- The Puell Multiple suggests Bitcoin is undervalued, indicating potential investment opportunities.

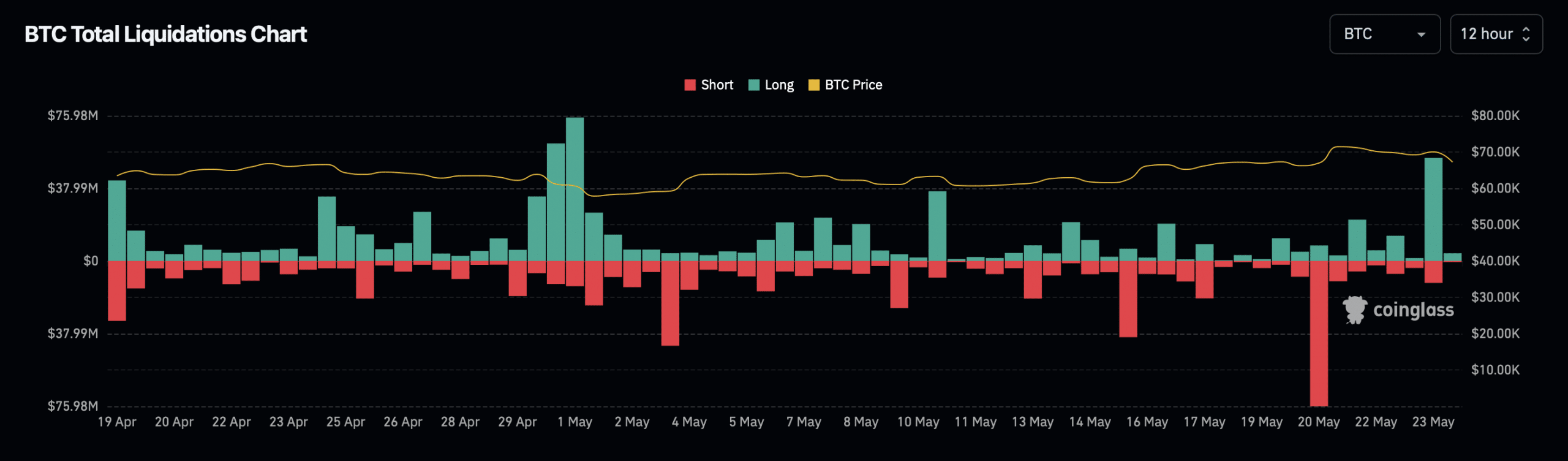

- Recent market volatility led to significant liquidations, with Bitcoin traders facing over $71 million in losses.

As a seasoned crypto investor with a deep understanding of Bitcoin’s market dynamics and on-chain indicators, I find the recent price fluctuations intriguing. The Puell Multiple’s drop below 1 suggests that Bitcoin might be undervalued based on historical norms. Miners are currently earning less revenue than usual, which could indicate a buying opportunity for investors. However, the recent market volatility has led to significant liquidations, with over $390 million in losses for traders worldwide. These events underscore the importance of risk management and staying informed about market movements. Despite these challenges, I remain optimistic about Bitcoin’s potential to enter an ‘escape velocity’ phase, pushing its price past $73,000. This bullish trend could be driven by enhanced investor interest and broader financial market developments. Nevertheless, I always remind myself to exercise caution and consider diversifying my portfolio to minimize risk.

Bitcoin (BTC), the trailblazing digital currency, saw a surge in value this week, driving its price past the $71,000 mark.

Although Bitcoin experienced a 3.3% drop over the last 24 hours, resulting in a current price of $67,197, it has continued to exhibit a weekly upward trend with a gain of 2.3%.

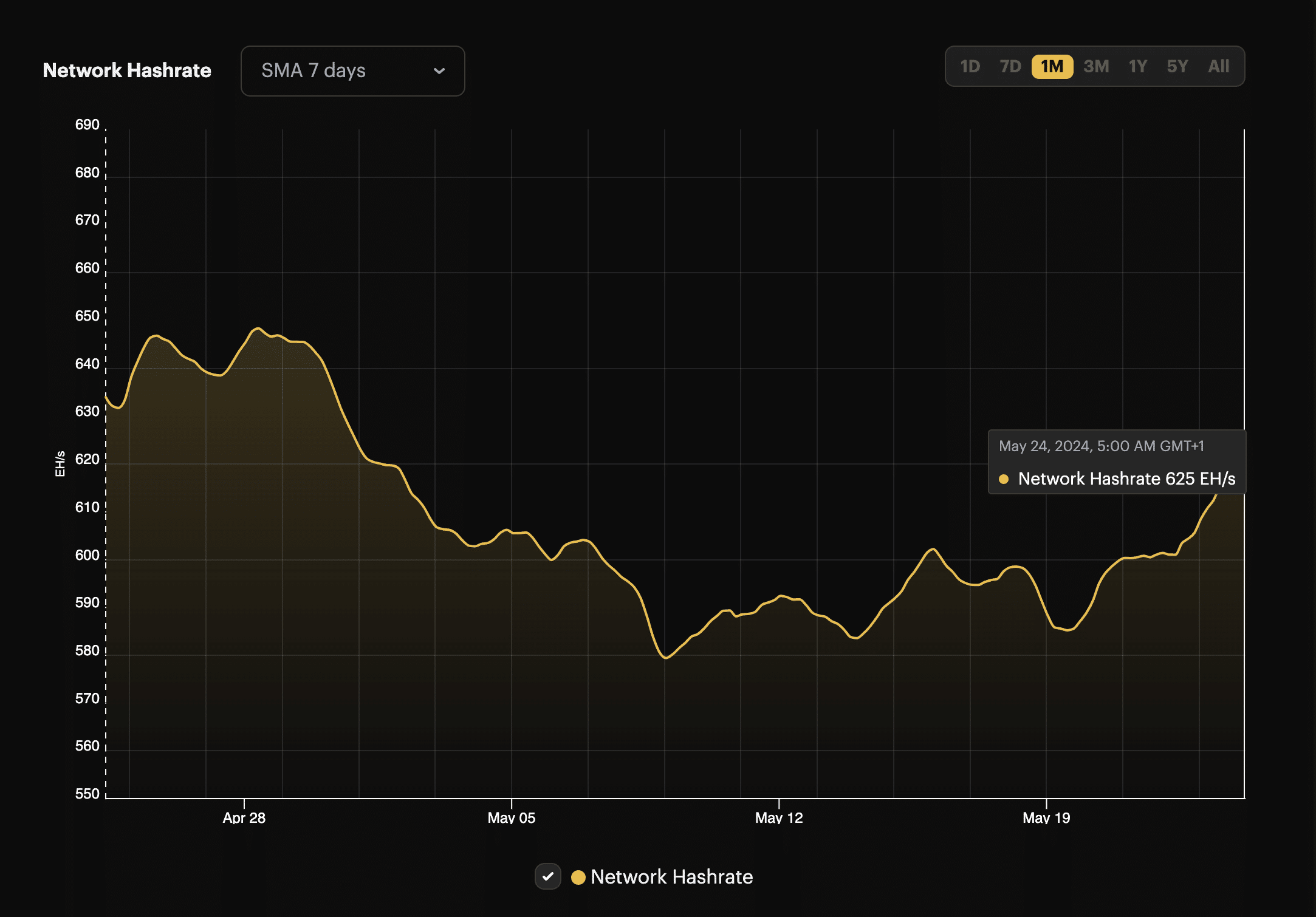

In the face of continuous volatility, Bitcoin has undergone substantial transformations in market conditions. These modifications encompassed alterations in mining complexity and computing power, along with adjustments in trader tactics resulting in considerable margin calls.

Insights into miner revenue and market valuation

A CryptoQuant analyst has recently uncovered some valuable on-chain information about Bitcoin’s pricing instability, shedding light on potential indicators for its value assessment.

The Bitcoin Puell Multiple, a metric derived from Bitcoin’s on-chain data, measures the relationship between the daily value of new Bitcoins released and the average value over the past year. Currently, this ratio has dropped to levels considered “undervalued” according to historical standards.

Based on recent market trends, Bitcoin’s dip in price could actually represent a bargain for investors, making it an intriguing prospect to consider adding to one’s portfolio.

The Puell Multiple is a tool that evaluates the financial well-being of Bitcoin mining operations by calculating the ratio of daily miner earnings to their average historical earnings.

As a Bitcoin analyst, I can explain that my mining income comes from block rewards, which remain constant in Bitcoin’s terms but vary in their USD value due to the cryptocurrency’s price fluctuations.

If the Puell Multiple surpasses 1, it usually signifies that miners’ rewards exceed the average, implying that Bitcoin’s value might be above its customary benchmarks.

In simpler terms, when the Puell Multiple is less than 1, it means that miners are currently making lower profits, possibly suggesting that the value of Bitcoin may be underestimated.

The decrease in the Puell Multiple aligns with the recent Bitcoin halving, leading to miners receiving only half of their previous rewards, thereby influencing this metric substantially.

As a market analyst, I’ve observed that the recent shifts in the crypto market occur at critical moments, aligning with broader trends. For instance, Bitcoin’s price consolidation and increased network activity have been evident, as signified by a soaring hash rate that recently surpassed 600 EH/s.

As a crypto investor, I’ve noticed an uptick in hash rate, which is a sign of growing optimism and increased activity in the cryptocurrency market. This surge could be attributed to the recent anticipation of spot Ethereum ETF approvals in the US. The adjustment in mining difficulty reflects this trend, as more miners join the network, making it more challenging for existing miners to maintain their profits. The potential approval of these ETFs has created a buzz in the market, potentially fueling this surge in activity and investment.

Recent liquidations and future market predictions

As an analyst, I’ve observed that the latest dip in Bitcoin’s value hasn’t just affected investors’ financial holdings but also triggered considerable market sell-offs.

As a researcher studying the cryptocurrency market over the past day, I’ve discovered that long positions on Bitcoin resulted in about $57.84 million in liquidations. Concurrently, short traders suffered notable losses, amounting to roughly $13.75 million.

As a financial analyst, I can tell you that the cumulative impact of these recent events reached a staggering $390.8 million in cryptocurrency market liquidations, affecting approximately 107,700 traders around the world.

In spite of present market difficulties, according to a new report by AMBCrypto, Bitcoin may imminently reach a stage of exponential growth, possibly driving its value above $73,000.

During this stage, there’s a strong likelihood for a robust upward swing in the market, potentially fueled by heightened investor enthusiasm and larger economic trends within the financial sector.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-24 18:32