- 1INCH bulls show signs of life after retesting a major support level.

- Will low network usage dampen sentiments and affect hopes of a major rally?

As a seasoned crypto investor with over a decade of experience under my belt, I find myself intrigued by the recent developments surrounding 1INCH. The bullish signs are certainly promising, with the token bouncing back after testing a major support level and demonstrating resilience in the face of market volatility. However, as we all know too well, past performance is not always indicative of future results, and this holds especially true for cryptocurrencies.

1inch (1INCH) has widened its distance from its recent lows during the last 24 hours, a boost likely due to the renewed enthusiasm sparked by Trump’s victory in the U.S elections. However, will this expansion in recovery prove fleeting or herald a prolonged bullish trend?

1INCH has found it difficult to break free from its lower price range that it’s been stuck in since August, losing much of the growth it had made over the past year. Yet, the bulls have persistently tried to regain control, leading to a 15% surge from its most recent low point.

In the past day, many leading cryptocurrencies experienced a substantial increase, largely due to the excitement surrounding Donald Trump’s victory in the U.S elections. It’s important to mention that this upward trend started following the digital token 1INCH testing a significant support point at around $0.22.

In simpler terms, the recent recovery confirmed the reliability of the same underlying structure once again. However, the real uncertainty lies in whether this time it will successfully trigger a significant surge, as 1INCH had previously surged by more than 200% when bouncing off the same support line back in September 2023.

It had also demonstrated some consolidation back then.

1INCH on-chain data may not be as convincing

1Inch DeFi, though it might have hinted at a possible surge earlier, doesn’t seem to be as impressive in its recent performance compared to its past. Once a leading player in the DeFi sector, significant shifts over the last three years have altered its standing.

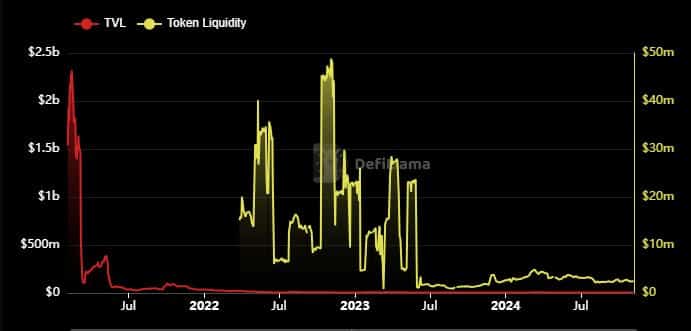

For instance, the TVL (Total Value Locked) surpassing $2 billion faced significant withdrawals in 2021 and hasn’t regained its strength since then. To give you an idea, as of now, 1inch boasts a TVL of $4.5 million. Additionally, the token liquidity suffered substantial losses in the year 2023.

Liquidity for the tokens reached a high of $48.79 million in November 2022, however, it has decreased significantly and now stands below $5 million.

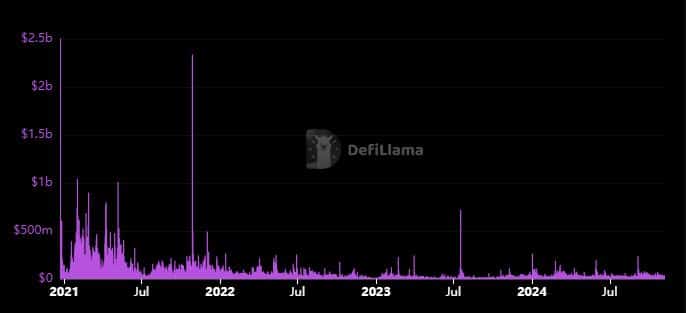

1Inch’s daily on-chain volume has found it challenging to bounce back. To put things into perspective, the network was consistently handling more than $100 million in daily transactions from January to May 2021. However, reaching these levels again seems difficult since then.

Read 1inch’s [1INCH]Price Prediction 2024–2025

In certain instances throughout this year, the on-chain transaction volume has spiked significantly, exceeding $100 million. As late as September, this occurred. Such events might suggest a potential increase in demand for the network if the market undergoes a significant bull run.

Despite the data showing that 1inch has been functioning at only a small portion of its maximum capacity, it’s plausible that increased competition from emerging and more efficient DeFi platforms is a significant factor behind this decline.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-07 10:47