- Bitcoin’s price fell 3.61% in 24 hours, hitting critical support levels between $98,830 and $95,830.

- Institutional transactions surged as Bitcoin withdrawals from exchanges reached 74,052 BTC this December.

As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent drop in Bitcoin’s price, while concerning to some, doesn’t phase me too much. I remember when Bitcoin was trading at single digits back in 2010!

As a researcher examining the current state of Bitcoin (BTC), I’ve observed a recent dip in its price and returns from wallets. At the moment, a single BTC is being traded at approximately $95,397. This represents a 24-hour price decrease of 3.61% and a weekly decline of 1.95%.

Even though Bitcoin hit a record high earlier in this month, its Market Value to Realized Value (MVRV) over the past 30 days dropped to -1.9%. This is the lowest it’s been since the current bull market began in October.

Based on Santiment’s analysis, the negative MVRM (I assume you meant MVRV – Maker’s Value Ratio of Value) indicates that numerous traders may have purchased assets at a time of high enthusiasm, potentially leading to current unrealized losses for them.

Santiment noted that the typical historical value of Bitcoin’s MVRV ratio was zero, demonstrating its characteristic as a market where gains and losses cancel each other out. Low MVRV values below zero might hint at potential buying chances since these lower-valued positions could suggest an undervaluation.

The platform proposes an investment strategy called Dollar-Cost Averaging (DCA), which is suitable for traders looking to take advantage of the current market conditions in this manner.

Key support levels and future price projections

crypto expert Ali underscores the significance of Bitcoin’s crucial support zone spanning between $98,830 and $95,830. In this price band, approximately 1.09 million wallets jointly acquired more than 1.16 million Bitcoins, making it a pivotal point to keep an eye on.

If the price falls beneath $96,000, it might lead to a decrease towards either $90,000 or even $85,000, as suggested by Fibonacci retracement ratios.

Moreover, Ali highlighted that there was a significant surge in Bitcoin removals from trading platforms, as approximately 74,052 Bitcoins were taken out in the month of December by themselves.

As a crypto investor, I’ve noticed a trend that hints at a move towards long-term investment. It seems that when coins are taken off exchanges, they become less likely to be sold, indicating a shift in strategy towards holding onto them for the long haul.

Market metrics and trading activity

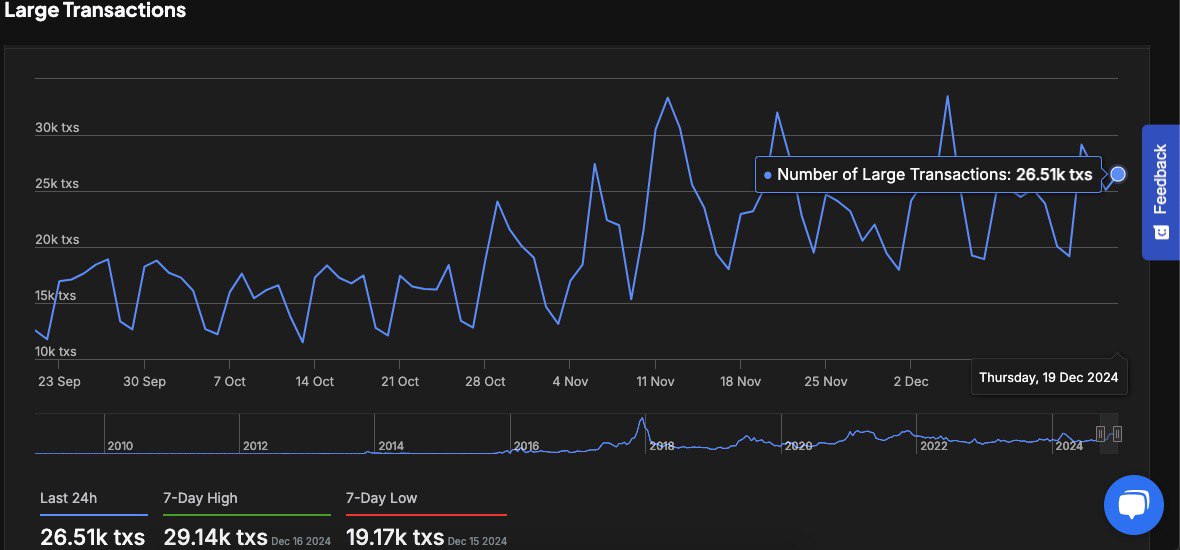

According to recent data from IntoTheBlock, there’s been a rise in significant transactions worth $100,000 and above. Specifically, on December 18, about 26,510 such large transactions were noted, which is slightly lower than the peak of 29,140 transactions over the past week.

It’s noticeable that the number of these transactions surges during times of market turbulence, especially in October and November. This persistent level of activity indicates ongoing curiosity or investment from large institutions or wealthy individuals.

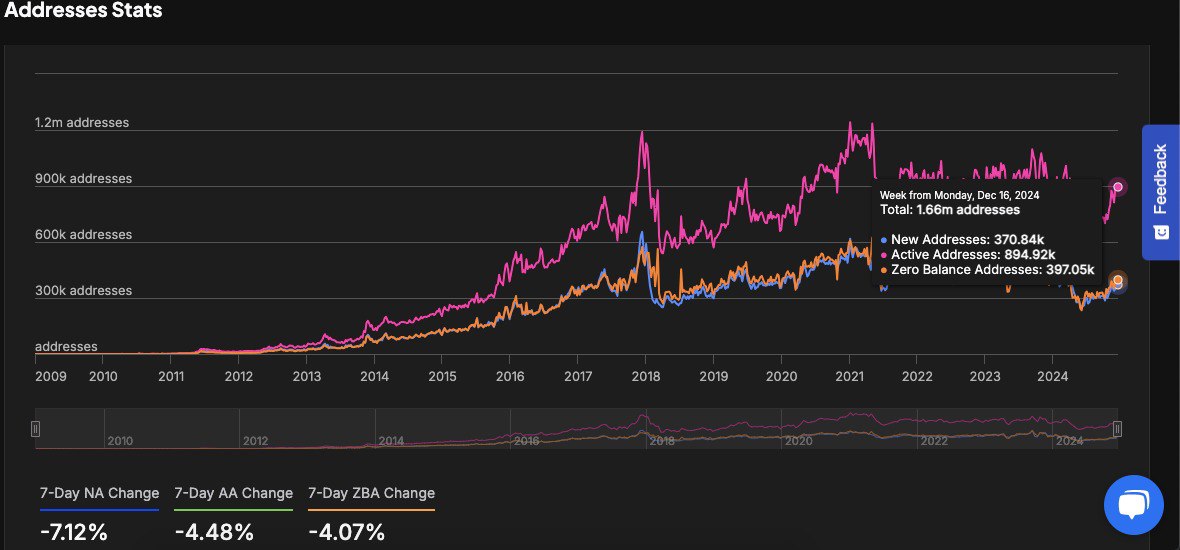

The pattern of address usage exhibits a blend of rising and falling trends. At present, we’re dealing with approximately 1.66 million addresses, out of which 370,840 are newly added, while 894,920 are currently in use.

Over the last seven days, there has been a drop of 7.12% in the number of newly created addresses, as well as a decrease of 4.48% in active addresses. This could suggest a possible reduction in retail involvement amidst the recent market downturn.

Technical indicators suggest a short-term correction

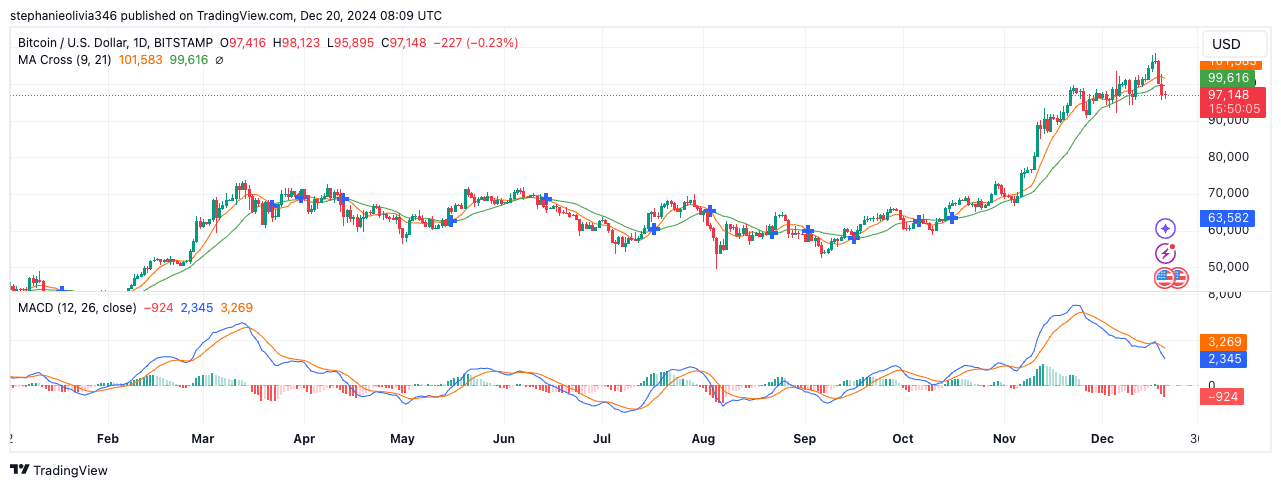

Analyzing Bitcoin technically, we see that it’s currently trading above both its short-term (9 days) and medium-term (21 days) average lines. This suggests a predominantly bullish sentiment in the market since October.

On the other hand, a recent MACD crossover indicates that the MACD line is dropping below the signal line. A reddening histogram suggests a decrease in the bullish momentum’s strength.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the present price level of $99,644, there’s been a minor retreat, hinting towards potential stabilization or even more adjustments.

Experts advise keeping an eye on the support level at $95,000 as a way to determine if the upward trend will persist or encounter additional drops.

Read More

2024-12-21 04:40