- We explore the possibility of a Bitcoin supply shock after recent market observations.

- Bitcoin velocity pivots, indicating that Bitcoin is well into a highly volatile phase.

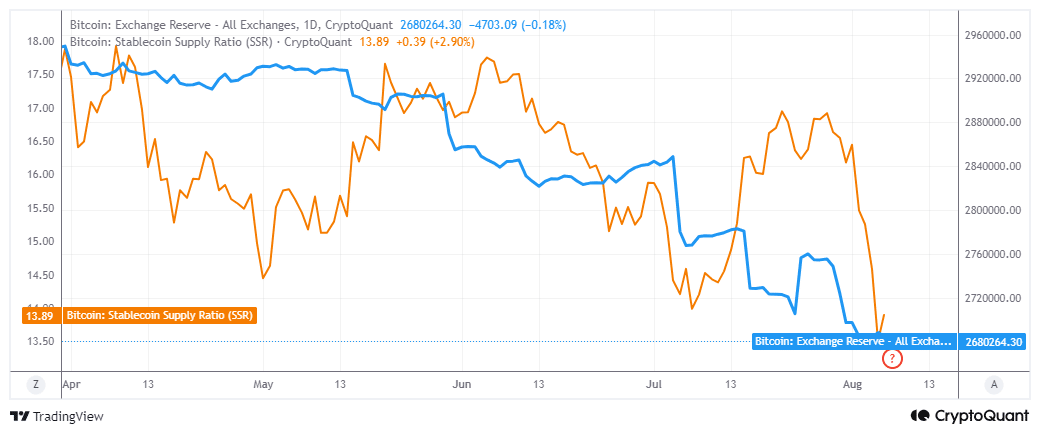

As a seasoned crypto investor with battle scars from numerous market cycles, I can confidently say that recent observations have me on high alert for a potential Bitcoin supply shock. The latest crash has only served to heighten my suspicions, as the exchange reserves indicator plummeted without a noteworthy uptick despite the massive sell-off. This, combined with the spike in the Bitcoin stablecoin supply ratio, suggests that we might be on the brink of another relief rally.

Earlier this year when Bitcoin [BTC] experienced another halving, discussions arose suggesting an imminent shortage in its supply. Given the recent market downturn, the likelihood of a Bitcoin supply shortage has significantly increased.

For Bitcoin, an event referred to as a “supply shock” could happen if the amount held in exchanges plummets significantly. Meanwhile, the demand could either stay steady or even increase dramatically. This implies that while the availability of Bitcoins decreases drastically, the interest and desire for them may persist or even escalate.

Such a scenario would likely lead to an imbalance in favor of a rapid upside.

During the recent market downturn, Bitcoin’s performance hinted at an impending disruption in its supply chain.

One clear indication bolstering this prediction was noticing that the Bitcoin reserve balance on exchanges has decreased compared to last week’s level.

In reality, it stabilized rather than significantly increasing during the crash, even though there was an enormous push for selling on the market.

In the past two days, we’ve noticed an increase in the supply of Bitcoin stablecoins following a decrease, as reported by AMBCrypto.

Making this observation is significant since historically, when this particular indicator increased, it has preceded a Bitcoin price surge. Therefore, it could potentially signal another price increase for Bitcoin.

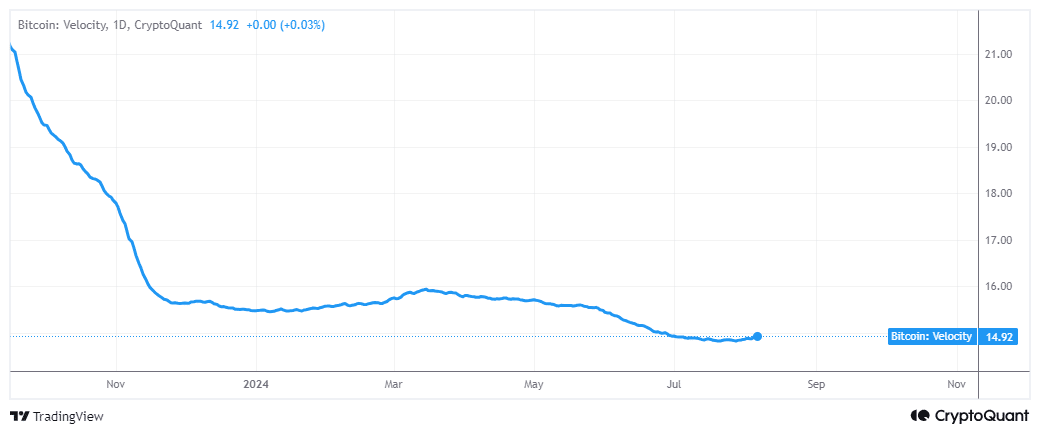

Bitcoin velocity pivots

There are several factors influencing the speed at which Bitcoin is traded (its transaction frequency). For instance, surges of enthusiasm, be they optimistic or pessimistic, can cause an increase in its trading speed.

When liquidity flows out of the market and BTC demand goes low, the velocity tends to dip.

As a market analyst, I observed a significant upward trend in the cryptocurrency market commencing in 2020, marked by a surge of enthusiasm and liquidity. This bullish momentum culminated in August 2022, following the FTX crash and the subsequent depegging of stablecoins that year.

As a crypto investor, I’ve noticed that the recent spike in Bitcoin’s momentum began in January and peaked in March. During this period, the market seemed to be testing the waters, which ultimately resulted in an upward trend.

At the current moment, the rate at which Bitcoin is being circulated suggests a shift towards an upward trend. If this trend continues, it could be a sign that Bitcoin is gearing up for another period marked by high volatility and increased excitement in its market.

This will all depend on the level of liquidity in the market.

But what would happen in the market, there was a strong Bitcoin velocity surge?

It seems that the decrease in Bitcoin supply available on exchanges suggests a persistent positive outlook for the long term, mainly due to increasing involvement from ETFs. Moreover, these bullish sentiments have not yet led to the wildly forecasted price predictions being realized.

A higher speed, coupled with high demand, could potentially benefit the buyers. It’s also likely to feature significant drops, similar to the one we’ve recently experienced.

Huge price movements would occur if a supply shock, likely pushing up Bitcoin’s velocity.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-08-08 06:15