- BTC is close to retesting its all-time high as it rises to the $70,000 price level.

- Indicators are showing that a bull run might be on the horizon.

As an analyst with over two decades of experience tracking the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. However, the current state of Bitcoin [BTC] is reminding me of the excitement that surrounded its meteoric rise back in 2017. The indicators are pointing towards a potential bull run, but as always, caution should never be thrown to the wind.

With Bitcoin [BTC] maintaining its position above $70,000, investors are growing more hopeful about the possibility of a Bitcoin price surge, also known as a ‘Bitcoin bull run’. By examining crucial factors like the Network Value to Transactions (NVT) ratio, active addresses, and current market trends, we can discern whether Bitcoin is preparing for a prolonged bullish trend or if some caution may be advisable.

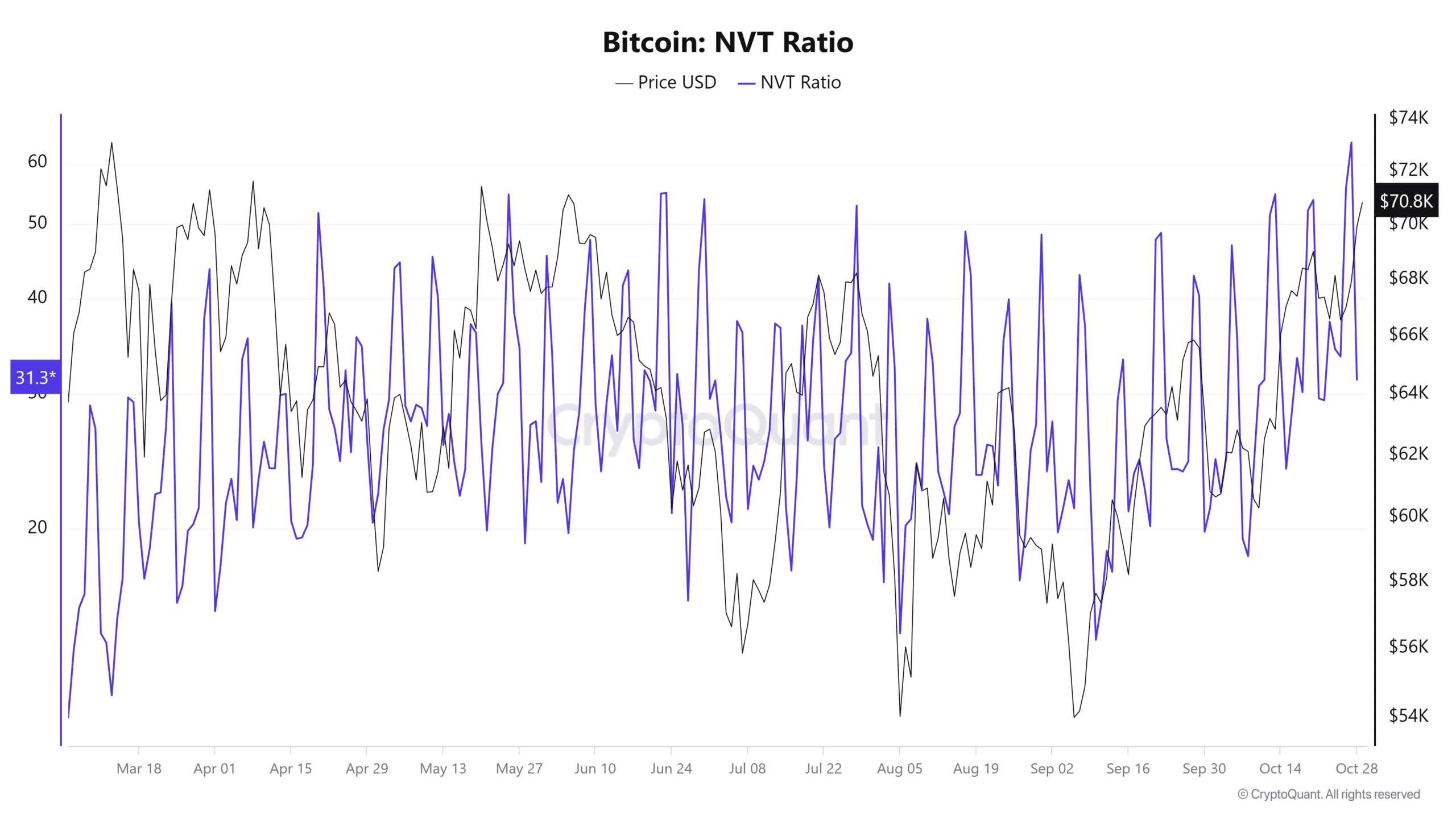

NVT Ratio signals stability for Bitcoin bull run

The Network Value to Transactions (NVT) ratio serves as a comparison to Bitcoin’s “price-to-earnings” ratio, offering a glimpse into whether the asset appears overpriced or underpriced relative to its network activity levels.

As a researcher, I’m observing that the Network Value to Transactions (NVT) ratio indicates a well-balanced and robust market for Bitcoin. This suggests that the network is effectively managing increased demand without any clear indications of overloading or heating up.

historically, a consistent or moderate Non-Venture Tokens (NVT) ratio throughout Bitcoin’s price increase indicates a solid basis for a bull market because it implies the upward trend is robust.

The positive Non-Volatility Trend (NVT) indicates that the present price movement could possess the durability required to extend a prolonged bullish phase, suggesting continued upward momentum.

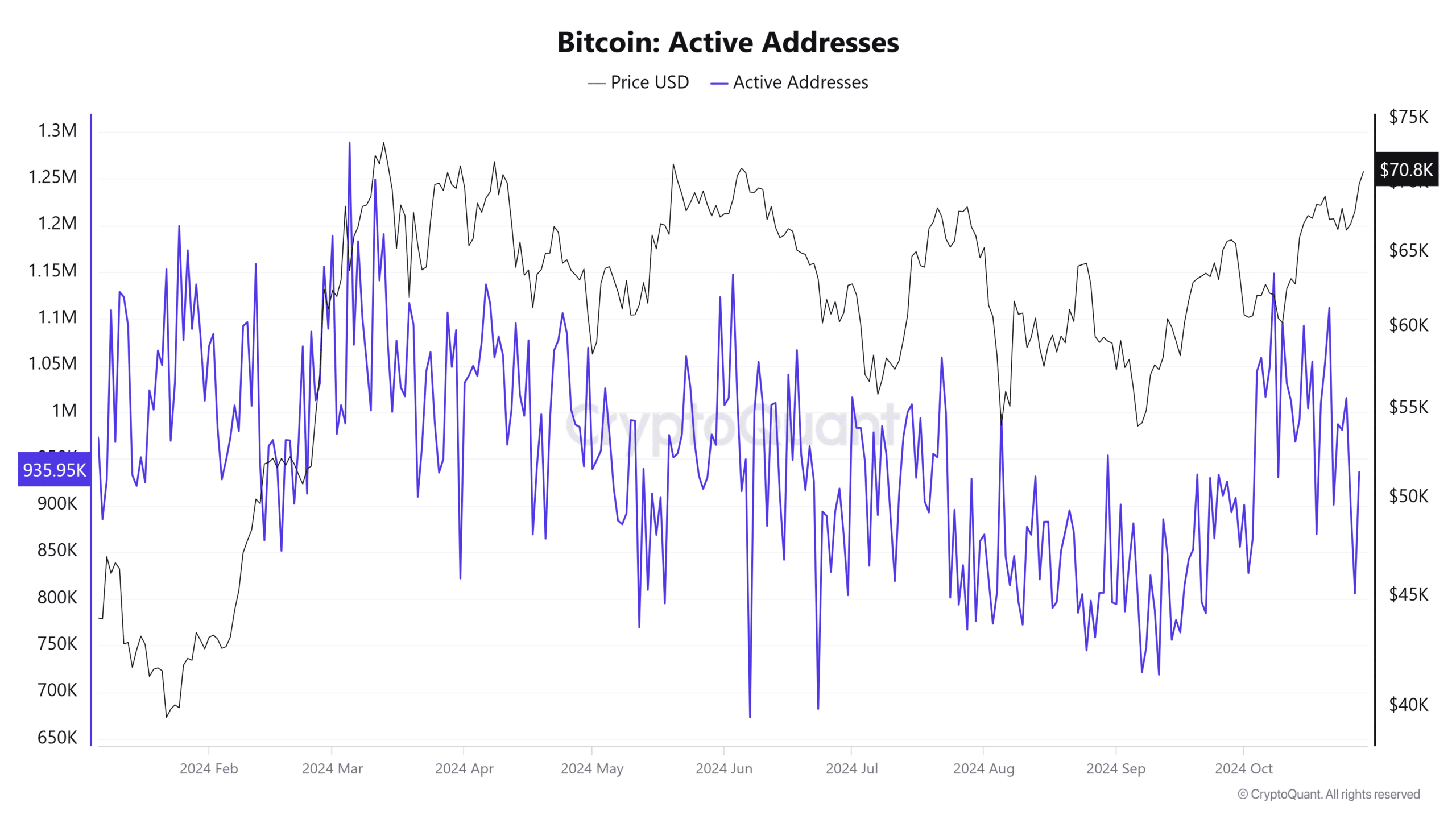

Rise in active addresses adds fuel to bullish sentiment

An increase in actively used Bitcoin accounts recently strengthens the argument for an upcoming Bitcoin price surge. Now that the number of active addresses regularly exceeds 935,000, it’s clear that the network’s activity is thriving and growing steadily.

Boosting active Bitcoin addresses usually reflects increased user involvement, leading to a rise in its demand. This pattern, frequently linked with price growth, may suggest growing enthusiasm towards this digital asset.

Thus, the continuous increase in active addresses might strengthen the current surge, contributing to the overall story suggesting a potential bull market.

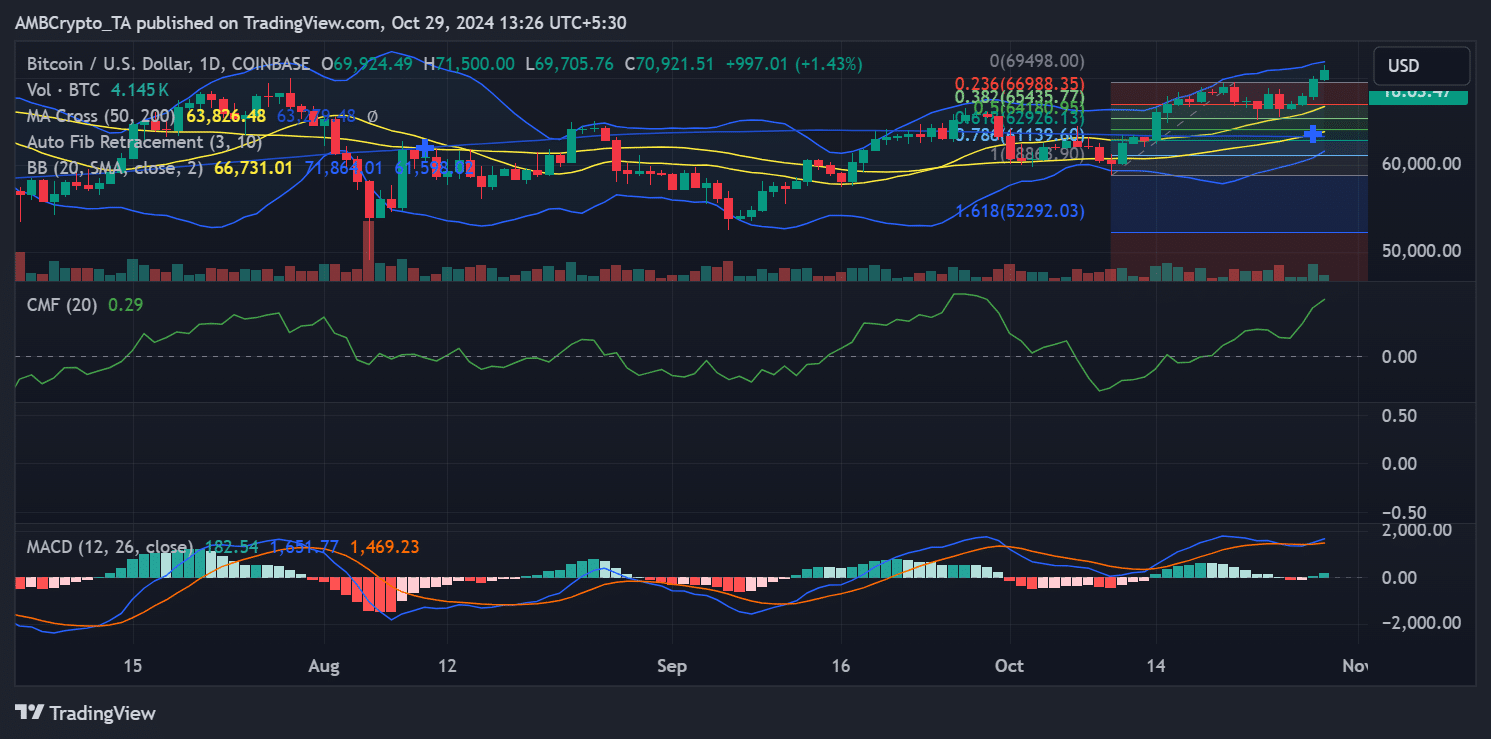

Technical indicators support Bitcoin Bull Run potential

The graph showing Bitcoin’s price suggests numerous positive indicators, implying a possible continuous rise in value. Lately, Bitcoin surpassed significant barriers of resistance and has maintained strong stability near its 50-day moving average, offering reliable backing.

This indicator has often served as a foundation for bullish momentum.

Moreover, the Chaikin Money Flow (CMF) stands at 0.29 positively, suggesting robust buying activity. Simultaneously, a recent MACD crossing over provides additional support to this bullish trend.

From my perspective as an analyst, the alignment of these technical indicators seems promising and complements Bitcoin’s underlying robustness, substantiating a compelling argument for an upcoming Bitcoin bull market.

To put it simply, the essential characteristics and technical signals of Bitcoin suggest that conditions could be ripe for a possible price surge, or a bull market.

A balanced NVT ratio, growing active addresses, and supportive technical strength all hint that Bitcoin’s upward momentum could persist.

Read Bitcoin (BTC) Price Prediction 2024-25

People monitoring the market for indications of a Bitcoin price surge might discover some positive signs from these statistics.

Keeping a watchful eye on significant markers is crucial for assessing the longevity of this surge, as there’s a possibility that Bitcoin might reach unprecedented peak values in the upcoming months.

Read More

2024-10-30 01:12