- Ethereum’s underperformance could delay the much-awaited altcoin season.

- Bitcoin’s rising dominance could derail altcoin performance post-Fed rate cuts.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself cautiously optimistic about the upcoming altcoin season, but concerned about Ethereum’s underperformance and its potential impact on the broader altcoin market. The lackluster performance of US spot ETH ETFs, as evidenced by zero flows on August 30th, is a troubling sign that could delay the much-awaited alt season.

The subdued movement in Ethereum’s [ETH] price and the underperformance of U.S. spot ETH Exchange Traded Funds might postpone the anticipated altcoin market surge. In fact, on August 30th, there were no inflows for US spot ETH ETFs at all.

One analyst referred to the zero flows as ‘sad’ and underscored a lack of interest.

‘I just realised that yesterday’s $ETH flow was a literal zero. For some reason, that’s even more sad than a negative flow. No one on this planet cares about ETH anymore lmao.’

Is ETH underperformance a risk to Alt Season?

In total, the products have experienced a net withdrawal of approximately $477 million since their launch, according to Farside Investors’ data.

As a crypto investor, I’ve noticed that the subpar performance highlighted by Quinn Thompson, founder of Lekker Capital, has had a significant negative impact on the altcoin market.

“The ETH ETFs’ lacklustre performance is a detrimental sign to the rest of the altcoin universe…Bitcoin dominance will rise…ETHBTC is the alt barometer.’

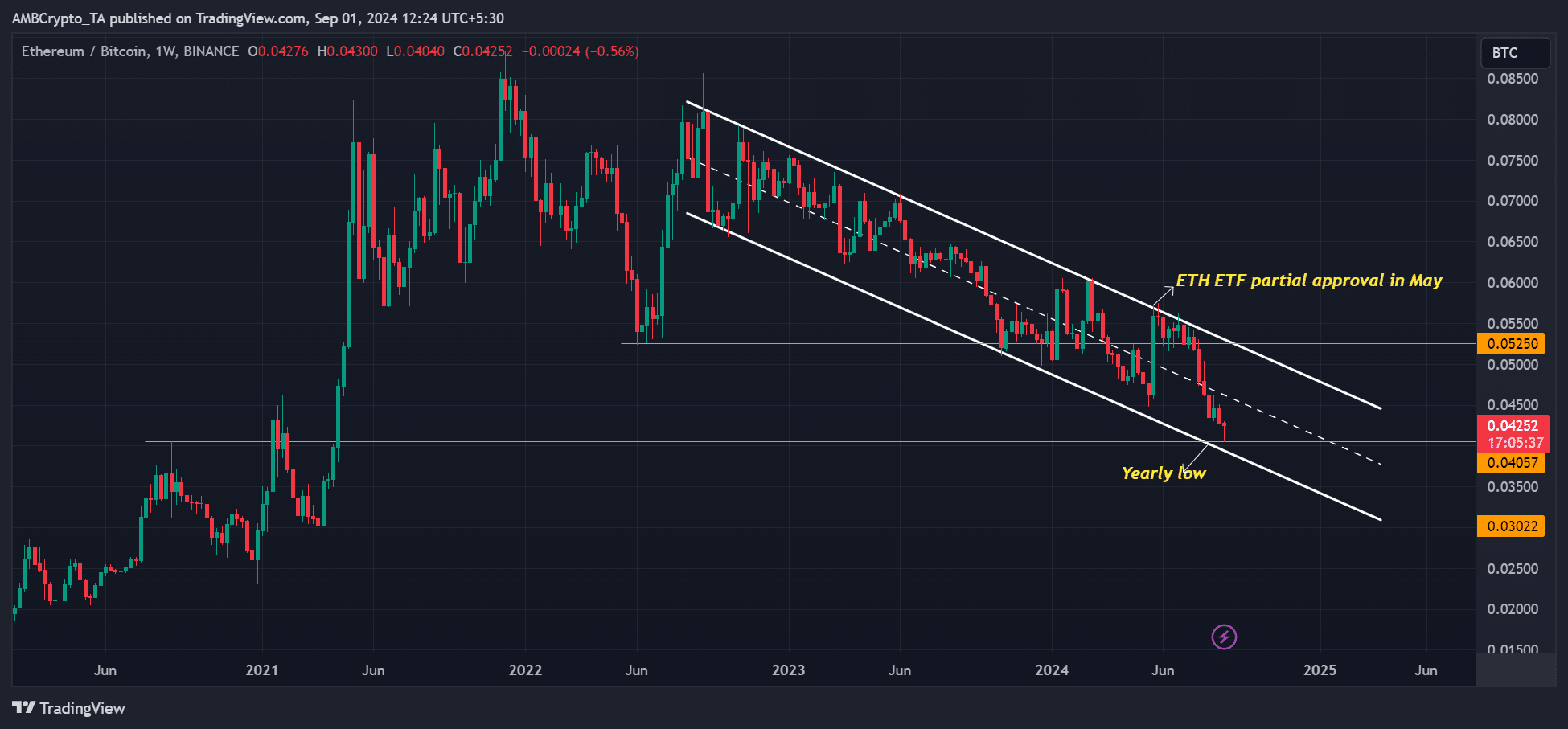

In simpler terms, the ETH/BTC ratio indicates Ethereum’s value compared to Bitcoin. Over the past two years, this ratio has been steadily decreasing and just reached its lowest point this year at approximately 0.040.

2024 saw a significant dip in Ethereum’s performance against Bitcoin, with this disparity reaching an all-time low. The main factor contributing to this trend was the surge in demand from investors buying Ethereum through ETFs.

In simpler terms, it is anticipated that the value of ETH relative to BTC will reach approximately 0.033 by the end of 2024. To put it another way, this prediction assumes that Ethereum’s performance will lag behind until December when potential buyers interested in ETFs may start showing interest in Ethereum as an altcoin.

Although some altcoin watchers have been timing a breakout for the segment using Solana’s [SOL] performance, the ETHBTC ratio remains a significant test for the sector’s health per Thompson.

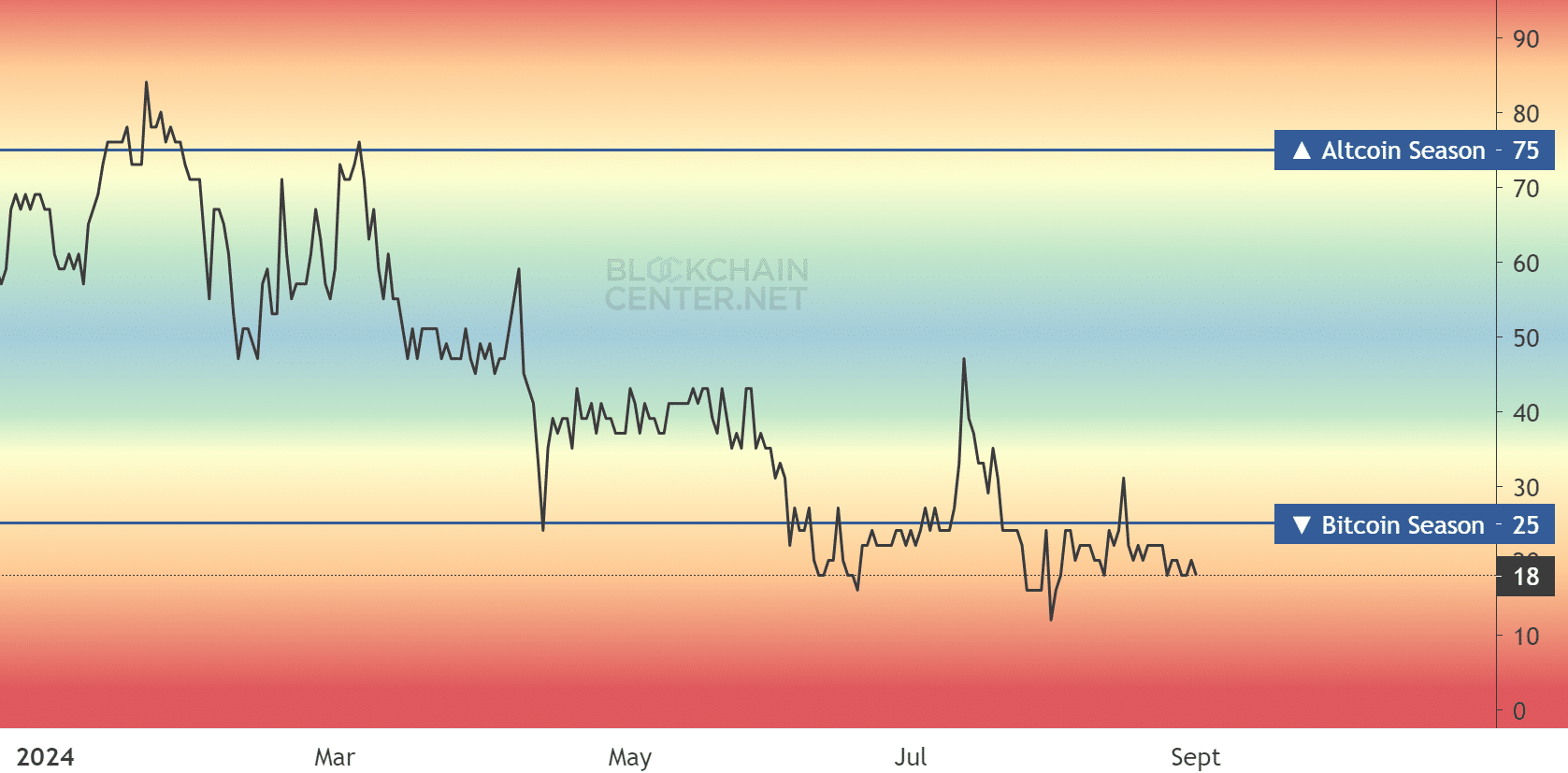

Currently, when I’m typing this, the Altcoin Season Index stands at 18, indicating that we are still in a strong Bitcoin-dominated market.

Some experts are discussing the possibility that an expected reduction in interest rates by the Federal Reserve might encourage growth in the altcoin market. However, according to cryptocurrency analyst Benjamin Cowen, the future is unclear because a similar situation in 2019 resulted in a collapse of altcoins.

In simple terms,

Currently, Ethereum (ETH) is being traded at approximately $2,400. In the last seven days, it has decreased by almost 10%, having fallen from $2,700.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-01 15:04