- Bitcoin dominance is a key indicator for determining the future trajectory of altcoins.

- Currently, Bitcoin and altcoins are emerging as two distinct asset classes.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by this fascinating analysis of Bitcoin dominance and altcoins. Over the years, I’ve seen bull runs, bear markets, halvings, and more – each event offering valuable insights into the dynamic world of cryptocurrencies.

Several well-respected experts have pointed out that this market trend differs from past ones, moving away from speculative trades towards a prolonged, fundamentally supported rally for Bitcoin. This positive sentiment stems from the belief that Bitcoin’s upcoming stage might trigger a substantial price surge potentially reaching $100K.

In about a week’s time, Bitcoin [BTC] skyrocketed to an unprecedented peak of $93K, while its market influence grew approximately 70%. This significant rise was fueled by several factors such as increased liquidity following the elections, FOMC rate reductions, and notably, the effects of the latest halving event.

Regrettably, although I initially held high hopes, a speculative squeeze seems to have taken hold, causing Bitcoin to falter and fail to reach its set target. For the past two days, it’s been steadily hovering just below the $90K mark.

Normally, concentrating funds in the “high-risk” category for Bitcoin might suggest that investors are moving their money to less risky assets. But according to AMBCrypto, there could be a concealed trend indicating just the opposite – the movement of capital towards other assets could secretly be happening instead.

History shows altcoins poised to break resistance

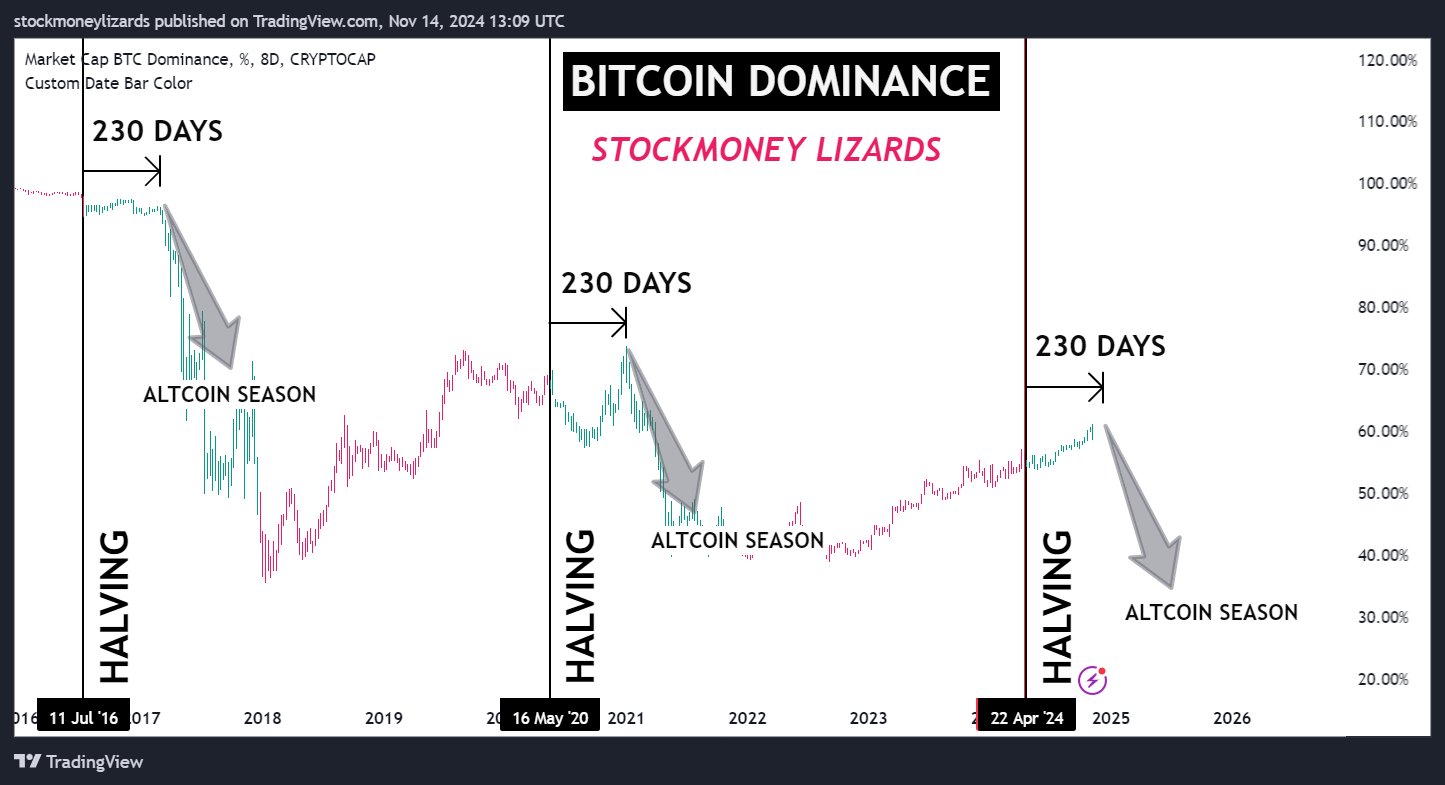

From past market trends we’ve noticed, a specific 230-day pattern seems to follow each Bitcoin halving event.

Following the bull rush that typically occurs after Bitcoin’s halving event, investors often seek out other cryptocurrencies (altcoins) as they explore further chances for financial gains.

Source : X

2020 saw the impact of a supply reduction event, known as the halving, manifest in just over five and a half months. For the initial time, Bitcoin surpassed $40,000.

Conversely, once Bitcoin’s growth rate decreased, alternative cryptocurrencies started to surpass it, with several of these alternatives recording impressive gains approximately 60 days later.

In a similar fashion, the reduction of miner rewards to 3.125 Bitcoins during April this year created an economic disparity. This imbalance resulted in a significant surge in demand, boosted by post-election cash flow, whereas the decrease in supply tightened market conditions, making Bitcoin scarcer.

In simpler terms, due to less availability of other cryptocurrencies (lower liquidity) and a limited supply of Bitcoins, the market conditions have become favorable for Bitcoin’s influence to reach almost 70% among all cryptocurrencies, which in turn propels Bitcoin towards a fresh record high.

If the pattern seen earlier continues, several alternative cryptocurrencies might surge enough to exceed crucial resistance barriers before the close of Q4. The growing popularity of Cardano makes AMBCrypto’s prediction even more credible.

Evidence to back this theory

It’s worth mentioning that Bitcoin staying below $90K indicates an increasing cautiousness or risk-aversion among traders in the market.

Although bulls are pushing back against bearish tendencies, the inability so far to ignite an unprecedented surge (often expected because of robust support from the new government and the hype on social media predicting a price of $100K) has sparked doubts.

To put it simply, when the market doesn’t seem eager to surpass significant barriers, it could mean that Bitcoin’s control is starting to weaken, making it a good time for investors to explore spreading their investments into large-scale cryptocurrency tokens.

These tokens, backed by robust community endorsement and boasting more competitive pricing, might present a compelling choice instead.

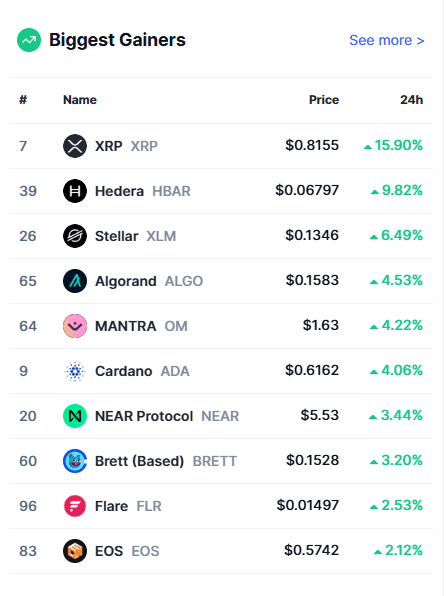

Source : CoinMarketCap

Over the past 24 hours, while Bitcoin dipped about 4%, plummeting to $86K – its daily low – several alternative coins seized the opportunity, and XRP was one of them, rallying over 15% in value.

In other words, if Bitcoin’s influence doesn’t increase again, with both large institutions and individual investors supporting it, Bitcoin might not have a strong future outlook. Consequently, alternative cryptocurrencies could potentially keep leading the list of price gainers.

On one hand, if Bitcoin’s dominance increases toward 70%, altcoins might see temporary growth. But, it’s important to note that this might not trigger a widespread altcoin rally, leading us to ponder:

Will Bitcoin regain its weakening dominance?

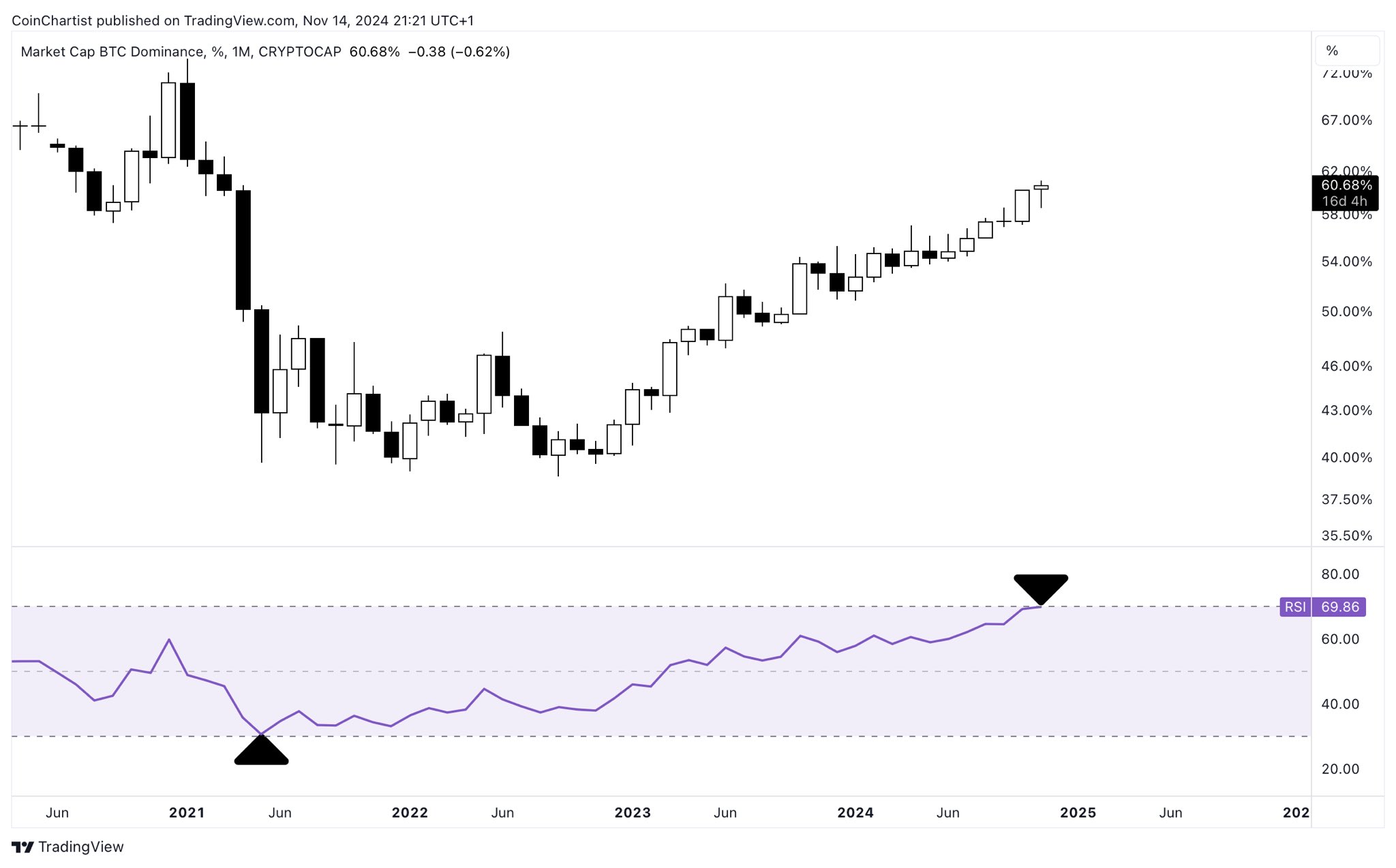

In simpler terms, the amount of Bitcoin in relation to other cryptocurrencies (Bitcoin dominance) has grown too much on a monthly basis, suggesting it might decrease soon, which could give smaller coins a chance to increase in value.

Source : TradingView

Currently, significant institutions are pulling back their support for Bitcoin, having cashed out substantial profits following the recent bull market. To resume control, it’s expected that these institutions will wait for a price drop, or a “dip,” which would make re-entering the market more affordable.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Until then, it presents a prime opportunity for bulls to capitalize on an altcoin rally.

Based on past trends, it appears that alternative cryptocurrencies (altcoins) could soon overcome crucial resistance points. This event might lead to an “altseason” – a period of increased activity and price growth for altcoins – before the end of the first quarter of 2023.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-15 16:08