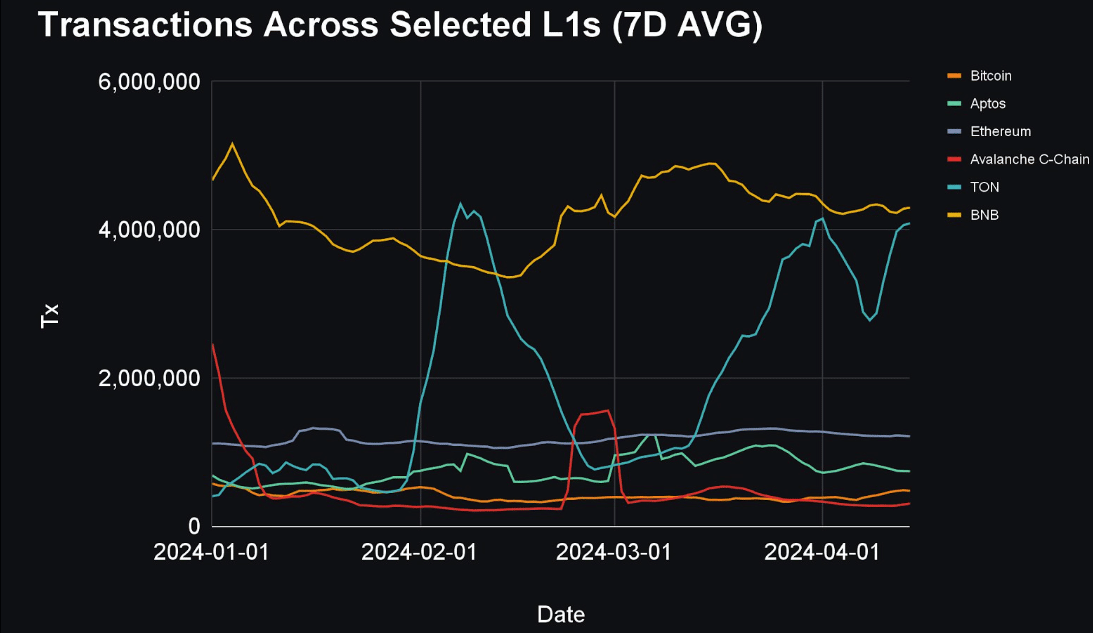

Based on our examination, various measurements related to the blockchain have significantly increased during the last month. One such measurement is the number of transactions on the network, which has experienced a remarkable jump of 100% since mid-March, as indicated by Artemis’ findings.

With more transactions taking place, there’s evident excitement and growing involvement in the Toncoin project. According to AMBCrypto’s assessment, Toncoin is currently locking horns with BNB Chain when it comes to daily transaction volume.

Using this information, it’s clear that TON holds the capability to surpass other Layer-1 projects based on its transaction volume and exceptional liquid staking participation rate. The research platform highlighted this observation due to these impressive stats.

“TON stakeholders boast the greatest volume of locked staked TON: Upon examining the amount of TON being staked across various platforms, it’s impressive to note that TON Stakeholders are leading the way in attracting substantial TON liquidity, surpassing more established protocols.”

Will the project continue to attract more?

With a significant number of investors taking part in staking at high rates, it’s clear that TON has attracted great interest and trust, as evidenced by their belief in its price trends. However, it’s important to note that the potential rewards from staking could be less substantial if the token’s price takes a downturn.

If TON experiences a loss of recent gains, stakeholders on the blockchain could face higher inflation rates. At present, though, the situation is just the reverse.

The amount of money locked in the TON project, known as Total Value Locked (TVL), mirrored the confidence in it. To put it simply, this figure stood at approximately $161.08 million when I penned down these words. Although the TVL saw a minimal decrease over the past day, this dip occurred following a robust 30-day growth of 262%.

If the need for TON keeps increasing, then its Total Value Locked (TVL) is likely to grow as well. Conversely, if market participants withdraw funds from the protocol, the TVL could decrease.

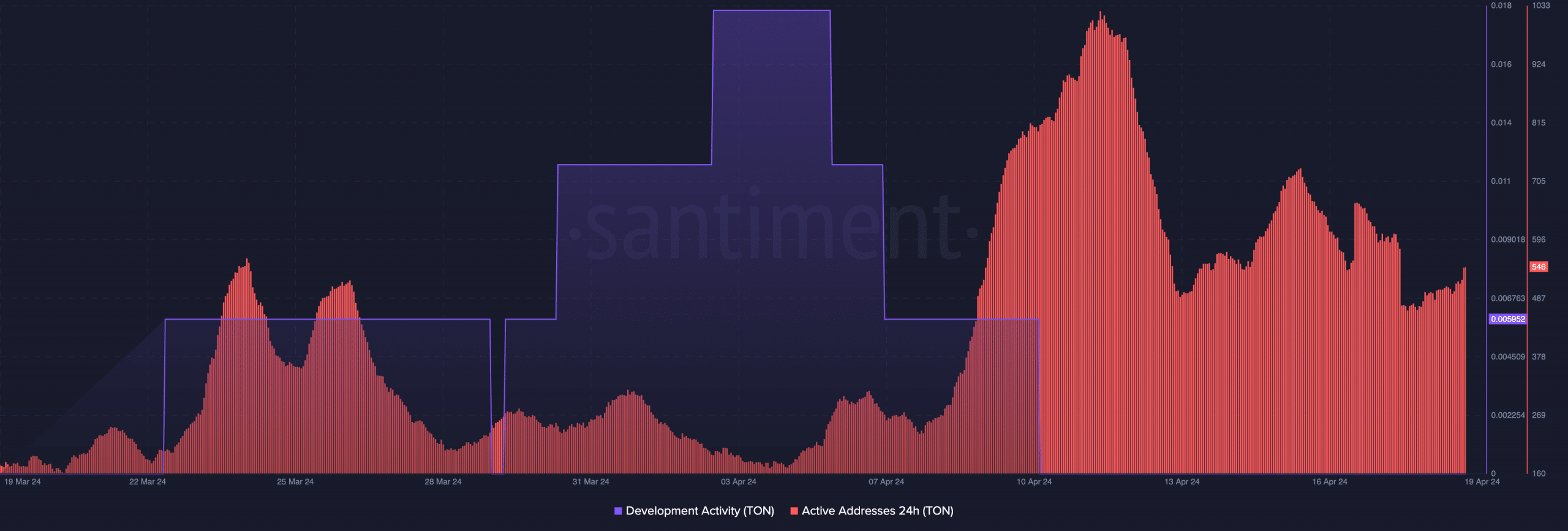

During this period, the level of work on the project decreased. Beforehand, there was a significant increase in the metric following Toncoin’s announcement of collaborations with Telegram and HumanCode, an artificial intelligence company.

A decrease in blockchain development signifies a potential waning dedication to adding new functions. This might be a warning sign for bears, but an increase in active user addresses may contradict this assumption.

Is your portfolio green? Check the TON Profit Calculator

Based on current news, data from the blockchain shows a rise in this particular metric, suggesting more active users. If user activity persists in growing, the value of TON could potentially remain above $7.15.

On the contrary, if growth stalls, the token’s price might head south.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Ethena rallies 45% in two weeks, but bulls still have an uphill battle

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Why Bitcoin could reach $71K in September, and $100K in December

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

2024-04-19 19:03