- Oh dear, BTC’s network activity has decided to take an unscheduled vacation, revealing a rather gloomy investor mood.

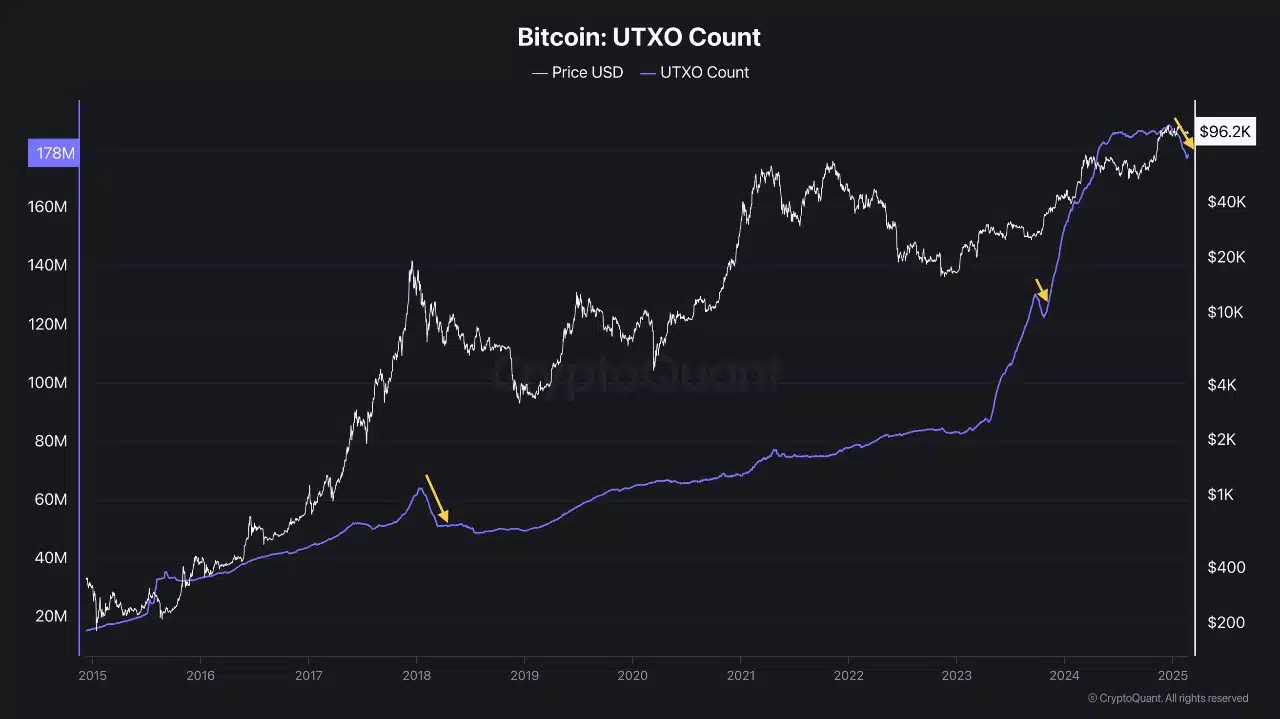

- It seems Bitcoin’s UTXO count from 2015 to 2025 couldn’t handle the pressure, plummeting to levels reminiscent of the infamous September 2023 correction.

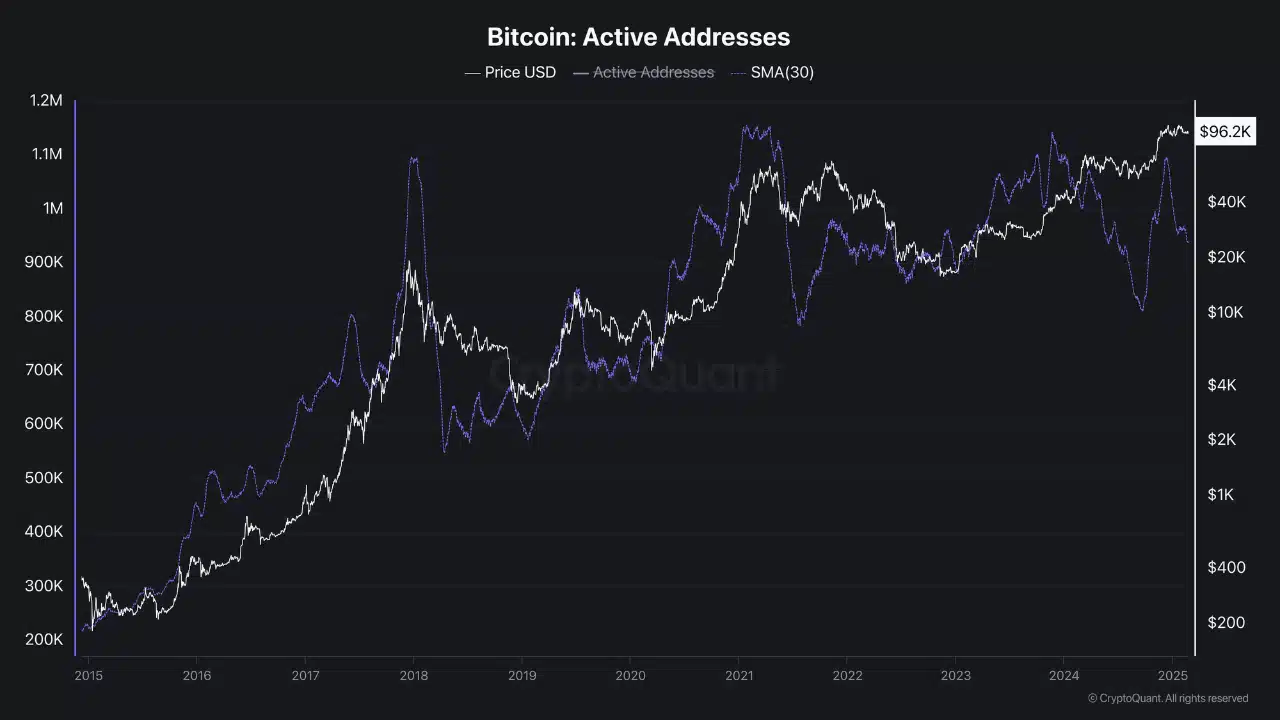

Ah, Bitcoin’s [BTC] network activity, dear readers, is displaying a rather distressing downturn—an echo of investor mood swinging like a pendulum! Active wallets, transactions, and UTXO counts are descending as though they’ve lost their way, seemingly in a most melancholic fashion, akin to the sorrowful past correction periods.

In a delightful twist of fate, the accumulation rate of Bitcoin spot ETFs has slowed rather dramatically. Imagine that! Recent capital outflows have formed quite the spectacle.

Fewer hands in the market, more space for dust bunnies

And lo! As a consequence of these tragic events, Bitcoin’s active addresses have declined sharply in early 2025. Once peaking near 1.2 million in 2021, they’ve tumbled to a mere 900,000. Isn’t it remarkable how numbers go on a downward spiral when they’re supposed to rise?

This plummet in trading volumes—that ancient tale—indicates less participation in the network. One might ponder: are investors packing their bags for an exodus, a reminiscent tribute to the exuberance of 2017?

Moreover, this decline is whispering a sad song of waning confidence, fueled by geopolitical dramas and a lack of pumpkin-spice Bitcoin-friendly legislation.

If this sad trend persists, Bitcoin’s price, now lounging at $96,200, might face a long and dreary consolidation, much like the dreary days of March 2024, unless sprightly catalysts make their grand entrance.

Bitcoin: A mere dip or the start of something more sinister?

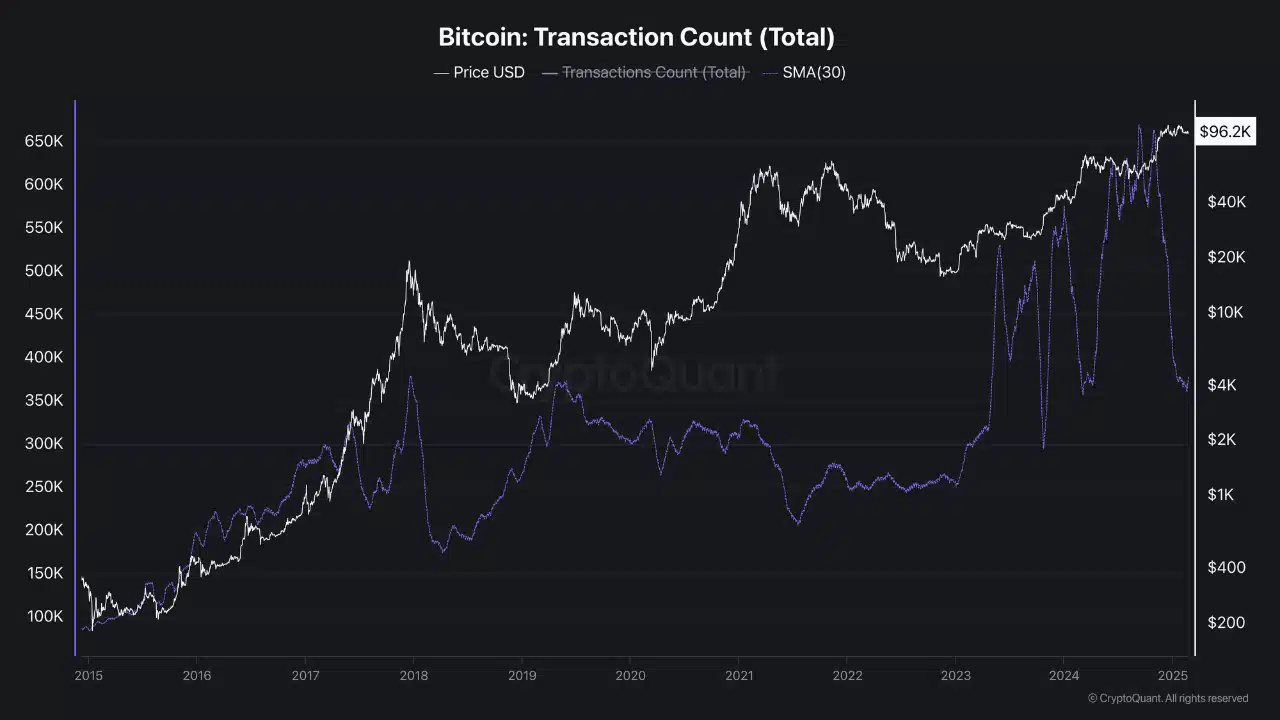

Further along our dismal path, Bitcoin’s transaction count displays a significant decline, reminiscent of an old friend who never quite says goodbye. Transactions, once a jubilant peak of 650,000 daily in 2021, have slipped beneath 400,000 by early 2025.

Such a reduction in trading activity is a cry of weakened investor sentiment, echoing the September 2023 correction like a long-forgotten tune during market downturns.

Continuous declines may place further pressure on Bitcoin’s price, especially wrapped in the warm embrace of risk-off sentiment caused by uncertainties in trade policy. A joyous reversal would require robust market optimism or some stability in the ever-so-volatile macroeconomic dance.

Are unspent BTC disappearing like socks in a dryer?

The Bitcoin UTXO Count spans from 2015 to 2025—what a journey! Alas, it declined notably in early 2025, crashing to levels akin to the dismal September 2023 correction.

This metric had once risen steadily to 178 million by early 2025 but has now tumbled like an unwelcome guest at a party, reflecting fewer unspent transaction outputs. How very tragic!

This trend raises eyebrows and concerns that the market may indeed be nearing the end of a cycle. How thrillingly dramatic; though conclusions are not definitive, hope springs eternal! The pattern indicates lower investor accumulation—oh, what a plight!—leading to worries about potential price stagnation amid our ongoing tale.

Yet, dear friends, some bullish indicators hint at a recovery—but only if new catalysts choose to waltz into the scene.

Buyers or sellers: Who truly wears the crown?

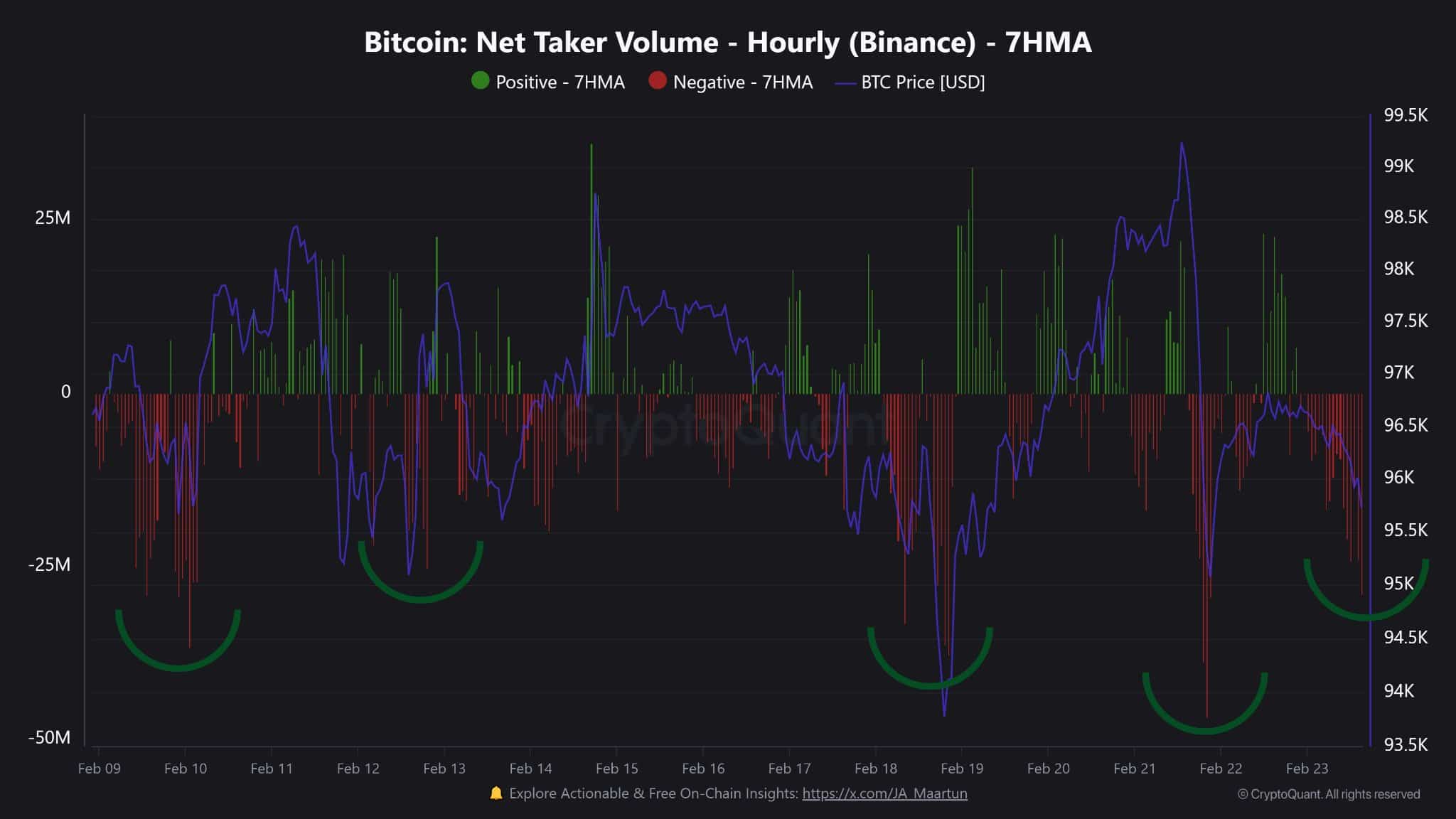

Bitcoin’s net taker volume on Binance, diligently tracked from February 9 to 23, 2025, revealed an awful lot of low 7HMA values, with gloomy negative spikes orchestrating the melody.

This performance indicated bearish pressure, where taker sellers somehow overtake buyers, further reinforcing weak market sentiment. The situation resembles March 2024 when low net taker volumes foreshadowed a consolidation phase—how original!

A resurgence in long positions now depends on taker buyers reclaiming their lost throne, contingent upon geopolitical stabilization or some charming bullish catalysts. Should sentiment improve, Bitcoin’s price might lift itself from its slumber at $96,200. If not, a prolonged period of hibernation seems rather likely.

In closing, dear humans, BTC’s dwindling network activity, shrinking transaction volumes, and reduced UTXO count reflect a deeply worried investor confidence, risking an extended period of stoic consolidation.

The slowdown in spot ETF accumulation and net taker volumes underscores the current market uncertainty, as if the universe itself is holding its breath. While historical patterns suggest that BTC could rise again, any sustained upward movement would demand a grand shift in macroeconomic sentiment.

It also begs for the resolution of geopolitical tensions or an influx of renewed institutional enthusiasm to spice things up and keep fortune on its toes.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-02-24 15:10