As a seasoned researcher with years of experience navigating the volatile crypto markets, I find myself intrigued by the current state of Bitcoin (BTC). The fear among investors due to escalating geopolitical tensions and the Fed’s potential interest rate cut adds an extra layer of complexity. However, it seems that whales are taking advantage of this market condition, buying the dip and holding strong.

Financial analysts anticipate that the Federal Open Market Committee will lower interest rates during their gathering on September 18th. Yet, rising political conflicts in the Middle East and Africa have been causing unease among investors.

From my perspective as a crypto investor, I find it intriguing that despite the anticipated rise in BTC due to the easing of U.S inflation, it surprisingly failed to hold its $60,000 psychological support level. Instead, it was trading at a 3.10% discount when I last checked.

A silver lining emerges

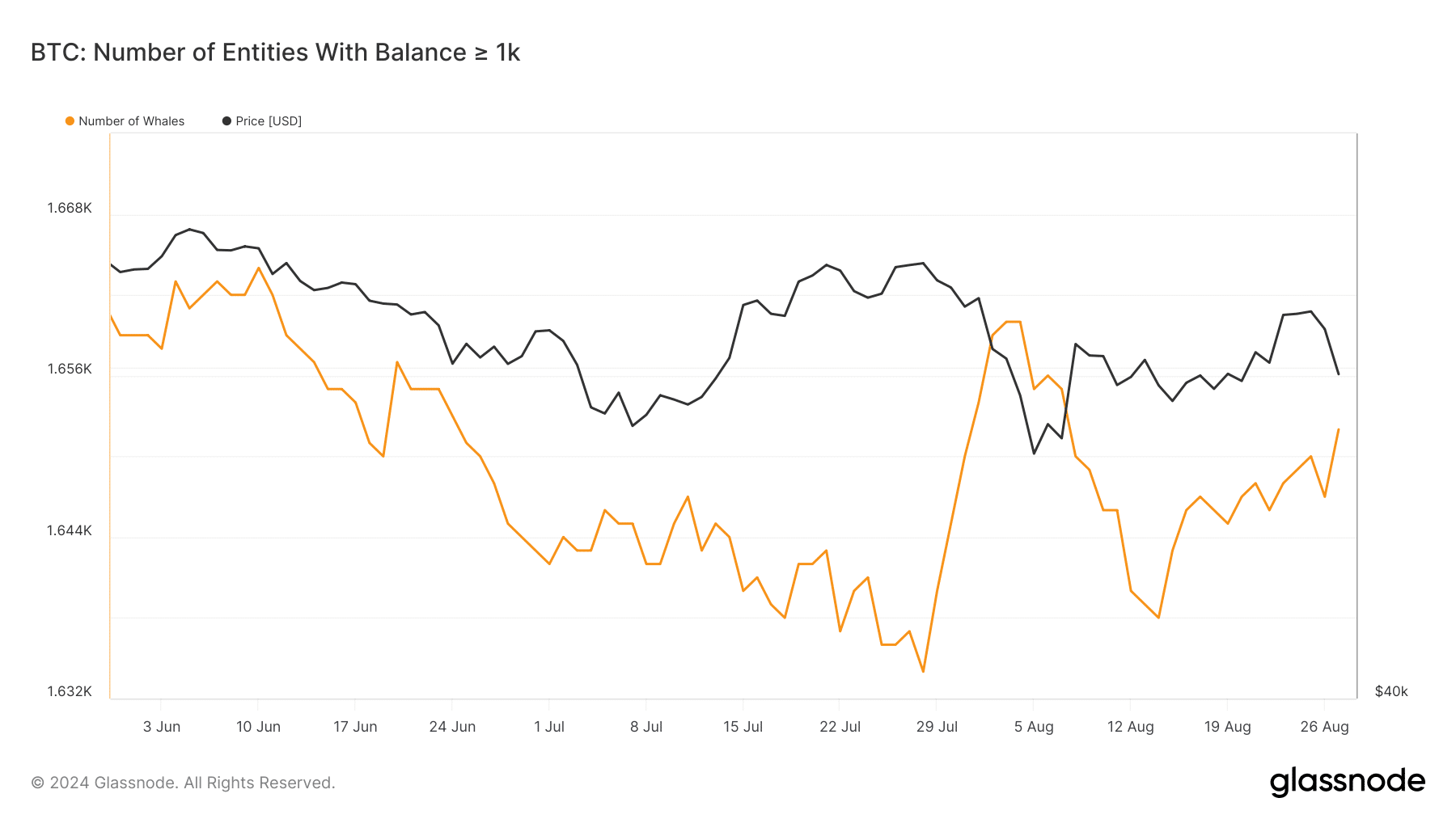

It’s worth noting that AMBCrypto’s August 2024 study revealed that ‘whales’, or large investors, have been taking advantage of market dips and holding onto their cryptocurrency investments (HODLing). Intriguingly, the number of these whale investors has also seen a steady rise since it dropped to a minimum of 1,638.

Absolutely, large-scale investors view the present market situation as a chance to invest for the long term.

In early August, it was the whales who showed strong support for Bitcoin, but there was less enthusiasm among individual traders. Instead, they preferred investing in alternative cryptocurrencies. However, starting from 25th August, the tide turned, with more people showing interest in Bitcoin again as evidenced by a significant increase in active addresses.

From my analysis, the pace of BRC-20 inscriptions noticeably slowed down in August compared to its peak in April, which stood at 18,085. Despite an increase in newly recorded inscriptions last month (552), the total volume still fell significantly short of its previous high.

As a crypto investor, I found myself closely watching the latest on-chain advancements, but one aspect caught my attention on August 28: the BTC OI-Weighted Funding Rate turned negative. This shift suggested that those trading perpetual contracts were predominantly adopting a bearish stance.

Factors that could spark a short-term bullish reversal

21Shares’ U.S. Business Head, Federico Brokate, shared in an interview with AMBCrypto, that inflows into Exchange-Traded Funds (ETFs) may mark a significant shift in Bitcoin’s price trend.

“It seems that the entities who are expected to make the largest or most extended purchases of Bitcoin Spot ETFs have yet to join the market.”

As institutional investors like pension funds and asset managers increase their investments in high-risk assets, Bitcoin’s $100k target may become more attainable. Moreover, the upcoming introduction of Exchange Traded Funds (ETFs) based on Solana could bring about substantial changes within the broader cryptocurrency market.

21Shares was queried by AMBCrypto regarding potential ETFs for SHIB and DOGE. However, Brokate mentioned that their focus at present lies with more established cryptocurrencies for their Exchange Traded Fund (ETF) options, recognizing the impact of memecoins in popular culture.

Although not dismissing the potential for future memecoin ETFs, the exec stressed the need for clear utility and value propositions in ETF product development.

Headwinds for the crypto market

Although on-chain signals and broader economic trends appear to be supportive of cryptocurrencies, security issues such as hackings, thefts, and ransomware attacks are proving to be a significant hurdle in the growth of the digital currency market.

2024 saw a significant resurgence of crypto thefts, with hackers making off with more than $1.58 billion in digital assets by July. This represented an impressive 84% jump compared to the previous year, during which hacking incidents had noticeably decreased.

To gain a closer insight into how investors protect their assets from crypto hacking incidents, AMBCrypto carried out an exclusive poll. The findings showed that a significant 78% of participants viewed Binance and Coinbase as the safest cryptocurrency trading platforms.

Approximately 43% of respondents prefer using hardware wallets for protecting their digital resources, as detailed in the comprehensive report published by AMBCrypto in August 2024.

Dive into AMBCrypto’s August 2024 crypto market report

This comprehensive report dives deeper than just Bitcoin and security. It explores emerging trends like the surge in staking and restaking on Ethereum, and the growing popularity of memecoins on Solana.

The report even talks about a big development in the world of stablecoins and discusses factors that might help the NFT market recover.

You can download the full report here.

https://www.slideshare.net/slideshow/embed_code/key/8lhbBYHWv9dUMZ

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-29 16:40