- Bitcoin’s $70K surge seems like a dream as prices and social metrics decline.

- Michael Saylor’s optimism clashes with market uncertainties.

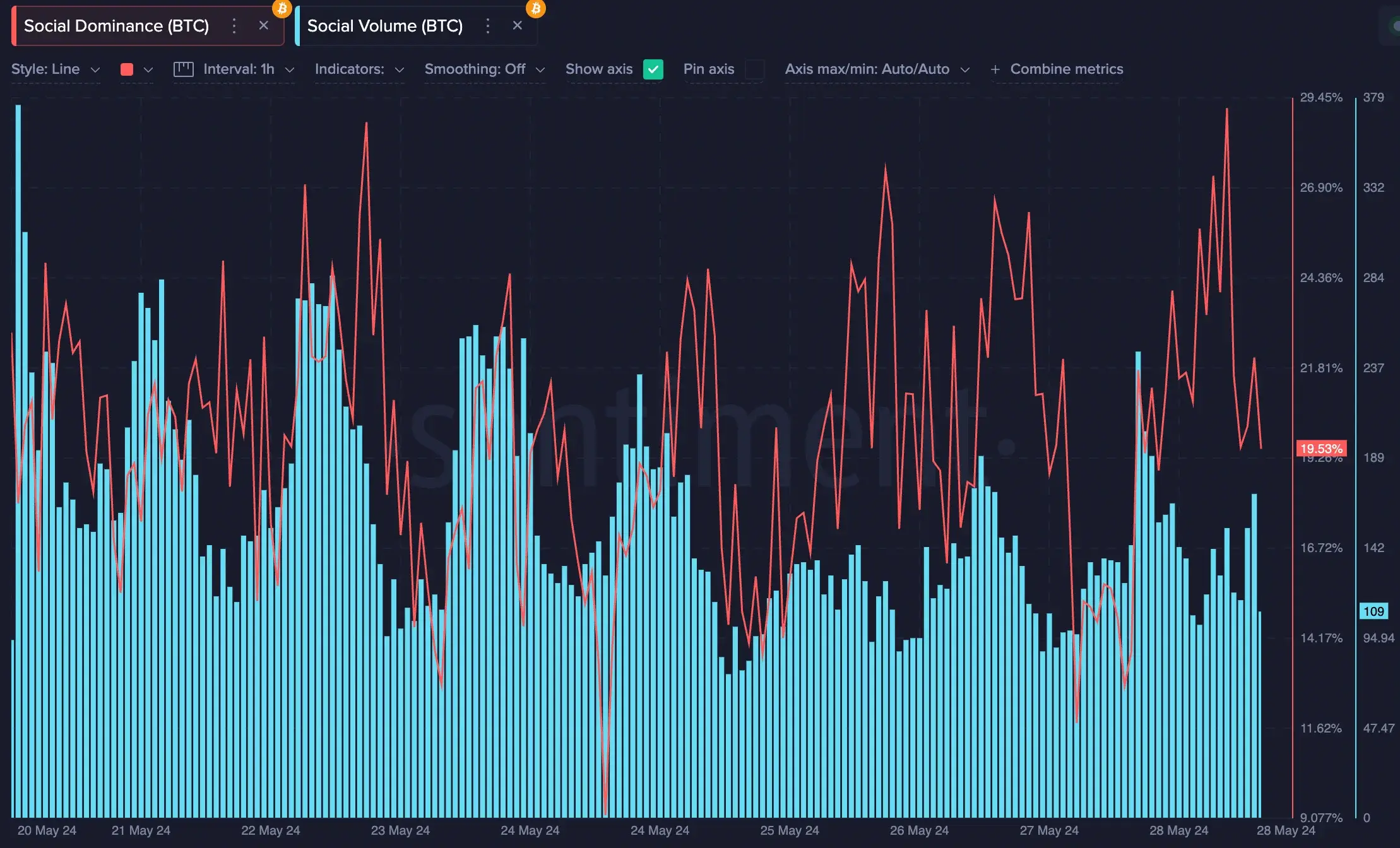

As a researcher with extensive experience in the crypto market, I find myself both intrigued and concerned by the recent developments in Bitcoin’s price action. The sudden surge to $70,000 only to retreat within hours has sparked a wave of FUD among traders, as evidenced by the decline in social volume and dominance metrics.

Amid great excitement, Bitcoin’s price reached an all-time high of $70,000 on May 27th. However, it dipped to $68,101 the next day, causing concern among traders, as pointed out by @EmperorBTC in a recent social media post. This price drop has generated substantial anxiety and uncertainty within the crypto community.

According to AMBCrypto’s examination of Santiment’s statistics on social activity and influence, there was a noticeable decrease in both measures.

Execs weigh in…

Shedding light on the same, crypto analysts Wolf took to X and noted,

As a researcher studying the cryptocurrency market, I believe that Bitcoin’s dominance will not surpass the 70% mark or even drop below the 60% threshold. The current trend indicates that Bitcoin has peaked and is on its way down. This downturn can be attributed to the growing strength of Ethereum, which is expected to spearhead the long-anticipated altcoin season.

The Ethereum ETF’s approval brings up an intriguing point: Could Bitcoin’s buzz be starting to fade?

Michael Saylor, a prominent Bitcoin advocate, has expressed a negative response on platform X, previously known as Twitter, as indicated in his recent post.

As a crypto investor, I can confidently say that this development is beneficial for Bitcoin. Not only is it good, but it might even be superior for Bitcoin given our increased political clout and industry-wide support.

Is Saylor excessively optimistic?

As a crypto investor, I’ve been closely following MicroStrategy’s bullish stance on Bitcoin. However, I cannot help but notice that recent metrics tell a different story. From my perspective, Saylor’s outlook appears overly optimistic based on the current data. To put it simply, the numbers don’t align with his positive viewpoint. As ‘The Bitcoin Therapist’ pointed out in his latest post, we need to be mindful of these discrepancies when making investment decisions.

“He’s not infallible; for instance, his prediction that #Bitcoin would be the sole crypto Exchange-Traded Fund (ETF) was disproven.”

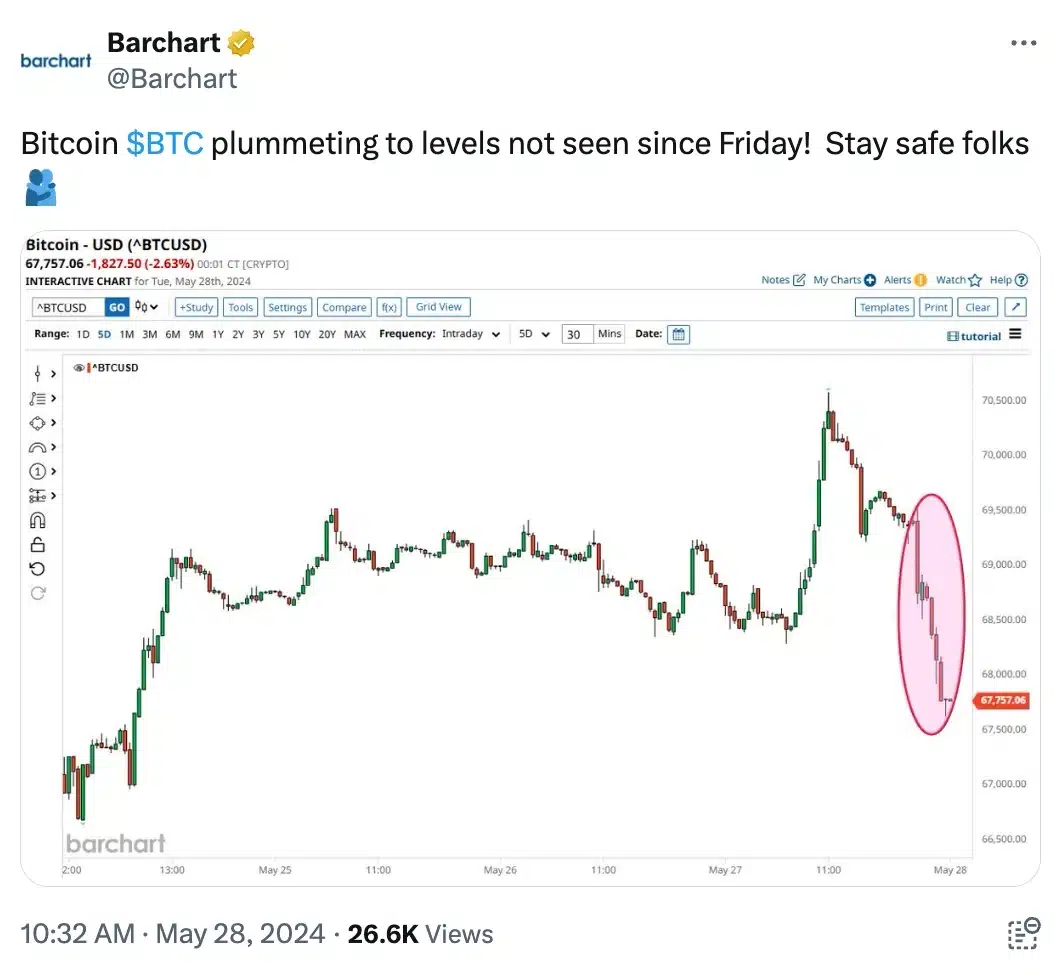

I analyzed the data from Barchart and found that Bitcoin (BTC) was trending downwards towards prices last seen on May 24th.

Just a matter of time!

However, despite prevailing negative sentiments, another trader, Daan Crypto Trades had a completely different angle to share. He noted,

Bitcoin’s price action has been reminiscent of past consolidation phases during this market cycle. There was a brief instance where its value dipped slightly below the previous range, but it was swiftly recaptured.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-28 19:35