- Well, folks, it seems the $20 mark has become a veritable fortress for our dear AVAX bulls, and they ain’t getting in anytime soon!

- Now, don’t get your hopes up too high; a little bounce might be in the cards, but the bears are sharpening their claws for a feast.

In the early days of March, the crystal ball was all aglow, predicting a 10% bounce for Avalanche [AVAX]. But lo and behold, the downtrend was as stubborn as a mule, and it came to pass just as the soothsayers foretold.

Later on, the wise men of finance anticipated a drop to $14, and wouldn’t you know it, AVAX plummeted to a mere $15.2 a week later. Talk about a nosedive!

The bearish outlook is still as thick as molasses. Demand is weaker than a kitten in a dog park, and those resistance zones are looming overhead like a dark cloud on a sunny day.

Swing traders, you might want to grab your popcorn and watch from the sidelines, or perhaps look for short entries if you’re feeling particularly adventurous.

Avalanche Set to Keep on Sliding Downhill

That November rally? Well, it was retraced quicker than a cat can lick its paw by the 24th of February. Since then, Avalanche has shed another 14%—like a snake shedding its skin, but much less glamorous.

The trading volume has been as high as a kite during this drop, showcasing some serious selling pressure. It’s like watching a stampede of cattle, folks!

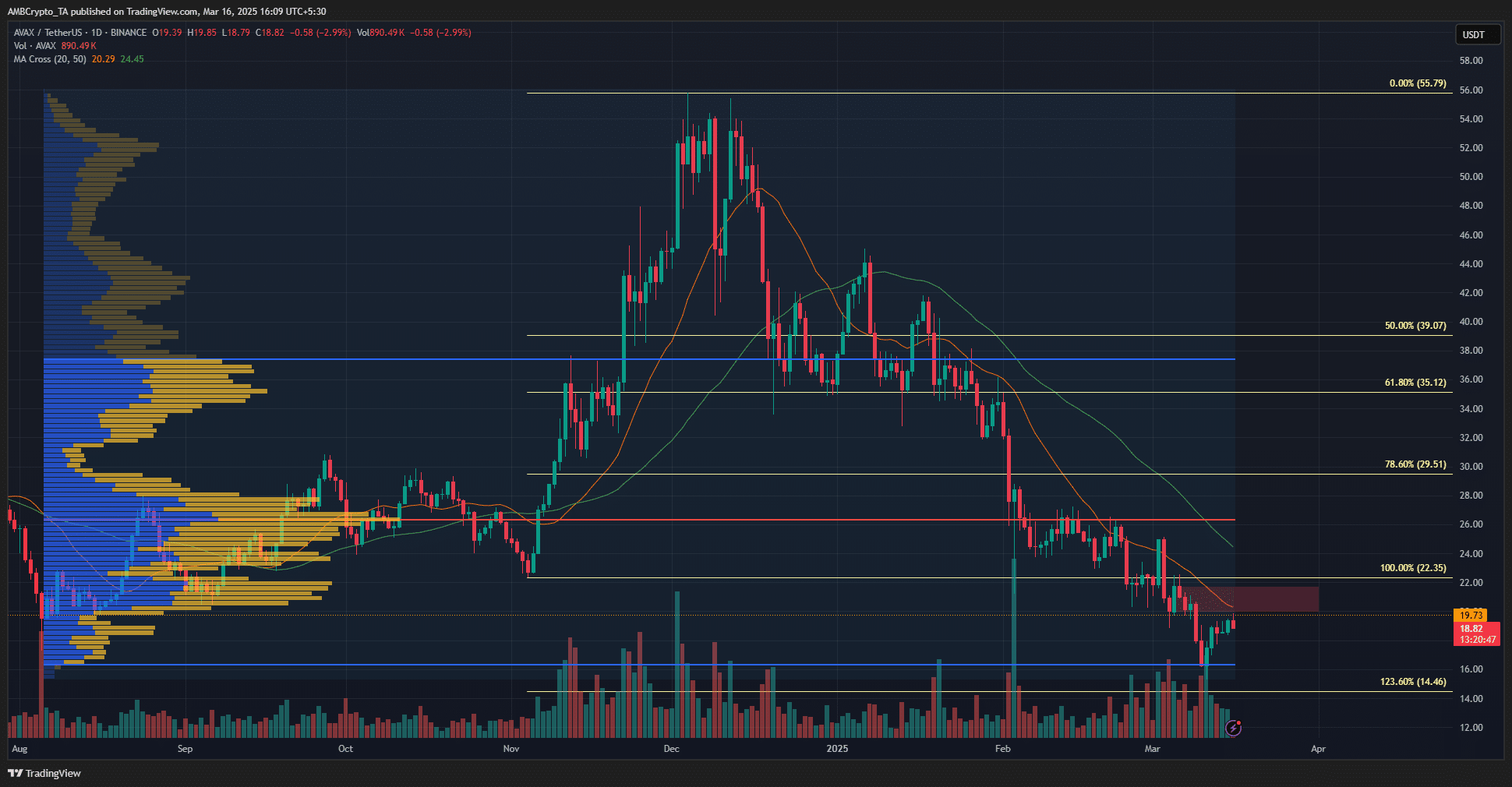

The 20 and 50-period moving averages are showing a steady downward trend, with the 20 DMA acting like a bouncer at a club, keeping the price from getting in. As of now, that bouncer is standing firm at $20.29.

The $20-$21.7 region has become a veritable no-man’s land, a bearish order block where any price bounce will likely be met with a chorus of sellers saying, “Not today, my friend!”

Moreover, the Fixed Range Volume Profile tool has revealed that the $20.5-$22.1 area is a high-volume node, reinforcing the strength of that resistance like a brick wall.

This tool was plotted from the August lows to the present day, marking the Point of Control at $26.36. Quite the landmark, wouldn’t you say?

The daily market structure is as bearish as a grizzly in a bad mood, with the recent lower high set at $24.95. A daily close above this level is needed to shift the structure, but at this moment, that seems as likely as finding a needle in a haystack.

The Fibonacci retracement and extension levels are pointing to the 23.6% extension level at $14.46 as the next target. Hold onto your hats, folks!

Swing traders, keep your eyes peeled for a short-term bounce toward $21, and target that level for a take-profit. But beware! The bearish idea will be invalidated if the price manages to climb above $22.15. Now that would be a sight to see!

Read More

- OM PREDICTION. OM cryptocurrency

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What You NEED to Know!

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

2025-03-17 04:11