Gasp! On a rather nervous Tuesday, Bitcoin ETFs performed the financial equivalent of slamming the brakes on a highway—net outflows, and the once-gleaming inflow streak (over $1 billion, mind you) snapped like a soggy breadstick.

The Federal Reserve, that enigmatic and perpetually caffeinated institution, now loomed on the horizon with its next policy pronouncement. Meanwhile, institutional goliaths rather poetically tiptoed away from exposure, like debutantes ducking out before someone suggests a group waltz—anticipating a ballroom brawl of market volatility. 💃🕺

Those Titanic ETF Whales Get Squeamish as the Fed Soft-Shoes

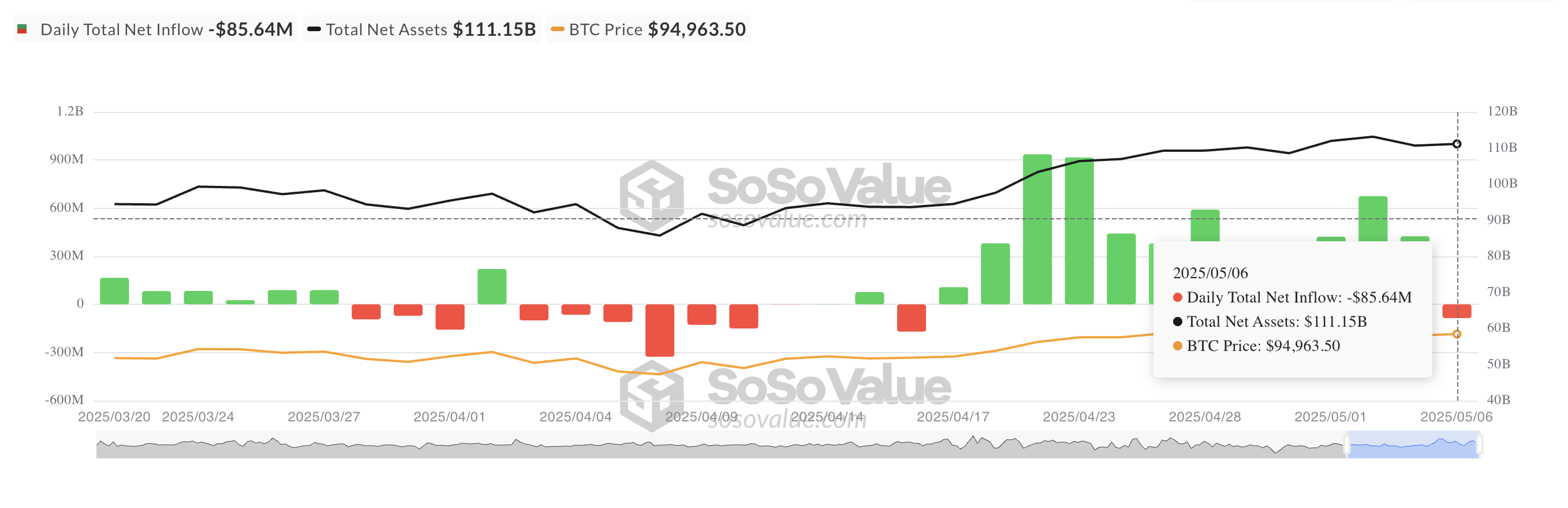

To the tune of $85.64 million, Bitcoin spot ETFs blushed crimson (net outflows), signaling either remarkable strategic foresight or a craven retreat. And why? Well, the looming Federal Reserve meeting—enough to make even the steeliest-eyed suits perspire into their pinstripes.

Just three days prior, these funds were gorging themselves greedily, nearly choking on $1 billion in inflows. Then, the music stopped. Cue the frenzied dash for the exits, as if someone had whispered “bear market” or “free shrimp.” Uncanny how market participants anticipate volatility and react as though allergic to profit risk.

Perhaps, this collective flinch was less cowardice and more chess—ditch the ETFs, avoid a slap from some surly FOMC twist, live to speculate another day. Of course, one must never underestimate the Olympian dexterity required to sidestep imaginary losses in favor of very real headaches.

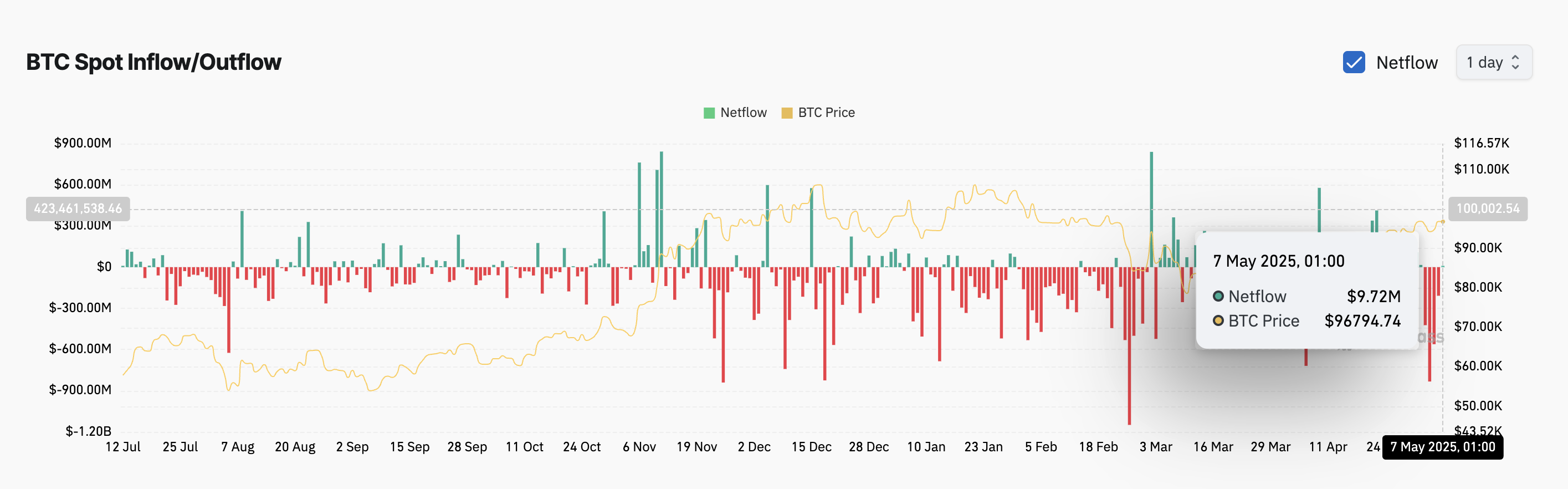

Interestingly, while the ETF crowd was evacuating, a subtle ballet unfolded elsewhere: on-chain data lit up with spot net inflows, conjuring visions of institutional types snaking capital directly into spot positions, nimble as pickpockets at a Parisian train station. After all, volatility is opportunity; why not try to pirouette through the chaos for fun and perhaps a little short-term gain? 💸🤏

Our esteemed pixel-wranglers at Coinglass chime in: $9.72 million quietly slipped into BTC’s spot pockets. Spot inflows—where the truly shameless flock—signal rising demand, and perhaps the hope that the price itself might begin to feel some rarefied air up above the clouds.

In short, direct buyers appear to be stockpiling Bitcoin like a doomsday prepper in a boutique, their accumulation threatening to tip the scales further upward—assuming they don’t all panic-sell the moment a central banker clears his throat.

Bitcoin: The Ballet of Buyers (or the Lurch of Lunatics?)

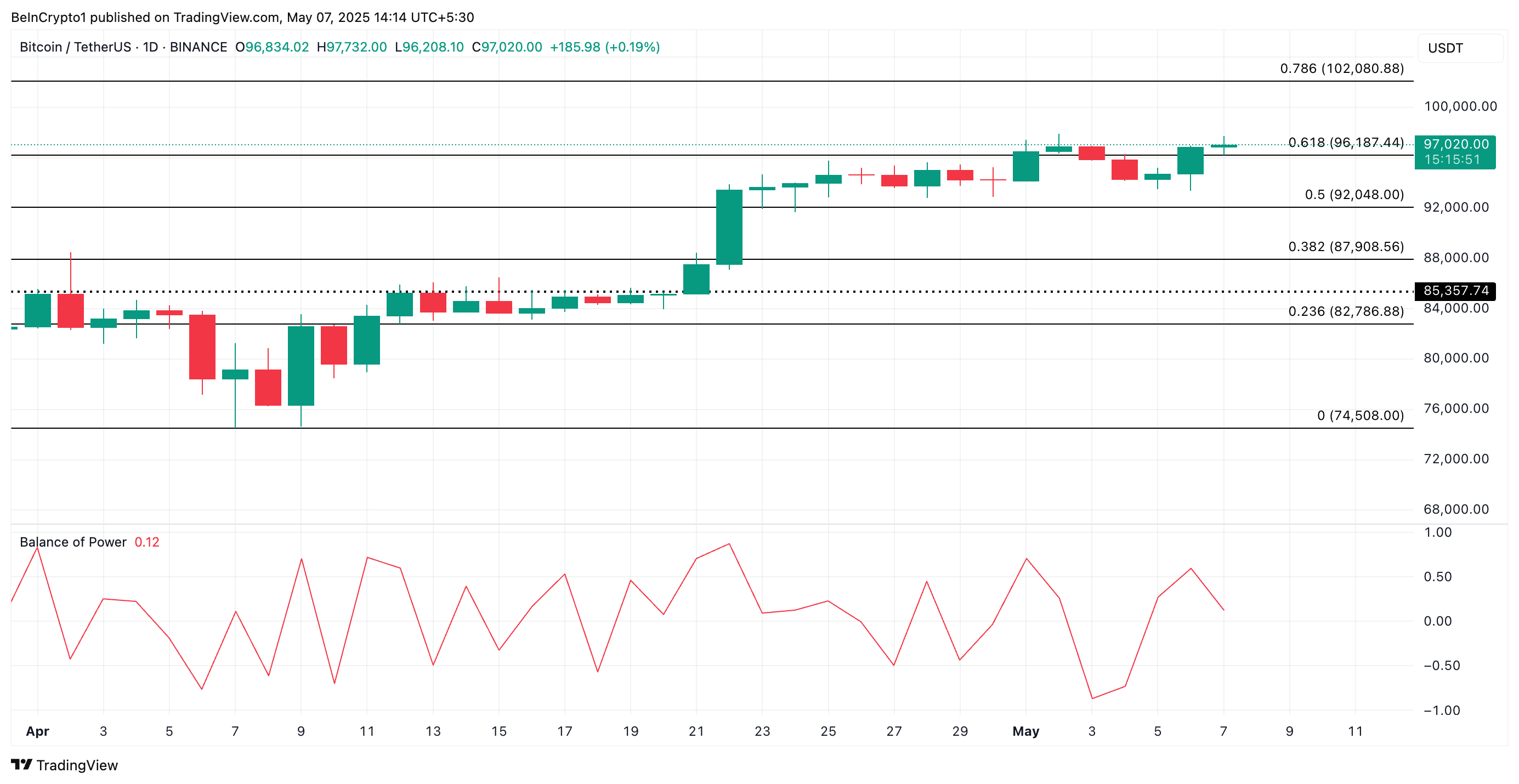

Ah, Bitcoin! It preens at $96,679 (give or take a cent), suddenly feeling robust after a 2% jog upward—in financial circles, a “sprint.” Balance of Power? A delicate 0.10, which in technical parlance means, “Buyers are huffing and puffing while sellers look sulky.”

The BoP is that rare idiosyncratic creature attempting to weight buyers versus sellers by examining closing prices and trading ranges—like a referee tallying fouls in a dance competition. When positive, it’s a bullish fanfare; when negative, someone’s lost the sheet music.

Should demand erupt and the FOMC not stomp the fun, Bitcoin might well pirouette to a dazzling $102,080. Then again…

Let’s not get carried away. Should volatility unleash its inner poltergeist, we may well revisit $96,187 en route to the especially dreary $92,048. What is trading if not an elaborate game of Russian roulette, only with more champagne and emojis? 🍾😉

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-07 13:47