- Franklin Templeton has expanded its tokenized security to Arbitrum.

- An observer sees the move as institutional interest in Arbitrum and Ethereum.

As a seasoned crypto investor with over a decade of experience in the digital asset market, I find Franklin Templeton’s expansion onto Arbitrum to be quite intriguing and potentially beneficial for both parties involved. Institutional interest is always a positive sign for any blockchain network, as it validates its potential and can lead to increased adoption and growth.

Arbitrum’s network has seen significant expansion, placing it third amongst Ethereum’s Layer-2 solutions in July, boasting a total of 35.7 million distinct user addresses.

But with the latest Franklin Templeton move, more network growth seems likely.

As a researcher delving into the realm of blockchain and digital assets, I’ve chosen to broaden our offerings by tokenizing our securities on Arbitrum. This strategic alliance aims to expedite the fusion of Decentralized Finance (DeFi) with traditional finance (TradFi), thereby bridging the gap between the two worlds and potentially opening new avenues for financial innovation.

Commenting on the update, Roger Bayston, Franklin Templeton’s Head of Digital Assets, stated,

Moving into the Arbitrum network marks a significant milestone in our path towards strengthening our asset management tools using blockchain tech.

Will institutional interest boost ARB?

To provide some context, the market for tokenized securities saw significant growth following BlackRock’s initial investment, which they announced in early 2024 through their BUIDL launch.

Currently, when this text is being penned down, Arbitrum stands as the 4th largest network concerning the value of tokenized securities. This value amounts to approximately $10.57 million, which represents a fraction of its overall market capitalization totaling $1.09 billion.

In my analysis, by associating with widely recognized financial powerhouse, Franklin Templeton, ARB could potentially expand its network and increase its worth within the segment.

One market observer, Adriano Feria, claimed the Arbitrum move could also trickle down to ETH.

“It’s no accident that industry pioneers prefer to develop on Ethereum. The institutional interest in Ethereum is likely to grow significantly from this point.”

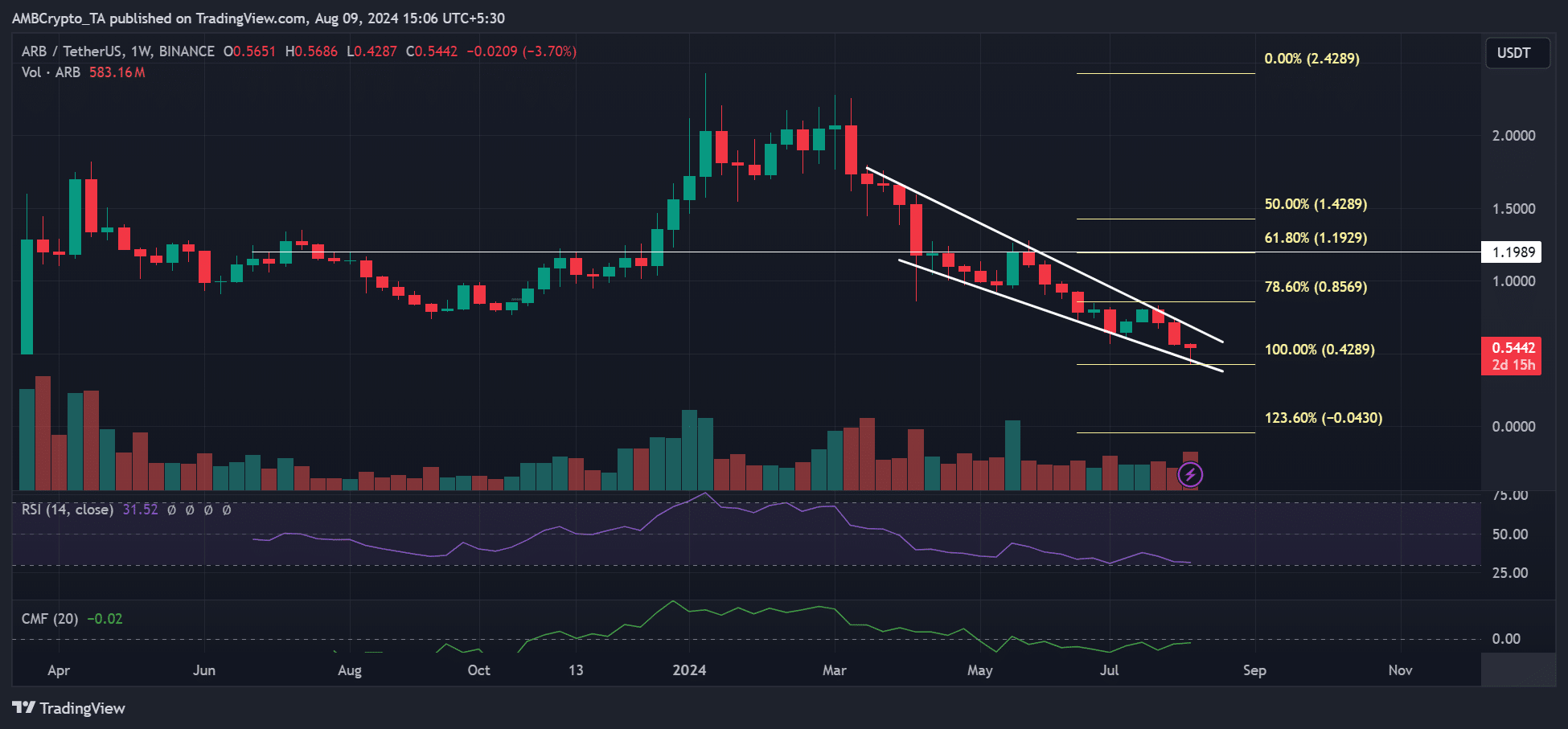

On August 8th, ARB experienced an increase of 14%, climbing from $0.47 to $0.55. Yet, since March, its price has generally trended downward for the altcoin.

During this timeframe, the interest in ARB has generally been low, a trend that is suggested by the declining pattern of the Relative Strength Index (RSI), which indicates its relative weakness compared to other securities.

The lack of interest dragged ARB 80% lower from its March highs of $2.4 to below $0.5 in August.

Additionally, significant money exodus during that timeframe, as indicated by the decrease in the Chaikin Money Flow (CMF).

Even though there was a rebound in July, the influx hasn’t been substantial enough to elevate the Common Money Flow (CMF) above its usual level, thereby failing to drive up ARB‘s price any more.

It’s uncertain if Franklin Templeton will bring in additional investments and positively impact ARB‘s future performance on the price graphs, but it’s something we’ll have to observe.

Read More

2024-08-09 19:03