- U.S lawmakers want to ban CBDCs, but 94% of central banks are not so sure

- Stablecoins have been adopted cautiously amid regulatory concerns

As an analyst with a background in finance and economics, I find the ongoing debate surrounding Central Bank Digital Currencies (CBDCs) and stablecoins intriguing. The recent U.S House of Representatives’ bill to ban the Federal Reserve from issuing a CBDC seems out of sync with the global trend. According to a survey by the Bank for International Settlements (BIS), 94% of central banks are now exploring CBDCs, up from 90% in 2021.

Although the US House of Representatives has approved a legislation prohibiting the Federal Reserve from creating a Central Bank Digital Currency (CBDC), there’s been a surge of global curiosity and exploration into this digital monetary innovation.

Findings of the survey

Based on a recent study conducted by the Bank for International Settlements (BIS), it was found that an impressive 94% of central banks have begun investigating Central Bank Digital Currencies (CBDCs), which is a noteworthy increase from the 90% reported in the previous year.

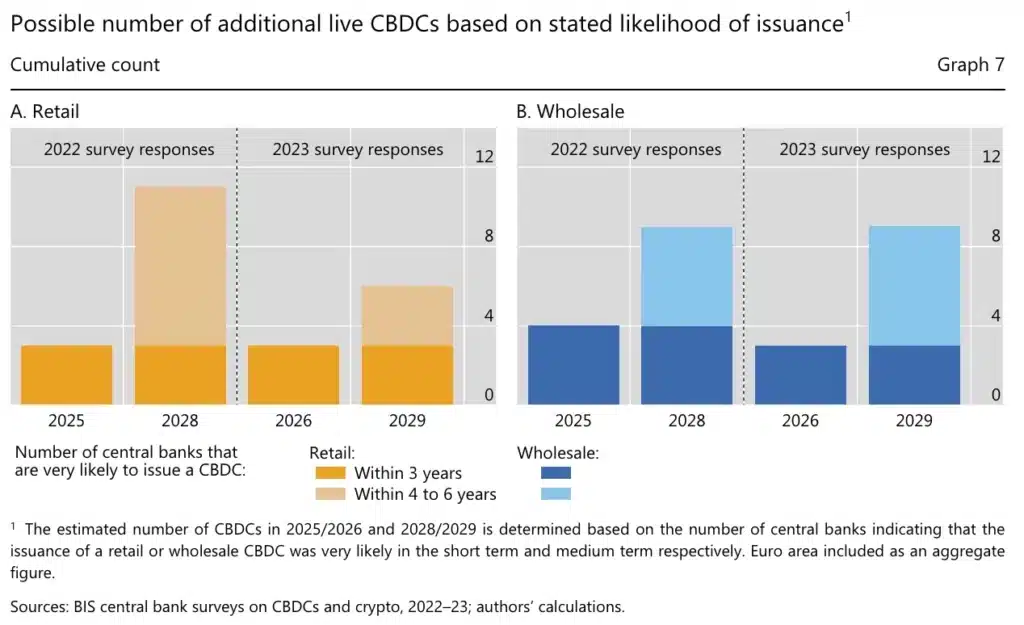

Among the 86 banks involved in the survey, it was discovered that a larger proportion of them are inclined towards introducing wholesale central bank digital currencies (CBDCs) in the ensuing six years compared to retail CBDCs.

As a crypto investor, I can explain that Central Bank Digital Currencies (CBDCs) come in two main types: wholesale and retail. Wholesale CBDCs are designed for transactions between banks and financial institutions on a larger scale, such as inter-bank settlements or cross-border payments. In contrast, retail CBDCs are intended for everyday use by the general public, making purchases easier and more convenient, like buying a cup of coffee at your local café.

Providing further insights on the same, BIS researchers noted,

Based on the findings of the survey, it appears that central banks are acting independently, adopting various methods, and weighing distinct elements in their decision-making processes.

They added,

Approximately sixty percent of central banks exploring retail Central Bank Digital Currencies (CBDCs) are contemplating regulations such as hold limits, ensuring interoperability, providing offline accessibility, and implementing zero-fee policies.

In the financial world, there are concerns that the implementation of a Central Bank Digital Currency (CBDC) could result in heightened government surveillance and control, potentially stifling innovation and infringing on freedoms. The release of this most recent report has brought welcome reassurance to market participants who have been apprehensive about these potential repercussions.

Popular around the world?

It’s intriguing to note that numerous countries worldwide have explored the concept of digital currencies for quite some time, with China taking an early lead in this area. Notably, Nigeria and the Bahamas were amongst the initial nations to introduce their central bank-issued digital currencies (CBDCs).

As a crypto investor, I’ve noticed some contrasting views on central bank digital currencies (CBDCs) between myself and former U.S. President Donald Trump. During a campaign speech in New Hampshire, he expressed strong opposition to the idea. If re-elected, he vowed to prevent the creation of a U.S. CBDC, viewing them as a significant risk to individual freedoms. He cautioned against their implementation, labeling them as “dangerous threats.”

“In my capacity as your president, I will vehemently oppose the establishment of a central bank digital currency. This form of currency could potentially grant our federal government unfettered authority over your financial transactions.”

Earlier this week, he had also claimed,

Stablecoin adoption lags behind

In advanced economies, while central banks are actively investigating Central Bank Digital Currencies (CBDCs), the usage of stablecoins has been fairly limited so far.

As a market analyst, I can tell you that as of May 2024, the aggregate value of all cryptocurrencies reached an impressive figure of $2.7 trillion. However, not all parts of this expansive market share equal size. In particular, stablecoins, which are a specific category of cryptocurrencies known for their price stability, accounted for merely 6% of the entire crypto market capitalization. This equates to approximately $161 billion in value.

The significant difference indicates that while major cryptocurrencies have firmly established themselves, the adoption of stablecoins has been more tentative.

Shedding light on the same, the report concluded,

Regarding cryptocurrencies, the survey results reveal that so far, stablecoins are seldom employed for transactions beyond the digital currency community. Additionally, approximately two-thirds of the questioned jurisdictions have established or are in the process of creating regulations to oversee stablecoins and other cryptoassets.

As events unfold, it’s intriguing to consider the impact that debates surrounding digital currencies may have on future economic strategies and financial advancements around the world.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-15 12:08