Ah, the Aptos community, a group of well-meaning individuals who have decided that halving staking rewards is the best way to celebrate spring. Yes, you heard it right! A new governance proposal, AIP-119, is on the table, and it’s about as welcome as a surprise visit from your in-laws. They want to chop the annual staking yield from a generous 7% down to a meager 3.79%. Who knew that inflation could be so… deflating?

Enter stage left: Sherry Xiao, a senior engineer at Aptos Labs, and Moon Shiesty, the network’s core developer. They unveiled this delightful proposal on April 18, presumably while sipping herbal tea and contemplating the meaning of life.

Aptos: The New Frugal Friend in Your Life

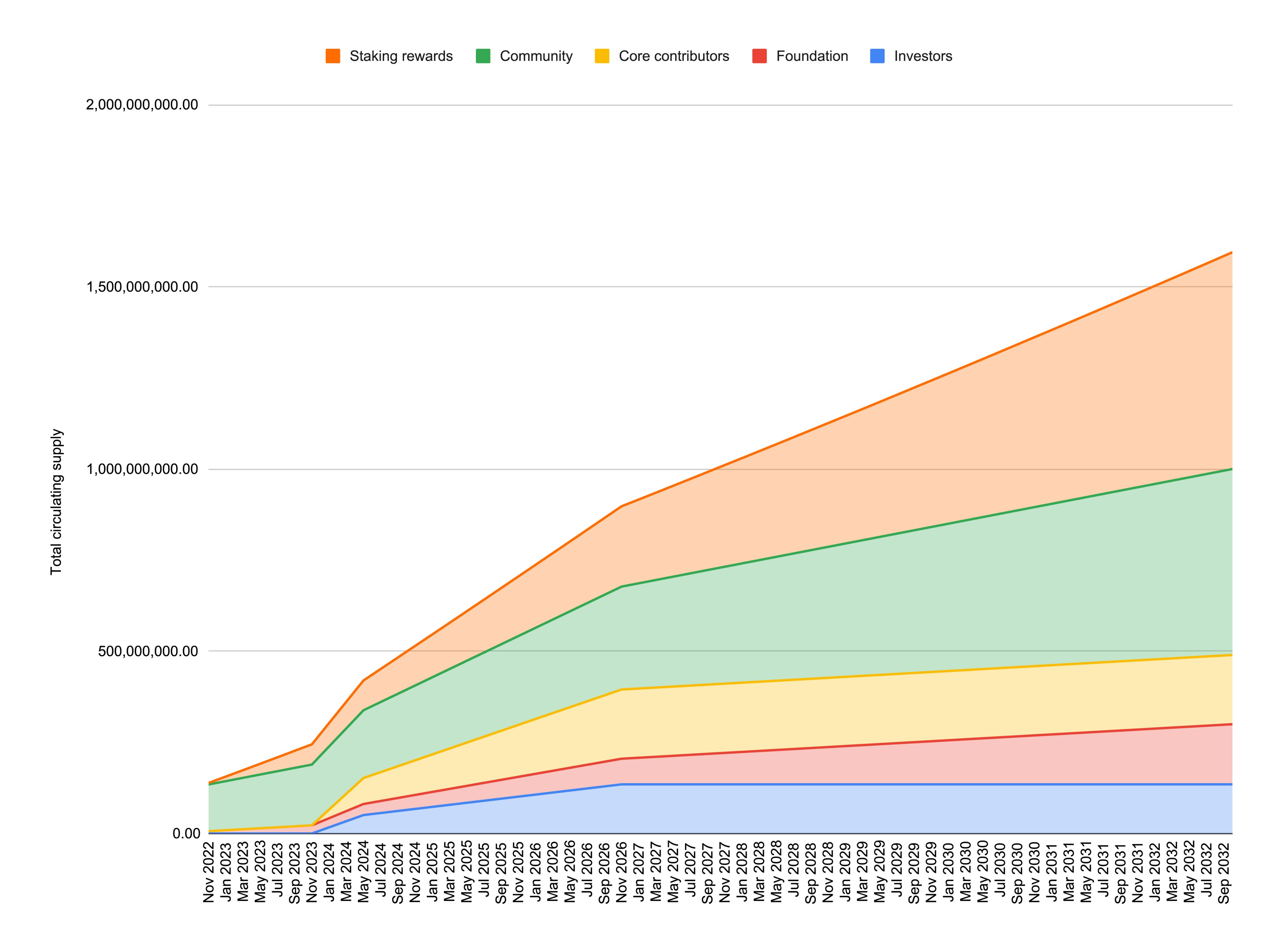

According to AIP-119, staking rewards are like that “risk-free” benchmark we all wish we could achieve in our lives—like finding a parking spot right in front of the coffee shop. But alas, the current yield of 7% is apparently too high, discouraging the productive use of capital. Because who needs productive capital when you can just sit back and watch your money grow, right?

So, they propose to lower the yield to 3.79%. The hope? That users will suddenly become economic overachievers, diving into the thrilling world of restaking, MEV extraction, and DeFi participation. Because nothing says “fun” like a good old-fashioned economic activity!

“I expect any lowered staking demand [to] be offset by the reduction in inflation from this AIP and new reward-generating opportunities launching in the next 6 months, and other sources of defi rewards,” Shiesty added on X. Sounds like a plan, right? 🤔

But wait, there’s more! Shiesty also mentioned that some of the saved emissions could support initiatives like liquidity incentives and gas fee subsidies. Because who doesn’t love a good subsidy? It’s like getting a coupon for your favorite ice cream, but instead, it’s for your financial future.

However, not everyone is on board with this proposal. AIP-119 raises eyebrows about validator sustainability. Smaller operators might find themselves in a financial pickle, and we all know how much fun it is to be in a pickle.

Shiesty pointed out that running a validator node in the cloud can cost between $15,000 and $35,000 a year. That’s right, folks! Over 50 validators are managing under 3 million APT each, which is about 9% of the total network stake. Talk about a small club!

To help these smaller players, the proposal introduces a validator delegation program. It’s like a charity for validators, where funds and tokens are allocated to maintain decentralization, geographic diversity, and community involvement. Because nothing says “community” like a bunch of validators holding hands and singing Kumbaya.

Meanwhile, the community is split on this proposal. Yui, the COO of Aptos-based Telegram game Slime Revolution, warned that smaller validators might be pushed out. “While it could drive innovation, I’m concerned about the potential impact on smaller validators and decentralization. We need to make sure the move doesn’t push out smaller participants! Aptos should focus on balance and long-term resilience,” Yui wrote on X. Sounds like a reasonable concern, right?

However, Kevin, a researcher at BlockBooster, argued that the shift could benefit Aptos in the long run. He noted that high inflation often masks weak product-market fit. Lower inflation, on the other hand, forces developers to build real demand.

Kevin also suggested that reduced token emissions might improve APT’s scarcity and boost its price, potentially balancing out the lower staking yield. Because who doesn’t love a good price boost? It’s like finding a $20 bill in your winter coat!

“We expect APT’s price to grow due to the reduced inflation rate, and validators’ actual returns may offset the APY decline through price appreciation, forming a positive cycle,” Kevin concluded. And there you have it, folks! A positive cycle, just like your morning coffee—necessary and slightly addictive.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2025-04-19 15:21