On this day, beneath the vast digital sky, the token known as IP arose like a plucky underdog amid a retreat in trading fervor. Climbing a modest 3%—a small but mighty ascent—it extended its bullish odyssey that began on July 11. In a world where fortunes ebb and flow like the tides, IP’s rise is a saga of grit and guile. 🚀

Over the past week, IP’s price has soared more than 20%, defying the broader market’s downward tug-of-war. It’s as if the token had unearthed an elixir of prosperity that others could only envy. In this arena of shifting sands, IP stands as a beacon of audacious hope.

Spot Inflows: $5 Million and Counting, and It’s Only the Beginning

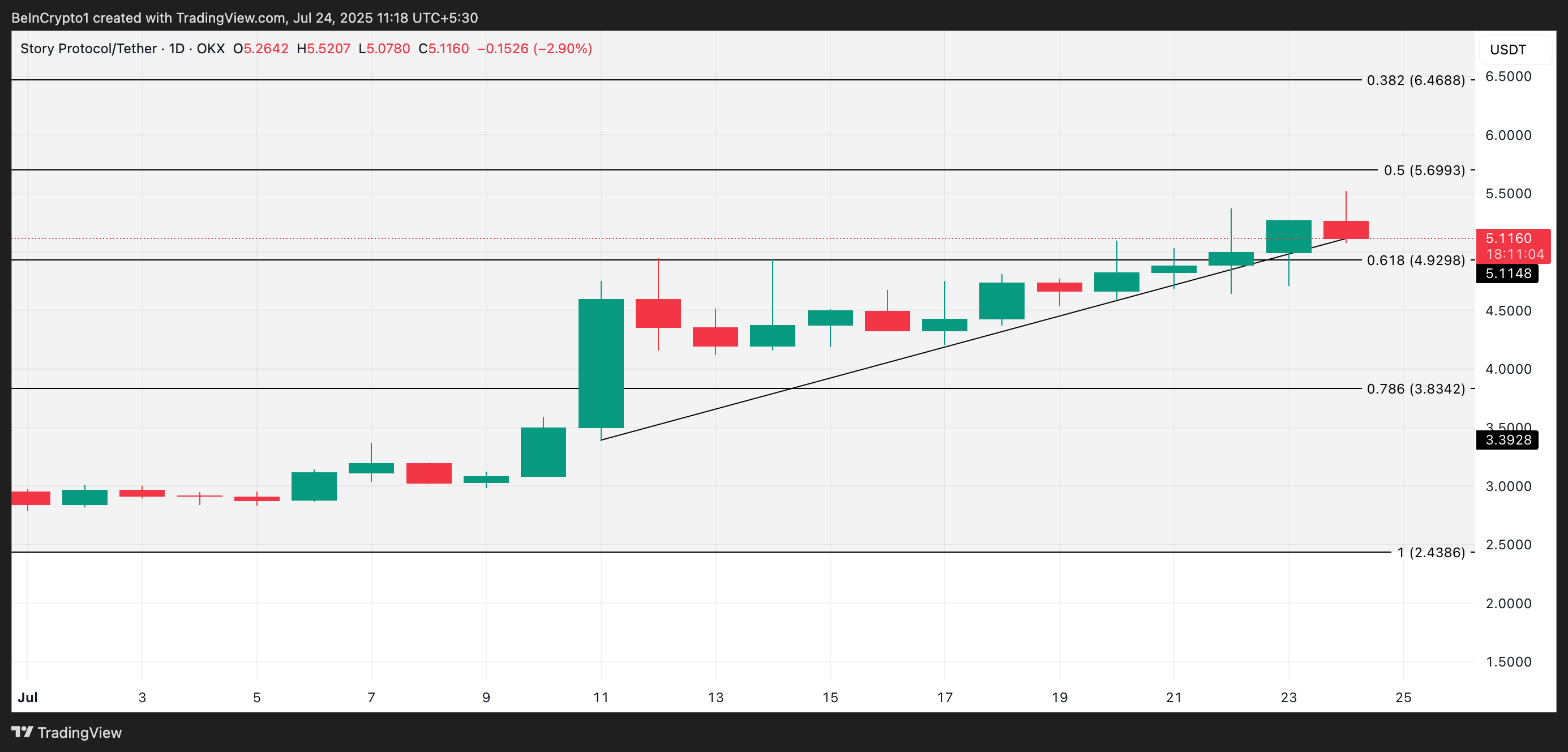

Traded at a modest $5.11, IP holds firm above a key technical support that has long served as its rock-solid backbone. A glimpse at the IP/USD one-day chart reveals that since July 11, our token has faithfully ridden the crest of an ascending trendline—a line that whispers tales of higher lows and unwavering buying interest. It’s a narrative of resilience, where even a token can dream of greatness.

This dynamic support, much like an old friend in a storm, continues to fuel IP’s price uptick despite the market’s occasional fits of weakness. It’s a reminder that even when the winds of fortune wane, true grit keeps one’s course steady. The token’s journey is a testament to tenacity—and perhaps a dash of destiny. 🚀

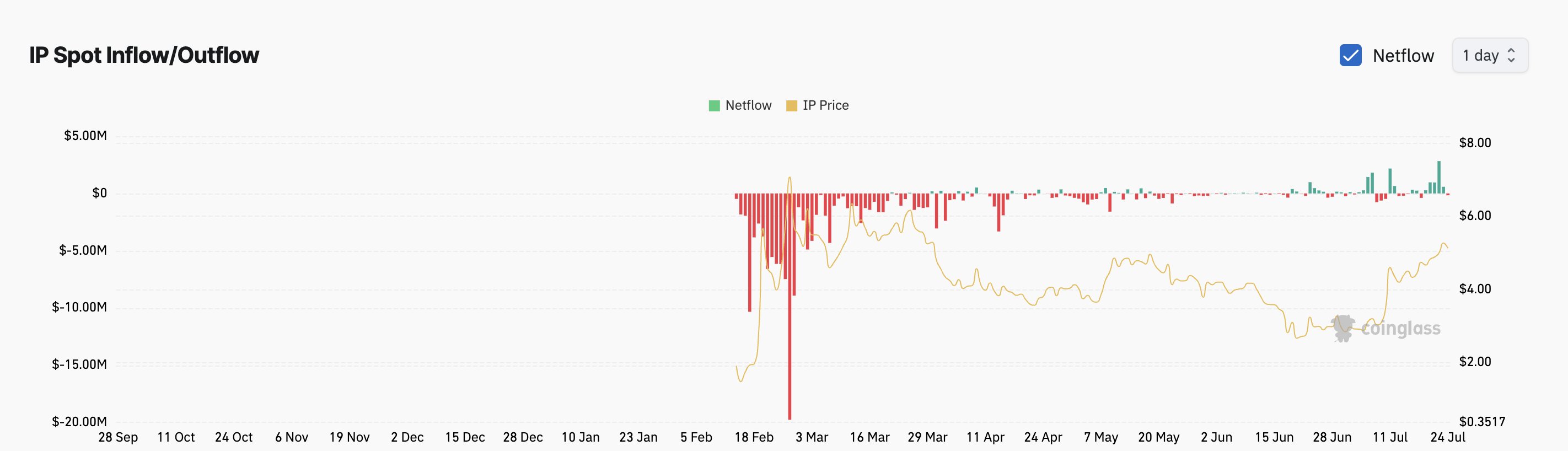

Moreover, the spot market has been abuzz with a steady stream of inflows into IP over the past few days—a sign that investors, with their eyes on the prize, are pouring faith into this unlikely hero. According to Coinglass, even as the market-wide profit-taking trend reared its ugly head, IP has seen consistent spot net inflows exceeding $5 million over the past four days. It seems the token has captured hearts, one dollar at a time.

When capital flows like this, it’s clear that more money is entering the asset via spot purchases than exiting—a clear signal of growing demand and confidence in IP’s near-term prospects. In a realm where fortunes change with the wind, such steady inflows are nothing short of a miracle. 😏

Although today has witnessed a modest $157,000 net outflow from the spot market—as some traders cash in their gains—the overall sentiment around IP remains one of cautious optimism. Much like a stoic farmer in a drought, IP knows that today’s loss is but a chapter in a longer tale of ambition and hope.

Futures Traders: Betting Big on IP’s Rally

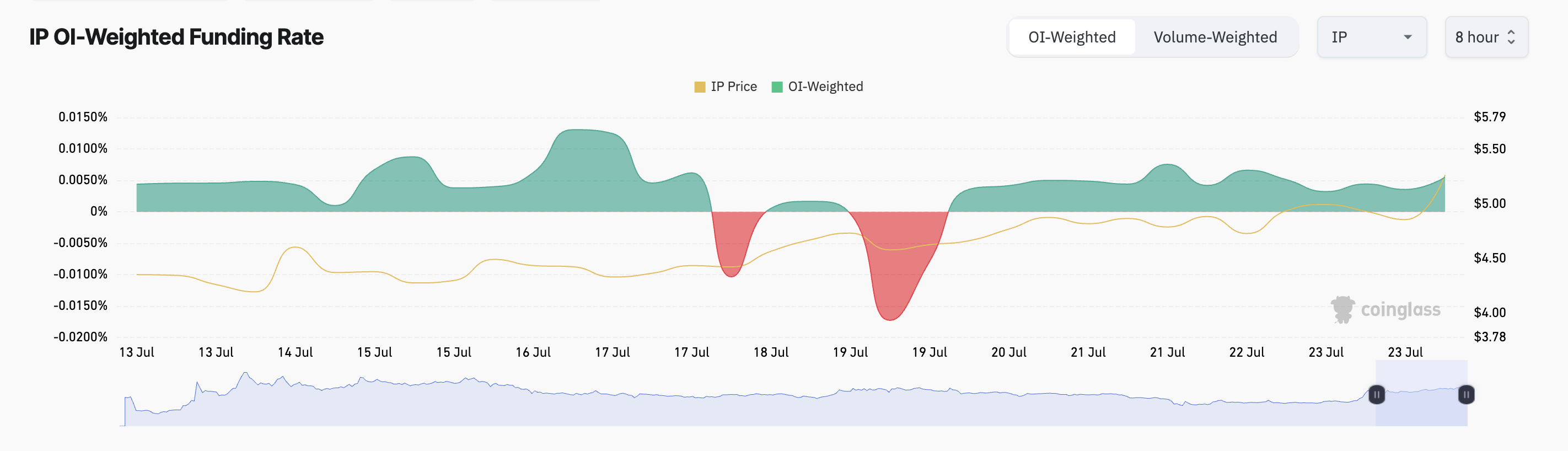

The positive on-chain activity only reinforces the belief in IP’s continued ascent. This sentiment is echoed in the world of IP futures trading, where the funding rate—a fee exchanged between long and short traders—has remained positive since July 20. As of this writing, the metric stands at a modest 0.0055%. In the grand tapestry of market lore, even a small positive funding rate is a clarion call for bullish sentiment. 🚀

This funding rate, a periodic fee that keeps contract prices aligned with spot prices, is a subtle dance between long and short positions. A positive rate means that those holding long positions are paying a premium—a sign that the market’s collective wisdom sees a bright future for IP. In a way, it’s as if the token were the unlikely hero in a story where every character vies for a piece of the action. 😏

IP’s positive funding rate signals that its futures traders are leaning heavily toward long positions, further bolstering the token’s rally. It’s as if the token, with all its quirks, has become the darling of the futures market—a symbol of hope in an otherwise desolate landscape.

Breaking Through the $4.92 Wall: Momentum Points to a March High

IP’s ongoing rally has pushed it past a long-standing resistance at $4.92—a barrier that once seemed insurmountable. Should this level solidify as a support floor, the token might very well continue its journey toward $5.59, a peak reminiscent of its days in March. The token’s odyssey is akin to that of a determined pioneer, facing down old foes and charting new territories. 🚀

However, like any great tale, there is the ever-present shadow of uncertainty. Should demand begin to wane, IP could see a retracement, testing the $4.92 support once more. And if that floor fails to hold, a deeper correction might await—a descent toward $3.83 that would remind us all of the harsh realities of the market. Yet, for now, IP rides on—a token forged in the fires of ambition and hope, buoyed by the promise of a brighter tomorrow. 😏

Read More

- Best Controller Settings for ARC Raiders

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- The Best Members of the Flash Family

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- Legacy of Kain: Ascendance announced for PS5, Xbox Series, Switch 2, Switch, and PC

- 24 Years Later, Star Trek Director & Writer Officially Confirm Data Didn’t Die in Nemesis

- Best X-Men Movies (September 2025)

- 7 DC Villains Ruined In Movies

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- 10 Best Anime to Watch if You Miss Dragon Ball Super

2025-07-24 10:14