- AAVE’s price shot up by 18% in the last 24 hours.

- Selling pressure on the token increased, hinting at a slight price correction.

As a seasoned researcher with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself intrigued by the meteoric rise of AAVE in the last 24 hours. With an 18% surge, it’s not just breaking records but also challenging skeptics like me who often find solace in our cynicism.

As a cryptocurrency investor, I’ve been thrilled to witness AAVE’s impressive surge over the past 24 hours, with its prices climbing significantly and breaking double-digit gains. With this momentum, it seems plausible that the token could continue climbing and potentially break through the $400 mark, as suggested by a well-regarded analyst.

Therefore, AMBCrypto assessed its metrics to find out whether the road ahead is clear.

AAVE bulls are on the move

In the past day, AAVE has separated itself from other leading cryptocurrencies by surging 18%. Currently, each unit is being traded for approximately $378, and its total market value exceeds $5.6 billion.

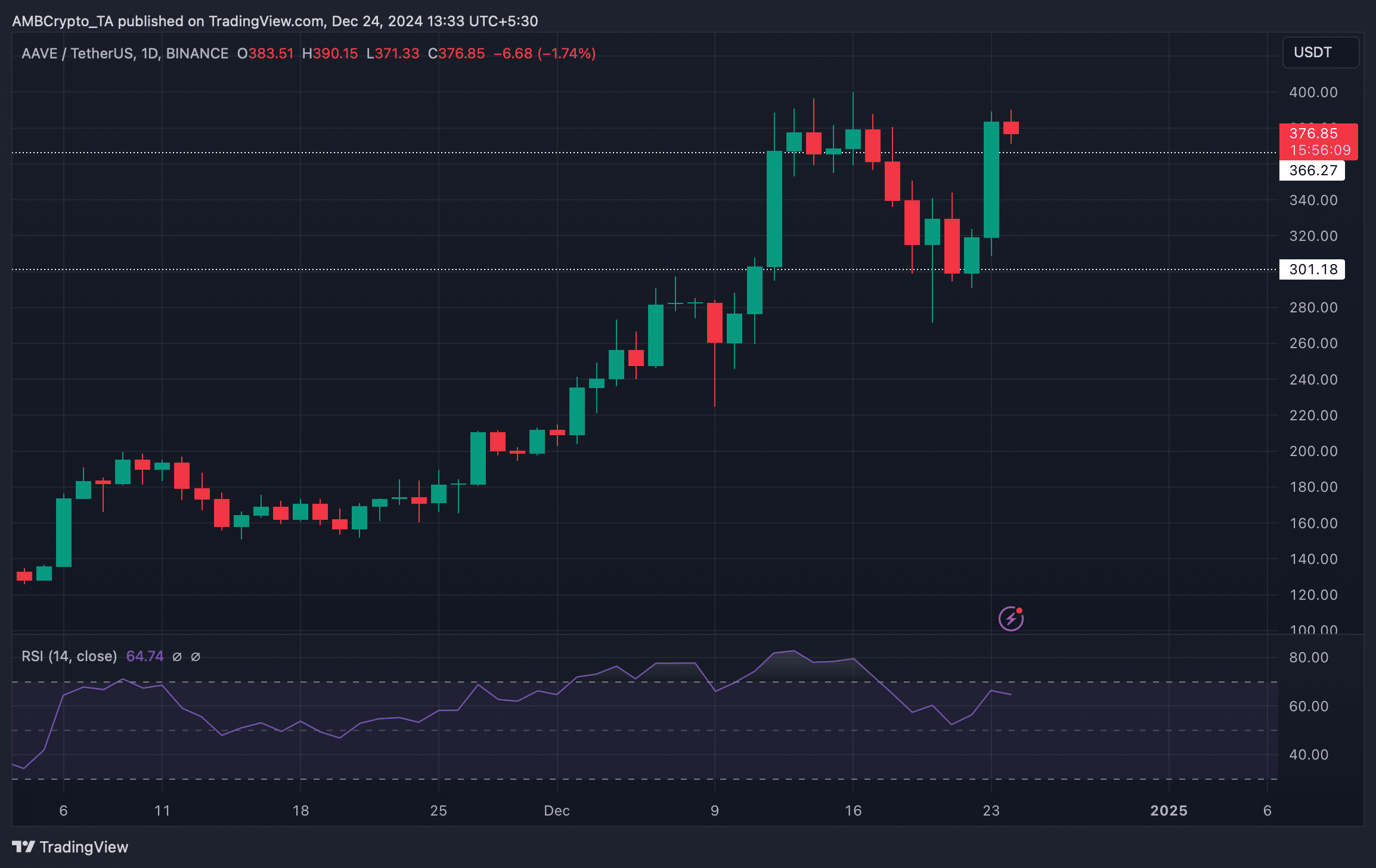

Ali Martinez, a well-known cryptocurrency analyst, recently posted a tweet suggesting potential growth if a specific condition is fulfilled. His tweet indicates that an Adam and Eve pattern may be emerging on the chart of this token. If the token manages to break through the $342 resistance level, it could potentially reach over $400 in the near future.

Specifically, Martinez pointed out that a breakout might cause a 19% increase in price. Luckily, the token accomplished a successful breakout, and currently, it’s on its way to reaching the $400 level.

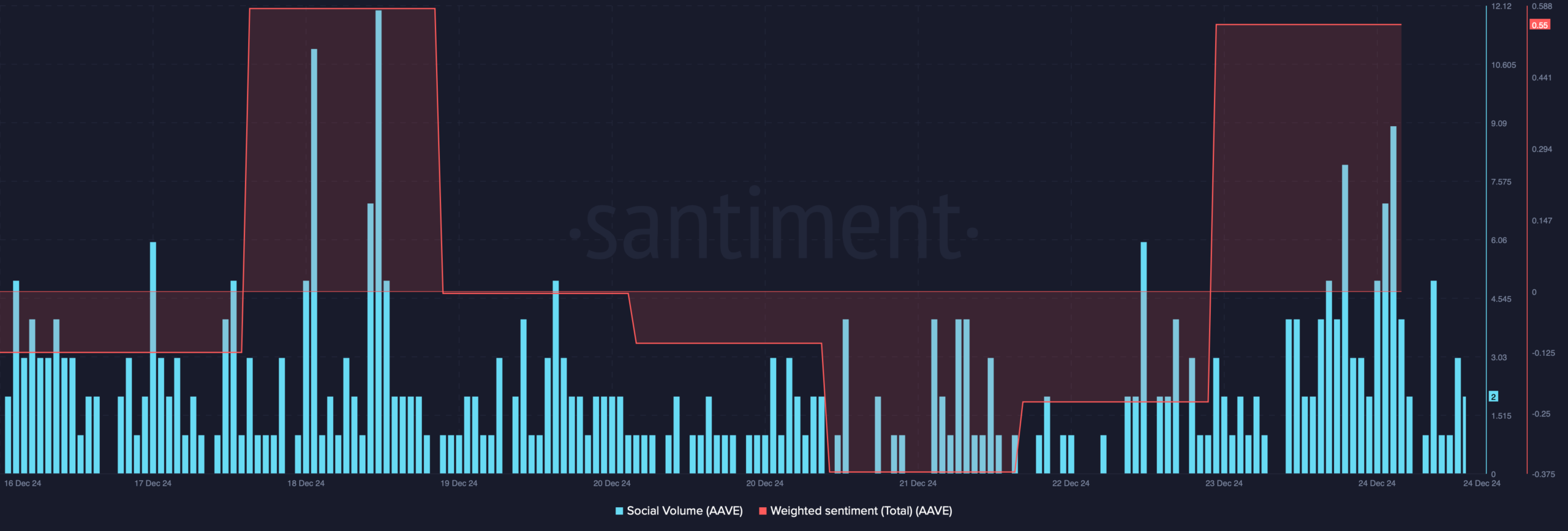

The latest price surge has positively influenced the social statistics of this token as well. For instance, its sentiment score moved towards the positive side, indicating an increase in optimistic feelings about AAVE among investors.

Its social volume also increased—a clear sign of the coin’s popularity in the crypto market.

Odds of AAVE sustaining the pump

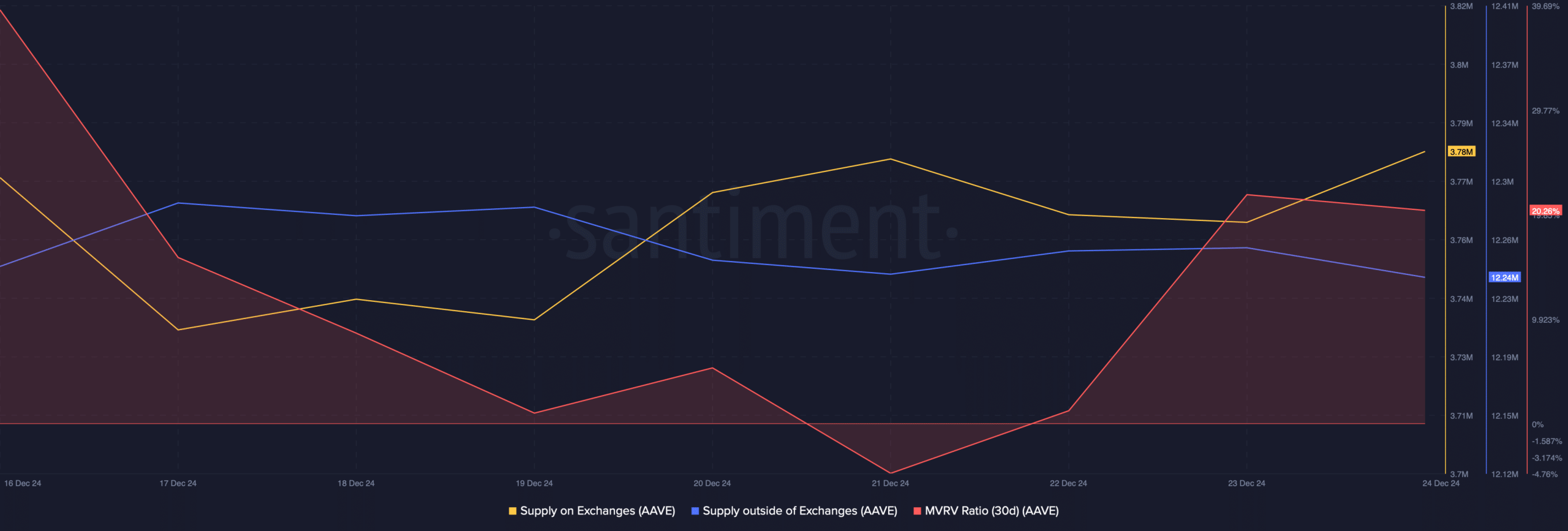

Later on, AMBrypto examined the token’s on-chain information to determine if the current bull run would persist. Upon reviewing the data, it appeared that there had been an uptick in selling pressure over the past few days.

The amount of AAVE available on exchanges went up, but the amount held off-exchange decreased. This pattern, occurring during a bull market, typically suggests that investors are taking their profits, leading to price adjustments or corrections.

Another bearish metric was the MVRV ratio, as it dropped slightly after registering a promising uptick on the 23rd of December.

In line with the previously mentioned indicators, it was found through Coinglass’ analysis that there were more bets against the market compared to those for it. Specifically, the token’s long/short ratio (over a 4-hour period) decreased in the last 24 hours, implying an increase in short positions.

Read Aave’s [AAVE] Price Prediction 2024-25

Should there be a price adjustment, it becomes significant for Aave to examine its support level around $366. If this holds firm, we might expect Aave to resume its upward momentum aiming at $400 over the next few days.

But if the token slips under the support, its price might once again drop to $301.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-12-25 06:15