-

BTC’s long-term MVRV was below 6% at press time.

BTC might see capitulation or accumulation soon, based on the reaction of holders.

As a seasoned crypto investor with scars from the 2017 bull run and the 2018 bear market etched into my portfolio, I find myself cautiously watching the current state of Bitcoin. The long-term MVRV being below 6% at press time has me on edge, as it could signal capitulation or accumulation soon based on the reaction of holders.

Although Bitcoin‘s [BTC] prices have remained fairly steady over the past few months, some crucial on-chain indicators hint at potential difficulties that might affect the market.

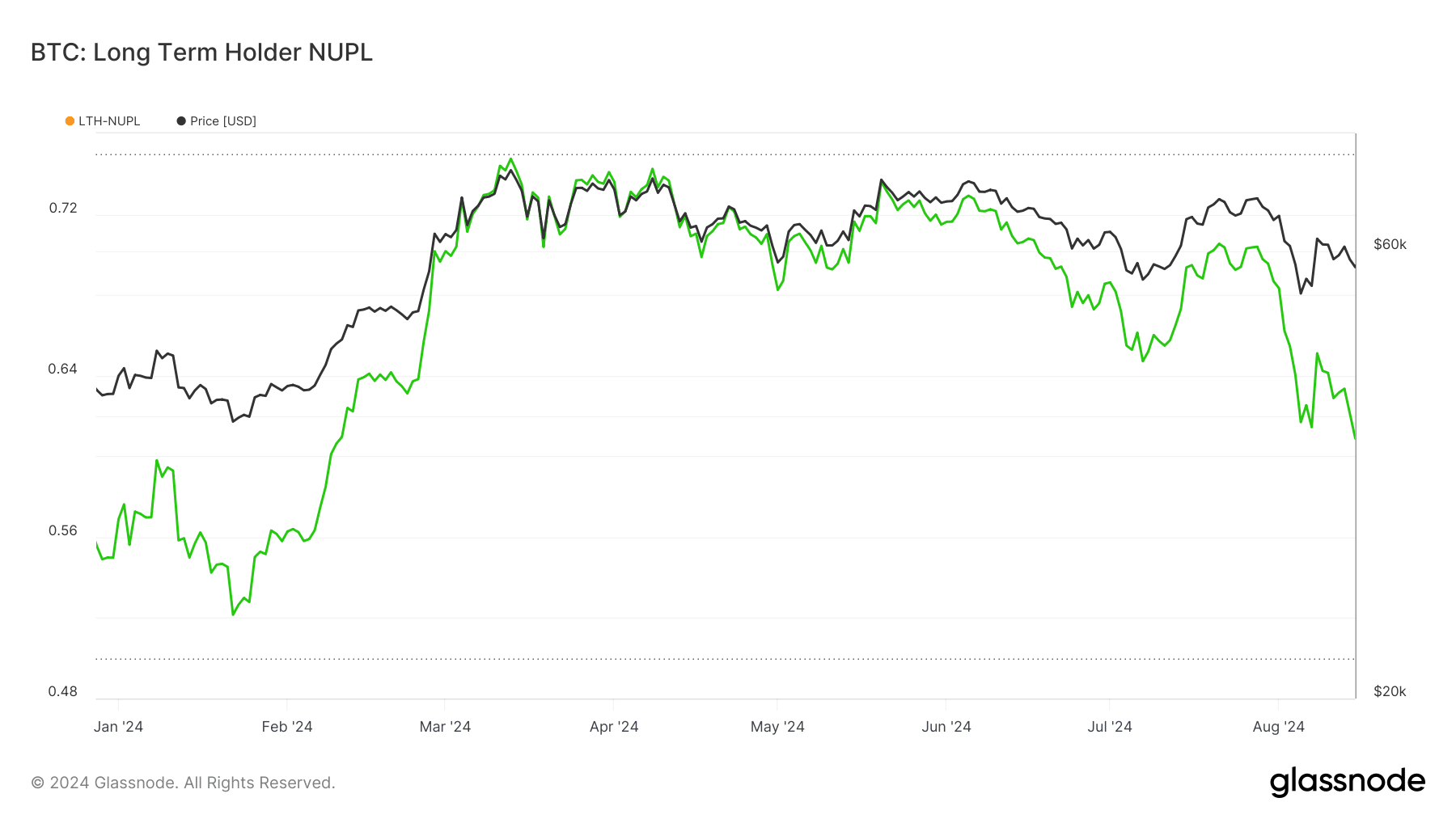

One concerning indicator is the Long Term Holder Net Unrealized Profit/Loss (LTH-NUPL).

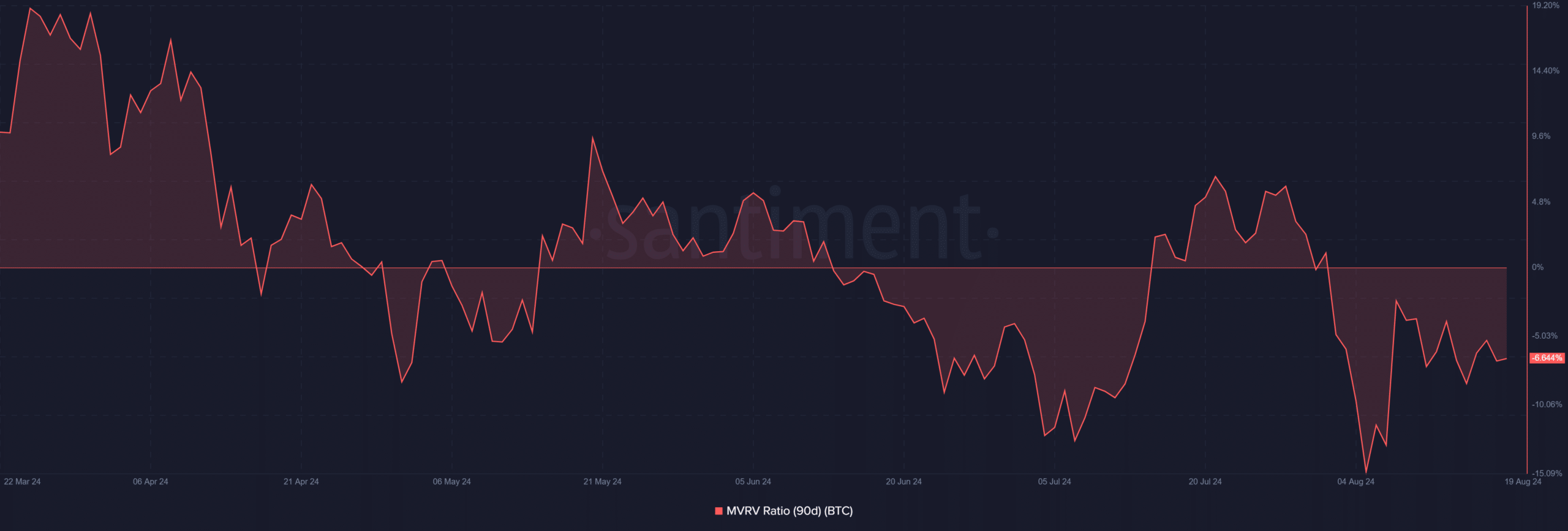

For a few weeks now, the Market Value to Realized Value ratio (MVRV), which measures long-term performance, has been staying below zero.

Declining Bitcoin profitability

At present, a comprehensive evaluation of Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) on Glassnode indicates a substantial decrease in the profitability of long-term Bitcoin owners.

This trend could be a critical indicator of the market’s future direction.

By around March 2024, both Bitcoin’s price and the Long-Term Holder Net Unrealized Profit Ratio (LTH-NUPL) reached their highest points, suggesting that a large number of long-term investors had accumulated significant unrealized gains on their Bitcoin holdings.

After reaching this high point, both the price and Long-Term Holder Net Unrealized Profit Ratio started to drop, implying that the market might have experienced significant profit-selling.

Between June and August 2024, the LTH-NUPL followed a similar pattern as Bitcoin’s decreasing price trend, consistently dropping during this period.

By August 2024, the LTH-NUPL sits at a lower position along the spectrum, suggesting that the earnings of numerous long-term investors have experienced a substantial decrease.

What this could mean for Bitcoin

The current circumstances might indicate we’re getting close to a significant turning point in the market. It’s possible it’s on the verge of reaching a ‘panic sell-off’, where investors may decide to offload their assets to minimize future losses.

Additionally, it might be nearing a possible low point, at which more purchases may take place as investors hunt for attractive deals.

The LTH-NUPL specifically measures the unrealized profit or loss of long-term Bitcoin holders.

A large NUPL value suggests most of the coins owned by this group are currently making a profit, which could trigger selling and possibly cause a price drop due to profit-taking and market adjustment.

In my analysis, when the NUPL (Net Unrealized Profit/Loss) value is low or even negative, it suggests that a higher number of coins are currently being held at a loss. This situation might potentially trigger a wave of selling among investors, often referred to as capitulation. Alternatively, such a scenario could present an attractive buying opportunity for those who see the dip as a chance to acquire coins at a reduced price.

LTH’s profits sinks

According to an analysis by AMBCrypto, it was found that long-term Bitcoin investors were currently holding their coins at a price lower than what they originally paid for them, as of the current moment.

The trend reinforces the findings from the Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) analysis.

Additionally, the 90-day MVRV (Maker Value Ratio) has remained below zero starting from August 1st, and currently, it’s approximately -6.6%.

During this timeframe, the data showed that those who purchased Bitcoin ended up with an average loss exceeding 6% on their investment.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A consistently low MVRB (Maker’s Value Realized to Maker’s Value Held ratio) indicates that long-term investors might be feeling a financial crunch, potentially impacting their short-term choices.

As a crypto investor, I can’t stress enough the importance of closely watching the behavior of other Bitcoin holders. Their decisions – whether they choose to sell off their assets to limit losses or hold tight in hope for a market rebound – will have a substantial influence on Bitcoin’s price trajectory.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- ANKR PREDICTION. ANKR cryptocurrency

- Best Axe Build in Kingdom Come Deliverance 2

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

2024-08-19 14:16