- USDT dominance patterns suggest a potential upcoming altcoin season, as per analyst predictions.

- Solana’s declining metrics and performance indicate a bearish sentiment, with market fundamentals not yet supporting a rally.

As a seasoned analyst with over two decades of experience navigating crypto markets, I must admit that this current landscape feels eerily reminiscent of a wild west showdown. The altcoin market has been on quite a rollercoaster ride in 2024, and while there are promising signs of an upcoming altcoin season, it’s important to scrutinize the fundamentals before jumping headfirst into the fray.

2024 saw the altcoin market go through an exhilarating up-and-down journey, reaching a staggering peak of over $1.27 trillion in March, only to subsequently follow a persistent path of decline. Since that time, the market has been exhibiting a pattern of progressively lower peaks and troughs, which suggests a predominantly bearish sentiment.

Even though there were some temporary increases in value, they haven’t been enough to balance out the losses experienced earlier in the year. For instance, the total value of altcoins peaked at a staggering $921 billion towards the end of last month, but it has since dropped back down to $872 billion.

As I delve deeper into my research, the steady decline in the market has sparked intriguing thoughts about the possibility of an approaching altcoin surge. Interestingly, a well-respected crypto analyst, often referred to as Moustache, has expressed optimism towards this anticipated altcoin season, backed by his analysis of Tether’s (USDT) influence on the market.

Technical pattern signals bullish trend for altcoin market

On the social media platform X, Moustache highlighted that USDT’s dominance is currently forming an “ascending broadening wedge” pattern, which typically has bearish implications.

The analyst noted that USDT (Tether) has been stuck in this repetitive pattern for more than half a year, implying it might be entering a “bearish retest” phase. Subsequently, Moustache proposes that the long-awaited “altcoin rally” could surface, presenting possible advantages for altcoin investors.

In simpler terms, an ascending broadening wedge is a chart pattern that suggests uncertainty in the market. It’s formed by two trend lines that gradually widen as they move upwards, indicating increased volatility. This pattern, when seen in an asset or indicator, could signal a potential future drop in price, often referred to as a downward breakout.

If USDT’s dominance shows a bearish breakout, it might indicate that funds are moving back towards altcoins. This shift could ignite an upsurge in the value of altcoins, possibly triggering an altcoin market surge, often referred to as “altcoin season.

Solana as a use case

As speculation about an altcoin rally builds, it’s essential to scrutinize the current state and underlying factors of key altcoins to confirm this trend. For instance, Solana [SOL], a prominent altcoin, has been encountering substantial hurdles in the past few weeks.

Over the past week, Solana has shown a steady decrease in both value and activity indicators. In fact, the cryptocurrency’s price has decreased by approximately 6.2% within the last seven days, with an additional drop of about 4.2% over the past day.

At the moment of reporting, Solana (SOL) was hovering around $141.51, suggesting a downtrend and sparking concerns regarding its immediate future prospects.

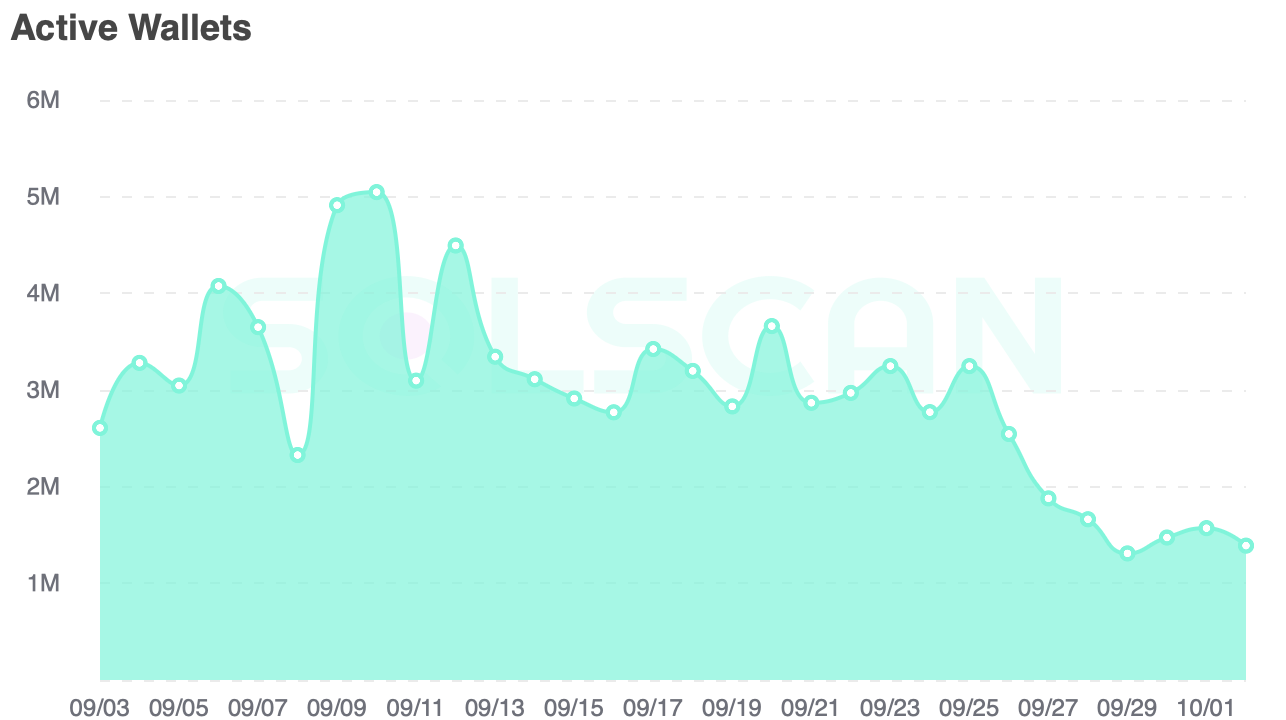

Of greater concern is the significant decline in the number of active Solana addresses, a crucial indicator that reflects both retail investor involvement and overall activity on the platform.

According to data from Solscan, there has been a significant decrease in the number of active addresses on the network. Last month, there were more than 5 million active addresses, but now that figure stands at roughly 1.3 million.

As a researcher studying Solana’s network dynamics, I’ve observed a noticeable drop in the number of active addresses. This trend suggests a decrease in user engagement within the Solana community, which could be linked to less frequent participation, lower transaction volumes, and perhaps a diminishing trust among retail investors.

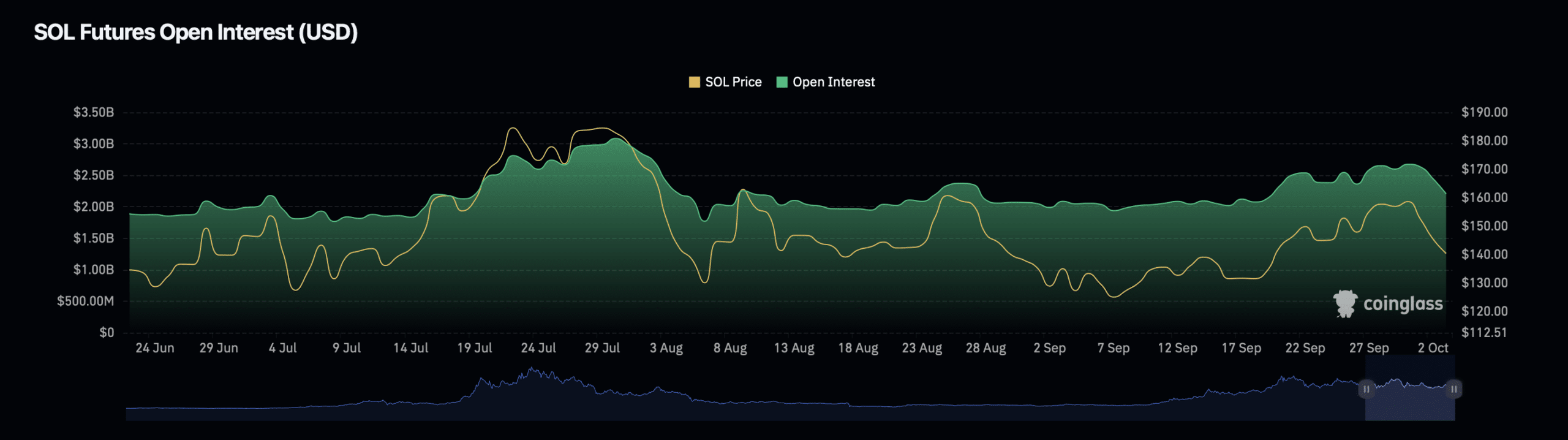

Furthermore, it’s worth noting that Solana’s open interest has decreased by approximately 7%, now standing at around $2.27 billion. Open interest represents the total quantity of futures contracts or options yet to be settled, and this decrease might suggest less trading activity or waning speculative interest in the asset.

Similarly, the value of open interest for Solana has decreased by approximately 29% and is currently worth around $7.25 billion.

Read Solana’s [SOL] Price Prediction 2024–2025

This emphasizes that there’s decreasing enthusiasm among investors regarding this asset, as reduced trading activities are making the market conditions less advantageous for SOL.

In summary, despite some experts like Moustache predicting a bullish trend for SOL, the underlying factors have not fully supported this optimistic outlook as observed from a technical standpoint.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-03 13:44